RBI has recently issued some new guidelines for bank lockers which are consumer-friendly to some extent and will come into effect from 1st Jan 2022.

RBI went through lots of customer grievances and feedback from banks too and finally came up with some new guidelines. Let’s look at some of the most important points which really impact you!

1. Compensation of 100 times the locker rent

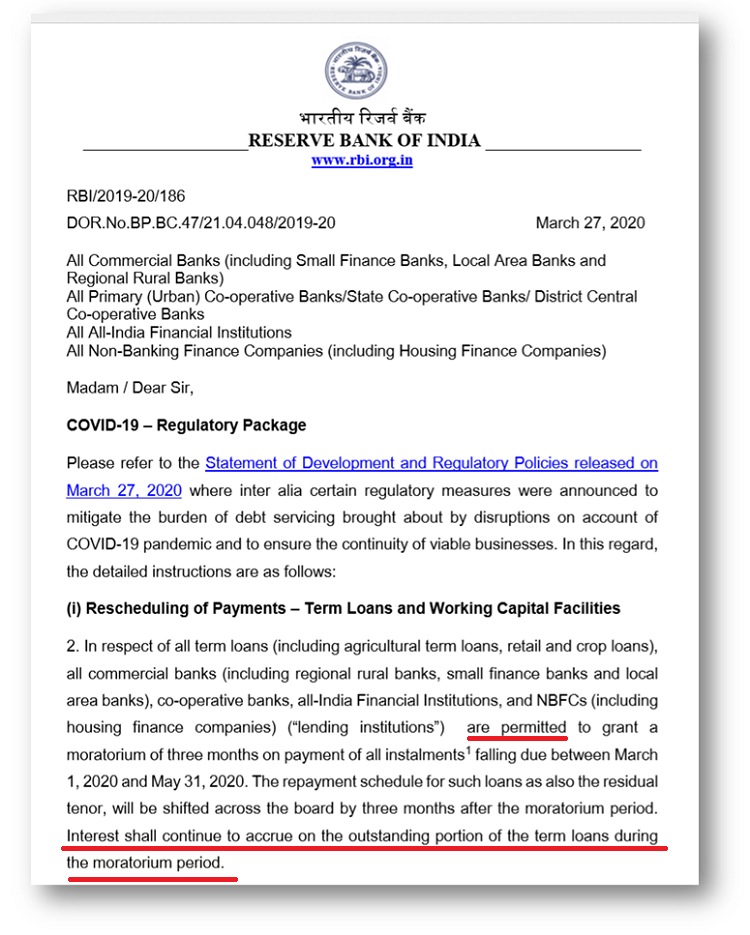

If there is any loss of lockers content due to bank negligence or irresponsible behaviour, then bank locker holders will get 100 times of locker rent as compensation. So if the yearly rent of the locker is Rs 4,000, then the compensation will be Rs 4 lacs

Here is what point 7.2 of RBI notification says

It is the responsibility of banks to take all steps for the safety and security of the premises in which the safe deposit vaults are housed. It has the responsibility to ensure that incidents like fire, theft/ burglary/ robbery, dacoity, building collapse do not occur in the bank’s premises due to its own shortcomings, negligence and by any act of omission/commission.

As banks cannot claim that they bear no liability towards their customers for loss of contents of the locker, in instances where the loss of contents of the locker are due to incidents mentioned above or attributable to fraud committed by its employee(s), the banks’ liability shall be for an amount equivalent to one hundred times the prevailing annual rent of the safe deposit locker.

2. SMS and Email alerts at the time of locker access

Now you will get email and SMS notifications on the same day when the locker is accessed. This will help if there is any kind of fraud or unauthorised access (like someone from your family opens the locker without telling you)

Here is what point 4.1.3 of the notification says

Banks shall send an email and SMS alert to the registered email ID and mobile number of the customer before the end of the day as a positive confirmation intimating the date and time of the locker operation and the redressal mechanism available in case of unauthorized locker access.

3. Last 180 days of CCTV footage are required for locker operation

Banks will have to install CCTV to monitor the common areas and doors from where entry and exits happen inside the locker room. This CCTV footage has to be stored for the last 180 days.

Here is what point 2.1.2 of the notification says

The area housing the lockers should remain adequately guarded at all times. The banks shall install Access Control System, if required as per their risk assessment, which would restrict any unauthorized entry and create digital record of access to locker room with time log. As per their internal security policy, banks may cover the entry and exit of the strong room and the common areas of operation under CCTV camera and preserve its recording for a period of not less than 180 days.

In case any customer has complained to the bank that his/her locker is opened without his/her knowledge and authority, or any theft or security breach is noticed/observed, the bank shall preserve the CCTV recording till the police investigation is completed and the dispute is settled.

4. Banks are allowed to charge 3 yrs of rent as term deposits

Banks are allowed to charge up to 3 yrs of rent + charges of breaking the locker from customers. So they may ask you to create an FD, but this has to be of a small amount, not any exorbitant fees like what happens on ground level. This is just to make sure that banks are protected for a situation where the locker holder does not pay rent on time or is unreachable for some years.

So if locker rent is Rs 4,000, the FD – they can ask you shall be for Rs 12,000 + some more charges like Rs 500-1000. So in total, it shall surely not cross 4 times the rent in any situation.

If the bank official asks you to create an FD for 2-3 lacs or forces you to buy any kind of insurance policy, then please tell them you are aware of rules and you will complain to RBI on this.

Here is what point 2.2.1 of the notification says

Banks may face potential situations where the locker-hirer neither operates the locker nor pays the rent. To ensure prompt payment of locker rent, banks are allowed to obtain a Term Deposit, at the time of allotment, which would cover three years’ rent and the charges for breaking open the locker in case of such eventuality.

Banks, however, shall not insist on such Term Deposits from the existing locker holders or those who have satisfactory operative account. The packaging of allotment of locker facility with placement of term deposits beyond what is specifically permitted above will be considered as a restrictive practice.

Another small point is that if locker rent is collected in advance, in the event of the surrender of a locker by a customer, the proportionate amount of advance rent collected shall be refunded to the customer.

5. Waitlist numbers & Vacant Locker list to be displayed

Now each locker application has to be duly acknowledged and a waitlist number has to be given to the customer. That waitlist number has to also get displayed in banks along with the number of vacant lockers. This is to ensure transparency. Right now the things are very opaque and customers don’t get enough information and clarity about their locker applications

Here is what point 2 of the notification says

In order to facilitate customers making informed choices, banks shall maintain a branch-wise list of vacant lockers as well as a wait-list in Core Banking System (CBS) or any other computerized system compliant with Cyber Security Framework issued by RBI, for the purpose of allotment of lockers and ensure transparency in allotment of lockers.

The banks shall acknowledge the receipt of all applications for allotment of the locker and provide a waitlist number to the customers if the lockers are not available for allotment.

6. New Agreement by Jan 1, 2023, for existing locker holders

A new locker agreement has to be signed with all existing locker holders with all these new guidelines and rules. A draft copy will be framed by IBA (Indian Banking Association). So if you already have a locker, do wait for the bank to reach out to you in 1-2 yrs to sign a new contract.

Here is what point 2.1.1 of the notification says

Banks shall have a Board approved agreement for safe deposit lockers. For this purpose, banks may adopt the model locker agreement to be framed by IBA. This agreement shall be in conformity with these revised instructions and the directions of the Hon’ble Supreme Court in this regard.

Banks shall ensure that any unfair terms or conditions are not incorporated in their locker agreements. Further, the terms of the contract shall not be more onerous than required in ordinary course of business to safeguard the interests of the bank. Banks shall renew their locker agreements with existing locker customers by January 1, 2023.

Here is what point 2.1.2 of the notification says

At the time of allotment of the locker to a customer, the bank shall enter into an agreement with the customer to whom the locker facility is provided, on a paper duly stamped. A copy of the locker agreement in duplicate signed by both the parties shall be furnished to the locker-hirer to know his/her rights and responsibilities.

Original Agreement shall be retained with the bank’s branch where the locker is situated.

7. Closure and Discharge of locker items

The notification lists down 3 situations when a locker can be opened by the bank.

Here is what point 6 of the notification says

This part refers to the breaking open of the locker in a manner other than through the normal access by the customer using her/his original key or password under any one of the following circumstances:

- If the hirer loses the key and requests for breaking open the locker at her /his cost; or

- If the Government enforcement agencies have approached the bank with orders from the Court or appropriate competent authority to seize lockers and requested for access to the lockers; or

- If the bank is of the view that there is a need to take back the locker as the locker hirer is not cooperating or not complying with the terms and conditions of the agreement.

Banks shall have a clear Board approved policy together with a Standard Operating Procedure (SOP) for breaking open the lockers for all possible situations keeping in view the relevant legal and contractual provisions.

Apart from the points above, there are many minor things which are all listed in the notification which can be downloaded below

Download the RBI Guidelines PDF here

Please share your views about this notification and guidelines set by the RBI in the comments section.