Aditya Birla Sun Life Insurance Income Shield Plan – Review, Features and Benefits

Everyone wants to protect the future of their families after them and it can be only possible through a life insurance plan. Therefore, the Aditya Birla Sun life insurance has introduced a plan that will help you to secure the future of your family and loved ones after your demise.

The name of the plan is ABSLI Income Shield Plan that is especially for entrepreneurs and salaried individuals. This plan ensures your family to provide a monthly salary after your death. It is now time to give your family the shield they deserve to protect their dreams.

Features of this Policy –

- Complete financial protection at an affordable cost

- 4 plan options to suit your protection needs

- No loan facility is available under this policy

- Tenure of the policy is 10 to 40 yrs

- Tax Benefits available under the policy

- EVA benefit – a benefit exclusive for females

- Flexible-Premium Paying Terms & IncomeBenefit Term

- Enhance your insurance with appropriate rider option

4 Plan Option under the policy –

- The plan option once selected cannot be changed during the policy term.

- # Monthly Income is 1.25% of the chosen Sum Assured

- ^ Explained in detail later in the brochure

| Option 1 – On death, the company will pay the nominee a level monthly income# during the Income Benefit Term |

| Option 2 – On death, the company will pay the nominee a monthly income increasing at 5% p.a. (simple) during the Income Benefit Term |

| Option 3 – On death, the company will pay the nominee a level monthly income during the Income Benefit Term Additionally on the diagnosis of a Critical Illness^ or diagnosis of Total Permanent Disability^ whichever is earlier, the future premiums will be waived off and the policy will continue till the end of the policy term. |

| Option 4 – On death, the company will pay the nominee a monthly income increasing at 5% p.a. (simple) during the Income Benefit Term. Additionally, on the diagnosis of a Critical Illness^ or diagnosis of Total Permanent Disability^ whichever is earlier, the future premiums will be waived off and the policy will continue till the end of the policy term. |

Benefits of the Policy –

a) Death Benefit –

In the event of the death of the life insured during the policy term, monthly income depending on the chosen plan option will be paid to the nominee over the Income Benefit Term. The first payout will be made on the acceptance of the death claim and subsequent monthly payouts will be made on each policy monthiversary throughout the Income Benefit Term.

The monthly income benefit payable on death is equal to 1.25% of the Sum Assured. The total monthly income payable on death over the Income Benefit Term will be the assured benefit to be paid on death under this plan.

The Sum Assured on Death is the highest of –

- 10 times of the annualized premium for all ages; or

- 105% of the total premiums paid up to the date of death; or

- The assured benefit to be paid on death.

The Sum Assured on Death will be the total Monthly Income benefit payable over the Income Benefit Term. The monthly income will be due from the first policy monthiversary on or after the date of death. The first payout will be made on the acceptance of the death claim and subsequent monthly payouts will be made on each policy monthiversary throughout the Income Benefit Term.

If Plan Option 3 or Plan Option 4 is chosen –

In the event of the Life Insured being diagnosed with the first occurrence of any of the covered Critical Illnesses or Total Permanent Disability as defined below, the company will waive off all future due premiums, if any, provided the policy is in force and the Life Insured has not attained the age of 65 years.

The policy will continue with full benefits till the Policy Maturity Date as shown in the Policy Schedule. In the unfortunate event the Life Insured dies before the Policy Maturity Date, the company will be liable to pay to the nominee/ legal heir the applicable Death Benefit.

The annualized premium shall be the premium amount payable in a year chosen by the policyholder, excluding the taxes, rider premiums, underwriting extra premiums and loadings for modal premiums, if any.

Total Premiums paid means to a total of all the premiums received, excluding any extra premium, any rider premium, and taxes.

b) Maturity Benefit –

No maturity benefits under this policy.

c) EVA Benefit –

A benefit exclusively for women where the company ensures freedom from paying premiums for a year in case the life insured delivers a baby during the policy term. At that stage, the top priority for a mother is to bond with the newborn without working about financial obligations.

Although this benefit will be offered under all plan options, the life insured (if females) can avail of this benefit only once during the policy term. Post the one-year waiver, the premiums are to be paid when due to enjoy the policy benefits for the rest of the policy term.

d) Reduced Paid-Up Benefit –

i) For Regular Pay –

- Not applicable

ii) For Limited Pay –

If you discontinue paying premiums after having paid premiums for at least four full years, your policy will not lapse but will continue on a Reduced Paid-Up basis. Under Reduced Paid-Up, your Sum Assured shall be reduced in proportion to the premiums actually paid to the total premiums payable during the premium paying term.

Once the policy has become Reduced Paid-Up, the monthly income payable on the death of the life insured is amended to 1.25% of the reduced Sum Assured as on date of Death.

If Plan Option 2 or Plan Option 4 is chosen the monthly income payable on the death of the life insured will continue to be increased by 5% p.a. simple every year. The premium waiver on Critical Illness or Total Permanent Disability or for EVA benefit shall not be applicable to RPU policies.

e) Tax Benefit –

This policy offers tax benefits on premium paid under Section 80C and Section 10(10D) of the Income Tax Act, 1961.

f) Rider Benefit –

ABSLI Accidental Death Benefit Rider Plus can be taken in the policy by paying an additional premium.

g) Surrender Benefit –

There is no surrender benefit offered for regular pay under this plan. However, for a limited pay option, your policy will acquire a surrender value after all due premiums for at least four full policy years are paid for limited pay.

The surrender benefit will be payable as follows –

Surrender Value Factor × Total Premiums paid× (Outstanding Policy Term) / (Policy Term)

- The Total Premiums paid will include any waived off installment premium due to the Critical Illness / Total Permanent Disability or EVA benefit.

- Surrender Value Factors are shown in Appendix I.

- Outstandingpolicy term is calculated as the number of whole months from the date of surrender to the end of the policy term.

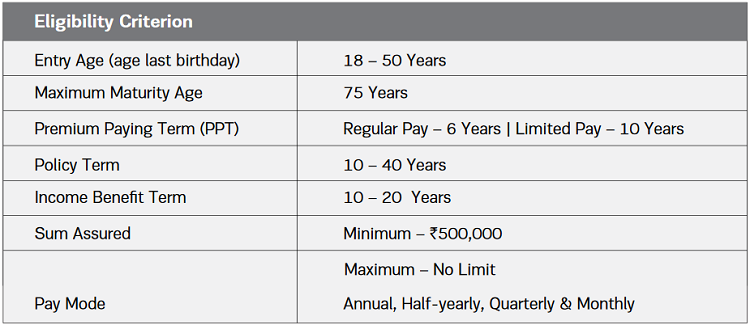

Eligibility Criteria of the Policy –

Is there any grace period in the policy?

If you are unable to pay your premium by the due date, you will be given a grace period of 30 days. During this grace period, all coverage under your policy will continue. If you do not pay your premium within the grace period, the following will be applicable –

For Regular Pay Policy –

- If you do not pay your premium within the grace period, your policy will lapse and all benefits will cease immediately.

For Limited Pay Policy –

- In case you have not paid premiums for four full policy years, your policy will lapse and all benefits will cease immediately.

- In case you have paid premiums for at least four full policy years and any subsequent premium is not paid, then on the expiry of the grace period, the policy will continue on Reduced Paid-up basis.

Can the lapsed policy be revived?

Yes, the lapsed policy can be revived for its full coverage within five years from the due date of the first unpaid premium by paying all outstanding premiums together with interest as declared by the company from time to time and by providing evidence of insurability satisfactory to the company. The policy can be reinstated only during the revival period.

Exclusions under the Policy –

a) Suicide Exclusion –

The company will pay the premiums paid to date (excluding applicable taxes) or surrender value, if higher in the event the life insured dies by committing suicide, within 12 months from the date of inception of the policy or revival date of the policy, provided the policy is active.

b) Total Permanent Disability and Critical Illness Benefit Exclusion –

The following exclusions are applicable only for Waiver of Premium benefit in case of diagnosis of Total Permanent Disability and/ or Critical Illness.

The insured shall not be entitled to receive the benefit if Total Permanent Disability or covered Critical Illness results either directly or indirectly from any one of the following causes listed in the exceptions below –

i) Any Pre-Existing Disease. Pre-existing Disease means any condition, ailment, injury or disease –

- That is/are diagnosed by a physician within 48 months prior to the effective date of the policy issued by the insurer.

- For which medical advice or treatment was recommended by, or received from, a physician within 48 months prior to the effective date of the policy or its reinstatement.

- A condition for which any symptoms and or signs if presented and have resulted within three months of the issuance of the policy in a diagnostic illness or medical condition.

ii) Any sickness-related condition manifesting itself within 90 days from the policy commencement date or its latest revival date, whichever is later;

iii) AIDS and/or HIV related complications or any sexually transmitted diseases;

iv) Suicide or attempted suicide or self-inflicted injury, irrespective of mental condition;

v) Participation in a criminal, unlawful or illegal activity;

vi) Taking or absorbing, accidentally or otherwise, any intoxicating liquor, drug, narcotic, medicine, sedative or poison, except as prescribed by a registered medical practitioner acceptable to the company;

vii) Nuclear contamination, the radioactive, explosive or hazardous nature of nuclear fuel materials or property contaminated by nuclear fuel materials or accident arising from such nature;

c) Additional Total Permanent Disability Benefit exclusion –

In addition to the common exclusions above, you shall not be entitled to receive the benefits if the Total Permanent Disability results either directly or indirectly from –

- Engaging in or taking part in professional sport(s) or any hazardous pursuits, including but not limited to, diving or riding or any kind of race, underwater activities involving the use of breathing apparatus or not, martial arts, hunting, mountaineering, parachuting, bungee jumping.

Conclusion –

So, by now you know each and every important detail about this policy. Do let me know if I have missed any important points in the comment section. Please feel free to ask any doubts regarding this policy.