We all make various kinds of financial mistakes, and then regret it later.

Don’t we?

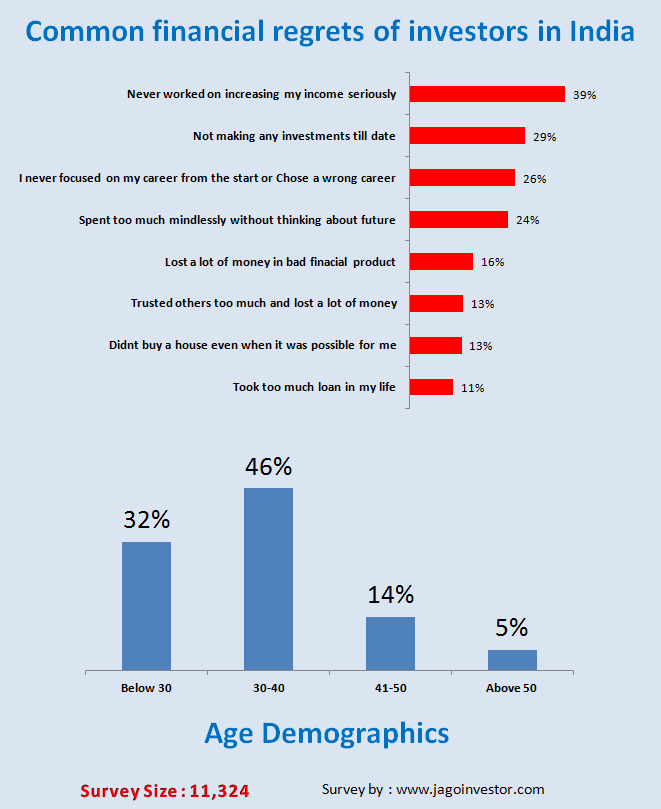

I wanted to find out, what kind of regrets are widespread among Indians, so I ran a survey for many weeks & got an amazing 11,324 participants for the survey. The survey had many questions and various insights can be drawn out of the data, but today – I am just going to share one of those insights with you (more to come later in other articles)

Most common regrets investors have

When I created the survey, I was able to think of 8 mistakes & asked the participants to chose among those only (It was possible to chose more than one mistake) and here were the results

Now we will look at each of these regrets and discuss them in detail

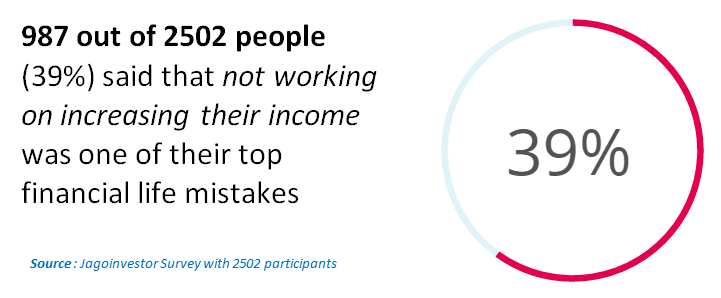

Regret #1 – Not working seriously on increasing the income

When I listed down 8 mistakes as the part of the survey, I was quite excited to know which mistake will be on the top and after I looked at these 11,324 results, it was clear that the biggest regret was – “Not working on increasing the income”

Think about it for some time…

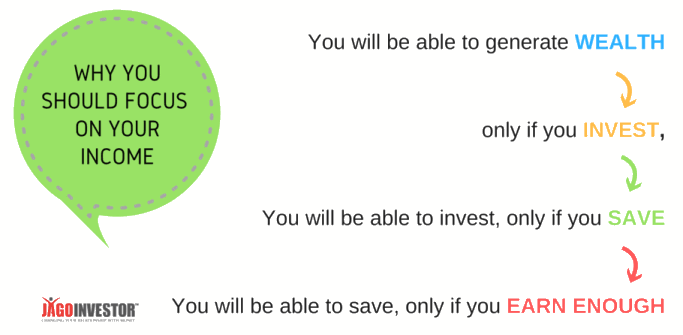

The “income” one earns is one of the tops most important things in financial life. You will be able to build wealth over time, only if you invest the money.

The investment can only happen if you are saving a decent amount of money after your expenses happen. Which becomes possible only if you are earning good enough income.

So if one has low income, then it’s not a great situation to be in, especially in today’s times. Because then your expenses itself will eat up all your income and you will not be left with enough surplus each month. You will not be able to save enough for your financial goals, for buying a house, and other necessities in life. If this continues for many years, you will be stressed most of the time thinking about the future and handling the short term demands which life keep throwing at you.

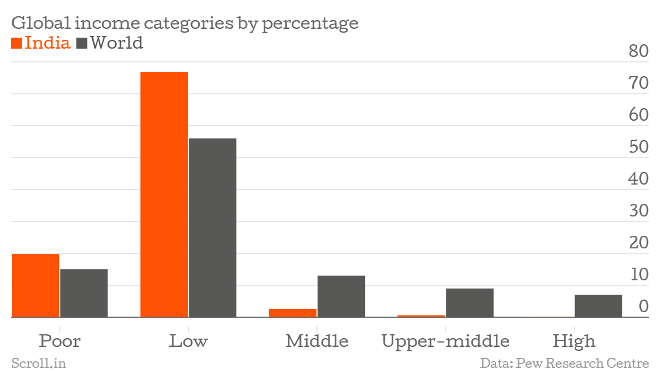

As per the Pew Research Center study, India primarily has poor or low-income families and even by world standard, we are not doing well. Not everyone in India works in Big IT parks or sophisticated jobs like you and me.

When most of people start earning money, they go into the comfort zone of life and don’t take enough measures to increase their income. Whatever pay-raise they get from their employer is taken silently for many many years assuming that they are getting what they deserve, only to realize years later, that they are underpaid.

As an investor, you should spend a lot of quality time on building your skills, and finding the right environment which values you and pays you good enough. You should find out various ways through which you can increase your income.

This article gives you some background on how to change your habits and mindset around money, in case you want to do something about it.

Regret #2 – Not making any investments till date

Even after many years of earning money, a lot of investors still don’t make any real investments. By real investments, I mean a considerable wealth. I am not talking about a few small Recurring deposits you did or your LIC investments which you did for tax saving. No!

Answer this …

“How much of your earnings to date, have you saved?”

There are many people who have been working for the last 10 yrs, but their savings/investments are just equal to their yearly income!.

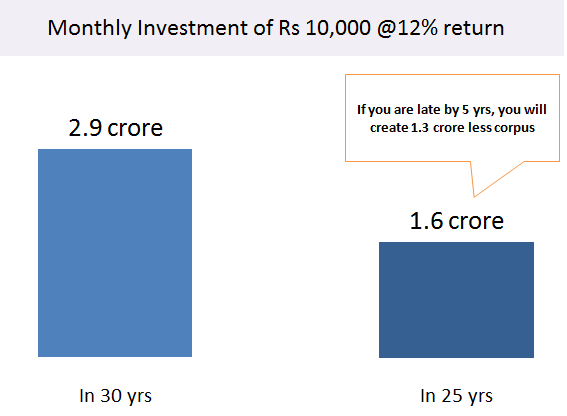

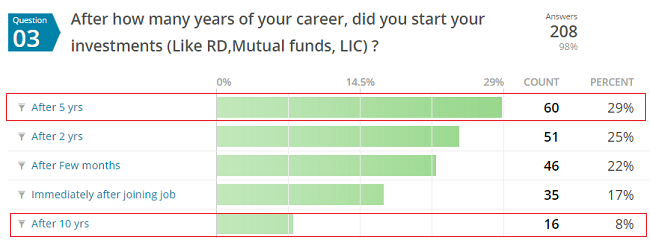

1 in 3 investors wait for 5 yrs before they make the first investment

Here is a survey I did last year where I asked investors how late they were for making their investments. 29% of people said that they waited for 5 yrs before making their first investment and 8% of people had not invested even after working for 10 yrs.

If you add both the numbers, seems like 1 out of every 3 investor wait for at least 5 yrs before making any investment. That’s a scary number.

Here are the topmost reasons why people do not make investments for many years

- They don’t save enough after their expenses

- The amount of saving they do is very small and they feel it’s not worth saving that much

- They are spendthrifts by heart and just spend the money

- They just keep thinking – “I will invest once I have enough money”

- They tried saving some money, but eventually used it for some purpose

- They faced a bad experience and then decides to not invest

- They just avoid investing because they feel it’s complicated and confusing

If you are a young investor and waiting for the right time to invest, trust me – it’s never going to come!

Start with whatever small amount you can, so that you at least teach yourself the habit of investing, see how it feels to see a few thousand in your bank account which was saved by you. That feeling will be great and the chances of that habit of saving getting stronger are high.

Regret #3 – Not focusing on a career or choosing the wrong career

Your career is a very important part of your life.

Your career will decide how much you will earn, which in turn will decide the quality of your financial life to a great extent. Your career will decide how will be your mood for 8-10 hours each day. It will decide your stress level and your health too.

Your career is like the center of your life if I am correct.

If you don’t love what you do to earn money, there will be issues in your life and many things will get affected due to that. I want you to read a few answers from quora where people have shared their views on the career mistakes people make.

I have often seen that a bad financial life is a result of a bad career or wrong career. Many a time, people get into a job which they don’t hate, but then they never work on making themselves skilled enough to reach the top positions.

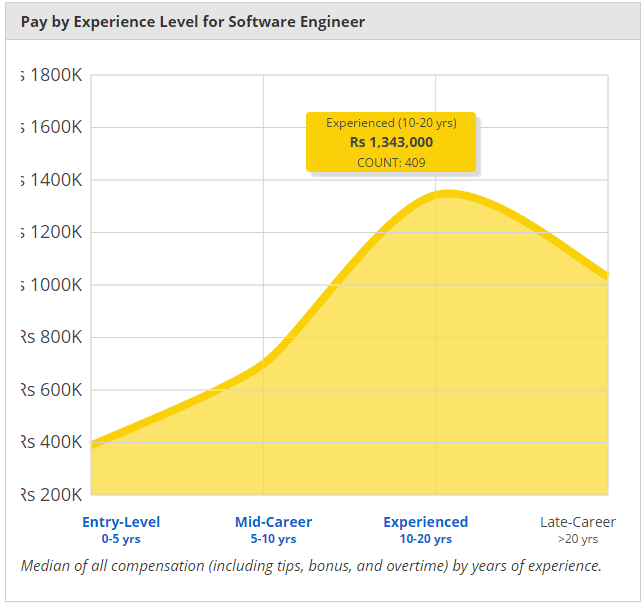

Take an example of a software engineer, there are many people who don’t hate their job, but then they are stuck with a profile or skills which they have not upgraded and hence they are not fully satisfied with themselves.

Don’t be that person!

If I have to share from my personal life, My first and only job was at Yahoo as a systems engineer. I was recruited from the campus. I was an algorithm and problem-solving guy who was chosen for the server related work which involved everything I never enjoyed, nor I was confident enough.

Within a week of joining the job, I realized that I am in a mess.

I knew that I am stuck into something which I am going to hate like anything for the next coming years. I just survived for many years and side by side worked on this website and with a few thousand in my bank account, I told my manager that I am quitting my job.

Current Situation

I changed my career path totally. I am now satisfied with what I do for a living and to earn money. I have increased my skill levels in a totally new domain.

I know it’s not easy, but see what all actions you can do and improve things on your side.

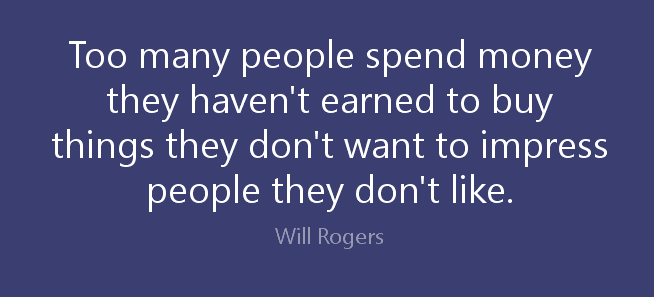

Regret #4 – Spent too much mindlessly without thinking about future

This regret is somewhere closely related to #2 point – “Not investing anything till date”

After the first paycheck comes to one’s bank account, it’s a very special phase of life. Most of the people get into the spending spree. We all have done that and there is nothing wrong with it. After all, for so many years you wait for that day when you will have control over money and take decisions of spending without any restrictions from parents.

After all, there are so many unfulfilled wishes and desires we all have.

However, there is one problem

Many investors never stop their spending spree and continue it for many years, without looking back on how it’s affecting their financial life.

They are busy enjoying life, buying expensive gadgets, taking vacations they can’t afford, and eventually get into debt trap and keep paying a big portion of their income into EMI’s

No, we are not talking about spending money on needs and enjoyment. We are talking about people who go overboard and cross their limits. We are talking about that person, who earns Rs 5 lacs a year, but lives the lifestyle of a person who earns Rs 10 lacs/year.

- If their financial status allows them to own a Maruti Wagon R, they buy Honda City.

- If they can afford eating out twice a month, they do it twice a week

- If they can afford to call 50 people for a family function, they call 500 so that they “look good”

And this continues for years and years … and once they get married or once they have kids, then they start wondering about the future.

That’s when they wake up and realize that they have messed up.

If you want to do mindless spending and never restrict yourself, then better earn like hell.

Make sure you take your income to a level, where “how much you spend?” does not matter. But most of the people earn a fixed income whose growth is going to be linear over time. Better control your spending beyond a level if you can’t earn enough.

Regret #5 – Lost a lot of money in bad financial product

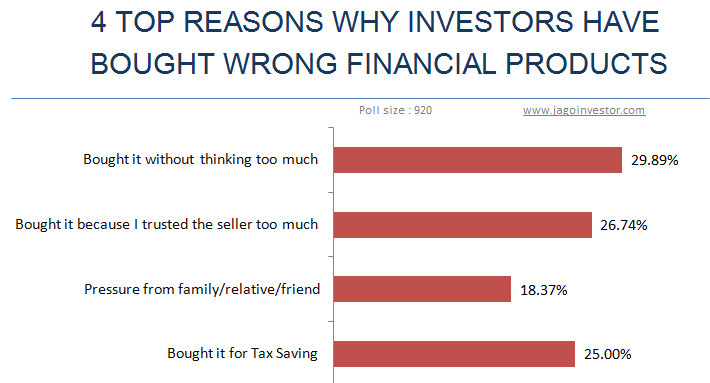

Investors trust close relatives and friends while investing their hard-earned money and invest money based on relations, hearsay or recommendations and don’t think enough before writing that cheque.

So the family uncle becomes the insurance advisor and the tax-saving expert, and the friend in the next cubicle is your financial advisor at times.

In the name of the tax-saving rush, investors commit themselves for years of premium payment in a useless product which is packaged very well and then many years later, they realize that they invested in a dud product.

Check the poll results below were 920 investors have shared why they bought a financial product which they realized is a wrong one for them. People buy it because they trust others easily, or its pressure from family/relatives at times.

The worst thing is the time lost and not exactly the money only.

If you invested Rs 50,000 each year for 10 yrs and finally realized that you only have Rs 4 lacs back out of 5 lacs paid, Your loss is not just 1 lac, its 5-6 lacs, because your 5 lacs could have become 10-12 lacs over these 10 yrs, think about the opportunity lost too.

Regret #6 – Trusted others too much and lost a lot of money

This is just a subpart of the point we just discussed.

A lot of people have lost a lot of money because they trusted someone. It can be a friend/relative or completely unknown person. There are various scams that happen in our country and worldwide. There are chit fund scams and get quick rich kinds of scams and people put their hard-earned money without thinking much.

Here is a recent case where a woman trusted a person and transferred 11 lacs to their account and later realized that she has been duped.

I am not recommending that you become paranoid about your money security and just never trust anyone, but when you are investing your money, make sure you do the background check of the person you are dealing with, do your homework and understand what you are getting into.

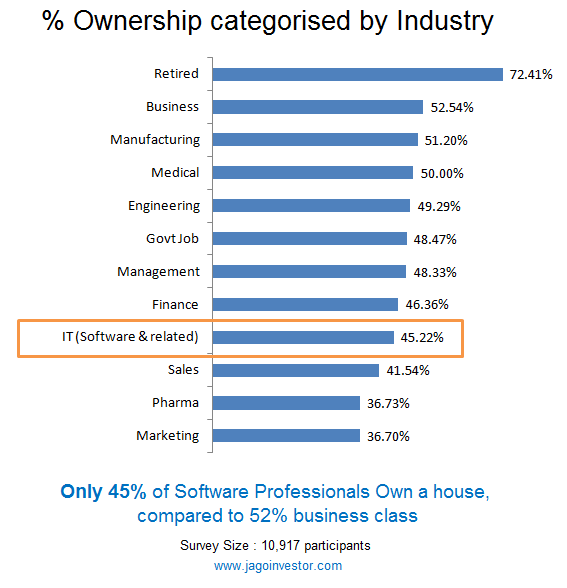

Regret #7 – Didn’t buy a house even when it was possible to buy

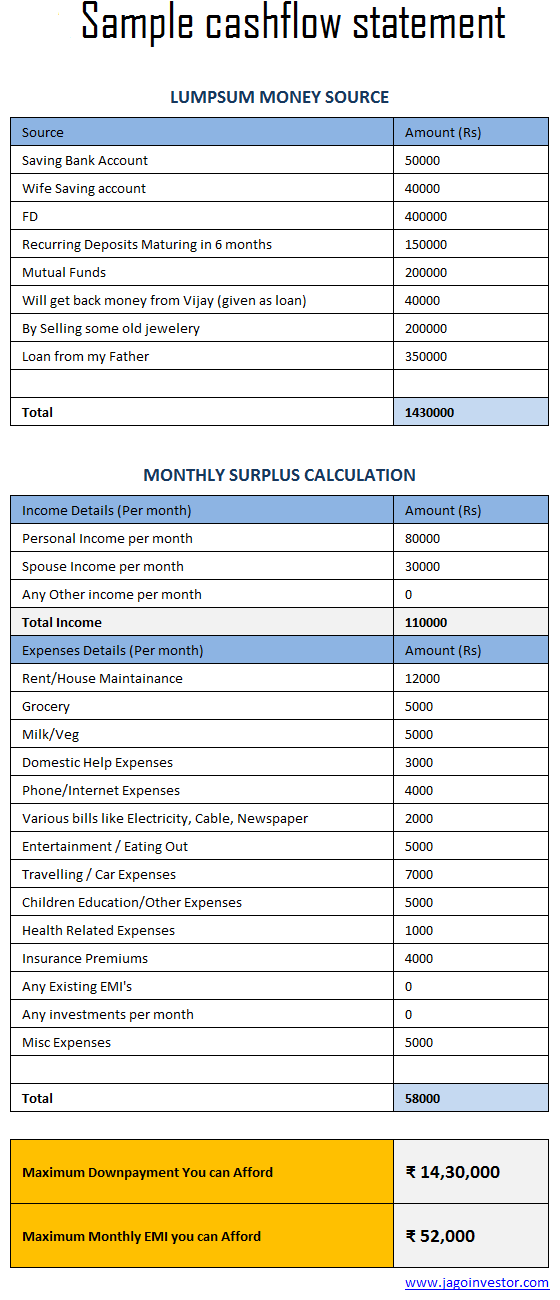

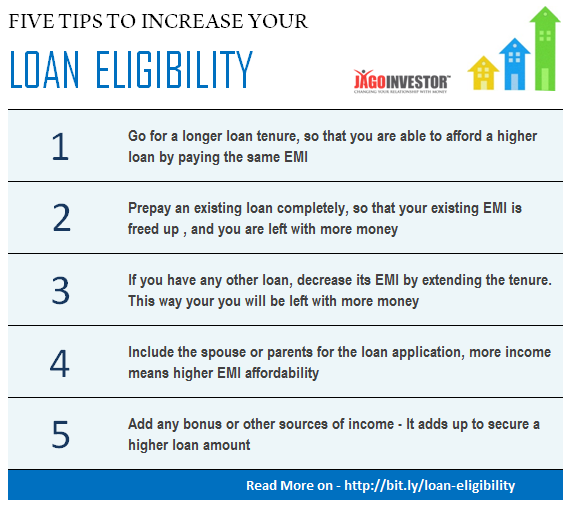

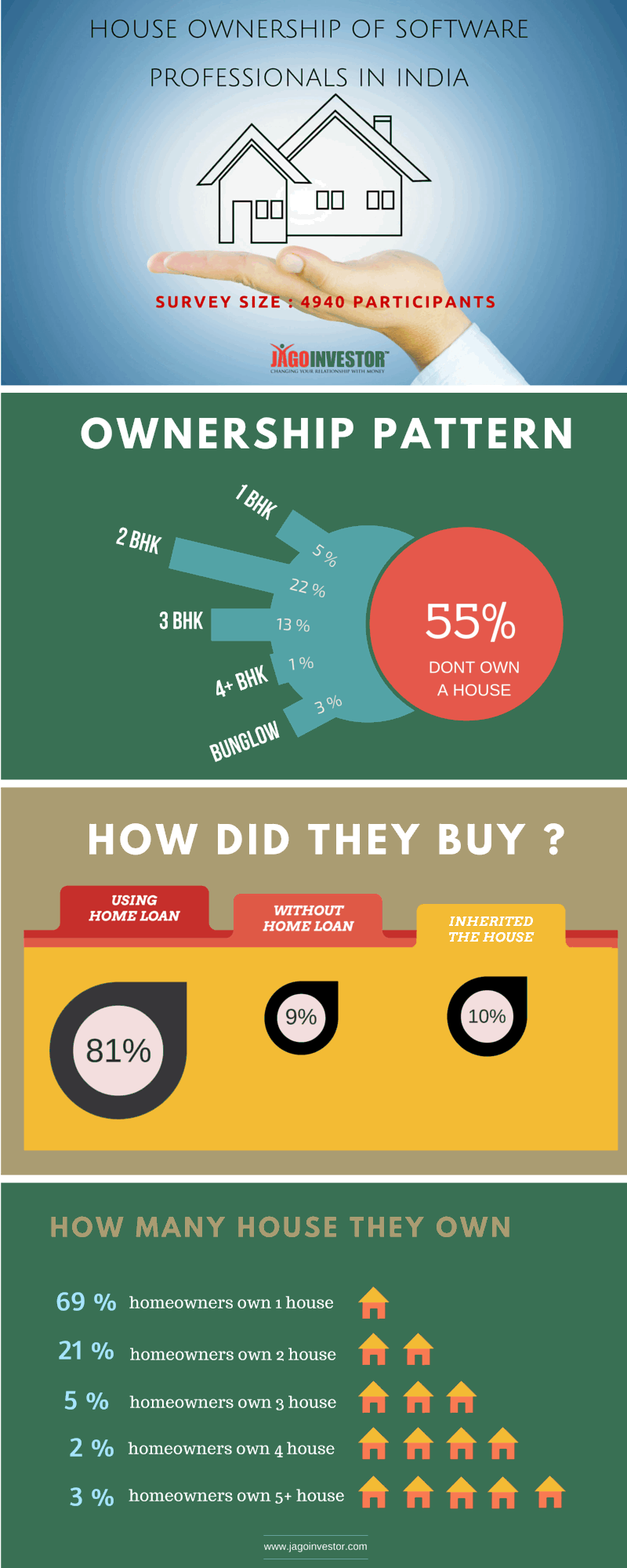

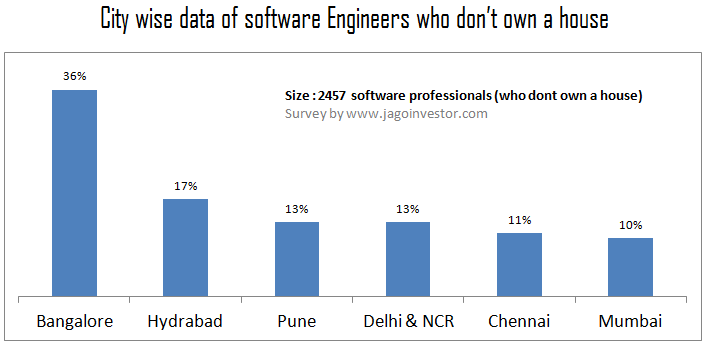

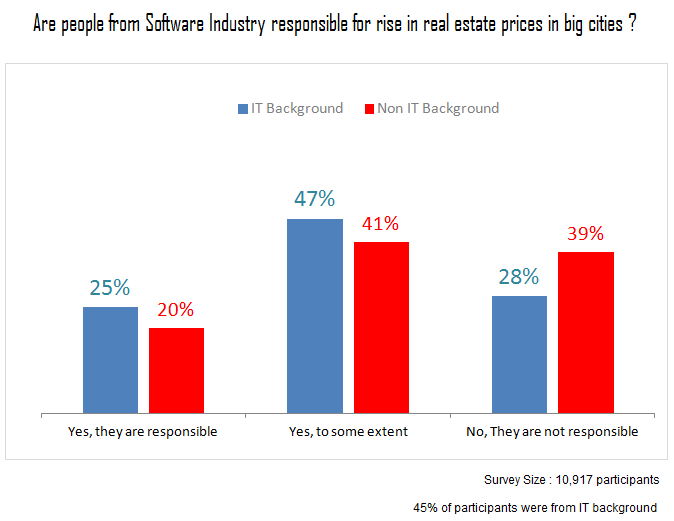

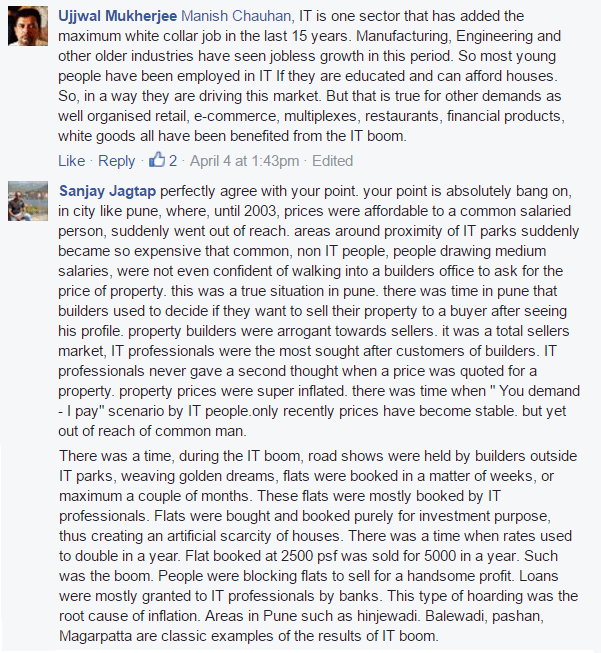

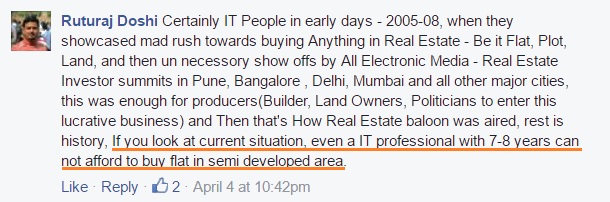

13% of people from 11,324 people who took the survey said that they regret not buying the house when it was possible for them. I am not sure what percentage of these people don’t have a house at the moment, but I am speculating that many people had the money to commit for down payment and take a loan, but they didn’t do it and finally prices went up and they could not buy the house later due to rise in prices.

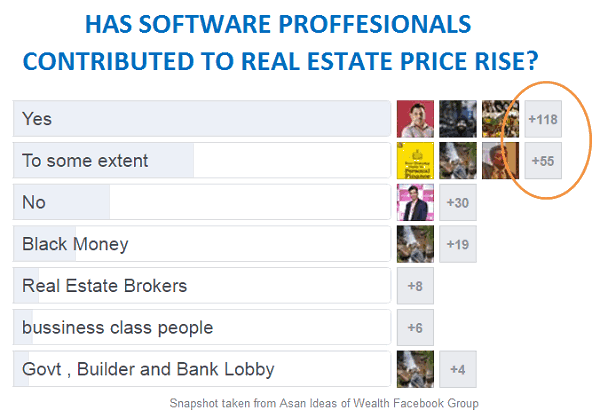

(Check this interesting article discussing software engineers and house ownership pattern)

My suggestion is that if one has the potential to make a down payment for the house and can afford to pay the EMI, then one can buy the house for consumption purposes (if not for investment purposes). Once you buy the house, a big pending task of life seems to be completed. But then this is a personal choice.

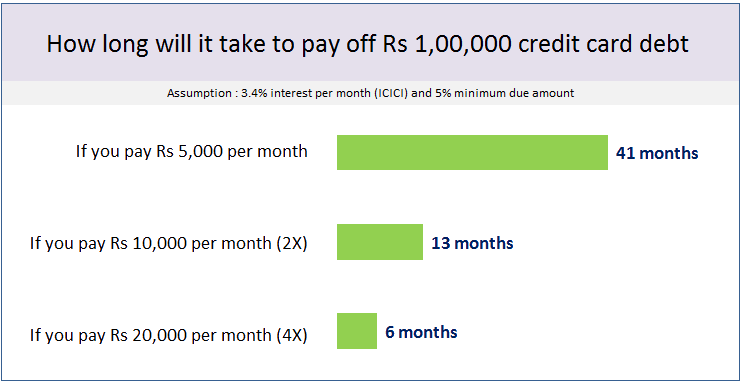

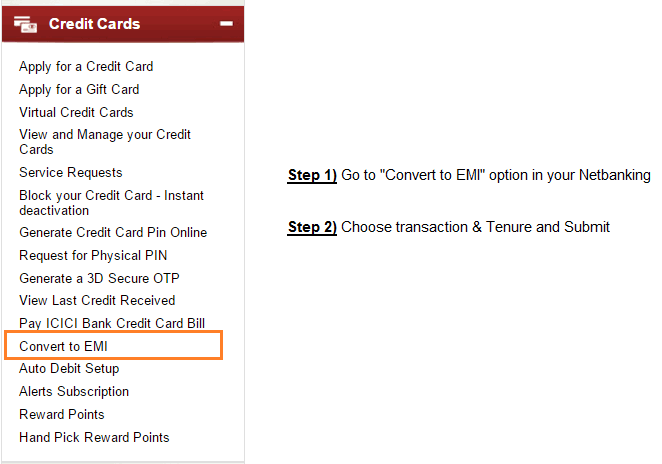

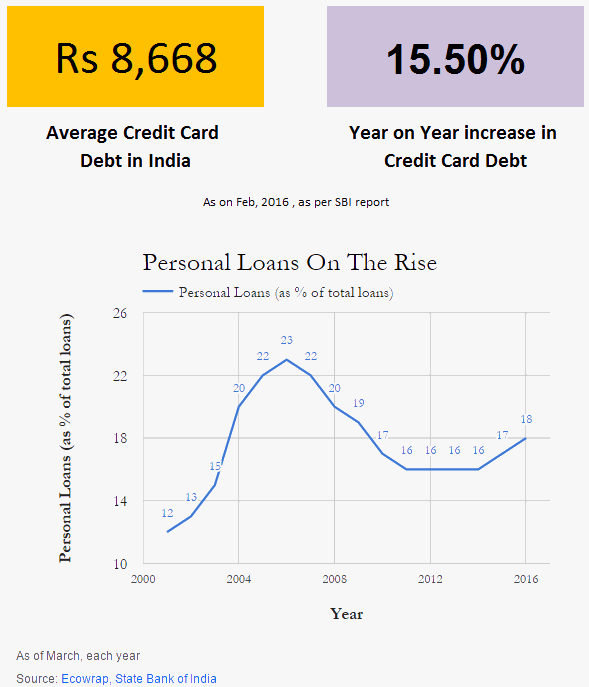

Regret #8 – Took too much loan in my life

Only 11% of people chose said that they regret taking too much loan.

It does not mean that people are not taking a lot of loans, just that they are ok with it or deal with it properly and don’t consider it as an issue. A lot of people prepay their loans before the original tenure.

My recommendation is to not take unnecessary loans for consumption purposes like vacations, alliances etc. The only two loans which to me make sense are Education loan and Home loan. At times car loan is fine, but then no other loans. Personal loans should only and only be taken in case of emergency and never otherwise.

What is your financial regret?

I would like to know from you what has been your biggest financial regret? Have you committed some mistake which you repented for years? If you had avoided that mistake, you would have a different financial life today?

Please share it in the comments section!

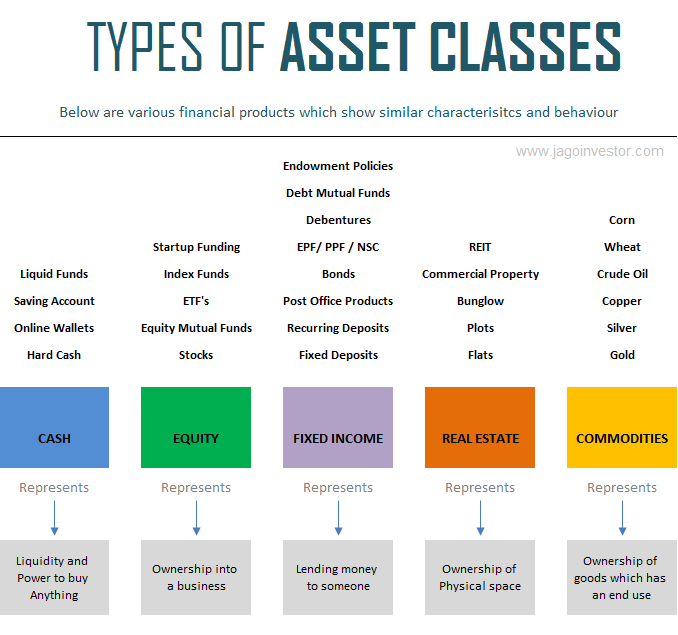

![asset class-] comparison](https://www.jagoinvestor.com/wp-content/uploads/files/asset-class-comparision.png)