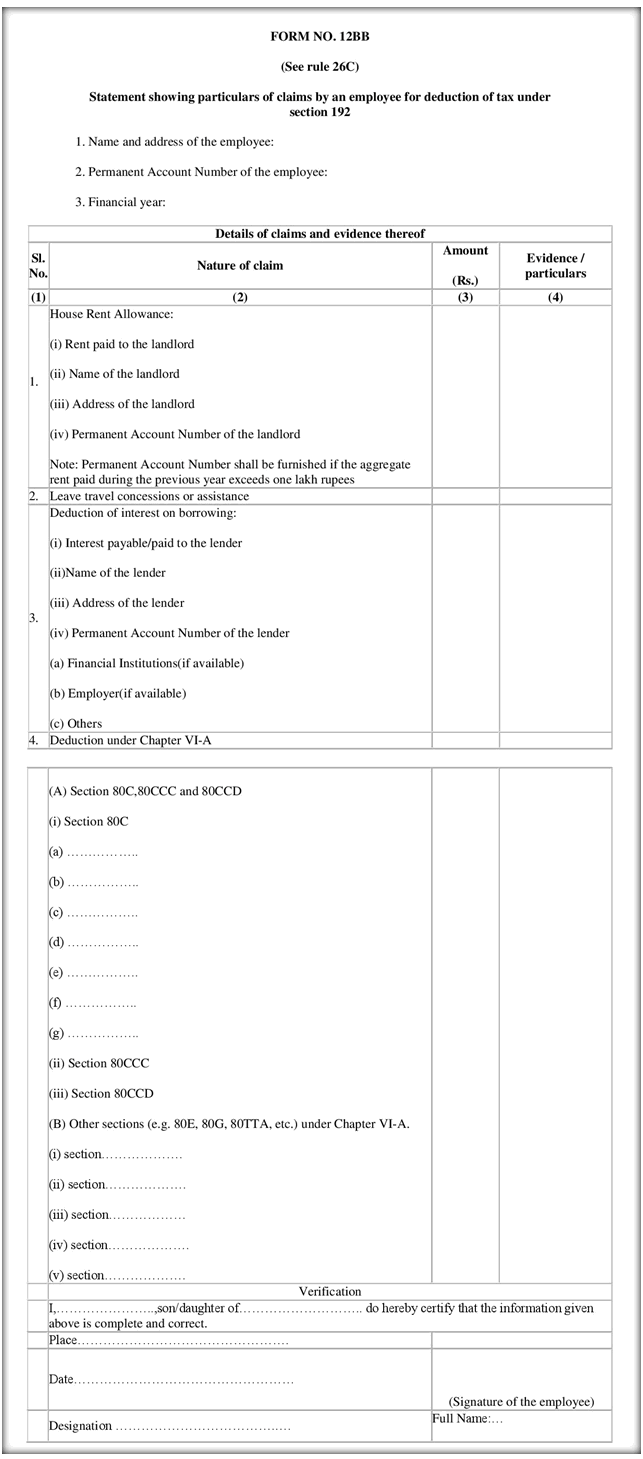

Download Form 12BB to claim LTA, HRA and Home Loan Interest

In a recent notification, income tax department has come up with a new form 12BB, which from now onwards has to be submitted if you want to claim your LTA, HRA and Interest on Home loan interest.

It’s a single form, which you need to fill and attach all proofs and furnish all information related to these exemptions. This form will be applicable from June 1, 2016.

What all information is asked in Form 12BB?

Following is the list of various things you need to arrange before you fill up this form 12BB form

- LTA (Leave Travel Allowance) – One has to provide all the proofs of travel like tickets, invoices, boarding pass (in case of flight). More info here

- HRA (House Rent Allowance) – For claiming HRA, If the rent paid is above Rs 1 lacs a year, one has to provide Name, Address and PAN of the landlord and Rent receipts.

- Interest on Home Loan – To claim this, one has to furnish the name, address and the PAN of the lender organization

- Deductions under 80C & Others – You will also have to furnish the details and proofs of the actual investments done under Sec 80C and others

You can download form 12BB here, It’s a PDF version (We don’t have excel format). Below I have provided a snapshot of the form 12BB format, so that you can have a look at it and see what all fields you have to fill up.

Main reason to introduce this form 12BB?

The primary reason why this new form is being introduced is that till now there was no standard process to collect all the proofs and information regarding the various deductions.

IT department thinks that with this new change, fraud will go down. Here is what Financial Express says on this point

You may no longer be able to provide fake bills to claim income tax deductions for leave travel allowance (LTA) and house rent allowance (HRA).

Changes announced on Tuesday in reporting format for individuals claiming tax deduction on leave travel allowance (LTA), leave travel concessions (LTC), house rent allowance and interest paid on home loans is aimed at plugging leakages on account of fake bills, experts say.

So with this form, all the information will be captured in one place and even the employers will be made accountable for checking all documents and if the proofs are genuine or not.

Please share what do you think about this new form? Do you think that this will add more work and headaches for salaried employees?

May 25, 2016

May 25, 2016

As per the form shown here, i can also see 80G. Is that to be submitted to the employer too? or is it something that you can include while filing returns as usually it is outside the purview of the employer.

You need to just give it to your employer !

where should we submitted form 12BB?

To your employer !

Hi Manish.

It seems like this is the extra burden for the salaried class to provide HRA details. As only salaried class peoples pay the income tax correctly to some extent. People associated to other occupation doesnt even provide the details of the income correctly. Why govt is targetting only salaeied class people who are paying the taxes directly to goveenmnet???

Thanks for your comment Sachin

Its applicable from this year. My employer has already sent the form and asked us to fill in

Thanks for sharing that !

I really doubt that this will be applicable AY 2016-17 or FY 2015-16.

And when to submit form, at time of declaration start of FY or at time of submission end of FY?

I am not sure it is good ieda or not. Right now my employer taking most of proof online. It will increase paper work and also defeating digital india policy:)

From what we read on internet, its applicable from this coming year !

Hi Manish what is the procedure for collect gratuity

That will be shared by your employer !

I would like to know when Jago Investor started writing articles on financial matters OR we can say on personal finance.

Since 2007

Well first of all thank you for replying. Now a days all articles writing on personal finance are saying that if you invest an X amount, you will get so and so much return if it gives 12% per annum conservatevely. I came to know that during 80s and 90s, the post office was giving interest @ 12% on NSC wherein the money become doubles in six years. At that time, may be no one was writing the article on personal finance. Even if it was writing , no one has given much thought on that. I have not come across any such article. Now suddenly , the people have woken up from their sleep but alas the interest has come down to almost 7 to 8% per annum . The investor missed the BUS. My point is that if the article was published on personal finance at that time, the investor might have given thought. Any how better late than never. I seek your opinion in this matter whether it is correct or not . thank you in advance.

Hi,

My name is Yogita Jadhav. I have resigned from job on medical terms, hence was not able to serve notice period. Employer is not giving signature to withdraw PF. Hence I have Affadivit all the details and taken a signature of Gazette Officer. I have send all the documents along with the form to the Delhi PF Office, but didn’t got reply. Now don’t understand how to follow up.

Please help me in this matter. Thanks.

Hi Yogita

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Do we really need to fill this form even if we have already submitted all documents to employer and employer has generated form16 with all investment details?

Yes

Is this form to be filed for current assessment year (2016-17)?

Yea ..

THANK YOU.

I am not able to see this form or notification on Income tax web site.

Its not yet on the income tax site !

APPRECIABLE ACTION FROM GOVERNMENT OF INDIA.

MURALI

Thanks for your comment MURALI

Good step forwad – to rationalise declarations submitted…

Thanks for your comment VPRaguram

hiii team members

i am leaving the jobs before 2.5 years .how to draw the my PF with out employer(management) interference.

Hi venkat

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Its a good step from GOI to catch the drains of salaried tax payers. The same action is required for professionals like doctors, lawyers and charted accoutants. I am pretty sure political leaders will never asked for this kind of documents as they are the final authority to pass the same.

Everyone has to do it who falls under the qualifying criteria

Do we need to fill this form with IT return this year?(i.e. for FY2015-16)

No

Ninad

To Employer for claiming deduction from your salary

Thanks for your comment Naresh

Hi Team,

What if Landlord does not have PAN ? Is it Mandatory ? Cant be provided “Not having PAN” declaration ?

I think a declaration is to be given that the landlord does not have a PAN !

Recently My Employer Demanded this form from me for the current FY. I was not aware that this is mandatory. Now i come to know real point. Actually Employer demanded Only filled form. Proof can be submitted later

Thanks for sharing that

Hi Manish, For LTA Rows, there are no details showing up to fill the details. What are the details to be filled for LTA?

Amount only and then attach the bills and proofs !