Beginners guide to investing in Fractional Real Estate

POSTED BY ON July 21, 2023 NO COMMENTS

Will you be able to buy a property worth Rs 20 crore? In all probability, you would say NO. However, if I say – “Can you buy 1% of that real estate property for just Rs 20 lacs?”

Now, I guess the answer may be YES!

Welcome to the concept of Fractional Real Estate.

What is Fractional Real Estate?

So, as the same says, when you buy a small fraction of real estate and become a part owner, that’s called fractional real estate. It’s a growing trend in India and a lot of people are now investing in fractional real estate because the ticket size is smaller and it gives you access to quality real estate.

Real Estate investments are one of the favorite’s of Indians, and in the last few years, this concept is quite a hit among Indians. I would like to share 10 things about fractional real estate which will help you understand various things related to fractional real estate.

Here is how it works

Imagine there is a property worth Rs 20 cr, where you want to invest, but you have only Rs 20 lacs with you, under fractional real estate you will become 1% owner of property.

1. How to buy Fractional Real Estate?

While technically you can make a group of 5-10 friends and all can contribute to buying the real estate which will make it a fractional real estate, truly speaking its not possible for all people and hence there are various online platforms which help you invest a small amount into a real estate. Various investors like you will invest from that platform and this way everyone will become a part owner.

These websites or platforms are called FOP’s or Fractional Ownership Platforms. There are various websites which have cropped up in the last few years and you can search them online. FOP’s are various important because they are the one who carry out all the tedous tasks like.

- Researching property

- Buying Property

- Selling property

- Documentation work

- Legal work

- Collection of Rent

- Distribution of Rent back to the co-owners

2. What kind of properties can you buy under fractional real estate?

It mostly deals in commercial real estate, because those are the properties which have very good appreciation and a regular rental income. Also, these are prime properties which are quite expensive and can be of the ticket size of anywhere from 20 cr to 500 cr.

Obviously, the retail investor cant invest on their own in these properties and fractional real estate is the only option.

3. Minimum ticket size

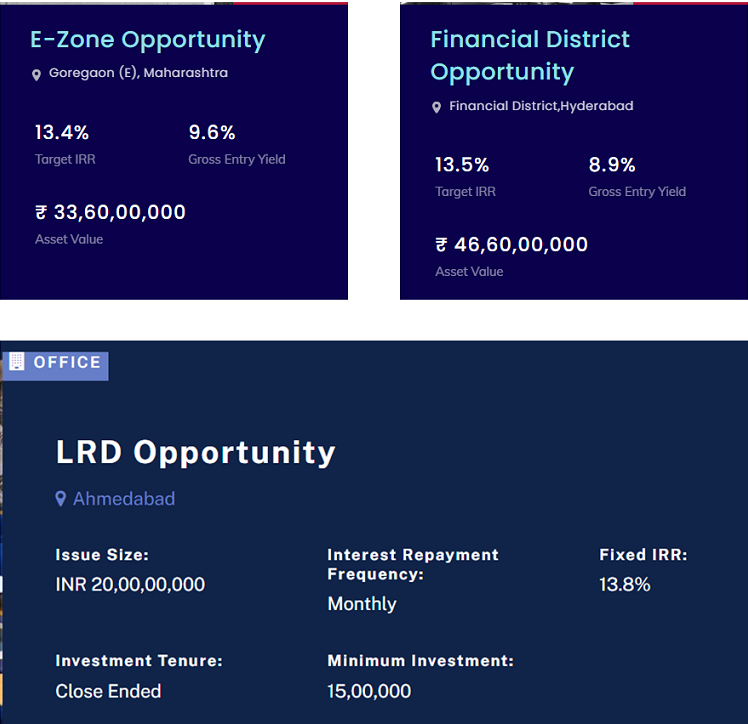

The minimum ticket size to invest in fractional real estate are mostly in range of Rs 5-25 lacs, which is within reach of most of the people who want to invest in real estate.

You can see the target IRR, and total price of the real estate along with other details on the website of these Fractional Ownership platforms

4. Liquidity issues in Fractional Real Estate

Real estate in general is a illiquid asset class, where it takes time to find buyer and get the right price you are looking for.

However in case of fractional real estate deal, if you want to exit, then you don’t sell the property per se, but sell your share to another buyer. Hence its quite tricky to comment on the liquidity in fractional real estate. If the rental cashflow and property quality is very good, it will be easier to find a buyer, other wise you may be stuck for a long time, because unlike a residential real estate, the end usage does not exist for the buyer.

5. Less Hassle, no management

One of the best parts of Fractional real estate is that you as an investor don’t have to do all the research about the property, documentation, running around for all tasks, buying process and maintenance of the property.

For the end investor, all you need to do is just research the deal and if it makes sense for your investing needs or not. You pay and that’s all. You become the part owner.

Even the collection of rent, property construction progress, selling the property, paying of taxes etc is done by the FOP and not you as the end investor.

So the investment in fractional real estate has very less hassle, which quite a good thing.

6. SEBI coming up with regulation on Fractional Real Estate

Over the last many years, many platforms have come into this market and there is no standard way these companies deal. There are no proper processes and standardization is the disclosures which are made to investors and how the dealings happen.

Hence SEBI has come up with a consultation paper which aims to regulate the FOP (fractional ownership platform) and bring them under REIT regulations in the coming days. It will be interesting to wait and watch this development.

REIT vs Fractional Real Estate

REIT’s are already in existence and getting popular from last many years. Its also a simple way to invest in real estate, however when compared to Fractional Real Estate, they are different on various parameters. Let’s see those differences

We hope that you are now clear about the fractional real estate and various points related to it. Do let us know if you have any queries in comments section.