Silver prices vs Gold Prices in India

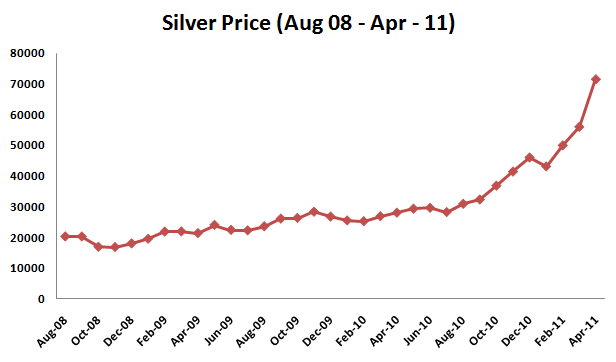

Imagined what gave maximum return in 2011 or 2010? Well, was it Gold, Equity or Real estate? Nope! Hold your breath, it was SILVER and it gave huge returns! It is almost unbelievable that the price of silver as on Aug 2008 was around Rs. 20,000/ Kg, and it went to Rs. 72,000 by the end of Apr 2011, which was a 300% absolute rise in less than 3 yrs. But don’t get too excited, Silver in just 1 week has fallen like anything. From the peak of 72,000 in Apr 2011 end, it went down to Rs 52,000 in just 1 week. Can you believe that? A 28% fall in the prices of silver in just 7 days! Let’s explore more on this.

Gold vs Silver returns ?

Now a days there is a big debate going on different TV channels as well as newspapers that what should a common man buy? Gold or Silver?

In our country, Gold is something which every family buys because of the attraction we have for this metal. On any occasion, gold is the obvious choice. But Silver is not seen the way gold is looked upon. It’s generally limited to not so well off section of the society. This is one of the reasons why middle class or even richer one’s never considered looking at what’s happening in silver and if it can have some potential in future as an investment option. Gold, Gold and Gold was the only option when it came to buying some precious metal.

A lot of people are surprised to hear and see how gold has given fabulous returns year on year in the last decade, but now you would be more surprised to know that for most of the years silver has outperformed gold with good margins in terms of returns. For example, everybody knows that Gold gave 25% return in 2010, but not many know that Silver in the same year gave 80-85% return.

Silver has given 24% absolute return in just one month of April 2011. I don’t think it’s anything other than speculation because that rise was short-lived and in just 1 week (May-‘11 first week), all the gains made in Apr disappeared and prices fell by 25%.

Below is the chart which shows you the monthly price movement in silver for last 30 months. You can see how silver prices exploded in last 4-5 months (2011)

Factors affecting price of gold and silver

1 . Supply and Demand

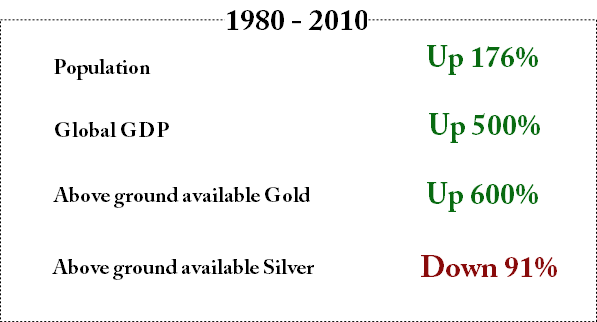

One of the biggest and obvious reasons behind the price movement for anything is its demand and supply in the market. It directly impacts the movement in price. It is estimated that in 1950, the reserves of gold was 1 billion ounces, but by 2010 it increased by 700% to 7 bullion ounces (see the video below)

However on the other hand it is totally different with Silver, in 1950s there were 10 billion ounces of silver, but by 2010, it dropped by huge 95% and its current reserves are only 500 million ounces worldwide. A very obvious reason for this is that gold is mainly stored in form of bars, jewellery etc and its recycled again if required. However silver is also used widely in Industry in very smaller and thin parts which get lost and never reused. In fact, it is not possible to use it again because of its used in lesser quantity and in small parts.

2. Practical use in life

Gold and Silver are very different when it comes to its usage in real life. While both of them are precious metal and often used as jewellery, Gold has a very different image and can be considered as the undisputed king in this area. From millenniums Gold stands the most favourite metal for jewellery, in fact there is some kind of unseen connection which humans have with gold, which cannot be explained. May be it’s the way it has always been and it can’t be changed. But if you see gold as a useful metal, it does not have much to show off. It’s literally not used anywhere other than at a few places.

Silver on the other hand is also used in various industries and holds a very important position. In fact you can see it as “gold” for industrial use. Let me give you more info on this. Silver is used in Bandages, batteries, soldering process, cell phones, computers, satellites, high-tech weapons, laser and digital technology, electronics circuit board, solar cells, water purification, RFID chips and the list goes on.

Silver has more industrial applications than any other metal. A recent report by Hinde Capital says: “It’s the best conductor of both heat and electricity, the most reflective, and second-most ductile and malleable element, after gold.” The white metal is also being put to several new uses like-water purification, air-handling systems and a natural biocide.”

In last couple of decades, Silver is so extensively used in Industry that it’s reserves has drastically gone down. Just to give you an example, in the decade of 1990 – 2000, around 2 billion ounces of Silver was consumed. That’s a lot of silver!

3. Role as alternate currency

Precious metals are always considered as the alternate currency and wealth in pure form in any emergency situation. Gold is a universal currency and not dependent on country or any community.

In times of war, people fear that their assets may be seized and that the currency may become worthless. They see gold as a solid asset which will always buy them food or transportation. Thus in times of great uncertainty, particularly when war is feared, the demand for gold rises. That’s exactly what happened in Zimbabwe lately, where currency is worthless now and people are using gold as alternate currency to buy bread

Recent rise in Silver Prices

You might have heard lately about rise in Silver prices and definitely you might have felt that you “missed the bus”. Let me talk a bit on that. You have already read about the reasons of price rise in silver above. One of the biggest reasons is fundamentals of silver, it is a valuable asset and over a long-term, it’s going to be much valuable because of its use in industry, every industry requires silver!

But other than fundamentals, there are elements of speculation also involved, otherwise I don’t see any reason for 150% rise in its prices in just 1 yr and then a 25% fall in just 1 week. It’s going to be volatile.

To know why the price of silver fell recently , read this article . Please share your comments on Gold and Silver as an investment .

May 12, 2011

May 12, 2011

hi mr minash..

thank you for your information..it help me to complete my final year project..

Welcome !

Hi,

Buying physical silver seems safe & easy than e-sliver after NSEL scam. However few clarifications that would help me:

1. Is there a way to test purity of physical silver – bars/coins?

2. What is the best shop to choose? with price varies across cities and outlets

3. How to sell after we buy for best price and with comfort.

I think this needs a full article 🙂

Hello , Good Morning

I am thinking of investment in physical Gold or Silver at current rates, which should give me the best returns locked period of atleast 5 years.

Is it a question or a declaration ?

Hi Manish,

Firstly i want to thank you for coming up with such a good blog.

I believe investment in Silver is a very good option. As i can see in the past 7 Years (Since 2004) Silver has also given equal enough returns as like gold. And I feel it will continue to give good return in future also. Since the industry usage of silver is increasing day to day also the investors are getting more awareness about investment in silver. As an investor we should look for long term (Say 3 to 7 Years)…

What do you say Manish???

I agree .. but the issue is again you can never be sure of price movements in short term !

as in on any topic presented can we have a summary. So those who dont want to read a detailed, can just have a look at the summary.

Thats not possible with all articles 🙂

Thanks. Continue the good work. Can v hv a brief and detailed report on the same topic?

On which topic ?

I’m a complete novice at investments and hence was looking up the net for advice. I’m looking at investing a decent amount in either gold/silver or both. At current prices would you recommend it? It’s intended to be a long term investment. What would you recommend?

We cant give any investment suggestions like this , You can invest in it if you are ok with the volatility and the risk factors !

Hello Everyone, Good Morning

I am thinking of investment in physical Gold or Silver at current rates, which should give me the best returns locked period of atleast 2 years. Please advise

Almost same

Hey Manish,

Is their an ETF for silver in India? After reading your blog I think I should have a portion of silver in my portfolio.

Vikram

There is no silver ETF in india at the moment , the only way to invest in silver is either physical or e-silver : http://jagoinvestor.dev.diginnovators.site/2010/09/invest-in-gold-and-silver-through-e-gold-and-e-silver.html

Manish

Yes, I think investment in gold is best in this point of time. Inflation is high in emerging markets and developed markets failed to attract investors as recession continues. I read a good article and I am sharing the link. http://www.want2rich.com/2011/05/personal-finance/an-asset-for-all-times-gold/. Hope this will be helpful.

I seriously think that there could be an alternate to silver that could be developed, for industrial consumption. Petrol/Diesel…. everything will vanish by this logic, but substitutes will be invented.

I can have silver as part of my portfolio, but not as a commodity to speculate and make big money on.

Dear Manish,

I, a 29 year old central govt. employee, have been an admirer of your blog for nearly an year now even though I am taking the step to comment for the first time.

I always wished that someone would take care of my money like Tim Robbins in ‘Shawshank Redemption’ who says ‘Do you want your sons to go to Harvard… or Yale??’…to a guy who comes to him for financial advice in the jail ;-). But over time I have realized that one has to make their own informed choices. And I take my hat off to your efforts in helping people like us.

I will just put my 5 paisa worth of thought in the light of the post about silver. I had been noticing the leaps and bounds by which silver has been growing and only understand it better after reading your post. For the past few months, I have decided to follow an old school method to save in silver. I went ahead and bought a clay piggy bank. I have been putting 5 silver coins in it on around 10th of every month. I see it as my SIP in Silver. I understand the risk about purity of silver used and I intend to trade the pot with a silver bar once it gets full.

It feels reassuring to think that the general rising trend will most likely continue. Please let me know if I am overlooking something obvious.

Regards,

Gaurav

Gaurav

Thats great way to invest , truely .

In todays world of digitalization , we are so much into internet banking and online transactions , that we have lost the touch with traditional way of saving things which I think was a great way .

the best part is your discipline to act every month and thats what makes it great. You are not missing on much things , the only thing is security of the silver (theft , mishandling etc) and purity offcourse .

I think each 4-5 months once you have enough in the piggy bank , you can trade it with the big bar and keep it in locker or your safe deposit at some place .

Also accept the risk that silver after so great upmove , can also have some months of downturn , check the reasons for your investments and be with it

Manish

The way Silver rose parabolically during the last one month, it was inevitable that any such rises will bring crash. Remember Nasdaq in March 2000.

My gut feeling tells me Silver will slide all the way to low 20 Dollars before coming up. Gold on the otherhand will not fall so much and will recover before Silver has a chance to catch up to it’s recent peak.

If someone is more inclined to take risk consider investment in AIG World Gold Fund or DSP BR World Gold fund. They are falling even sharply than Gold prices, since they are invested in Gold/Silver Mining Companies. I will wait till Silver touches low 20s before investing in one of these funds.

Sundar

Can you explain more on technical side for the fall ? Is it just a correction because of high rise ?

You can get a good hang of technicals from this link:

http://globaleconomicanalysis.blogspot.com/2011/04/taking-silver-profits-swapping-silver.html

I read this article on the 28th April and immediately shorted Silver on MCX and made huge gain in 5 trading days and now I am waiting for reentring Gold or Silver at low 20/Silver.

Sundar, If you know Gold and Silver Prices always fall in a ratio 37:1 then you would not expect silver at

$20 at the current demant and the silver reserve. You are saying that gold will recover but silver not. I do not see any loguc behing this. The fact is Silver is still consumed in large quantities in both domestic and industrial use. If its true that Price increases ad demand increases then falling of silver price back to $20 will be a dream. oh! common even Steel prices are increasing… I am not saying that silver prices will go so high but it will continue to give decent returns if not exraordinary.

Silver prices plunged over 28% in the week to 5 May 2011. While the recent margin increases by the CME have been cited as a reason for the pullback, the volatility highlights the huge influence of speculative forces in the silver market.

You might want to think again and know more before investing in this safety zone! For more information on invetsments in this safety zone check out the link below:

http://www.fundsupermart.co.in/main/research/viewHTML.tpl?articleNo=717

NIketa

THanks for that article . I agree that speculation is one of the major reasons for high volatility

Manish

Yeah Manish! 🙂

Hi Manish,

Are there any currencies that are backed by silver? I know Indian Rupee used to be backed by silver and US Dollar was backed by gold.. What is the situation now and will this change in reserves affect global currencies?

Bala

I am not sure, but it could be true that for milliniums currency had a close relation with silver , Infact even the word Rupee is derived from Sanskrit word “Raupya” which means SILVER 🙂

Mansih

hi Manish

I think silver will never be considered as good for investment purposes as do we have for gold. As you have said that silver is highly being used now, but then why did the prices of silver after getting so high it went drastically down?

Hi,

When the price of a particular asset rises sharply there is always a chance the a bubble is created and once the bubble burst the prices crash. As silver supply is limited compared to its use prices were driven up by the speculators. As the process go up more and more people get involved in the speculation and then it is question of finding the greater fool. Once the search for the greater fool fails the prices crashes. This happens in all assets. It will happen in future too. So beware and increase your knowledge. Do not invest in anything just because it is hot today. Ask yourself do i have sufficient knowledge to invest in this. Remember the great Investor Warren Buffett does not invest in ICE ( IT, Communication and Entertainment) stocks as he says he cannot predict their earnings for the next 10-15 years with a measure of certainty.

It is not important for us to invest in all asset classes as long as we can learn the intricacies for a few asset class and then apply our knowledge.

Ujjwal

Why do you think so , Silver will never be considered as good investment only from those who do not understnad it , for people who understand it , have taken the pain to understand its potential , they have already acted on it and made money 🙂 .

Hey i will call that as ignorance…Its now catching up…Silver has proved that its worthy staying invested, thought all the eyes have only now turned on the while metal. We are so much used to gold and we are not ready to accept silver as an investment i guess that the mindset. Silver is certainly being viewed as another investment worthy commodity. To simplify things NESL has already introduced e-Silver at a time where there are no Silver ETF’s people who wan to invest in silver but not comfortable about physical silver for they have storage problems can invest in e-silver. I think soon silver ETFs would come in to picture. There is a huge amount of silver being consumed in china and india by Consumers, industrial consumption is any way known to us. Its true that there was a recent bubble and prices were volatile however over a long term perspective its still good. As a matter of caution it may not give 50-80 % returns yoy. However it has potential to give us good returns adjusted with inflation.

Retailization of the silver is not as much as Gold be it Jewellery or Investment products. Unlike Gold, I am not sure whether the central bank of any country is buying silver as substitute for currency.Most of the consumption of silver is in the bulk segment i.e industrial use with little statistics.

However the retail segment is catching up and soon the consumption figures would emerge as research picksup. I believe the hay days of steep rise are over for silver and we could be seeing the rise in price at par with inflation if not reverse.

With little information on demand, supply and growth, it would be difficult to take a call on investment into silver in any form.

Krish

Over the long term , you can expect inflation linked growth in silver or gold , but its very long term , sometimes every 15-20 yrs

Manish

Manish,

Thanks for this article , but all these facts like

– Supply for Silver being less

– Practical Usage of Silver being high

were even true for past 5-10 years.

So what drastically changed in 2010-2011 for prices going so high ? Did people realise it now due to global uncertainity ? Did people started to look for another metal ( other than gold ) because cash could devaluate as it happened in Zimbabwe ?

hi Manishbhai

06 months ago, I have lot of money but dont know investment.I just put my money in LIC & FD.When I read your blog,a new view/ideas develop in me regarding investment.

Thanks..Thanks.. thanks .. 1000 times to you.

pl.write in the same way for common readers.

Lage raho manishbhai

-raj

Raj

Great to know that you liked what I write and learnt from it 🙂

Manish

Manish … Ur site followers like me know wat U r & the noble motive behind this work …. just ignore guys like Gautam who dont want to take any responsibility ok … move on …. dont entertain them…

N thanks 4 replying 2 my query on money-sights, few more points:

1) When I enter the value against “Months remaining for SIP”, it gives an error… moreover I cudnt understand everything that U explained …. can U Plz clarify?

2) It wud be better if money-sight gave details of mutual-funds like returns on “Since launch” basis as well n not just on 1/2/3/ 5 years only…

3) Is this site Ur brain-child??

Thanks…

Saurav

thanks .

1. Let me connect you with Santosh of moneysights and he can take more info and question from you on moneysights error .

2. they can reply on this better .

3. Yes , its mine

Manish