Why your credit report remarks matter more than high credit score?

So, you have been reading a lot about CIBIL these days and you have got the impression that having a high credit score like 800 or 850 is a key to get your kind of loan?

If that’s the case, let me break your myth that having a high credit score is not a guarantee that you will get a loan from a company. Look at the following comment and you will understand what I am talking about

Dear Sir,

I have taken the PL of Rs.1.5 L from HDFC and get settled of amount Rs.15 k in 2013. In March 2015, I checked my CBIL score, it is 813 however loan status is settled.

Recently I applied for PL of Rs.5 L in ICICI but it gets rejected based on previous settled loan. I don’t get this, when my CBIL score is 813 then how its get rejected. Kindly guide me how could I get PL as its v.urgent for me.

Regards

What is CIBIL remark and score?

In case you are new to this CIBIL concept. I suggest you read this article or watch this video below from the Cibil team.

It will help you understand the concept of the credit bureau and credit report. Once you view the video, then you can move ahead.

Your credit report remarks matter more than your Credit Score

Let me share with you a personal experience. My brother had taken a bike on loan a few years back and I was with him in the Bajaj showroom where I asked the executive if they really looked at CIBIL score (CIBIL was new around that time). The executive shared with me that they don’t look at a credit score, instead, they look at the remarks on the report and that is what matters most along with your other factors.

It was really a new thing for me to know that a credit report does not have that much Importance compared to the credit score in your loan approval process.

Credit remarks vs. Credit Score

Let’s understand both the concepts and the meaning of these two things

What are Credit Remarks on your report?

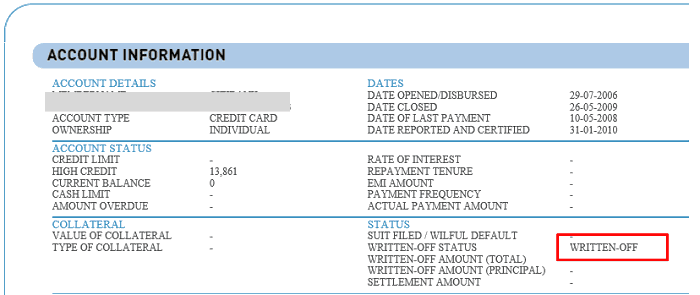

If you have 3 different kinds of loan accounts (1 home loan, 1 car loan, 1 credit card). In that case, you will have the remarks for each of these loan accounts and the current status. Imagining you have closed the loan accounts, the remarks may say “Settled” , “Written Off” or “Closed”, out of which the first two are bad remarks. At times, if you are not able to pay off the loan, the loan guys will try to persuade you to settle the loan with a lesser amount and close the chapter.

However note that it’s a short term solution to just get away with the problem. Eventually, the remark will be marked as “Settled” or “Written Off” and in future when another lender looks at your report, he will come to know that you didn’t pay the full/partial amount of loan outstanding.

At this point in time, even if you have great salary or a good credit score (we will look at it below), they are going to reject your loan application.

What is a Credit Score?

Credit score is a number between 300 and 900, which signifies your credit worthiness and how likely are you to default on paying your loan installments. A low credit score means that there are higher chances of you defaulting on the loan payments. This credit score calculation is a trade secret and no one knows the algorithm of how it’s calculated, but there are various factors that are considered by the credit bureau which its calculation.

So one can still have a high credit score (the chances of paying their future EMI’s regularly), but still their past remarks will have a greater impact on their loan evaluation process. While a score of 750+ is desirable (as per CIBIL around 79% loans were given to those with CIBIL score of more than 750), don’t think that just because your score is higher than 750 means that you will surely get a loan.

In the same way, if yours is less than 750 (like 600 or 720), but if your credit remarks are clean, you will most probably still get the loan, considering you qualify on other parameters like (salary, other EMI etc)

So while credit score gives a future insight, the credit remarks gives insight into the history.

4 other factors because of which loan application rejection can happen?

- If you are a guarantor for a loan which is already defaulted. Though you have not taken the loan directly, your application might get rejected if you have become the guarantor of a loan by your friend/relative and they have defaulted.

- If you are too dependent on credit already (means if you are over-leveraged). Imagine if you are already paying 50% of your income on EMI’s and have many different kinds of loans running. Even then your application might be rejected.

- You don’t have enough tax payment history. If you have not been paying your taxes regularly, then it’s tough for the company to ascertain your paying capacity, hence, make sure you file your returns regularly and properly

- Too many unsecured loans, if your loan portfolio has too many unsecured loans (credit card, personal loans) then it’s not a good sign and makes you look a credit hungry customer. This might lead to rejection.

So what’s the learning?

So what’s the learning out of this?

The main thing you should focus on is to make sure that your credit report does not contain any bad remarks and if there are any, then you should take actions to rectify it. It will by default help you in improving your credit score. Don’t get obsessed with increasing the credit score. If your credit score is above 700 and your report is clean, you are 95% good to go. Beyond that, if your score is higher, it’s a great thing. But don’t over-focus on it.

Before applying for any kind of loan, make sure you apply for your credit report and score before few months and analyze it to find out if you need to fix it or not. Over the long run, just keep paying your dues on time and do not abuse your credit utilization and you should be good in the long run.

Let me know if you have any queries about this.

December 31, 2015

December 31, 2015

Did you know your credit remarks matter more than a high credit score? Well, this article talks about that. Firstly, with the help of an example, you will understand what the article is trying to convey. Then you will get to know about CIBIL remarks and score. The differences between credit remarks and credit score are in this write-up as well. Thank you for this amazing information about the factors affecting loan application rejection.

Hi Manish,

If I request for CIBIL report, will that inquiry be mentioned in that report and can affect my future load application?

No , just making a enquiry for cibil report has no impact on score !

Hello Sir,

My credit score is 770as I pulled out my Cibil Report today. Last month in january i applies for a personal loan in CAPITAL FIRST BANK but i Recieved a call from them saying that m CIBIL score is low i.e., 706. The point is how can my score jump from 706 to 770 in a month, as far as i think…thats impossible then how did they reject my loan….i have an unsecured credit card from AXIS BANK from last one year and all the payments have been made on time…so can you please help me out that for what reason they said that my score is low and this enquiry made by me is now in my report and also I am planning to get a secured credit card and a gold loan along with my current card to boost my score. Is my decision correct??

As per their standard it might be a low score. THey might be looking for a score something like 800+ .. Regaridng how your score jumped, I have no idea ..

Mandeep, never go for a loan that you don’t need. When you already have a normal credit card, having a secured card may not help much. Also gold loan may not be viewed as favourably as a home loan, even though it is a secured loan, as it points to some urgent need of cash. It is not the same thing as having a home loan where you are creating a long term asset.. Thus while we may not know exactly how the Cibil score gets calculated, it is important to make all payments in time, not apply for a large number of credit facilities in short time frame and keep utilisation of credit to a moderate level. As Manish has pointed out, each bank will have its own policies regarding credit score and below a certain score they may reject an application.

Dear Sir,

I have a credit score of 706 and last month one of my personal loan application got rejected. I am holding an unsecured credit card and haven’t defaulted any payment till date. I want to improve my score so opting for GOLD LOAN and SECURED CREDIT CARD from DCB Bank, will this help me boost my score by 6-7 months so that I can avail loan at that time.

Please reply soon.

Thank You.

Also my EQUIFAX score is 745

Yes, if you improve it will get better

Mr. Manish, Firstly, I appreciate for your website and great articles posted from time to time. Thanks for all your efforts in clarifying the common man on many aspects through various articles that you post.

Coming to my query on CIBIL Score / report, I had always maintained a clean status on my payments be it on my Home loans or Credit Card payments. However, there was one dispute around 7 years back with SCB CC. Because of the billing mistake, I was forced to pay extra money and which I had refused to pay as it was not my fault. Few examples of my good transactions, 1) I had a Home Loan with SBI for 15 Years, however i had closed it within 6 Years through bulk payments. 2) After the dispute with SCB CC, I had cancelled that CC and applied for SBI CC and I have been using this for the past 7 Years and till date, there wasn’t even a single instance where in I had delayed my payment on dues, it was always on time. 3) I had taken a second home loan from HDFC approximately 3 years back and have always been paying my EMIs on time without a single default / delay in the payments.

Now, my query is can my CIBIL score be pulled down due to my SCB CC issue (as per the SCB, i am due, but is not the case), despite maintaining clean records on my other home loans and SBI CC payments.

Regards,

Sudheer

Mr. Manish, Can you please let me know how it is justified by the financial institutions to take a decision based on the CIBIL report, as it is one sided not taking into consideration the customer’s inputs. In a scenario like the one I mentioned above, is there a way to fight back legally on these disputes. – Regards, Sudheer

No , there is no way to fight legally on this.

CIBIL report is based on the information bank has about you. If there is any descrepency, then you need to talk to bank. CIBIL cant be blamed on this.

Unless you check your CIBIL score/report, you will not come to know if its part of it or not. Please check that first

Thanks Mr. Mansih, appreciate your inputs.

Mine is also the same case of many here with SCB Card. Despite settling their final amount during 1998 and destroy the card Shaha people are still showing Rs.17k+ being written off and current claim is mind blowing Rs.66+ lacs.. This is some thing crazy.. I have already registered ‘DISPUTE’ in CIBIL, Pl let me know what is next course of action.

You will have to check with the teh CIBIL itself and the bank.

Hi Manish,

It is a great article.

Manish, last month I bought a TV on EMI from bajaj finance. Will it be considered as a secure or un-secure loan.

Thanks

Unsecured !

Thanks a lot

Hi Manish,

Any idea if a personal loan taken from RURAL CREDIT CO-OP SOCIETY LTD, Kerala would have an entry in the CIBIL report?

Due to my CIBIL score, I am not getting loan from any other financial institutions. However I am getting a personal loan from this Co-Op Society. Hence wanted to understand if a proper closure of this personal loan would help improve my CIBIL score?

Please let me know if you have any other suggestion to improve my score, currently it is 588. Thanks!

They might be. Almost every small bank is linked with CIBIL . I am sure even they would be listed there .

Statement : “The main thing you should focus on is to make sure that your credit report does not contain any bad remarks and if there are any, then you should take actions to rectify it. ”

Question : Credit scores increase over a period of time as regular payment happens but how to make a remark go off .

It does not change . What actions that should be taken to rectify it are not given ?

Joel

A remark will go off only when you fix the issue and ask the bank to update the new status with CIBIL

Hi Manish,

Thanks for the insightful information !

Can you please let me know:

How to obtain the CIBIL Credit Score and Report ?

Regards,

Vikas

You can get it from cibil.com by making online payment

WOW..! This post is coming to me as an eye opener. I did purchase my new car this week for 6.5 lacs on-road. To which I paid 3 lacs as down payment & 2.5 by carload. The reason I went with car loan is to leave behind some liquid cash for any unforeseen situations.

I am planning to do a part payment of 1.5 lacs to my banker in about 6 months, reduce the tenure to 3 years & service the loan for balance.. My school of thought towards EMI’s are old fashioned. and its urging to pre-close the loan asap.

However, I’ll stick with my part payment strategy. Will it still be classified as “settled” or written off to dent the credit report by any chance. Please advise

Written Off – Didn’t pay the remaining due and bank just cleared it.

Settled – Paid some due amount and bank cleared it

Closed – Paid full loan amount without any dues

Hi Gopi

There wont be any issue with your payment strategy. You are not settling here. Dont worry !

Thanks Manish..!

Why you loan application can still get rejected even with high credit score?

Please change YOU to YOUR

Done