6 tricks to increase your Home loan eligibility and learn how its calculated by banks ?

POSTED BY ON October 20, 2014 COMMENTS (51)

Today you are going to learn how much home loan amount you are eligible for. I will show you how banks calculate your home loan eligibility and what are some of those factors which can impact your loan eligibility.

At the end, I am also going to share some tips you can take to increase your home loan eligibility.

What is Home Loan Eligibility ?

Home Loan Eligibility simply means how much loan amount you can get for buying a home. Just because you are earning Rs 1 lac a month, does not mean that you can take a Rs.50 lacs loan. Its always based on a formula and is calculated based on some formula and logic, which we are going to see today.

There are several other kind of loans like Personal loans, Car Loan, Education loans – but out of all the loans, home loan is the biggest ticket size loan and takes longer to pay off. While this article is true for all kinds of loans, still we will focus on home loan eligibility in this article.

Think from the Lender’s point of view

Before we go deeper into this article, I want you to think like a lender for some time. Think as if you are a lender and you are giving loan to someone. How will you think, how will your thought process be? Think for a minute and trust me, you will yourself realize that calculating someone’s loan eligibility can be very easy.

There are various factors one has to look at before giving a loan to someone. Just because someone is earning a lot of money, does not mean that he/she is eligible to get loan of any amount. There are various other factors which will come into picture.

I have recorded a full video on this topic which you can view below or on this direct link on youtube.

So before we look at those factors, let me quickly show you an example and explain you the simplest way of calculating the home loan eligibility

Example of Calculating Home Loan Eligibility

Lets say Ajay earns Rs 80,000 per month as a Software Engineer. Now its very obvious that he is not left with all Rs 80,000 per month as his savings. After deducting his expenses and commitments, he must be left with some amount.

As a thumb rule, banks in India assume that you are able to save anywhere from 40%-50% of your in hand income. For this example, lets say that the ratio is 50%.

So the bank will assume that the savings per month is 50% of Rs 80,000 , which is Rs 40,000. This Rs 40,000 is available for repayment of any kind of EMI’s .

Now bank will do the reverse calculation and find out how much EMI is required to pay off Rs 1 lac loan using the standard interest rate and tenure. Assuming that the bank takes 20 yrs tenure and interest rate of 10.5% , the EMI required to pay Rs 1 lac loan per month comes to Rs.998.

Now they find out how much loan Ajay can handle if he can pay Rs.32,000 EMI per month, considering Rs.998 is required to pay Rs 1 lac loan. So it would be

Rs.1 lac * 40,000/998 = Rs.40 Lacs.

So this way, Ajay’s home loan eligibility is Rs.40 Lacs.

What if there was an existing EMI of Rs 10,000 ?

Assume that Ajay had an existing personal loan for which he was paying Rs.10,000 EMI per month. In that case, his available saving would not be considered as Rs.40,000 , but 30,000 only (40,000 – 10,000)

In which case, his loan eligibility would be just Rs.30 lacs using the same technique.

Now this is the most simple way of looking at home loan eligibility calculation. There are various banks which use different formulas and calculations, but all of them will revolve around this same logic I explained about.

Important Note –

It depends on the bank on how much % saving they assume a person does. In the example above I have taken 50% as the assumption, but some banks might take it as 40% or even 35% .

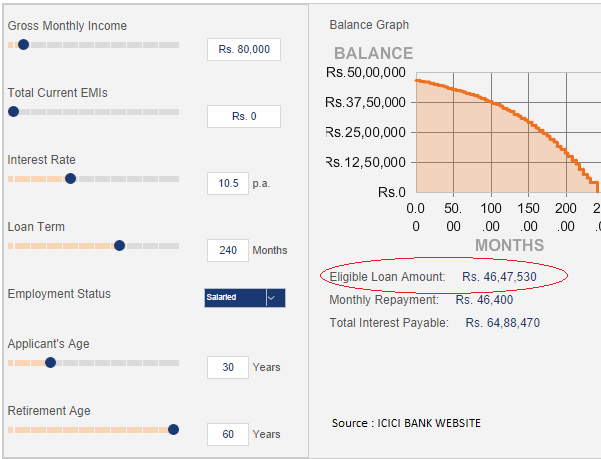

I calculated home loan eligibility on ICICI’s Home Loan EMI and Eligibility Calculator for the same example above and I got the following result

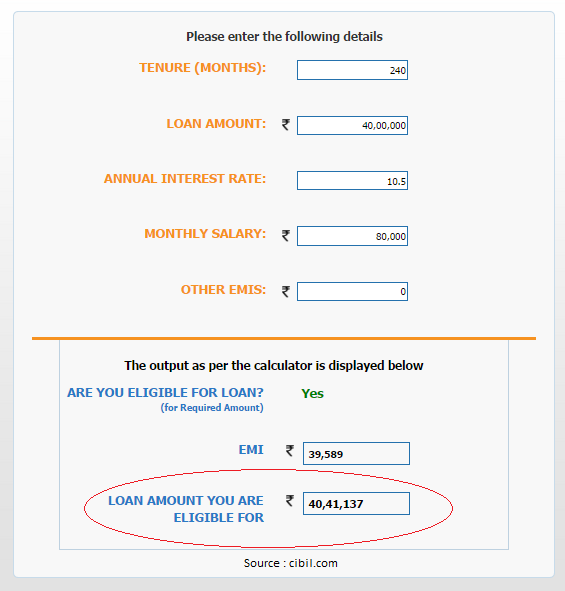

I checked the same example on CIBIL website and even there website gave me very similar result

Factors which Affect your House Loan Eligibility

Now lets look a little deeper into some of the core factors which affect your loan eligibility. Some lenders might not use all the factors, but still its a good idea to understand how its related and do something about it.

1. Your Income

The amount of loan you are eligible for depends directly on your income.This is one single factor which impacts your home loan eligibility to the greatest extent. Its very simple, higher your income, higher is the chance of you being able to pay the bigger liability.

Your actual situation might be anything, but the simple logic is that higher income person can pay more EMI and hence he/she can take higher loan.

A person earning Rs 1 lacs has higher chances of affording Rs 30,000 EMI , compared to a person who earns just Rs.40,000 .

Now if you are salaried employee, your income is assumed to be more stable than a person who is self employed or into a business. Its more easier for a salaried person to get a loan compared to a self employed person earning Rs 1 lac a month for obvious reasons.

Note:

A lot of banks will ask for your salary slips for past 1 yr and 3 yrs of IT returns, and bank statement for atleast 6 months. This is to calculate and get an idea of your overall cash flows and what are your spending patterns.

A lot of banks do not consider the LTA , HRA and medical allowances you get from the company, so they will deduct those amounts from your yearly take home.

I thought I will mention one important point here. In reality your income can be anything, but what really matters is your income on papers, which is ITR returns you have filed over last 2-3 yrs. A lot of people do not disclose their full income and pay less taxes, Its going to directly impact their loan home eligibility.

For a self Employed Professionals, along with the ITR’s for past 3 yrs, banks also require Profit and loss statement along with Balance sheet certified by a CA for last 3 yrs.

2. Age of the applicant

The age of the applicant also matters to some extent, but not significantly. Paying a home loan is a long term commitment. And banks have to ascertain how long you can pay off the EMI.

A person in his 30’s can pay the loan for next 30 yrs, but a person who is 50 yrs old will retire at 60 and has just 10 yrs in hand and in that case, he can get a loan for lower amount compared to more younger person.

3. Credit history

Your past credit history and repayment record has direct impact on your loan eligibility. If someone has a bad repayment record, then he/she might not get the loan itself. But in some cases where bank considers the application it might happen that they only approve a certain percentage of the eligibility

In our earlier example, Ajay had a loan eligibility of Rs 40 lacs in normal circumstances. Imagine that he has a bad record in past and he had not paid his past EMI’s on time and his overall credit score was bad, then it might happen that the bank agrees to only approve Rs 10-15 lacs of loan instead of his original 40 lacs loan.

4. Profession

Profession of the loan-seeker also matters a lot. Some professions are categorized as negative or risky by the lenders. People in such professions may find it difficult to get a loan sanctioned. What a lender requires is a stable income for a very long term.

So if a person is into jobs which are well paying and which are considered stable like Software Engineers, Banking jobs etc (which are white collar jobs), then the person is eligible for a higher loan amount.

However certain jobs like BPO sector jobs, running your own shop, Insurance Agent have lower loan eligibility because the income is uncertain or the chances of losing a job is higher.

5. Your Relation with the Bank in Past

A lot of banks (especially PSU and cooperative banks) still look at your past relationship very seriously. If you have an account with bank from last 10 yrs, it will matter a lot sometimes. In some cases banks directly issue a loan in multiple of your income.

6. Your Employer Category

Almost all the banks categorize various big companies into A,B,C category and offer different interest rates to their employees. so employees of Infosys, TCS, Microsoft and companies like that will be offered a better interest rates companies to smaller companies.

Check with the bank about it and you might get a slightly less interest rate, which can matter a lot on long term. You can also get processing fee waiver if special schemes are running.

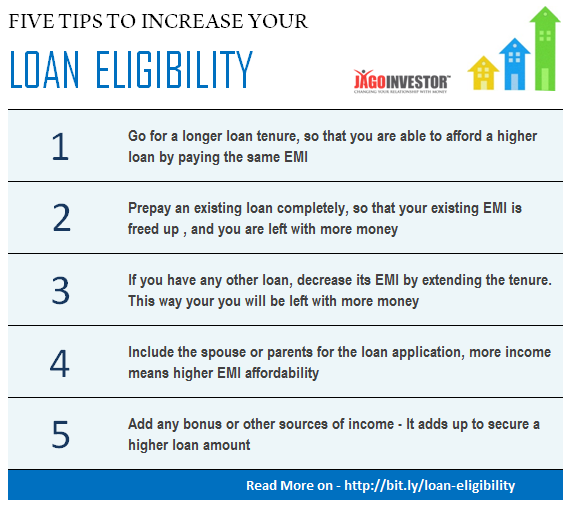

5 tips to increase your loan eligibility ?

So you understood how the loan eligibility is calculated and some factors which impact it, so now lets see some of the actions you can take to increase your loan eligibility.

1. Go for a longer loan tenure

your EMI depends on the tenure of the loan, so if you increase the loan tenure, you might get a higher loan eligibility.

So if you were planning to take a loan for 10 yrs, and assume that your loan eligibility came to Rs 20 lacs, if might happen that it goes up to 30 lacs if you are ready to take a 20 yrs loan. Its as simple as that. This is because you are committing to pay over a higher time frame.

2. Prepay an existing loan completely

If you have any existing loan which is about to complete, then better pay it off completely. This is because in that case, your monthly savings will go up and that will increase your loan eligibility .

For example – imagine you are able to save Rs 40,000 per month. But you have an existing personal loan for which you are paying Rs 15,000 per month EMI and that leaves you with remaining Rs 25,000 only. Now imagine that you have Rs 1 lac in outstanding for that personal loan and its going to complete in next 8 months, after which you will have full 40,000 with you for paying home loan EMI .

But right now your bank will see that you just have Rs 25,000 in hand to afford additional EMI , and you will have a loan eligibility of only Rs 25-30 lacs, where as in reality you know personally that you can afford much more EMI given a chance.

So in this case, its always a better idea to arrange for money from somewhere else and pay off the personal loan fully and that will free your EMI there, and you will be left with full Rs 40,000 in your hand. This simple action will increase your home loan eligibility by a big margin

3. Extend your other loan tenure and decrease the EMI for the other loan

Now this is just an extension of the above trick . You have to think about how you can show the bank that you have a higher amount available with you.

So if you have any other EMI going on and you cant prepay it fully, then at least you can increase the tenure of that other loan, which will decrease the EMI part and that would leave you with more money in your hand each month.

For example, imagine you have another home loan for which your tenure left is 4 yrs and your EMI is 15,000. Now if you cant prepay it fully, what if you can increase the tenure to 10 yrs, may be the EMI comes down to Rs 9,000? That would mean extra Rs 6,000 with you. That can show the bank that you can pay more EMI on the other loan now …

Check this point with the bank when you need the loan. In some banks this thing might not be of any use if they do their calculation on outstanding loan.

4. Include the spouse or parents for the loan application

This is pretty clear. If you include your spouse or parents as additional loan applicants, then your overall loan eligibility will go up because now there is more income to support that loan.

The person you are including should have all the documents and ITR as proof for their income and its stability

5. Add any bonus you are liable of

You should also mention to the banks if you get additional bonus or perks from your employer or if you have any other source of income like rental income, interest from deposits or some other business income apart from your regular income.

Even if you mention that your spouse also earns some additional income which can be used later, then it might help sometimes. This particular point is not going to increase your loan eligibility, but at times this can help you get your loan approved.

Conclusion

The simple point of this article is that banks look at your potential to repay the future loan and there are factors which affect that and you can take some actions to improve your chances of securing the loan or increasing your loan eligibility

Let us know about any questions you have or some thoughts you want to share ?

51 replies on this article “6 tricks to increase your Home loan eligibility and learn how its calculated by banks ?”

Comments are closed.

Manish, Trust you are doing great.

I have a query regarding home loan and income tax benefit on home loan interest.

I already have two houses in my name; one at my native and one in the city where I live. The house that I have in my native place is very old and I decided to construct a new one without demolishing the old one. I have taken a homeloan for the house I presently live and my wife is a co owner and borrower for this property .

When I applied for the loan , the bank responded that per RBI rules , since I have two houses in my name I can not apply for a home loan to construct the third house. However they agreed that they have a product by name ‘Home Invest’ and the bank can issue the loan thru ‘Home Invest’ .

Could you let me know if the actual interest paid on the housing loan (Home Invest) is allowed as deduction while filing the return?

Thank you.

TM

I think the bank will able to clarify that, I am unaware of this product

Dear Manish, Can i add my father’s pension amount as source of income to improve my eligibility? (My father is aged 73 yrs and mother – 69 yrs. Both are in good health and staying with me. My Father is a retired State Government Employee). Thanks, B.Santhosh

YEs, that can be done !

Sir

I work as an artical assestent at a chartered firm for 3 years and i am receiving stipend(salary) of Rs. 4000 pm. I want to buy a home after 3 years or later and if i file my ITR return for this 3 years showing my annual income around Rs.60000 (only stipend income) and after 3 years if i get a job having a package of Rs. 20000 pm will the bank consider my previous ITRs which shows only Rs. 60000 annual income and will it effect my home loan application. Currently i save my stipend income in mutual funds, rd & atal pension for home loan purpose, please suggest me.

Yes, its a low income and looking at that your eligibility would be very very low .

Hi Manish,

Sobha is offering ’36 months NO EMI’ for their Sobha Dream Acres project.

Pay 20% upfront and no emi for 36 months.

Is it a good choice?

Its a very high level question. We wont be able to comment on that !

Hi sir I need loan to build my home I have plot but I field only two itr in same year

First one 2014/2015 in June 2015 and second one 2015/2016 just one month after in August

2015 am I eligible for loan or I have wait while

Hi raja

I think it will depend on bank. Try with HDFC ..

Hi. I have taken a home loan from Tata Capital. The Loan amount is Rs 1.0485 Cr. The EMI comes to 96134 per month @ 9.85% for 23 years. The problem is when I saw the loan amortization schedule, the last EMI was shown as 1.53 Lacs… When I asked them about the calculation, they said that the interest is being computed on daily basis, which is the principle amount isnt regularly increasing with every EMI, and also why the last is so high… Can they calculate the interest on daily basis ?

Its written in your agreement . See if its written that it would be daily rest .

Hiiii

I want to take home loan of abt 30 lakh and m eligible for taking bank loan of abt 26 lakh amount but actually I want my husband to be co applicant but some bank is saying he is not eligible as he is having education loan so can you tell me solutiin so that I can get a loan abt 30 lakh.my salary is 41 k and his 20 k.

If bank is telling not possible, then its not possible

I have an existing personal loan with 14 more EMIs of 18044. My home loan consultant advised me to pre-pay for 5 emis and reduce total remaining EMIs less than year. Banks will not consider this loan as tenure remaining less than one year while checking eligibility.

He said this will increase my home loan eligibility more than emi amount reduction.

Is this correct ? suggest?

Hi Vikrama

Yes, looks good to me .

If I filled 2 years ITR within 3 months, then am I still eligible for Home Loan?

I didnt get the question

If 2 years ITR is filled within 3 months , in that case, am I still eligible for home loan.??

I have bought an under construction property for Rs 1.68 crores, of which I have paid 25% of the amount ie 42 lakhs. The construction period specified by the builder is 3 years. I intend to take around Rs 1 crore as loan for 15 years and pay the remaining Rs 26 lakhs myself. I have zeroed on SBI Maxgain at an interest of 9.85% wherein my monthly EMI would be Rs 1 lakh. My question is whether I should go in for full EMI or tranched EMI wherein principal also stands reduced. I am quite tuned in to the markets and have made sizeable investments in mutual funds and stocks which have worked well or me. I continue to maintain SIPs in mutual funds and expect that I could gain around at least 12-15% from my investments. I do not want to pay the entire amount myself as my liquidity would dry up completely.

I think you can go for full EMI ..

Ok i know but my question is that

1st year -3-4 lac

2nd year- ?

3rdd year-?

If you are earning 15 lacs every year, then you will pay the same tax each year as per calculation . If you are earning more or less in 2nd and 3rd year, then you will pay more or less.

I think you should involve a good CA now

I would like to know that what itr shoud be filled 2 & 3 finacial year….pl reply asp

Hi Major

For each year you need to file seperate ITR

i am manoj current running my hotel in delhi i have booked at flat in mumabi currently i am not filing any itr so how much itr i will fiill for 15 lac.. pls reply

Manoj

I assume that all this money is coming in your bank account. You will have to paying around 3-4 lacs tax on this .

Dear Tara,

In case you go for a home loan, you need to take into consideration the tax benefit you will receive and the amount you pay as interest on the principal amount. Your decision to go for a home loan or not will depend on the amount you pay or save in case you go for a loan.

Regards,

Credexpert

Hi,

I am coming under tax slab of 30%. I want to construct a house. Is it advisable to take the amount as loan, or I can use my savings for the same.

Regarda,

Tara

You can surely take some loan and use the interest and principle for tax exemption ,but better evaluate it from all angles !

Dear Sir,

Home loans are available at ‘Fixed’ as well as ‘Floating’ interest rates. As the name implies, fixed interest rate home loans allow the repayment in fixed equal monthly installments over the entire period of the loan. The interest rate in such a case is fixed and doesn’t change with market fluctuations.

Floating interest rate home loans are tied up to a base rate plus a floating element thereof. So, if the base rate varies the floating interest rate also varies.

Hence, the interest rate charged will depend on the type of interest rate that you have chosen. Also, you need to check whether the fixed rate home loan is fixed for the entire tenure of the loan or fixed for just few years. This has to be ascertained while taking the home loan. In case your rate is fixed only for a part of the tenure, your fixed rate home loan will automatically change to a floating rate one once that time period is completed.

Regards,

Credexpert

Dear Sir,

I was completely blank abt the paramaters, terminologies, terms & conditions for a House Loan. Must appreciate Manish & other friends who have shared their knowledge & experiences.

Well, I have bought a house in Vadodara and I am yet to finalize from whom I am going to take loan, but its sure I will be going with the bank which will reduce rates soon RBI directs… My question is there are some banks which offer Interest rates at 10.15%. I ve heard from my friends that Bank do say Interest rates 10.15% initially and den after few years say 2-3 yrs, they start charging 10.25%… how should i take know such kind of hidden conditions??

Its not like that. For 2 yrs its fixed and then it moves to floating interest rates option ,Read more about it on internet !

The word tricks is somewhat misleading. But content is useful.

One has to understand that a financial institution also would like to get its loaned money back with same eagerness as the lendee in getting the loan and getting the house. For this, these are some of the measures which they use to assess the suitability of the lendee. These things can be correlated to the caution one takes when is required to lend to an unknown person.

As such housing became a national obsession second only to cricket. It is better if one takes a careful decision in this matter. By careful consideration, one can make oneself loan worthy over a period of time, by inculcating good financial habits. The above inputs can guide one into becoming one loan worthy.

Thanks for sharing your views on this Srinivas !

Loan Purpose is very better policy is, How a handle with time taking , I want for loan , My first chance loan .

Hi,

If I get DDA flat in coming draw,and I need to finance it.Would bank calculate my salary for financing it or pass the loan on my suitability for term like 25 or 30 years tenure since they have flat as a security.

Regards,

Vinni

They will evaluate your financial position and then only give the loan ?

Hi Manish,

I have taken home loan from GIC. But the interest is very high. Its 12%. When I bought home, I didn’t want to slow down process of approving home loan. But now I think with this rate of interest I will end up paying 2 lacs+ more to GIC. Is there any other way by which I can save this amount? I thought of changing bank. But GIC representative says, I cannot change bank for next 2 years.

Thanks!

Hi Dharmadas,

Please read the loan instructions document that you signed. It will have a column for preclosure. If you are going to preclose the loan they will charge some percentage of amount. The representatives will say like that to make you stay with them. Please check whether the instructions you siged also mentions the same message. Also please mention when u had taken this loan. Generally there will be lock in period for a particular period even for personal loans also.

Thanks & Regards

Hi Srinivas,

Thanks for your advice. I had taken this loan in Jan 2014. There is facility of preclose, but funds should be self finance. I haven’t read documents totally. But they had told me that if I transfer there will be 2% of whole loan I will have to pay.

There are various facts that need to be looked into while looking for alternatives. please consider the following points.

1. Do you want to run full tenure or fore close in <1/2 tenure.

2. Can your relatives spare that money.

3. Do you have other resources which give lower returns than this.

IF the loan is to be run for only few years, the % of interest rate won't matter much. It will, only if you want to run the full tenure. This I did and foreclosed my loan in 5 years.

If any of your relatives can lend you this money(or partly also), the tax exemption applies to that loan too. This is one way of easing your loan burden. For that you write a promissory note and get the money into your account and pay it from your account to lender. I did this and got tax rebate on the interest paid to my relatives.

If you have some FDs etc which are giving post tax returns less than home loan EMIs, it makes great sense to use them to part pay the loan.

Once these points are considered, a better decision can b taken.

Hey, thanks for your advice. I think I am not going for full tenure. So I will plan accordingly.

I dont think there is enough way to deal with it .. Why did you take the loan with them in the first place ?

It was compulsion by builder. That’s why I took loan from GIC. And I was in happy mood that finally I will have my own house, so didn’t think of interest that time.

Also, one can show the number of fixed deposit he has (preferably in the same bank). The loan amount gets increased by 40-80% of the FD value. First hand experience 🙂

Yea .. me too !

The best advice would to avoid loan of any form. If at all it is required to take load, it should be kept to minimum possible level. There is a difference between eligibility and affordability!

Not all loans are equal . Unlike a car which loses value over the years the value of house usually increases over the years. Hence it is actually advisable to take a home loan rather than car loan as it is an asset building loan.

LOL Ganesh… it seems that you suggesting right kind of tobacco product for a kid! All are bad; of course severity varies. All loans are bad and should be avoided as much as possible or at least to be kept at the minimum possible level. In India, it does not make any sense to buy a car with a loan. It makes no sense to buy a house for investment purpose by taking a loan, that too, maximizing the loan amount.

Yes, thats the primary thing ~