Assured Income Plans

Buy assured income plans which can give you predictable income in your retirement

Know More

Features of Assured Income Plans

Assured Income Plans provide life insurance coverage and a guaranteed income source, offering regular payouts, tax benefits, and a lump sum at maturity. They suit risk-averse individuals seeking financial security, but may yield lower returns compared to aggressive investments.

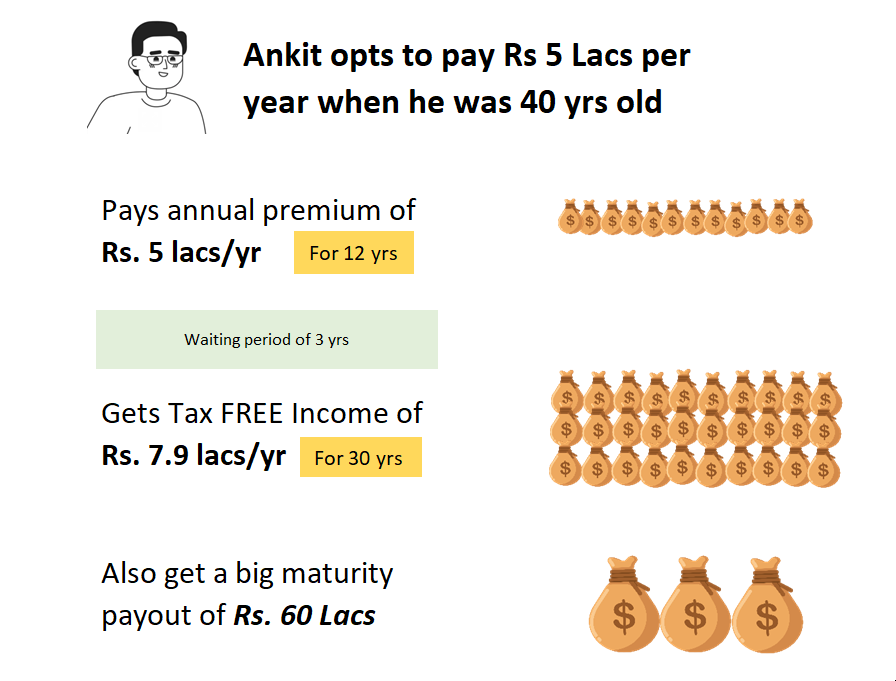

Fixed Income + Assured Payouts

Pay premiums for 10-12 yrs and get the assured income for next 25-30 yrs. You can also choose to wait before getting back the payouts for few years.

Big Payout On Maturity Of Policy

You also get a big lumpsum payout in future when the policy matures. This big amount can either be used for your expenses or can be left as legacy to next generation.

Income Tax Benefits

You get income tax benefits on the premiums paid. The best part is that the payouts which you get from the policy are 100% TAX FREE as per IRDA rules.

Flexible Payment Terms

You can choose to pay the premiums for as low as 5 years and it can also go upto 15 years depending on your situation and requirement.

Assured Returns of 6.5%-7%

These policies can give you an assured 6.5-7% kind of return. This is comparable to other debt options available to investors. As this is tax free, the pre-tax returns comes around 9-10%.

Life Insurance Coverage

You also get the life insurance benefit of around 11 times your yearly premiums

Example of a Policy

WHAT YOU PAY?

₹5,00,000 per year for 12 years

Total Premium Paid

₹

60 Lacs

8 Reasons why you may want to buy these policies

- Can be an good addition to your debt portfolio

- Get income after retirement which is assured and 100% tax free

- One of the highest return (IRR) in the Industry

- No-surprise, clear policy wordings and offering.

- No link with any stock markets movements, payouts are assured!

- Ideal for those who don't have any social security in India

- Ideal product for those want are looking for income after next 12-15 yrs (NRI, or Professionals)

- Can be bought on the name of Spouse (to generate pension) or even Children

Our Clients Love Us

It was indeed one of my biggest sigh of relief even before starting SIPs - it was when I registered myself with JagoInvester membership. I had been following JagoInvestor blog since 2 years and I knew I needed help. My financial health check was an expected eye opener.

Rachana Chokkapu

Invest in Assured Income Plan with Jagoinvestor

FAQ's

Is There A Minimum Investment Required To Become Your Client?

Yes, we want to associate with serious clients who really want to give their best for their wealth creation project and have the potential to be part of this initiative. Hence we would like to make sure that any one who wants to join this program brings a minimum One time investment of around 30 lacs – 1 cr Monthly SIP of anywhere from 50,000 – 5 lacs Incase you are not able to bring any lumpsum for now, then you shall start the SIP of minimum Rs 1 lac per month, so that you can cross the first level of 25 lacs corpus within next 2 yrs and then you shall also be deploying some additional lumpsums in between.