Credit Card Reward Points & Cash Back Comparison – Unearthed

Do you know which is the best credit card in India in terms of rewards points which you can redeem at different categories ? Have you ever wondered how different or close these credit card reward points are ? Let me take an example!

Ever thought the difference between how does 5X rewards from Standard Chartered differ from 10X rewards from Amex, ever wondered whether taking a 5% cash back is better than going for 10X rewards. Ever thought how can you save in excess of 16K per annum only by having a few cards in your wallet, well continue reading.

Every credit card company offers rewards in the form of Cashback / Reward Points to its customers. These rewards are funded by what is called as interchange. Interchange is transaction fees charged by the bank from the merchant. Its usually 2 – 3 % of every transaction. This is the reason, why some merchants ask an excess 2% if you tell them you would be swiping your card instead of paying them in cash (Read some must know points about your credit card). Cash is the preferred mode for another reason and that is to save taxes, as every credit card transaction goes into the books of the merchant, but that’s a separate discussion and we’ll leave it to some other day.

A few disclaimers before I proceed. This article is about rewards points and how you can save maximum through credit cards. “A rupee earned is a rupee that earned 6 percent” – So lets save some money for all of you. Again the entire article has been based on my experience and research, so am open to suggestions and feedback. Also I haven’t included Airlines spend, as I still don’t fully understand the Points to Miles conversion for different Airlines.

Following are some of the points that I hope the readers will have a much better understanding of, by the end of the article.

- Comparing Credit cards by their rewards proposition – If you have multiple credit cards, how to figure which one has a better reward structure?

- Accelerated Rewards: Most of the credit cards have an accelerated reward structure. So how should that impact your spending pattern so as to maximize the rewards?

- Wallet of Credit cards that one should own – Using the methodology explained above, this would be a list of credit cards that will help maximize your savings.

Credit Card Reward Points & Cash Back Benefits

Lets start of with , How should one go about comparing credit cards by their rewards proposition. To understand this, there are two important concepts that one should be aware of

- Earn Rate: Earn Rate is number of points earned per amount spent.

- Burn Rate: Burn Rate is the Rupee value of a reward point.

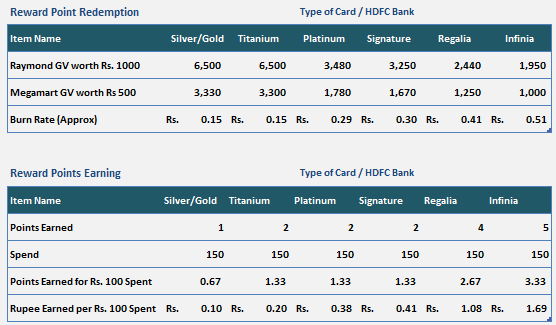

For Example – For a HDFC Silver/Gold card, you earn 1 reward point for Rs. 150 spent, so the earn rate is 1/150. Whereas each credit card reward point of a silver/gold card is worth 15 paise or Rs 0.15 only. So the burn rate is 15 Paise. You multiply the two and you will get a metric which you can use to compare credit cards from different companies.

Using the Burn Rate and the Earn Rate, I have come out with a very simple metric “Rupee earned per every Rs. 100 Spent” , which can be used to compare some of the top credit cards in the market.

Rupee earned per every Rs. 100 spent = Earn Rate (Calculated on Rs. 100 Spent) * Burn Rate

Also the comparisons below are based on the basic earnings. Most of the cards have an accelerated reward-earning proposition. We shall factor that when we calculate the monthly earnings from different spend scenarios. Also will show you how to create your own savings through your own spend numbers.

Example – 1

I will give you an example of how this metric would be useful to differentiate between two cards of the same bank or different cards across the bank.

The above tables give us an idea of hdfc credit card reward points benefits in the market. If you look at the value proposition of different cards, they are vastly different in terms of Rupee Earned per Rs. 100 spent. Rs.100 spent on a HDFC silver/gold card will give you Rs. 0.10 whereas spending the same amount on Regalia will give you a Rs. 1.08 in terms of reward points. But again Regalia and Infinia are fee based cards and hence one needs to factor this in when computing the relative reward proposition of the card.

Example – 2

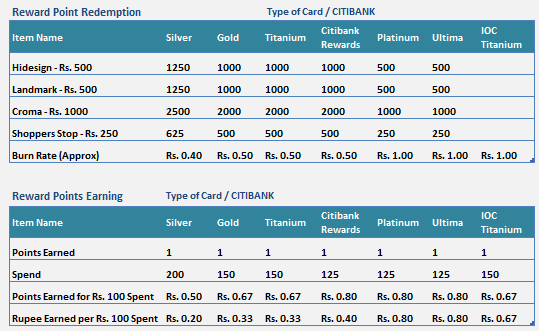

Now lets compare HDFC reward points with CITIBANK rewards points

If we compare the same metric Rupee Earned per Rs. 100 spent, Platinum and Ultima cards are decent options and in the premium segment HDFC provides better rewards.

Accelerated Rewards – Categories of Spend and Best card in each category

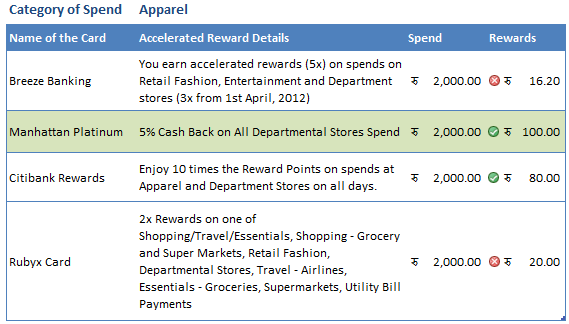

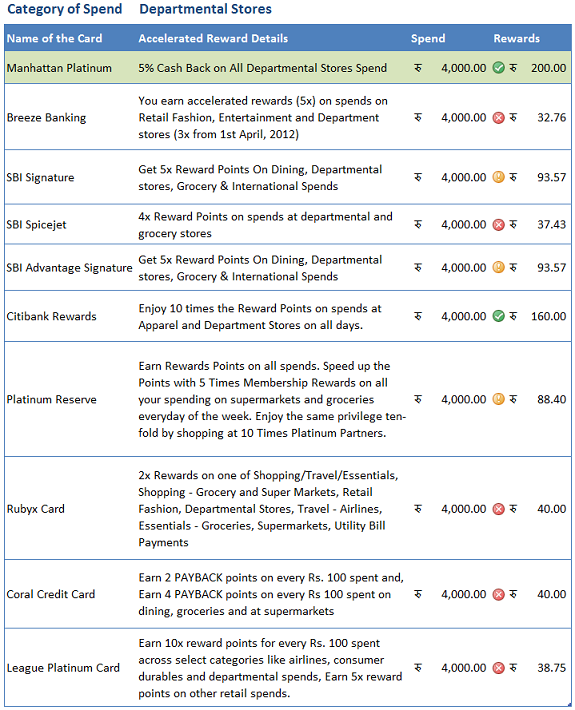

Apart from the basic reward proposition that’s present with every credit card, most of the cards in the market offer an accelerated rewards earning proposition. These accelerated rewards can be in a variety of forms. E.g. 5x rewards on Departmental Stores, 10X rewards on Online spends or a 5% cashback on Departmental Stores.

Now lets use the concept above and factor in the accelerated rewards propositions, (That some of these cards offer) to get to the best cards in each of the spend categories. The formula to calculate the rewards is a simple one: Just multiply the basic rewards earned above by the accelerated reward earning multiple.

Formula

Rewards Earned = (Rupee Earned per Rs. 100 Spent) * (Accelerated Reward Earning multiple)*Spend/100

Example – Rewards earned if you have spent Rs. 2000 on Citibank Rewards card.

- For Citibank Rewards, Rupee Earned per Rs. 100 spent = Rs. 0.4

- Accelerated Reward Earning : 10X on Departmental Stores

- Rewards Earned = 10*0.4*2000/100 = Rs. 80

A few disclaimers here:

- A few credit card companies even though offer accelerated rewards proposition but offer it only on select merchants. For e.g. Amex offer 10X rewards on its partner merchants, CITI rewards card offers it on select merchants, etc.. If you do not shop on these merchants then you won’t be earning any accelerated rewards. That’s the reason I prefer credit cards which offer a flat accelerated rewards structure so that I get the freedom of shopping wherever I want to

- Also some of these accelerated rewards have a validity, which means have an expiry date. You are eligible for accelerated rewards only in that period.

- Also I have a preference for Cash back as compared to reward accumulation, reason being two fold. First: Cashback impact my outflows directly as compared to rewards (where one has to go through the process of reward redemption and its benefits). Second: Its faster.

Keeping the above in mind, lets factor in the accelerated rewards to the basic rewards proposition of credit cards and figure out which card will give you the maximum advantage. Also the following will give you a chance to rate your card with respect to the cards available in the market.

The data has been collected from the sites and catalogues of different credit card companies. Since the accelerated rewards are mostly provided in specific categories, so we shall consider each category separately and figure the best card in that category.

Winner – Manhattan Platinum Card

Even though it seems, owning a Citibank Rewards card will give you, Rs. 80 cash back, but that’s just superficial because the 5X rewards on Citibank card is limited to only a few stores. Lifestyle being the major one of them.For Manhattan Platinum card, even though the offer tells only about Departmental stores, it covers all kinds of retail spends. Spends in malls are covered by this offer

Winner – Manhattan Platinum

Again it’s a straight fight between Manhattan Platinum and Citibank Rewards. And Manhattan Platinum wins hands down.

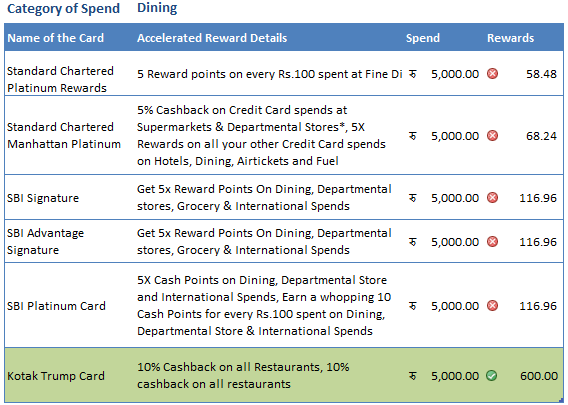

Winner – Kotak Trump Card

Clearly Kotak Trump card is the clear winner. With you saving almost Rs. 600 per month if you are a heavy diner. There are a few finer points, that the total spends on Movies and Restaurants should be more than Rs. 4000. There are a few other cards, where the card issuing companies have a tie up with specific restaurants in different cities. Citibank being one of them where they have tied up with more than 200 merchants across India and offer a 20 % discount flat.

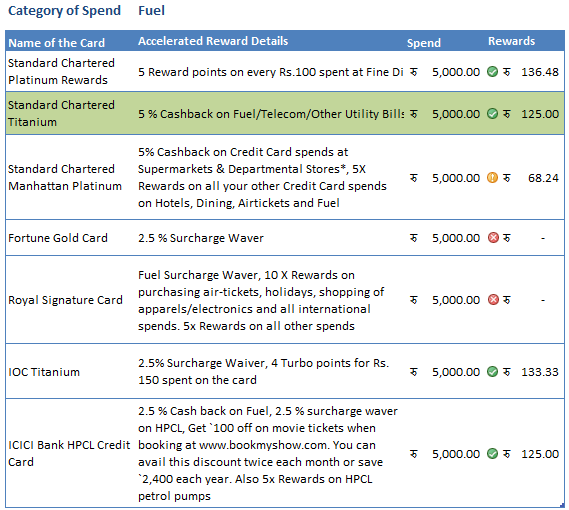

Winner – Standard Chartered Titanium

Standard Chartered Platinum Rewards, Standard Chartered Titanium, IOC Titanium and ICICI Bank HPCL card are quite close in terms of the monthly earnings. But I like cashback more than earnings through reward points. Also the 5% flat cashback on any petrol pump as compared to IOC and HPCL for Citibank and ICICI bank cards respectively make Standard Chartered Card a winner in this category.

Winner – Standard Chartered Titanium

Standard Chartered Platinum Rewards, Standard Chartered Titanium, IOC Titanium and ICICI Bank HPCL card are quite close in terms of the monthly earnings. But I like cashback more than earnings through reward points. Also the 5% flat cashback on any petrol pump as compared to IOC and HPCL for Citibank and ICICI bank cards respectively make Standard Chartered Card a winner in this category.

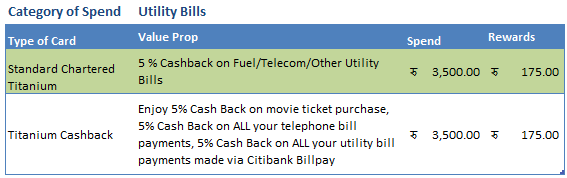

Winner – Standard Chartered Titanium Card

Again , both the cards are equally good, but the additional condition of paying your bills via Citibank billpay turns my preference towards Standard Chartered Titanium card.

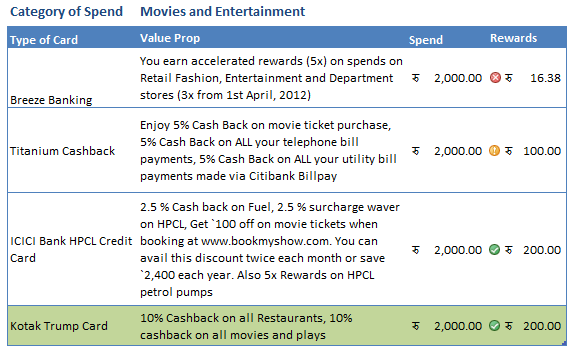

Carrying a similar analysis on categories of Movies and Entertainment and Utility Bills reveals that Kotak Trump card and Standard Chartered Titanium card emerge as the top card in the respective categories.

Wallet of Credit cards that one should own

Having done the hard bit of analysis, calculations and comparisons we come to the easier bit of creating a wallet of credit cards for you which will accelerate the reward earning and help you save a substantial amount over a period of time. To give you all an idea about savings that can be done by having this wallet, I have created a few scenarios and the respective savings. One can create his/her own spend/rewards scenarios using the table below.

| Category of Spend | Name of the Card | Value Proposition | Monthly Spend | Monthly Savings | Annual Savings |

| Apparel | Standard Chartered – Manhattan Platinum | 5% Cash Back on All Departmental Stores Spend, (This includes all kinds of Retail Spends) | 2,000 | 100 | 1,200 |

| Departmental Stores | Standard Chartered – Manhattan Platinum | 5% Cash Back on All Departmental Stores Spend, (This includes all kinds of Retail Spends) | 4,000 | 200 | 2,400 |

| Dining | Kotak Trump Card | 10% Cashback on all Restaurants, 10% cashback on all restaurants | 5,000 | 600 | 7,200 |

| Fuel | Standard Chartered – Titanium Card | 5 % Cashback on Fuel/Telecom/Other Utility Bills | 5,000 | 125 | 1,500 |

| Movies and Entertainment | Kotak Trump Card | 10% Cashback on all Restaurants, 10% cashback on all restaurants | 2,000 | 200 | 2,400 |

| Utility Bills | Standard Chartered – Titanium Card | 5 % Cashback on Telecom/Other Utility Bills | 3,500 | 175 | 2,100 |

| 21,500 | 1,400 | 16,800 |

This is a guest post by Gaurav Thakur, who is currently working as an analyst with a mutual fund company. An IIT Kanpur alumnus, he has primarily worked in the financial services industry, working with Citibank India Credit cards for a couple of years and also spending time in Citibank’s personal loans division.” This article has appeared first on gaurav blog here.

Which credit card you have already and are you satisfied with your credit card reward points and cash back benefits ? Did you get any insights from this article on credit card rewards points ?

February 11, 2013

February 11, 2013

Thanks its really helpful to understand the CC.. and eg on cash & reword points

Thanks for your comment Preity

Which are the top credit card, who offers the reward point redemption to cash?

Hi Dinesh

Thanks for asking your question. However, I dont think I am eligible to answer your query as its either out of scope of my knowledge or its not related to money matter directly

Manish

Hi Dinesh

I suggest you use this link to apply for credit card – http://jagoinvestor.dev.diginnovators.site/solutions/apply-credit-card

I would be glad if the author may update the blog with latest cards available in the market if any changes.

Hi

Can some one confirm what does online transaction means? does it mean any transactions done online(including utility payments online)?

SimplyCLICK SBI Card gives 5X rewards on all other online spends.

If online spends is “everything” online then I am more then happy to go for this card.

You should look at the card terms and conditions !

excellent analysis. but can you please analyze the category of “online spends” also? As in, which card gives maximum returns on online expenditure such as shopping, train/bus ticket booking, mobile/dth recharge etc?

CITIBank scores very good on these parameters . I suggest that

Hi Manish,

Citibank card is ok ok..merchants from which one could earn 10x has decreased and so is the value of 1 reward point.

Has this happened recently?

I have taken two loans from scb for which instalments are loaded with instalments and service charges. where is the question of service coming when I am repaying the loan instalments. I was charged with two service charge for the two loan instalments and losing nearly 1000 Rs. apartment from loan along with interest as service charge. hence i closed down the loans now. other banks such as sbi and citi were not charging for the loans taken with them.

Can you please see the terms and conditions of the card ? Also are you taking about service charge or service tax ?

Hi Manish, need to take a decision between sbi signature and hdfc regalia. Which is more beneficial?

Hi Bhavesh

Thats very high level question. It would surely depend on person to person

Hi Manish, neither me nor my wife understand credit card.my brother-in-law (saala) insisted my wife to take credit card and he is using my wife’s card. every now and then i see credit card statement i see late fee of 400 or 500rs. thinking of deactivating card because we cant monitor card and saala, but one question is creeping Do we really need a credit card ?? did some research online for 6hrs read so many articles butdint get answer..,

You dont need in reality, but these days you need it to build your credit score. But that will happen only when you are paying dues on time. In your case, its opposite, so its hurting your wife score. Better close it.

Manish

Hi Hari,

With lot of transactions happening online (Internet) and off line (Pay by Swiping) its good to have credit card.

If you are little worried about credit card restrict the card use initially only for paying grocery,utility bills and insurance premiums.

Over a period of time you will see the difference!!!

Hello namste sir this posht is vrry usefuLl and i got idea about credit cards. I have one question that i am a primary teacher in maharashtra i have 4 debit cards but not credit card i want to take one credit card and it will be free from any annual fees or etc my use is little like recharges onkine shooping ets plz sir suggest me any card plz

You can apply for a credit card from the same bank where you have bank accounts

Manish

Hello all

I just discovered this article (old but very good) while searching for the reputation of HDFC Regalia CC. I am a Classic banking customer with HDFC. I started out with a very basic HDFC Platinum Plus CC exactly 2 years ago. Since I came back from US, my credit history was pretty much non existent in India.

Slowly but surly, I got upgraded from Platinum Plus to Superia CC. Now I was just offered their super premium Regalia card which I took. The next in line would be to be eligible for HDFC Infinia card (in about 5 years of time) which is top of their stack as of this writing. I am just 30yrs of age, a young entrepreneur trying to get hands, on things which most can’t. The rewards are a very small incentive for people like my. Exclusivity on the other hand is a bigger drive. The only other card I have is an AMEX Gold Charge card( I was offered their Platinum Reserve CC which I turned down). I was under the impression that Charge cards are harder to qualify for. But in my experience, especially in Gurgaon, pretty much every other person is having this card. Maybe I made a wrong choice but my next target is to get AMEX Platinum Charge card (in about 3 years of time). This might make me eligible for the ultra exclusive, by invitation only AMEX Black Card(in about 10 years of time).

I am just an ordinary guy trying to build my credit history slowly. I intend to keep only 2 cards throughout.

Do let know if any of the best financial practices ( apart from making more money :)) may help me accelerate my goal of entering in the ultra exclusive club when I reach my 40s.

Current status

Credit score : 7/6/14 – CIBIL 860

CC Limit : HDFC Regalia – Rs 3,00,000.00 – 2 year old history with HDFC

Amex Gold Charge – Rs 1,75,000.00 (Theoretically it’s unlimited but ) – 6 month old history with Amex.

Thanks

Mohit

Hi Mohit Jain

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Manish, at the beginning of last year, this post helped me zero-in on the Citibank rewards card (that you very much!), and I was pretty happy with it at that time as I started accumulating the points pretty quickly. But after a 3 or 4 months I realized that I wasn’t getting the 10x rewards at the grocery stores that I was previously able to. After inquiring, Citibank told me that the list of stores that are eligible for this offer is maintained by Visa and they are not responsible if they update it. So, I shopped at a different chain the next month and I was pretty sure I got 10x rewards, but soon the same thing repeated. Sometimes, I got 10x rewards at one location but not at another (judging by my rough calculations) though both belong to the same chain. By now, I have tried every major grocery store there is in Hyderabad and none of them are eligible for 10x rewards. And on top of that, they recently announced the reduction in value of the points from 0.40p to 0.25p making them even less of a value. At this point, I can only think that it is all a big Gimmick. They either personalize the rewards for each person until they get hooked up (sort of like cheating unsuspecting consumer) or no longer want to keep the card competitive (too good to be true to begin with).

I want to replace it with a better card and wonder if you can come up with a new post based on the latest offerings.

Hi Hari

This article was a guest post wrote by another reader 🙂 . So I am not sure how feasible it is to edit the article now . I suggest you do your own research comparing benefits from other banks credit card pages.

Manish

Respected sir,

I want to know about credit card.I am in a business of newspaper agency and also work as a lic advisor.I need a credit card of Hdfc bank.but I have no account in that bank.is it possible to get card or am I eligible for credit card.my IT return is above 200000 p.a.suggest me how I get it

You are eligible for credit card, but generally banks try to make sure that you have a bank account with them .

excellent information indeed 🙂

Thanks Mahesh

All,

HDFC Regalia is now lifetime free (once you have certain salary) and has the highest payback of all..

Cheers

One more thing. The article doesn’t seem to have a ‘published’ date, I had to guess when it was written based on the dates in the comments. I have visited your site earlier and appreciate the quality of information available.

Hi Dbhat , the best thing is you can look at the article URL and check the month and year .. it gives you a good idea !

Yes, I see that now.

Nice article and nice comparison, would like to see some updated numbers as these terms and services change all the time. I am quite happy with my ICICI platinum credit card.

1. No extra charge for fuel at HPCL pumps.

2. Swiping Payback at the pump and participating stores such as Central gives me extra points.

3. I can actually buy with the payback card from the stores. Greater choice. No calling up customer care and waiting for vouchers. 🙂

Would you recommend a different card to me? I spend between 50k to 1L a month on the card.

Truely speaking I love the ICICI card my self 🙂 .. No need to even look at others 😉

Does anyone have a valid list of outlets that are under “Grocery Stores, Supermarkets, Departmental stores” MCC code.

I dont think so !

Hi Manish

Great Research.I have two queries

1.Std Chattered Titanium crad 5% cash back on fuel,is this 5% inclusive of 2.5% surcharge or exclusive of surcharge?

2. does LIC premium comes under utility bill payment option for Std Chattered Titanium??

Priya

1. Not sure

2. No

Excellent article here.

I use HDFC Platinum Plus card for Fuel expenditure since they do not charge any surcharge and use the Citibank Rewards Card for all other expenditures.

BookmyShow and Vodafone are accepting payment with Citi Reward Points, so in this way I’m saving some money.

Cheers,

Ajay

Thanks for sharing that !

One Typo: for Manhattan, it is a monthly cap of Rs500 cash bcak and not annually.

Thanks for sharing that.