World’s Simplest Money Management System – A habit that works for everyone

Most people have such a fear of (lack of) money that they almost equate money to oxygen. Cover someone’s mouth and nose and watch how they fight you to get their air back.

I came across T. Harv Eker’s book “The Secrets of the Millionaire Mind” it says “Rich people manage their money well. Poor people mismanage their money well”, I read this & my first reaction was, “As a Financial Planner I know that!” Trouble was I didn’t really know the effective system to manage money. I just thought I did.

If you want to get rich, focus on making, keeping, investing & managing your money. I had been managing my money for years but not in a systematic way, I paid price for the same (by not following any system). This Money Management System is very simple to understand & implement.

If you want Financial Freedom you got to follow a system for achieving it. As a financial planner people, I meet believe managing money will take away their freedom. They hate the idea of Budgeting. They believe managing money will not allow them to be free and enjoy life to the fullest.

I have been implementing this “Money Management System” for over a year now & it has given me tremendous freedom in the area of money.

Most of the people I meet say, “I will start managing my money when I have enough money”. As a planner, I tell them “if you aren’t managing your money now then you may not have any money to manage in the future”.

The Single biggest difference between financial success and failure is how well you manage or mismanage your money. People mismanage money in different ways (By not having a financial coach in life, by not having a financial plan in place, by not organizing their finances, by buying ULIPS, by not taking financial Literacy, etc)

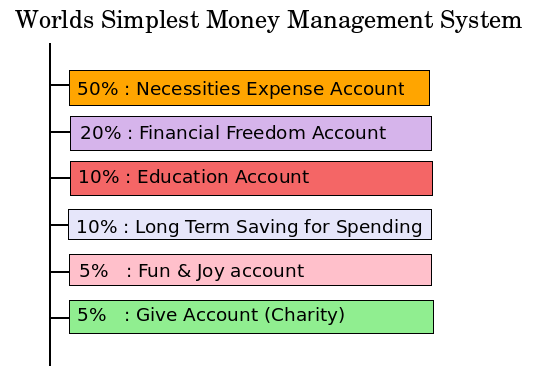

To master money, you must manage money through this effective Money Management System:

- 50-% Necessities Expense account (Your Day to Day Expenses Account)

- 20% Financial Freedom Account (FFA Account only for investments. Never spend only invested)

- 10 % Education Account (Invest in skill development, Personal Development)

- 10 % Long Term Saving for Spending Account.

- 5 % Fun & Joy account (balance out the investing for fun % joy(nurture yourself – fine dining, etc)

- 5 % Give Account (To a lot of people wealth is how much you have. But if you truly want to create wealth, you might want to change that viewpoint. Try thinking of true wealth as how much you give.

– Read about GFactor and Try out JagoInvestor Calculators

A Brief Definition of Financial Freedom

You are financially free when your Passive Income (Income from your investments, rental income, etc) is more than your desired lifestyle).To win the money game, the goal is to earn enough passive income to pay for your desired lifestyle.

One should design its Financial Plan with a context to achieve financial freedom. Having a Money Management System is equally important as having a financial. Always remember The real secret of successful wealth management is that your financial future is truly in your hands.

This one is dedicated to all the readers of JagoInvestor.com, their families & to Financial Freedom.

This article is written by Nandish Desai , who is a financial planner based in Ahmedabad

June 23, 2010

June 23, 2010

Hi Manish

Article is good. I will implement the same. But I think I read this article very late. I have a query. What is ideal age for these percentages to apply? Mine age is 35 and I think this will change proportion in different accounts. No body was there to guide me on this type of planning. I would like to do for my children and for their future by educating this. Please suggest..

You can start this any time , just that you will need to define your own numbers and percentages !

I am 23 i have no expenses(literaly 10% of my incomeas expence) at present and if have plan of working next 7 yrs should i invest all of my money in equity i am in market for 3 yrs or so and have decent knowledge of it and i keep in trak of my investment daily

regards,

abhi

Abhi

with this much info , I can only say aggresevely invest in Equity for starting of your career and you should be able to make decent money . Better invest in Equity Mutual funds and also some long term stocks in mid cap and small cap space if you have flair of being in the market

Manish

its a good article…no doubt but truly speaking it looks incomplete. We would like to know more on this. Things like Education Account, Long Term Saving for Spending Account needs more explanation.

Nilesh

ahh we didnt thought that it would not be self explainatory , will try to add the info .

Manish

Interesting read.

I think to make things simple for readers, it could be worthwhile to add to each of the headings, things that one could include in the Indian context. Most of the clarity seems to be coming from comments – like what the Freedom and Long Term Account should include. So for eg, when I read 20% for Freedom account, I was asking myself, where do I invest for it in the first place.

I think a variance on each of these also needs to be mentioned, if I haven’t missed it already. 10% for education could be a bit steep for the investor unless until it includes education for kids as well, that’s where probably I am confused a bit.

But a great article. Good job.

Radhey

Your suggestions are welcome 🙂 . Will make sure to take care of these things from next time

Manish

You are doing a good job. Keep it up. Have visited your site for the first time. Good article but under what category one should have for personal calamity or marriage/education of children ect. No light on that.

Marriage/Education will go for long term savings and personal calamity is a tricky one, it should be cured by taking insurance and building emergency fund .

Manish

Hey Manish,

Nice one! I have just discovered your website and it has brillant articles! I still have to catch up with most of the writeups, but as much as I have seen so far I appreciate your financial skills.

This article is also wonderfully written! Just to add the little bit I know about the finance world, I once read somewhere that one must invest in diversification, such that 50% is in real estate, 35% in equity, 15% in liquid funds and gold.

I promise to visit this website much more often.

Regards

Dhiraj

Dhiraj

Great to hear from you 🙂 . Diversification is required by investors who do not have much idea about a particular asset class and cant exploit it well . See you more often

Manish

Manish,

“A special report on debt ……Repent at leisure ”

Would like to share this URL in the latest issue of “The Economist”

It is one of the most incisive articles I have read.

http://www.economist.com/node/16397110?story_id=16397110

I look forward to your comments.

Mohan

Mohan

Thanks for the link , i will have a look in detail and comment back 🙂

Manish

Dear Manish,

Can we include Pension Fund and Life Insurance? How much can I save for these?

Caribou

You are looking in a different way , Lets not look at Product level , We have categorised things by need based cateogories

Manish

Hi Manish

Good Article…Thanks for sharing !

NIkhil

Thanks 🙂

Good Post, noted couple of point here. Will try to implement in my Portfolio.

Thanks for sharing

Khalid

Great to hear that. Keep it up 🙂

Manish

Disappointing :(…little clarity and substance !

Rahul

What happened , which part do you think is unclear or you are not happy with ?

Manish

Interesting viewpoint Manish! Thanks for sharing!

Pavan

THanks 🙂

Firstly, I thank Manish for always going an extra mile for Jagoinvestor readers. The Biggest investment anyone can make In you life is giving you time and I guess Manish does that by replying each and every Question with the same passion and care.

A common reply to some of the Questions :

This system can actually get you Financial Freedom. In readers Meet we are creating conversations that can help us achieve financial freedom. Basically three things we all want. We all want Happiness, we want our relationships to be great and we all want to achieve financial freedom.

Statistics show that only 3% people in the world achieve financial freedom. The reason they are not is they are not the readers of jagoinvestor ( and they don’t follow the money management system).

According to me Financial security does not come from the amount of money you currently have, it comes from your ability to get more of it whenever you want. This becomes real when you follow the system with integrity.

Lets look at two-three of in somewhat more detail:

Financial Freedom Account (FFA)- This account is “Sone ke ande dene wali murghi” (Chicken that gives Golden Eggs). Never ever kill this murghi (chicken) no matter what emergency you have in life. This will stay intact if other accounts are managed by integrity. Don’t be an invitation to emergencies (they come due to lack of planning). The idea is to create passive income.

Necessities Expense Account: You all understood this I am sure.

Education Account- This account is to give leverage …………….. Everyone who is in the top 10% today started in the bottom 10%!.Everyone who is doing well today was once doing poorly. Everyone who is at the top of your field was once not even in your field at all. Everybody who is at the front of the buffet line of life started at the back of the line. Now here is the question: How do you get to the front of the buffet line of life, where all the good stuff is waiting for you? The answer is simple. It consists of two key steps: First, get in line! Second, stay in line!. Keep moving. Keep putting one foot in front of the other. Keep developing new skills and acquiring new knowledge each day, each week, each month.

Long Term Saving for Spending Account: It is used for down payments on house or cars… basically through this account you are buying something which will stay with you on long term basis (Expensive ones)

Hope this has made a difference. I am Looking forward to meet Mumbai Readers on 26th June and learn new things from Manish.

Have fun, learn heaps, and may all your success be fun!.

NANDISH

Thanks Nandish

It was great to see the full explaination ,I think it should be added to post itself .

Manish

Manish,

A very nicely written article I congratulate the author for writing it and you for posting it on your site for the benefit of your readers. Most of the financial problems will get solved if we diligently follow this solution.

Thank you.

Kavita

Kavita

Thanks 🙂 . Nandish is the person who has given the beautiful atricle , it was a new learning for me too 🙂 . I hope we will get new articles from many people in future .

Manish

Manish,that’s an nice idea to open separate account for each head.One knows how much he is saving or spending under each head, and if control requires in a particular spending he can take immediate action.Also if someone saves money in necessities exp. a/c or any other exp. a/c, he can transfer that fund to financial freedom a/c or long term savings a/c.

Vikas

Yup 🙂 . Having a seperate account will definately help as you seperate out saving . tracking and operability part for each . It also helps in focusing 🙂

Manish

Solid Long term spending for saving is really very impressive 🙂

Nice 🙂

What did you understand from that ?

Manish

what is finacial freedom ac

Rohan

It means an account which saves enough money for you to have financial freedom , which means not having any dependency on some job or anything , you can be free from the tension of working for money , you can see it as your Retirement account .

Manish

I am wondering, where is the room for SIPs 🙂

Sorry, I mean to say EMIs.

Almost everyone takes some kind of loan now a days. And it takes out a chunk amount every month from your income. I think there should have been a place for it also.

Its in that 50% thing . We are talking about an ideal situation , but most of the people will have expenses + EMI etc upto 90% , which is dangerous

Manish

Naren

SIP is a more detailed concept. This article just talks about how much money should be invested , its talking about “How much” and not “In what way”

Manish

Really good one. I always carrying the same mindset mentioned while investing that i dont have an enough but really thankfull to Nandish Desai and Manish for this. I will have my increment from this month i will really follow this accounts to start my financial plans.

Rupali

Great to hear that . Yes you can open accounts like these and put money in this fashion .

Manish

Thts a real nice and simple one….i hv a query? should the percentages be calculated after subtracting the liabilities…i mean loans…personal education ..home loans etc….

The percentages are before that , The 50% Expense account is for that only , So there is the catch, make sure your overall EMI , expenses etc are 50% of what you earn , else its not the best situation .

Manish

Thanks Manish,

well…one more query…should we add PF money and Gratuity (considering if one would be able to avail it) to the take home salary and then calculate long term savings..in turn every amount will be affected i guess..

Pankaj

Yes , you should do that , after all the PF and gratuity money will be used in long run , however I would suggest that you should reserve it for retirement , better to link it with that .

Manish