Who doesn’t want to ensure the financial safety and security of loved ones?

You work so hard for your entire life to build the required corpus, assets or to grow your family business (if any) to inherit the legacy to your family.

But, what if there are many heirs to your property? In the case of having children from a previous marriage? In other words, you have a very complex family structure.

Have you given a thought that how will a smooth inheritance process take place after your demise? Who doesn’t want to avoid family disputes on property-related issues? This is where one needs estate planning.

In this article, we will introduce you to the concept of family trusts and the basics of estate planning.

Having an estate plan in place is to achieve seamless intergenerational legacy distribution, continuity of business, and safeguarding the benefit of all the heirs, are the best thing you can do for yourself and your loved ones.

What is Estate Planning?

Estate planning is nothing but writing it down, how you want to distribute your wealth among your family members after your demise. It can also be a plan that defines, how will your family legacy be carried on or who will head family business, in case you are ill or in a critical health condition.

Estate includes immovable like home (real estate), agricultural land, etc, as well as immovable assets like gold jewelry (commodity), our bank balance & fixed deposits (cash). Items such as our collections like coins and paintings are also a part of the estate.

When should one do estate planning?

People have a myth that estate planning is for rich, not for poor or it is a thing to be done after retirement. At the same time, it is suggested to do estate planning as soon as you are having any liability on you (Debt/Loans) and you have any asset whether physical or financial (whatever amount it can be).

You need to write it down, how will your debt be met, what asset should be used to pay off and who is answerable to things. It is to ensure that your loved ones are not troubled for loan related issues after your demise.

Most of us defer estate planning for a later date or time due to various reasons such as—to avoid discussion on demise, avoid difference of opinion with a better half on the distribution of asset, lack of knowledge, etc. But, the time is now and we must put this on our priority list and not postpone it, thinking it to be irrelevant.

As I said estate planning should be done by every person. However, a more important question is how to do it and what are the ways to do estate planning.

What are the ways to do Estate Planning?

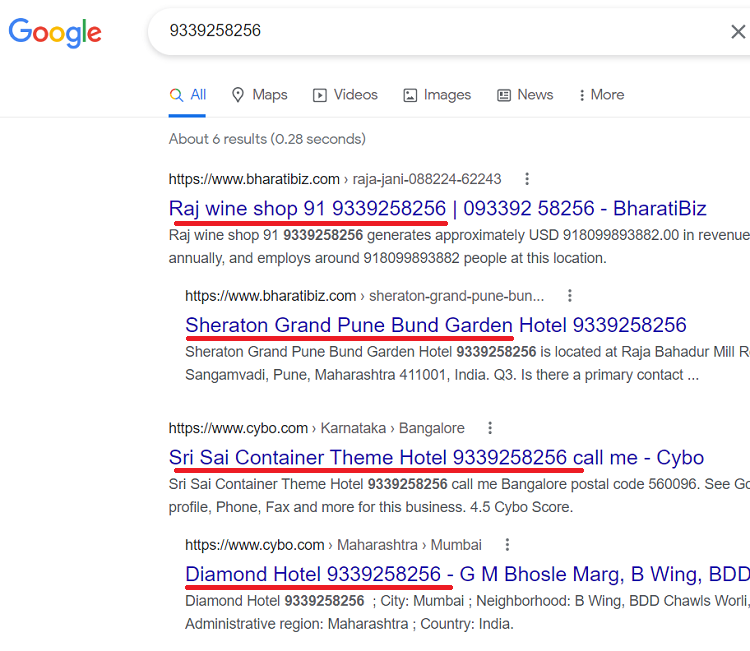

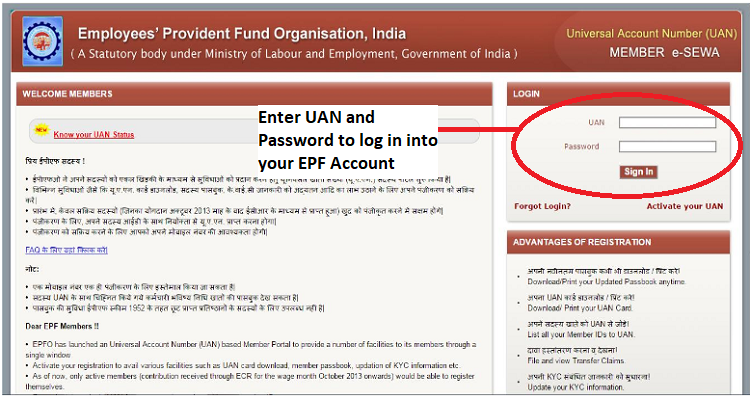

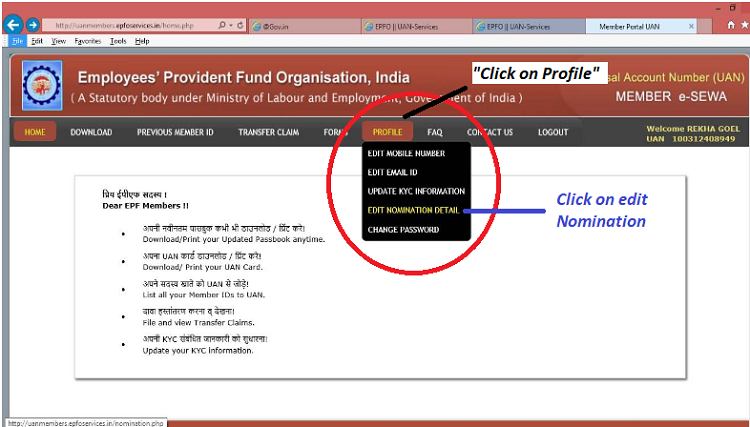

In India, it includes making a nomination (for financial assets – it is suggested to always nominate a person whom you want to actually transfer the asset), joint ownership, will or setting up a trust.

If there is no such thing or there are any disputes like nominee is different from the legal heir, then wealth distribution will happen as per the succession law depending on the religion you belong from.

As per succession law, the Property of a Hindu resident will be distributed as per Hindu succession law i.e. equally among class – 1 legal heir (spouse, mother, and kids).

For eg. You have a house worth Rs. 3 Cr. and there are 4 kids. You have not made any will or trust. So, it is not necessary that 4 of them will agree to the not single point of selling the house and distributing the proceed equally. One or two may disagree and keep the property with them.

If you want to know more about succession law, you can watch the video given below –

Estate Planning – using Trust

If there is a complex family structure like kids from first marriage, many kids, stepmother, special child or a minor, or you have a business empire and due to a lot of drawbacks/disadvantages of another source of estate planning like nomination, succession law or will (whether registered or not) it is suggested to have a living trust (private trust) to enable smooth inheritance of wealth.

Trust is an agreement between the settlor (maker of trust) and the trustees to transfer legal ownership of assets/property to the trustee with an obligation that the same should be held and used for the benefit of all the beneficiaries as specified in the trust deed.

For forming a trust, you (the giver of wealth) need to write a trust deed that specifies all the instructions for the distribution of wealth. The settlor then appoints a trustee to execute the trust deed and he/she also needs to fund the trust by transferring the assets (movable as well as immovable). Trust needs to be registered with registrar office of state government (trust falls under state list and hence are governed by state laws) by paying stamp duty.

Trust deed – The trust deed should specify the purpose of the trust, it’s objective and how will it function. You need to identify the trustee or trustees which can be a friend or relative or it can also be a corporate entity. You also need to give instructions in the trust deed about execution in case of any incapability happens to you (critical health conditions) and about its dissolution.

Trustee – Corporate trustees are professional firms or companies that provide or arrange different services as required by the trust. In a trust deed, you need to specify the successor trustees (if first trustees are not alive or are retired).

Myth about Trustee

People think that if they form a trust, their wealth will be owned by the trustee and they will lose control over it. So, yes the trustee becomes the owner but in a virtual world. In reality, the trustor has an obligation to fulfill the purpose of the trust deed.

A trustee has no right to use the property for himself/herself. He/she can use property just for the benefit of beneficiaries. However, while the settlor is alive, he has full control over the activities as well as an asset transferred.

In fact, nowadays there are various professional trust agencies that provide trustee arrangements. They don’t have any biased or personal sake in your wealth and they will stand as whole-time executor of your trust deed.

Drawbacks of Will

We know that a will is one of the traditional method used to do estate planning. But, will whether registered or unregistered can be challenged in the court of law. Let’s see in detail, what all are the drawbacks of will?

1. Will can not take care of unforeseen eventualities – As the will is a final declaration of your intention with respect to your property, which the courts endorse only after your demise. Thus a Will can not take care of unforeseen eventualities like any disability or illness as it is towards the disposition of property of the deceased rather than management.

2. Probate of will takes long period – A Probate which is necessary for establishing the rights of the executor or the beneficiaries under the Will in certain cases may take 6 months to 1 year and until such time, the beneficiaries would not be able to use the assets.

3. Can be challenged in court – Authenticity of a will can be questioned in the court on the grounds of fraud, forgery, undue influence (made in the pressure of something), mental illness of maker, lack of will-maker’s capacity, lack of knowledge and approval, and revocation. Even a registered will can also be questioned as registering a will does not lend it any legal sanctity or remove suspicion about its validity it’s just that it reduces the grounds on which it can be contested in court.

In India, a traditional way of estate planning has been setting up Hindu Undivided Family (HUF) which is a distinct unit for tax policy as per the provisions of section 2 (31) of the Indian Income Tax Act. However, it may be noted that after a property gets apportioned to a HUF, every coparcener has an equal rights to it and partition of HUF land has often led to clashes and court cases.

Therefore while the HUF with its archaic tax treatment and confused entity fails to cater to the requirements of present-day wealthy the Will is posed with un-certainties and the nonsense of a Probate. In such an atmosphere, one approaches the Family Trusts with a lot of hope and expectations that Family Trusts have managed to standby.

Why private trust should be used for a special child or minor child?

As an investor, we focus more on wealth creation. However, how will this created corpus devolve on the child and who will provide for & take care of the children when the parents are no more are important questions as well.

Hence, estate planning for parents with a special child (mentally or physically challenged) or minor children is even more crucial. Those parents need to plan in advance that who will take care and provide the needful to their special child.

A parent can grant responsibility of guardianship to a close relative but, it is a whole-time job and no one is sure that the things will work out as per the plan. In today’s world, everyone has their own priority and problem, there is no surety that he/she will be able to spend enough time on this responsibility.

So, to deal with it, a parent is suggested to form a trust and appoint two trustees – one from relative/friend and second should be a corporate trustee. In this way, the corporate trustee is a professional has all the arrangements mentioned in the trust deed of a parent with a minor child or a special child. It will also help parents to pass on the day-to-day operation and execution responsibilities to corporate trustee

Following are the services with a professional trustee can provide or arrange for a special child

- Full-time helper

- A cook

- Health care attendants

- Specialist doctor

- Basic household groceries

- A channel for making payments of all bills/expenses

Conclusion

For a special child or minor child, as they are not able to claim there right, you need to appoint an executor along with a will. And due to various drawbacks of a will like long probate period or execution-only after the demise of the maker, it is suggested to have a trust formed.