How your bank calculates Monthly Average Balance ?

Do you understand what is the meaning of Minimum Monthly Average Balance in your saving account? When you say “Monthly Average Balance of your saving bank account is Rs.10,000”, what does it mean exactly?

A lot of people feel that their balance in saving bank account should not go below Rs.10,000 on any given day, otherwise, there will be penalty charges and they make sure that they have a buffer of Rs.10,000 in their saving bank account all the time.

This means that their account should always have that much surplus. However, the way the monthly average balance is calculated is different and very simple.

Meaning of Monthly Average Balance?

It simply means that the average of the all the closing day balance in a given month. So given a month, add up all the closing day balance and then divide it by the number of days in the month. If you have to put it as a formula it would be

MAB = (Total of all the EOD closing balance)/(number of days in a month)

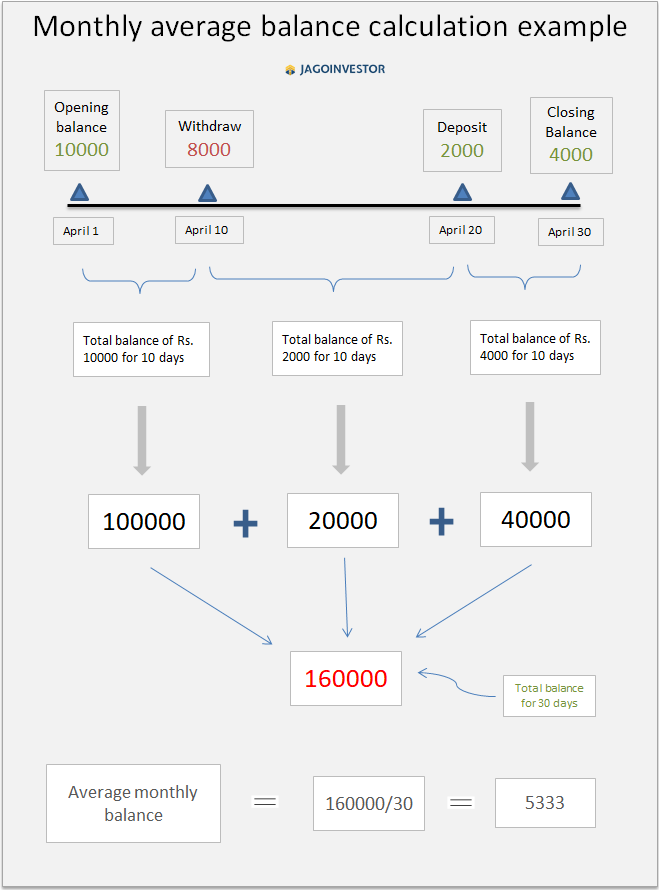

Let me show you an example. Let us say the month we are talking about is April. The minimum balance limit in your bank lets say is Rs.5000.

Now your balance at the start of the month (Apr 1) is Rs.10,000. You withdraw Rs.8000 on 10th Apr and then Deposit Rs.2000 on 20th April. What will be the Monthly average balance for the April month?

Learning’s & Tips

- Keeping Rs.10,000 in a bank account for 15 days is same as keeping 5000 for full 1 month (10k * 15 days = 5k * 30 days)

PSU Banks vs Private Banks

A lot of PSU banks like SBI bank, Bank of India, Allahabad bank generally have a lower monthly average balance to be maintained in saving bank account, it’s average limit is up to Rs.5000 non-Maintenance Charges are very low around Rs.40-50 only.

However Private banks like ICICI Banks, HDFC bank, Axis Bank etc have Monthly balance as high as Rs.10,000 and charges a high penalty for not maintaining it , It some times can be as high as Rs.750.

So by now, you must have known how the minimum average balance is calculated? Will this information impact your banking in any way? Will you keep less money in your bank account because you now know that Monthly average balance is calculated in a different way than you thought?.

Let us know if you have any query in the comment section.

June 19, 2018

June 19, 2018

I got my Dormant account activated today(10th august 2018). What will be the starting date for counting ‘MONTHLY AVERAGE BALANCE’ in my condition ?????

10th August or 1st august ????

Thanks!

Hi Abhishek Singh

As per my research the starting date for counting monthly average balance will be 1st august. Still you should contact to your bank and confirm the date.

Really wonderful explanation with sample goals for people who are zero (like me) in their financial planning. I Appreciate all the hard work you are putting in to educate people and help them take various financial decisions. Great work Thanks a lot.

Hey sushant kadam

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

Sir ! My account was in dormant state for many years. Today(10 August 2018), i got my account activated.

Question::: what will be starting date for ‘MONTHLY AVERAGE BALANE’ ?? 10th august or 1st august.

Please reply because i have to transaction.

Thanks !

Nice platform related to financial concepts. Keep it up Jagoninvestor

Thanks for your comment Hasan .. Please keep sharing your views like this..

Manish

Whenever I log into my bank account, I see my monthly average balance and also I heard from my friends too, to maintain the average balance. but I never knew how it calculated. Good article. Thanks for sharing 🙂

Glad to know that !

Hey Amit Kumar Bansal

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

Hi,

Thanks for expressing this concept in such simple words . All these tips are really important to know. they are valuable and simple to understand. keep up your work, it help us to understand the financial terms in such a simple way.

Thanks once again.

Hey Sunil Chaudhary

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

Great work! This article is very helpful and informative for calculating monthly average balance. One can get every details in single Infographic, the way you explain makes complicated things simple. Keep sharing your knowledge with us.

Hey Sadique Mazhari

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

Usually I never comment on blogs but your article is so convincing that I never stop myself to say something about it. You’re doing a great job Man,Keep it up.

Thanks

very good articel.thankuu

Welcome 🙂

Hi You have explained very clearly

I enjoyed reading your blog full of information

Hey vipul

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

Sir

I want to invest in mutual fund There are many mutual funds in the market. How to choose which one is the best which gives higher returns. Few years back I had lost money in uti mutual fund. Kindly let me know the best one.

Thanking you

Dwarakanath

Our team can guide you on that – Do enter your details here so that our team can call you and guide : http://jagoinvestor.dev.diginnovators.site/mutual-funds

Hi,

Is the article above, in the image, “Average Quarterly Balance” should be “Average Monthly Balance”.

Please correct the same.

Regards,

Nishant

This is corrected now .. thanks for pointing it out !

The figures shown in the infographic are not accurate. Please rectify them to avoid confusion for readers.

Its corrected now

Need advice as liquide funds are in FD with bank. Due to our age, we are afraid to invest elsewhere. What is the best option for us as we might need funds some times in between.

What advice you need? Please share your phone so that my team can talk and guide you !

Manish

In the illustration you have mentioned as quarterly average balance please rectify and make it average monthly balance However article explains funda in lay man language

Fixed !

I always follow and read your post, they are valuable and simple to understand. keep up your work, it help us to understand the financial terms in such a simple way.

Appreciate your contribution in financial awareness.

Thanks

In the chart it will be Monthly instead of Quarterly Balance. A petty mistake.

Its fixed now !

Thanks Priyanka

Welcome 🙂