8 Benefits of filing ITR, even when income is below exemption limit

Have you filed your income tax return?

Yes /No?

There are many investors who have very low or zero tax liability and therefore they skip filing their income tax return. Then, there are investors who do not file their returns for years and only when something urgent comes up which requires their last few years of ITR, they go to a CA and file their old tax returns.

Today, I will share with you why you should file your income tax return, even if you have income below the taxable limit.

Before that, let me share with you what exactly is ITR, for those who are not aware of it.

What is Income Tax Return (ITR) and who should file it?

An Income Tax Return is a form, where a taxpayer discloses details of his/her income, claims applicable deductions and exemptions and taxes that are payable on the taxable income.

As a responsible citizen of India, everyone who has an income should file an ITR, because in this way we are actually declaring all sources of income whether taxable or non-taxable.

The Income Tax Department mandates everyone to file an income tax return if one’s gross total income (before allowing deductions under section 80C to 80U) exceeds Rs. 250,000 in a financial year.

One can also file it even their income is below the taxable limit or its zero (in which case it’s called NIL return). Filing Nil return will act as proof of accumulated funds in your bank accounts or other investments.

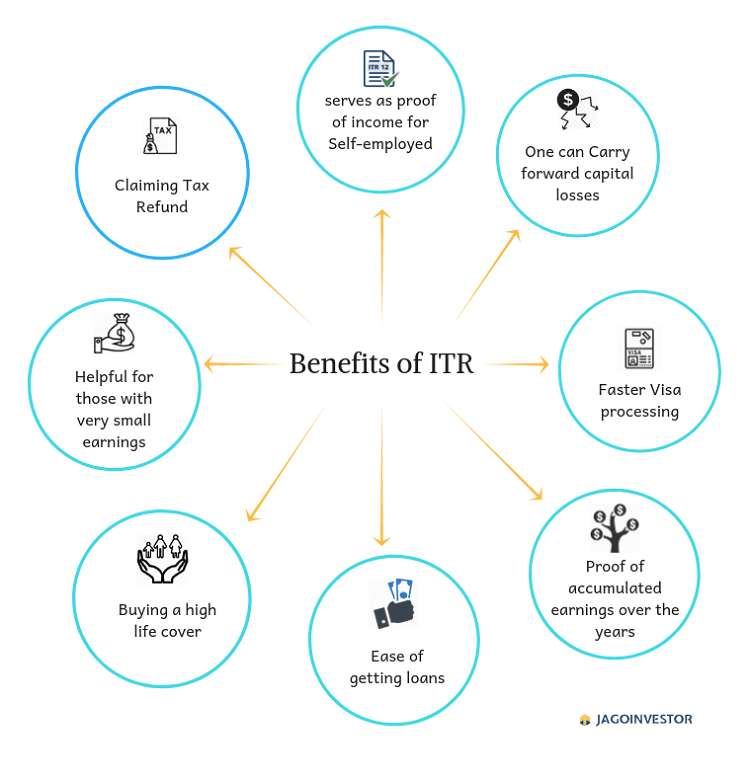

There are various benefits if one files ITR irrespective of their income. Below I have listed a few benefits of filing ITR.

Benefit #1 – Proof of accumulated earnings over the years

It might happen that a person is earning some small income over the years which is below the taxable limit and over the years they accumulate good corpus. Now it may happen that they might get tax scrutiny for some reason after a few years.

If someone has not filed the ITR over the years, it will be a lengthy and tiresome process to explain the sources of earnings over the years. However, with ITR, it will be legal proof of income earned in each year.

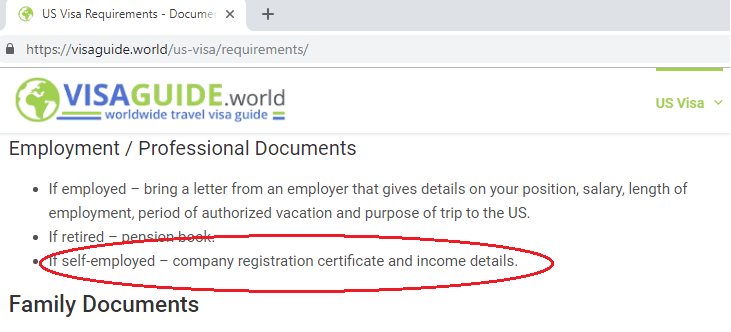

Benefit #2 – VISA processing

If you are traveling overseas or planning to travel in the near future, proof of earning is required. If you are salaried than the employer certificate will work but if you are self-employed than income details are needed to be submitted. So, ITR return will work as income-earning proof.

Benefit #3 – ITR serves as proof of income for Self-employed

Being self-employed does not provide earning proofs such as salary certificate from the employer and form 16. So, having ITR ready with you as proof of income is the most convenient proof.

Benefit #4 – One can Carry forward capital losses

If you have incurred capital losses, the Income Tax Act allows you to carry forward losses for eight consecutive years, and balance it against future gains and income.

To keep a track of your losses, the Income Tax Department has laid out that, Losses for a year cannot be carried forward unless that year’s return has been filed before the due date. So, even if it’s a loss return, you do not have any income to show – do file your return before the due date to declare the capital loss incurred.

Benefit #5 – Helpful for those with very small earnings

There are many people who get some small incomes such as

- Interest on bank/company deposits

- Dividends

- Family pension (received by a legal heir)

- Tax-free incomes like Agricultural Income, tax-free bonds, etc.

These people total income might be below the taxable limit and they might feel that they are not supposed to file any tax returns, as they don’t have to pay any tax (because TDS is already deducted). But by filing ITR they will get legal proof of income (in case they need it).

Benefit #6 – Claiming Tax Refund

If you have paid excess tax on your income, then you can file for a refund from the income tax department. In order to get this refund, it is mandatory that you file ITR.

Getting a refund of your taxes feels like getting a paycheck credited. Many salaried people don’t file their ITR as they feel that the tax on their income has already been deducted and they have form 16. But, it might happen that, the employer has paid more tax on your behalf, not taking into consideration your actual house rent, tax-saving investments or insurances. So, in that case, filing of ITR will lead you to ask for a refund from the IT department.

Benefit #7 – Ease of getting loans

If you apply for any loans such as a home loan, car loan, etc., then ITR for the last 2-3 yrs is asked as the mandatory documents. ITR will help your lender to assess your repayment capacity and is an important document. A lot of people who have not filed ITR on time rush at the last minute for these documents, so why not better file it on time?

Benefit #8 – Buying a high life cover

When you buy higher life insurance cover the Insurance company asks for proof of income to assess the cover amount to be provided to you. For this salary slip, bank statements or ITR of the last 3 consecutive assessment years are required.

It might happen that you don’t get a salary receipt or your monthly income is being paid from different groups so bank statements will also not work as strong proof. So, better to have an ITR return filed.

Do you know someone who should file ITR in your circle/family?

I hope the above points will make you understand why it is always preferable to file ITR, even if it might be NIL return. In a lot of families, there are people whose name there are small incomes like dividend income, income from tuition fees, small business income and this article applies.

So make sure you start filing an ITR for them and save yourselves from the future hassles involved.

Do share your views, experiences and ask queries through comments.

December 20, 2018

December 20, 2018

Recently people who have filed tax returns received an email, could you explain the process and more details on this topic.

Your Income Tax Return has been selected under risk management process wherein your confirmation is required on the claim of refund. You are requested to submit your response in the e-Filing Portal post login by selecting either of the following options:

The claim of refund is correct to the best of my knowledge and belief

Return of Income is being revised wherein, correct claim of refund shall be made

Hi Winston

Thanks for your comment.

It is because you have filed an ITR which shows tax refund to you from income tax department. So, if you want to continue with same amount of refund, select option one or option 2 if you want to revise your ITR.

Vandana

Very useful article on the advantages of filing IT returns even if the income limit is is less .Thanks for sharing the article sankaranarayanan ext 12

Thanks for your comment sankara narayanan .. Please keep sharing your views like this..

Manish

so simple yet so effective information

Hey Adv. B.Santosh Kumar

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

Simple article but gives 8 good reasons for filing an ITR – saves one from regretting why he/ she did not file one in the past!

Dear Sir,

I am a home maker and i am getting little income say around 60 to 70 thousand a year by doing some craft works and making cake for friends and relatives functions, etc. My husband also giving some money as a gift to me. So overall i am getting around 1.5 lakhs per year. I also invested in mutual fund, some equities as well as trading in commodities day to day basis. I wanted to file a income tax return bcz as you pointed out, some losses in commodities or equities can be carry forward for the future years. Kindly advice me which ITR i have to file and is it a easy process. Thank You

Thanks S Poornima for your query.

Filing an ITR is very easy one can self declare his earnings through ITR-1 by registering on inome tax india online portal.

Vandana

Excellent article, IT department should circulate to as many as possible, also must advertise. Have shared over Twitter & FB

Nice article. Will circulate it.

Informative as well as useful.

Thanks for your comment JS Grewal .. Please keep sharing your views like this..

Manish

Information presented nicely

Thanks for your comment Rajesh .. Please keep sharing your views like this..

Manish

Really useful article. I have already faced many problems for not filing ITR for a particular year where my income was below Taxable limits but there were large transactions in my share trading account and the case came under Scrutiny.

Thanks a lot sir.

Thank you so much for sharing your experience Sushil.

Vandana

Post filing returns, what is the time frame in which an assessee should expect completion of the processing. For me it is 6 months since i filed return and it still shows in progress

Mr. dheeraj there might be some sort of issues in you ITR filing. Because as far as I know ITR gets filed in 24hours unless there is some issue on the govt. site. Once the return is filed you need to verify it within 120days.

2 ways are there to get verification is online(E-verify) from income tax india website or by physical mode that is by sending the ITR-V to the income tax department physically.

I would suggest you to consult your CA or you may take customer support from IT dept.

Vandana

I am investing in mutual fund for last 5 years by SIP mode. I redeemed from some fund in April, may, and June months. How can i know the capital gain from those redemption in this financial year (TDS was cut). Can you please elaborate on the long term capital gain on the redeemed mutual fund

Mr. Sikander

You can visit cams and karvy mfs webpages to generate your capital gains statements.I have attached the links below..

Computer Age Management Service

Karvy MFS

Vandana

I thought this information would be useful to all

Thanks K Venkatarayan. Please keep sharing your views like this and the articles in your circle.

Vandana

What is benefit of filling IT for house husband/wife or retiree??

Hi, Krishna D

As a housewife or being a retiree, one can have some small earnings such as bank interest, pension, dividend or may be capital gains. These earnings might be less than the tax exemption limit but by filing ITR in those cases too will lead to have a proof of earning in hand. For any sort of loan, insurance or other financial agreement, it becomes very essential for one to show that you are earning.

Vandana

Good and useful article .Thank u sir.

Thanks Karanth SP for sharing your views.

keep reading and sharing the articles in your circle

Vandana