Are you Overestimating your future income and getting into debt trap ?

Today I want to discuss a problem which is part of almost everyone’s life and creates some really big issues. I am talking about the problem of “Over Estimating your Future Income” . Yes – A lot of people take their current life decisions, based on what they feel about their future career and future income.

My Salary Hike

When I was working in Yahoo, Bangalore around 2008, I saw all the newcomers around me “expecting” their salary hike to be around 20% and 25%, and guess what – It actually happened.

Then in 2nd year, the same people “estimated” that they deserve a minimum 15-20% salary hike at any cost, because they have given their best. It happened again ! .

Then in the 3rd year, they got into the same – “I think my salary hike this year will be .. ” game and by then these people were using maxing out their credit card limits, had bought all the financial products for tax saving and committed to pay huge premium, at times as high as 80,000 per annum. They were all living a life which they deserved after 7-8 yrs of their career.

Then there was a layoff in Yahoo and some people got FIRED (some were my friends)

One guy had almost finalized a home loan, obviously based on his “future income”. Another guy could not pay his credit card bills for next 3 months, because there was no money (he eventually got another job in few months) . And most of them wished if they had saved a bit more, it would have been a better situation.

We focus on positive side, but not on negative’s

The incident I explained above looks fine at the start of career, there is less to loose. But just imagine the depth of this problem. This shapes our financial life.

If you have been working for many years now, you probably have lots of things to achieve in life and due to peer pressure, you can go overboard on your expenses, just by assuming that your future is too bright. The issue is not that we look at the brighter side, the issue is that we look “only” on the brighter side – the salary hike, the promotion, the better salary if we switch companies, the extra bonus which we will get, and then the side income which we can generate along with job .. etc

We do not look at the negative side seriously or just under rate them. We feel job loss is something which happens to others, not us! . The accidents can never happen to us. We cant loose our wealth due to some reason. What about a sudden medical emergency which can wipe out your wealth, what about “No Salary hike” this year , what about “bonus below the expectation” , what about a Fraud which creates a big hole in your pocket?

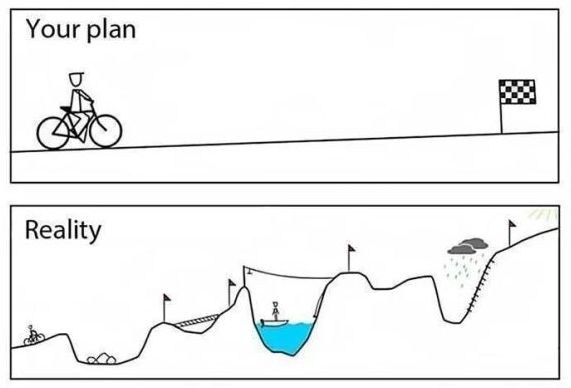

When we see our future from current situation, it looks like a straight line without any issue or problems, we extrapolate our smooth past into future and every thing looks promising. However the reality is full of surprises, and problems. Things can go terribly wrong and it can really damage your plans in life. How serious it will be depends on how much over estimation you have done for your future income. The image below clearly explains what I want to say here.

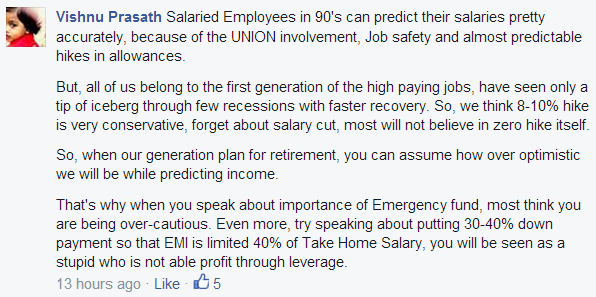

I posted this same point about “overestimation of future income” on my facebook wall, and I got a very good reply from Vishnu Prasath, which I feel everyone should read, below is that reply

In our 6 weeks online Investors Bootcamp, one of the weeks is about getting clarity of your current situation and where you stand in your financial life. With the help of an amazing excel sheet, participants are able to find out 12 insights which are related to their financial life, it tells them key hidden points about their financial life.

Yeah .. I am starting my business !

Let me also touch upon the point – “starting my own business”. When you do calculations and plan for your business potential, MS Excel makes you millionaire on paper and shows you all the rosy picture. However things are so different in real life. Assume a person, who is going to leave his job and going to start a business/startup . He forcasts the cashflows and profits and declares that in next 1 yr itself he will break even and start making money. Life will be on track again, but in reality – it can take 4-5 yrs. There can be losses, things can go totally wrong ..

In that case, imagine the situation, the stress the family will go through , the “I told you so … ” the person has to be hear every month. This is one real life example almost all the not-yet-successful entrepreneurs can relate to .

How we spend more and more Today

So because we over-estimate our future income, we buy bigger car, bigger Home, we go on more longer and premium vacations, and commit to higher EMI’s which looks possible considering our future income and cash flows. I do not want to sound like a pessimist here, I am not saying don’t be confident in life or career, one always have to do a calculative move and take decisions based on some assumptions, but some people go over board and damage their future at the cost of today. On that point I want to focus on two main points – which are

We are Consuming more today and not leaving much for future

The biggest problem I see today in most of the people financial life is that they are consuming a lot on the name of “Life is here to Enjoy” .. Yes – its a crime if you dont enjoy your life despite earning so much, but there is a limit to it. There is a always a cieling to your spending. If your yearly salary package is Rs 8 lacs, then you should NOT be spending all 8 lacs , because you “feel” , next year your package will rise to 10 lacs and “at that time” you will save more. If your salary is 8 lacs per year, you should start with Rs 5 lac car, and not Rs 16 lacs car, because your future looks bright. It just does not work that way in most of the cases.

Getting into Debt Trap

Another issue is that, When things dont turn out as per your expectations, you also feel very disappointed and frustrated and start comparing your imagination with reality. Just because you assume future is too bright, you spend on those things, which you dont really need today, but have potential to pay. You also over spend and this is also a cause at times for Debt Trap, you get into a small debt first, you assume its normal and next month you will take care of it, and then it never happens and after 3 yrs, you feel you should have controlled yourself in the start itself.

One of the guys commented his real life experience on one of the facebook groups I am part of. Here is what he said

The biggest problem with our generation is that we overestimate our future cash flows,, think ourselves entitled to expensive lifestyle due to easy credit and fall prey to EMI trap rationalizing it with our increasing incomes every year. I represent this generation and have badly suffered the consequences of overestimating my future earnings.

I took personal loan for construction of my home, then took top up loan next year when my salary increase and put it in interior and then again took maximum personal loan that I was entitled to for my sister’s marriage next year rationalizing every time that my income will only increase every year in my job.

But then I left job to start a business with one of my friends and all hell broke loose. All my cash flows dried up, debts increased andI was reduced to begging for money. I had to live on borrowed money for more than a year. All my aggression,confidence,self image and big talks took a bad beating. It was hell of a time. Now I hate debt and credit of any kind. It is slavery, bondage and evil.

You never know when things can go wrong for no reason or for no mistake of yours. Think a hundred times before committing yourself for high EMI, high tenure loans.

(Source : Asan Ideas for Wealth Facebook Group)

How long can you survive financially if you loose your job ?

So you must be wondering about your own case right now. Let me ask a very simple question – “If you loose your job, how many months or year can you survive without working?” . This is a powerful and disturbing question at the same time. If you have been working for many years, and your answer to this question is in months, then there is some issue.

Whats the right way ?

There is no right or wrong way here, there is only logical way. You always have to keep a balance in your spending and saving. You can surely expect the future to be good and bright, but make sure you do not over leverage to a limit which turns out to be a disaster if things go wrong. Also think about situations which are negative and then take a balanced decision.

Let me know what are your comments on this topic ? Have you ever faced any issue because you over estimated things ?

May 5, 2014

May 5, 2014

Dear Manish

I would like to invest around 2 lacs in Mutual Funds

Would now be the right time to invest after the election of the new government where the equity market is at an all time high?

Should i park funds in bulk in an STP of Liquid funds and then do an SIP in Equity every month

or

Should i Buy A bulk of Equity funds at one go WITHOUT STP

I am already subscribed to Axis Long Term Equity Saver,HDFC Top 200,ICICI Prudential Blue Chip,L&T Equity Fund and Canara Robeco Tax Equity Fund with an SIP of rs 2000 each

Pls suggest what would be the best option for me and good liquid and equity funds for the same.

Regards,

Ronette

Ronette

The best place to ask this is our Q&A forum – http://jagoinvestor.dev.diginnovators.site/forum

We are planning for a house. But after reading all these articles, now we have decided that we will go for a smaller house, with the concept being, my wife’s salary should be able to cover all our expenses, including housing loan EMIs, insurance premium and any other expenses not covered under insurance. We will rather go with a smaller house and a smaller car to have a smooth sailing in the financial life. Also, I am not a person who gets carried away easily by other people’s purchases ;). When they flaunt their Samsung Galaxy 5s (I use an LG A350, bought 3 years ago), I just smile and ask about how much they have invested, invariably people shut up after this polite query.

Haha .. that was a great point you have raised !

Your little diagram clearly sums up everything.

Wonderful article.

Me too in home loan debt. Since, it is maxgain, it helps in reducing interest as well as it acts as an emergency fund.

Nevertheless, it is a debt.

Welcome !

Hi Manish,

It is very good eye-opening article.

I am a retired person (opted VRS) at the age of 55 years. That is 5 years earlier retirement. It was my plan to retire at the age of 55 years from very beginning when I was young. To achieve this without any shortfalls in my monthly income even after retirement, I planned my small savings like Postal, SIPs, Mutual Fund, LIC Policies of my all family members (considering funds required for higher education of my two children which would be in hand at right age of my children).

Above all, I planned investments of my VRS compensation so meticulously, that today I am getting around Rs. 35,000.00 per month interest after tax is paid.

Looking at my age you will know that I am not from highly paid first generation. But, today I am leaving stress-less life just because of micro-planning I have done from my very young age. When I started my job in 1977 my monthly consolidated salary was Rs. 300.00 and at retirement my monthly take home salary was ~ Rs. 40,000.00.

It may look stupid of me, but I never used credit card and mobile phone through out my service of 36 years. Can you believe that one could manage all his work without these two devices ? I have managed and survived without these two devices during longer stays in USA, Germany, China, Indonesia and lot many local places. Not using these two deices I avoided unnecessary purchases and saved a lot.

I would not blame younger people from highly paid first generation, but they should always keep in mind to EARN > SAVE > SPEND and not EARN > SPEND > SAVE.

Your story is very inspiring given how you were able to achieve early retirement despite starting from very humble beginnings. It must have taken a tremendous amount of dedication to stay on your goal to retire early since there are way too many distractions in life and it takes a lot of meticulous planning for 30 years to get there. Hats off to you Sir!

Even though the naysayers will say Rs.35000/month won’t be enough to see you through your golden years, I would say its more than enough if you wisely plan ahead from now on.

Anjan and Adarsh,

Thanks.

I agree both of you. And I am well aware that after may be 2 years Rs. 35000.00 per month would not be enough. But, at this time I am looking at this glass as “Half full” and not “Half empty”. I will have to immediately start second episode of meticulous planning by following once again the same rule of EARN > SAVE FOR INVESTMENT > SPEND. But not for running our family of 4, but only to travel different places with my wife. As I am from field of engineering (special purpose machine design) people are calling me and offering jobs. But I do not want to wear any more and pay additional earnings to some doctor/specialist.

Fortunately my son is highly educated and earning hansom salary and could shoulder now running a family of 4. Life couldn’t be more stress-less.

So EARN>SAVE>INVEST WISELY>SPEND ON TOURING MORE AND MORE PLACES.

at present scenario things are different.

Earn> Invest> spent.

Thanks for sharing that .. its was amazing to learn from your experience !

Manish

Susuper article. I also faced job loss, recession.But as i am the long term reader of jagoinvestor, i was able to manage. Now i am recovered and continuing the financial behavior as like jagoinvestor reader..

Great to know that Tsashok ! 🙂

As always Manish, very nice article and I’m following the same thinking since long. But most of the people always told me that “Be Positive”, but I know that my thinking is not ONLY positive but I’m looking at dark side as well. Anyway thanks

Now, one question is lets say a person has taken home loan and EMI is around 22k-23k but after paying EMI correctly for 2-3 years he lost his job and later not able to pay his EMI. He got new job but due to less salary he is not able to manage his EMI and monthly expenses, then how these things can be sorted? How EMI can be paid, is there any waiver in any kind of Term Insurance which pay his EMI? Sorry not sure if there is any such waiver in policy

Please suggest

Can anyone share thoughts on above please?

First thing is that one has to be positive for future, thats ok and fine .. I was talking about over estimating things and getting over positive .

Next one should not create a situation like you mentioned. First a good emergency fund should be there to take care of 6-8 months of expenses and anyways one should consider taking only EMI which they can serve even if their salaries go a bit down !

Manish

Risk taking and expectations are the foundations of progressive patterns and always have been but what is important is that the these things need to made in a calculated amount in short what I prefer to say is calculated risk/ expectation is what people need to plan.

Correct .. agree with you !

hi Manish ,

very nice article as useal , now days home in metro cities are main requirement for most of the people and home loan is big problem. before 2005 very few people going for new home , even most of the people never thinking about it .

but from 2008 i have been seen people , friends … they easily book a flat for 45 L , 40L , 55L… with huge burden of 30k , 35 k etc . EMI even their take home salary not more than 45 k . i don’t know wether they really think before book a flat in all the side or just positive side . what you have expalined in the article is real and true. many people looks only positive side …

even some people spent all saving , takes one more loan on gold , land ..

to pay down payment for flat booking . for getting one think lose all other thing is it really good idea ? still i am surprised with this kind of decision from friends.

Correct .. but what can you do .. the pressure from life is so huge that this is the only option for many people . They do not want to repent their decision of not buying home later .

I think people should learn to live in the present i.e. based on their current earnings and not the future because none of us know what’s in store for us in the future.

When you start expecting yearly hikes as routine affair, it only leaves the door open for disappointments if things don’t go according to plan. This is why I consider salary hikes as bonus, nothing else. If I get it, its a cool surprise, if I don’t, no harm done. All my future goals and plans are based on current salary only.

Its all about living within our means. There is no point in living beyond your means just for that so called “social status”. Remember, when you are knee deep in debt and are about to hit the streets, nobody will be there to bail you out. Even your relatives will pretend they don’t know you, seen it with my own eyes. So who exactly are we trying to impress anyway?

Great point Anjan .. Its a good idea to consider salary hikes as bonus and nothing else !

Good article Manish. One has to identify what is luxury and what is need. I’ve seen many people who simply think having a good and costly car is a need but when you start questioning what is the use, whether you can survive without car, then it comes out as not a need but they wanted to have it because they are earning good salary adn they need to maintain such car. This applies to everything in financial life.

Fulfill your needs first and think about luxury only when you can answer the question “how long can you survive without a promising job?” and if you can get a satisfying answer for that, then you can go ahead and think about luxury items. Do not fall in the ‘society image’ trap, that’s bullshit and no-brainer.

it true .. i like last sentance ..

” do not fall in the socity image trap that’s bullshit and no brainer”. and 80 % people did same mistake at time of marrige…:)

Great .. thanks for sharing what you felt about that !

Yes Jayaprakash

Very valid point . It makes no sense to spend on things, if you cant justify !

that is my teacher always told me, “hope for the best but be prepared for the worst”

Great point !

Nicely presented/written article Manish.

Hi

Really great article.

Can you suggest some kind of ideas by which we may save the money as well as enjoy saving the money, like we teach babies by learning toys by which they learn as well as play. Lets we all share some ideas people save by their means. Might be this help others to make their saving more efficiently & effectively and having a better tension free life.

Its a good idea .. can you suggest how can we do this ? I mean we have a big group here . Do you think an article will help ?

Hi Manish

I will give you one example of myself,

Almost every people love to make shopping, ladies love shopping of apparels most and gents mostly gadgets. they spend whenever they get a chance to spend like say if there is any occasion they make expenses, whether its a festival, or a get together with friends.

I have a habit of saving 20% whatever I spend on such occasion. say I spend Rs. 1000 on hangout with friends then I consider I had spent 1200 instead of 1000 and make 200 as saving. by this at the end I realize that I have spent a lot this month but ultimately I had a little saving too. Also it pinch me to stop over spending as all the time when I spend I used to save also a portion of it.

One more thing I usually do, like I love silvers as gold are too costly. So whenever I feel to make expenses, most of the time I buy Silver bars of 10gm, 20gm or so as per the situation. This also feels like I have made spending and also at the same time I had made an investment.

There are different ways different people do but we only get to know very few when we see this type of habit. Can we share such ideas so that we can adopt most of the ideas as per our will and start making a habit of saving with full of enjoyment.

Please share your views..

Thanks

I’m fortunate enough to read this article at the very right stage of my life. Thanks for that !

What would the ideal saving % of take home salary? And can I consider home loan EMI as my additional saving/investment as I am saving my house rent?

Yes, you can consider it as saving !

There is a old melody that says ” Varavu Ettana, Selavu Pathanna” is the order of day, and takes a man to shame.

What is the meaning for that ?

Varavu (income) ettana (8 Paisa) Selavu (Expenses) Pathanna (10 paisa) Athigam (for balance) rendanna (2 paisa) kadaisiyil thunthana (lastly ????)

Here is the song link: http://www.youtube.com/watch?v=4DvC_ooYhwM

A man who spends and saves money is the happiest man because he has both enjoyments

– Samuel Johnson

Great saying !

Great 1. It shows the real picture. We always think from our point of view. Surely we need to improve our own thought process

YEs .. thanks for commenting !

HI

I wanted to ask that as of today, does defaulting on payments of mobile companies affect our credit score?And what happens in case the recovery is outsourced to collection agencies?

As of now mobile payment defaulting is not linked with your credit score. But this will be introduced in near future

BEtter not default .. its going to be counted in future for sure !

very good article.

I have always kept my requirements to good food, education, insurance, and a house. Have gone through job losses, house robbery as well, but could survive it because i had my savings and family support.

These days bare minimal requirement is also extremely expensive. The inflation has shoot up like anything.

Thanks for sharing your views on this topic and also telling about your personal case.