On 12th December, the Government of India has notified some changes to the PPF Scheme 1968. The government has replaced the earlier PPF Scheme, 1968 to the new Public Provident Fund (PPF) Scheme, 2019. You can view the following 5 min video I created on this topic.

Let us see what changes have been made –

1) Premature Closure allowed when residency status changes

OLD RULE – In 2016, the Government allowed premature closure of the PPF Account after 5 yrs, in case of account holders death, higher education of account holder, life threatening illness in family.

NEW RULE – As per new rules, two more condition is added.

Condition 1 : Now, a PPF account holder can close the PPF account after 5 yrs, in case of change in residency status (when you become an NRI or when NRI’s become resident) on the production of a copy of passport and visa or income tax return. However in that case, the account holder will earn 1% lower interest. This is great benefit to those NRI’s who are returning to India and want to redeem money from their PPF account, but they had to wait for 15 yrs lock in period.

Condition 2 : Now the PPF can be withdrawn to finance higher education of the dependent children of the account holder. For that one has to submit fees bills or confirmation of admission in a recognized institute of higher education in India or abroad

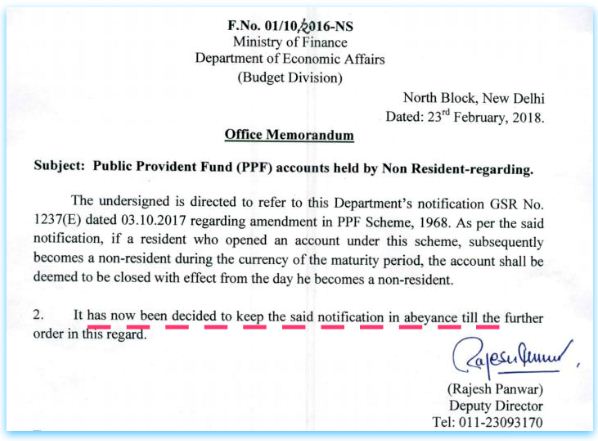

2) NRI investors might be able to open a PPF account

OLD RULE – As per old rules, it was very clear that NRI investors can’t open a fresh PPF account, however if they have an existing account they can continue holding it till maturity and then close it.

NEW RULE – However, the new PPF law is not clear on this. It does not restrict NRI investors to open the fresh account and it does mention if they have to close it on maturity. Hence looks like NRI investors can operate the PPF account in the same way the residents can. However in Form 1 (PPF account opening form) one has to give declaration that one is resident of India of not.

In that case, it’s unclear how NRI’s will be able to fillup form 1 to open a fresh PPF account. However it’s very sure that they are not required to close the PPF account on maturity and can continue it like any other investor.

3) Deposits allowed in multiple of 50 without limits

OLD RULE – Earlier as per PPF Scheme 1968, deposits were allowed in multiples of 5 with a maximum limit of 12 deposits in a 1 year.

NEW RULE – As per PPF Scheme, 2019 deposits are now allowed in multiples of ₹50 with no maximum limit on a number of total deposits that have been specified. In other words, you can make deposits to the PPF account as many times as you want, subject to the maximum limit amount.

Note – The minimum annual contribution of ₹500 and the maximum annual contribution of ₹1.5 lakh have been kept as it is.

4) PPF can’t be extended if there are no deposits made after maturity

OLD RULE – As per old rules, Once you choose to extend your PPF account on maturity with the option of “without deposits”, you could still choose to deposit the money when you renew if further after 5 yrs.

NEW RULE – However, as per new rules, once you have not made any deposits for 1 yrs after maturity, you will never be able to deposit the money after that in PPF account. All you can do is continue the PPF account and it will earn the returns till there is any balance.

Note : Once the PPF account is matured, you can renew it in the block of 5 yrs and if you want to continue depositing the money, you need to fill-up a form and mention specifically that you will continue your PPF account “with deposits”

5) Interest on Loan reduced by 1%

OLD RULE – Earlier as per PPF Scheme 1968, Interest on loan against your PPF Account was 2% per annum above the prevailing PPF interest rate. For example, if the PPF interest rate was 7%, you would have to pay an interest rate of 9% (7+2).

NEW RULE – As per PPF Scheme 2019, the interest on loan rate has been reduced to 1% per annum above the prevailing PPF interest rate. For example, if the PPF interest rate is 7%, you would have to pay a rate of 8% (7+1).

Note – In both cases, the interest is levied from the first day of the month in which the loan is taken to the last day of the month in which the last installment of the loan is paid.

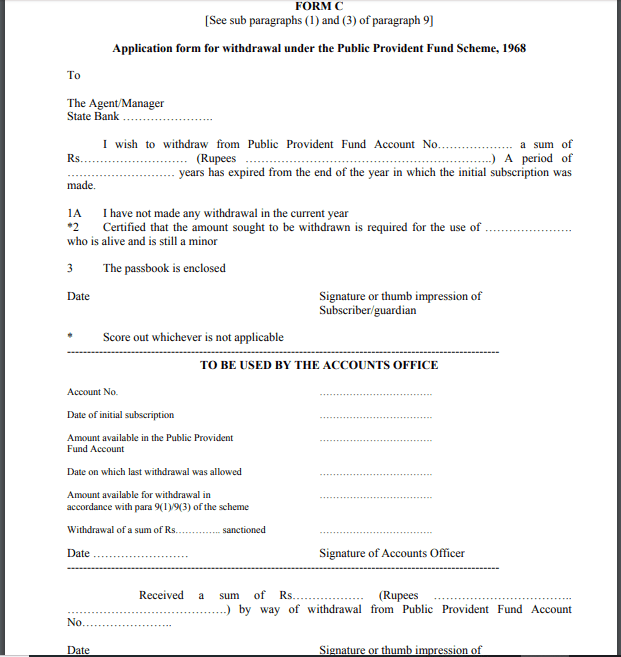

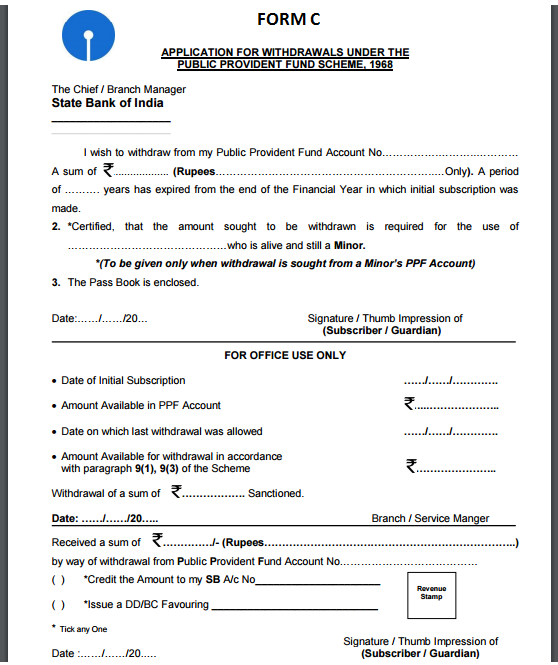

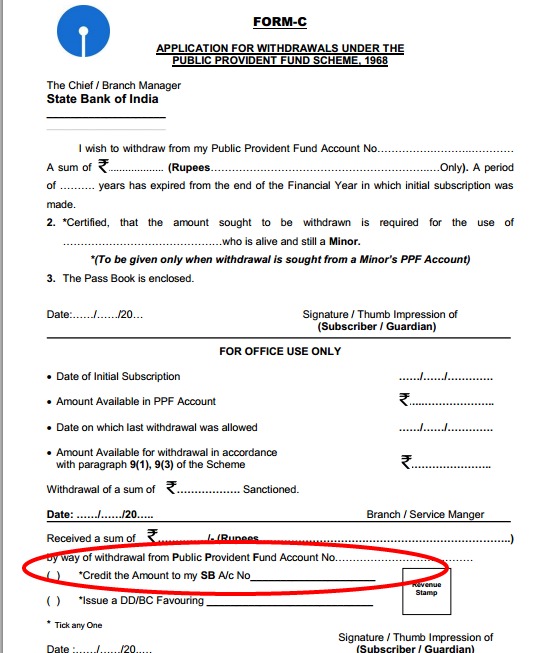

Changes in the FORM of PPF

Apart from these changes above, now there will be just 5 PPF related forms which are as follows

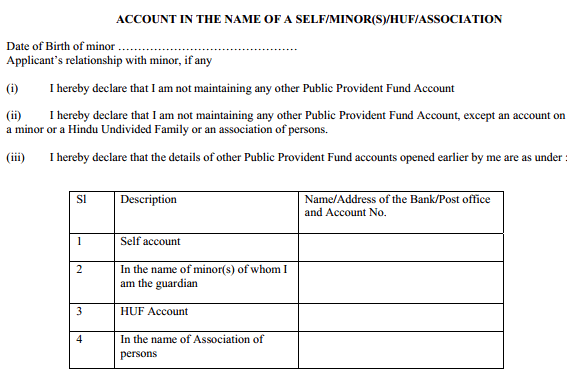

- Form 1 – Opening of Account form

- Form 2 – Form for application for loan/withdrawal

- From 3 – Form for application for closure of the account

- Form 4 – Application for extension of account

- Form 5 – Form for premature closure of the account

Here is a table showing how the old forms changed to new forms

[su_table responsive=”yes” alternate=”no”]

| Name of the Form | OLD Form | NEW Form |

| a) Account Opening Form | Form A | Form 1 |

| b) Contribution Form | Form B | Not specified |

| c) Partial withdrawals | Form C | Form 2 |

| d) Account closure after maturity | Form C | Form 3 |

| e) PPF Loan | Form D | Form 2 |

| f) Extension Form | Form H | Form 4 |

| g) Premature Closure Form | N/A | Form 5 |

| h) Nomination Form | Form E | Form 1 |

[/su_table]

Conclusion –

So now you all know the updated version of the PPF Scheme. Do let us know your views on the article in the comment section. Till then keep sharing this article with your family and Friends and Happy Learning.