How I arranged my financial life in 4 steps – The Inside Story of my real life

Today I am sharing my real life story of how I arranged my financial life. Our financial lives over time gets messed up because we are lost in our jobs and family and everyday some new information or financial document enter our life and gets piled up. We keep stuffing documents here and there in our almira thinking – “I will keep it properly next Sunday” .

Which never comes !

In my personal case, I consciously try to keep things arranged as far as possible, but just like everyone, my financial documents and various information become unorganised like every other person. So finally one day, I decided to have my own “Personal Finance Management Week” , where I decided to finally come out of my “comfort zone” and cross all my mental limits, defeat my laziness and arrange all my documents and fix various other “issues” and finally make things neat and clean in my financial life. And thats exactly what 150+ participants of our last bootcamps did in their financial life too.

But why Did I decide to arrange my financial life ?

- For Myself – Everytime I have to find out some document or information, I really had to struggle remembering where exactly I had kept it, The piles of xerox papers, insurance papers, bank documents, property papers etc etc had got mixed with each other and it takes more than 10-15 mins, lots of frustration and that little guilt inside for creating this mess and not keeping it clean . I wanted to have a clean space of things, where if you ask me about document X or information Y – I can give it you in less than 60 second.

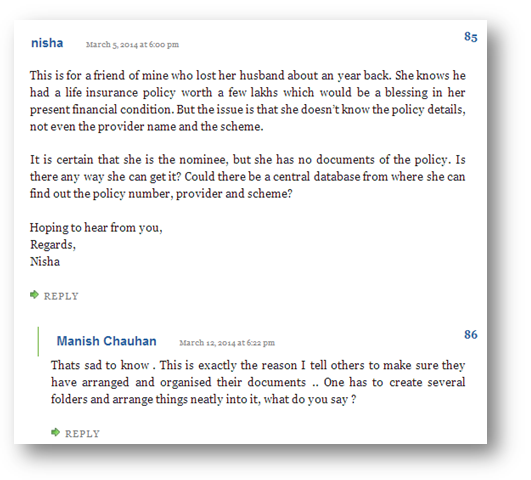

- For my Family – Because I know, my family will really get confused and frustrated when they will have to deal with my financial mess. They are not as much financially aware as I am, they dont understand this “personal finance” area so much and it will scare them like anything in future when they need to deal with it. So I need to create an environment, where my family members can find out various things related to my financial life, as easily as possible. If you want a proof that family members can suffer if you dont take care of this area, then I want to share a real life case which was shared on our blog itself where, a wife was never able to claim life insurance after her husband’s death, because she had no idea where are documents and which company was it .. here is the sharing by Nisha

- and Finally, because its once a year task – Truly speaking, this whole thing does not take a lot of time, all it takes is huge commitment and a small START. There is a great chance that even you have not completed this, just out of lethargy and nothing else, It takes few hours of dedicated work and huge commitment and nothing else. Once you arrange all the things, then from next year, it will be just 1 hour of additional work to update things.

4 things I did for arranging my financial life like a SuperMan

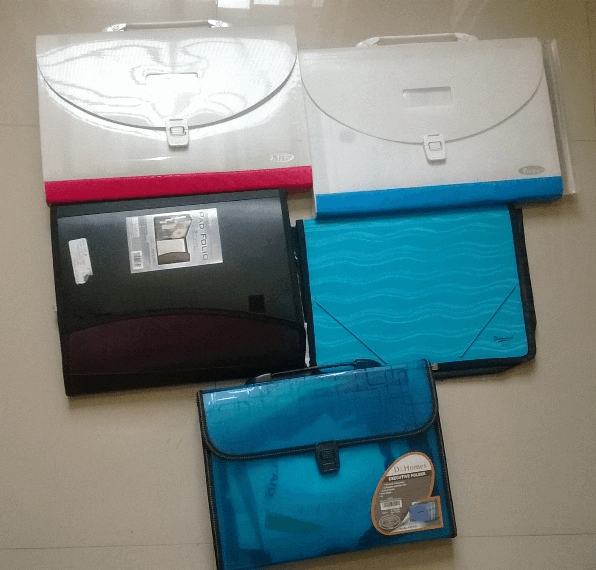

So, here is how I started. The first thing I did was to buy 3 BIG folders and 2 small plastic pockets which can contain few documents and then I did following 4 tasks

Action #1 – Created 5 folders to hold documents and categorise them

The first big thing I did was to buy 5 folders where I arranged 5 kind of documents in each, so that if I need a particular kind of document or information, I have a separate folder for that. Those 5 folders were

a) Protection Related Folder – This folder contains all my documents which protect my financial life like – Life Insurance, Health Insurance, Car Insurance related papers, which includes Policy documents, Health Cards, Premium Receipts, A paper containing all the customer care numbers. I still need to add a document which explains them what to do to claim each of them. Imagine you meet an accident and are not accessible, this folder will help them like GOD , Won’t it ?

b) Property related Folder – This folder contains all my property related documents, like Loan Agreement Paper, Home Loan related document, Property Tax receipts and any other small or big document which is property related

c) Banking Related Folder – Banking is a big aspect of everyone’s financial life and I thought why not have a dedicated folder for this. So in this folder I have all my cheque books, Bank related document, Locker papers, FD receipts (if any) , any bank statements which I want to keep etc etc. If you have more than 2-3 bank accounts, it really becomes very cumbersome to manage them, so this dedicated folder comes very handy.

d) All the Bills/Receipts/Warranty Cards Folder – This is not exactly related to personal finance, but over the years, you collect so many important bills, warranty cards, receipts which you want to keep because they are needed later in future and if you cant find them, you really regret mismanaging them and not keep them properly. So in this folder I am now keeping all the bills and important warranty cards. You can also store all your old ITR acknowledgement copies in this folder.

e) Education Related and Important Documents – And finally I have dedicated a folder for all my and spouse education related document like 10th , 12th , graduation and post graduation certificates , marksheets , passing certificates etc etc. Plus , I have also chosen this same document to keep our important documents like Passport, Aadhar card, Driving License xerox, Voter Id Card etc etc, Cable related, Electricity bills etc etc.

After making these 5 folders , now if you ask me you want X , I open my almira, know which folder has it, open it and can find out the required document 80% faster compared to old situation. Now my family, knows that things are not randomly lying here and there, but somewhere neatly arranged .

How 150+ investors organised their financial documents in Bootcamp

We have just completed our Facebook Bootcamp with 150+ investors and we dedicate one full week for arrangement and cleaning up of your overall financial life. Almost all the 150+ participants had taken huge actions and with lots of commitment, they all cleaned up their financial lives. They all arranged their documents and you should see what kind of conversations happens on our facebook bootcamp. See the snapshot below

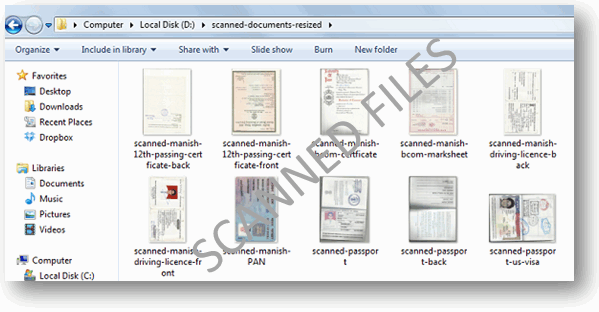

Action #2 – Created Scanned Version of all important Documents

The next important thing I did was to scan each of my very important document and keep the scanned version online accessible to me and my family. Some people might think its going extra mile and not required, but then its your choice and mindset. God Forbid, if you loose your physical documents somewhere, due to fire, robbery or any damn reason, it gets really tough sometime, especially in case of education related certificates.

There is no harm in scanning documents and keeping it with you online, especially if it takes 2-3 hours of work. All you need to do is take out time and pick which documents you want to scan and then finally scan then. Make a folder, compress it in ZIP format and mail it to yourself on your email id and someone else in your family. Keep it saved in a CD format also and keep at home or locker. It does not hurt at all, other than it takes fews hours of yours, but so what, its for your own good, Its a once and for all kind of activity.

I would still make sure I will take care of my physical documents , but god forbid if something happens to them (for any damn reason), atleast I have a scanned version of it, Its a better situation then to have nothing in your hand. In my case, I have scanner at my home so it was handy for me.

Here are those documents which I scanned

- Health Insurance Policy First Page (which mentions Sum Assured and Premium)

- Life Insurance Policy first Page

- Health Insurance Cards

- 10th , 12th and other educational certificates marksheets

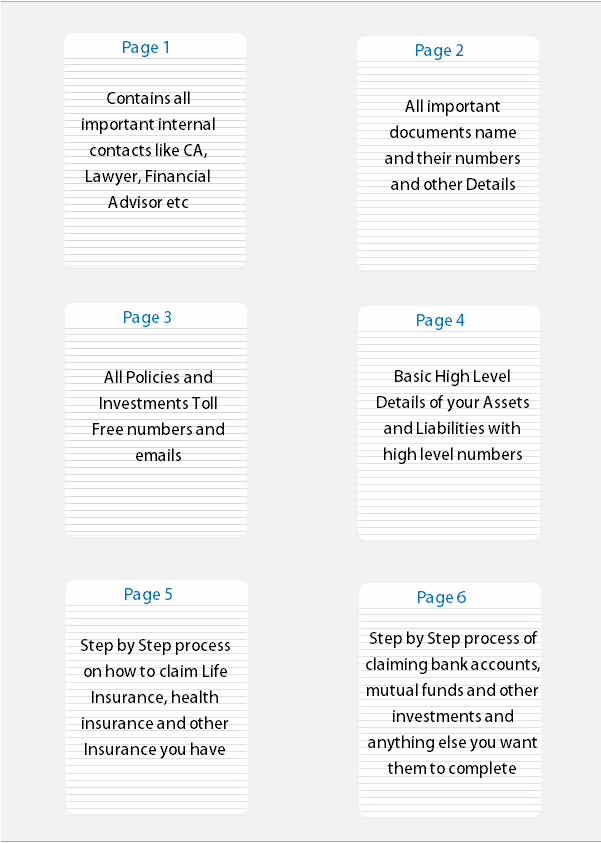

Action #3 – Created Emergency Black box Kit for my Family

The next thing I did was to create a emergency black box kit, which any one from my family can open and they will get every possible information about everything at one place. It will have all the basic + critical directions for them to follow, whom to contact in which case, where to go in which situation, how to claim for various things etc etc. Here is a snapshot of what all it can contain

- All Important Contact Numbers like CA, Tax Consultant etc etc

- Toll Free Phone numbers of Health Insurance, Car Insurance, Life Insurance

- Customer Care numbers of all the banks where we have account

- Email id of all the Insurance and Investment companies

- All Documents numbers like – PAN number, Driving Licence Number, Passport Number

- Process to claim life insurance, health insurance etc

- Process to close bank accounts and claim back the money

- Process to claim back all the mutual funds and other investments

Here is a rough idea on how it can look like

It can be roughly 6-8 pages long. You can keep the online version on your computer, email and dropbox and also take a printout and keep it at home and label it respectively like – “Open in case of emergency” . So incase something bad happens and you are not accessible or can’t help your family, your family members can look at it and their life will be more easier !

Store some important Contacts on Phone also

I extended this task and also stored some very important things on phone , which can be very handy and save you a lot of time in the times of crisis. I have my health insurance card scanned version on my phone, so that I can use it whenever required. Also I stored all the customer care numbers properly one by one with this format – “COMPANY-NAME CUST CARE” , so that in future if me or my family members have to call some customer care, we just can look at the phone search for “CUST CARE” and then choose the number.

I have seen people who try to find out the important phone numbers on the last minute, and that eats out some important time of theirs. Also in case of crisis or emergency – you really need it handy on your finger tips, This particular action might look very trivial , but in times of need, you will really feel very relaxed and happy to have it with you. More than yourself, its for your loved one’s who don’t have to struggle for this.

Action #4 – Created a Run-Away File

I dont know if this is my invention – but this came into my mind some weeks back . Every time I had to go for some important work which requires my Identity card xerox or address proof, I had to everytime arrange for it because I didnt had the xerox ready with me, so I had to carry original and then on the way, I have to xerox it. This takes up time …

Then at times, I had to return back home because I was not having my cheque book, because it was not asked to me . Then at one time, my trip to a property tax department was a waste because I didn’t bring my Index2 (house ownership proof) .. So then I thought why not create a RUN-AWAY file , which has all the things you can imagine which might be required ! for some work . So if you have to take a new phone connection, just pick the run-away file and go

If you have to go to book a new property – Phew .. Just pick the run-away file and thats all .. It will have all the things ..

So it will have

- Atleast 2 Xerox copies of PAN CARD

- Atleast 2 xerox copies of your address proof (electricity/phone bill)

- Passport xerox, aadhar xerox, driving licence

- 4-5 passport size photos of yours, spouse ete (if needed somewhere)

- 1 cheque leaf of your bank accounts (unsigned)

- 1 pen

You place all these things in a plastic packet and that’s all, you take it where ever you go , You don’t have to arrange for things every time. From the day I have created it, my life has become very easy, all I need to do is just open my almira and pick up that folder and I move on ..

Define your own style of arrangement

What you just saw above was my personal way of arranging things. This is just a idea of what all you can do, next – you need to define what all you want to arrange, in what manner, to which level and which are more important things for you and what is not. It might happen that you might feel, that what I did was little over-doing of things, but thats fine – its your choice. You can choose to go for a lower version, but I would just say that a lot of things are just one time task and then a small pinch of yearly review, Give the benefit you will get out of it, compared to the time you put, its worth going a little deeper.

Arranging Things is 1st Step , Communicating with Family is 2nd

We feel we should communicate all the things about our financial life to our spouse, children , parents etc and they should be aware about what all is there, but imagine if you do that without arranging things . If things are messed up in your financial life, the communication from do will not be effective.

However, if you arrange things neatly like this, and then when you show these things to your family members – they will be able to consume it in a better way, they will understand things more clearly, because they are able to “see” things before their eyes. They know what to find, where to find, and how to find. If things are clean and neatly arranged like this, they will also become more serious about overall finances and they will really feel that you are responsible and think about their care in future.

You will feel amazing

Once you arrange your financial life and fix lot of other things which were pending from long time, you will really feel amazing. I want to share one of our bootcamp member experience of working on his financial life and how our bootcamp has changed his financial life overall.

This looks so small thing, but the difference it makes in your day to day life is really great ! – So are you still waiting for “next Sunday” ?

March 20, 2014

March 20, 2014

excellent article Manishji,you are doing such a great job,please keep up the good work.

Thanks for your comment dipali

Hi Manish,

Excellent Article. I already saved all documents scan copies over the mail with me & my spouse. Just I need to arrange physical copies of all documents in separate folder. I hope, other readers also take benefits from this article.

Glad to know that Umesh P ..

One of my fav article on finance.. Very good.

Thanks for your comment Amit Ranasubhe

Will start on it today itself!! Such a simple thing that is there at the back of ones memory but easily gets overlooked every time.Stumbling upon this article has kicked me to my senses.thank you Manish.

-Jose

Its been close to 3 weks now. Have you completed it ?

So much informative article.

Hi Manish,

I am following all the above 4 actions exactly the way you have mentioned, since the time i started working i.e around 9 years back.

Good Job of educating people.

Great !

Very good & useful article,

But surprise is , I am actually doing the same thing from last some days,

I wonder, how you wrote, what i have done from last some days.

But I still appreciate your article, it is wonderful sharing.

Thank You.

Glad to know that BHUSHAN KOMPELLI ..

Thanks for sharing these amazing new ideas. Your contribution matters and all this information is really helpful.

Welcome !

Manish , Thanks a lot for sharing this valuable tip. We tend to gain a hold on Finance101 but overlook the part of cataloging and organizing the documents .

Somehow , we find time to play the game of missing documents , but do not carve out time to spring clean and keep the documents neatly organized. It takes discipline to bring order from chaos in our financial lives. We owe you a lot in spreading the key lessons of financial literacy

Thanks 🙂

Excellent article ..

A very very useful article

Thanks Deepak

Thank you for the insight. However, it is important to establish the relevance of the document today based on it’s criticality. I think a document retention plan for personal use is also required. All it needs is classification of the record based on the time for which it is needed.

Many people dispose photocopies of old documents without shredding. These full page photocopies end up at bhelpuri stalls and you can read all the details of the person on it. People must protect their personal information appropriate by shredding before disposal. Shredding does not mean using a shredder, but tearing the photocopy into small pieces, so it cannot be re-used elsewhere by anyone else.

Very valid point !

Incredible article Manish…We all move along with our life…keep investing.. Everybody should stop one day. Take some time and organize their financial details.. One of the key thing i think one would achieve by doing this activity other than the convenience of collecting all financial data @ one place is performing a postmortem on different investments made over the years..spotting the real worthy one’s and the one’s which should be stopped right away…This is def’ an eye opener. I ve taken the first step. Got 5 folders…:)

Great to hear that !

Nice work. Recently I arranged all of my old bills in folders. You just made my work easy. 😉

Thanks for sharing that !

Manish,

That is a real eye opener! I myself doubt how much I am aware of my family’s important documents. My friend’s case, which I shared in another post (and quoted by you here) and this blog of yours had done it for me! Yes, I am finally organizing my documents – this time, the right way!! Thanks a million.

My friend’s loss hurts – it really does. But thanks for sharing it with the many many readers here so that it doesn’t happen to any one else ever again. I really appreciate every help extended – both through your post and through the suggestions from others who have read it.

I’d like to add one point. The attitude of the society! When you lose a loved one, you might not be in a condition to think of all these. And the society too expects you only to grieve, and stamps you too selfish and money minded if anything is spoken about the insurance policies!

Even if some one tries to get you the benefits, this attitude of the society makes it all the more difficult. It will be hard to get the claims in such situations. And perhaps that is another big reason why one should have all these organised and readily available in one place. So that you, in an hour of need – or at least a friend or family who genuinely wishes to help you out (if not from the personal loss, at least from the financial hardships), can have access to these and make things happen!

Once again, thanks for your efforts! Wishing every one the very best

Regards,

Nisha

Thanks for your comment Nisha

I agree on your point that Society looks at you in bad way if you start talking about MONEY matters and insurance in some days after someone has died . It feels you are money minded !

Manish

Manish,

Wonder why you have not mentioned the ‘WILL’ under important documents. The Will too must be kept safely in a folder under information to nominees

Yes, one can .. the only thing is a lot of people keep WILL in bank locker or at times with a trusted friend of theirs if they dont want to share exact details about WILL with their family !

Hi Manish,

I have a query in the FY end/tax season. I know that debt and equity funds are treated differently for tax purposes (section 111A, section 112(1)). What I don’t know if how to classify funds in my portfolio into these two groups. A FMP or large-cap fund (as classified by Value Research) is easy one, but what about hybrid funds? I emailed Value Research 2-3 times on this, and they didn’t respond. Earlier I recall seeing a section about tax laws applicable on fund’s page, but now I don’t see that. There is rule floating around about 65%+ allocation in equity to be equity fund. But who and how can each person compute that when allocation change so frequently? It looks like tough problem which nobody wants to tackle, and investor is left to own devise!

At last resort, I request you, and your readers! Is there a way I can figure out whether I should classify that fund as Debt or Equity for tax purposes.

Ok. Looks like Jago Investor/readers don’t have anything to say about this. Investor is left to own devise…

Hi Ashish

Not sure how it got missed for replying 🙂 .. Here is the answer, each fund keeps changing their fund allocation, but each fund already defines its core allocation at the time of starting the fund, like for example a fund can say

Equity : Maximum upto 100% , But minimum 70%

Then the equity part will keep changing the will always be in between 70-100% . so its a equity fund. Have you looked at your fund allocation declared with SEB I ?

Manish

Hi Manish / Nisha,

My comment is against the query raised by Nisha. Her friend has two options now:

1. Ask her to scan all the bank statements for the last 2 years, there would be an entry showing cheque issued favouring an insurance company. Probably she will have to take help from the bank also to understand the narrations or seek additional info.

2. If her late husband was a salaried employee, he would have definetely submitted investment proofs to his employer. Ask her to reach out to the employer’s finance/ HR department and ask for a copy of the same or atleast tell her the details out of the same.

Hope this works for her best.

Regards,

Kanti Kiran

This is a very good idea, thanks for sharing that Kanti !

@ Kanti Kiran and Manish – Thanks a lot for the help. I wish there was such a way out! The policy holder who passed away was not a salaried employee. He was running a small shop and the transactions would most probably be in cash, not cheque.

Also, my friend now doesn’t have access to the house where they were living, as she had to shift home after her husband’s demise. And unfortunately, many documents were misplaced or lost in the process. She and her little kids were not in a state of mind to look for those immediately after the loss.

Another challenge we are facing is that he was quite popular with all the people around him. So the different policies he held were taken was with different agents who approached him. So my friend doesn’t know with whom he had taken this particular policy which is now badly needed by the family.

But any way, I will try to explore the angle of going through the bank details. Thanks a lot for that advice. Any possibility should be explored, that is the need of the hour! But I need to check it with her whether he had any regular banking habit or not. Hope something materializes!

Once again, thanks!

Sadly I think the chances of getting info about the the old policies are bleak now .. but I would suggest one more solution which I think will work

Ask your friend to file a RTI to LIC or IRDA and share her husband name and address and ask if there was any policy taken by him ? Also share the date of birth in RTI , I think this should get some information !

Try this ! , let me know if some help is needed !

Manish

Dear Manish Ji,

Thanks for the Article. You would be surprised to know that I am already following every bit of what you have wrote, since last 3 years. This Includes keeping track record of all my database in hard format (original) as well as Soft form (scan copy, Excel data record). The thing you did better than me was sharing of this information. Thats why we all (your fans) follow & praise you & your ideas.

Again thanks a lot for your helpful ideas.

Anand

Thanks for appreciation Anand

You can always write to me with some good sharing you have for all, if you are doing something good about your financial life, please let me know

Also , thanks to you, I started a thread on quora for others to share about one good thing that they are doing in their financial life – http://www.quora.com/What-is-one-good-thing-you-are-doing-in-your-financial-life-which-you-can-share-with-others-and-want-everyone-to-follow