What kind of investor face do you have ? Each and every one of us leads our financial life in a different way and we have an internal design, based on our beliefs about money. In my interaction with thousands of readers and dozens of paid clients, I can see each one of them with a face and I am sure you would be able to identify yourself with your face today. You will enjoy it 🙂

Cribbing Investor : This investor always find problems with the system, he keep on blaming Regulators, agents, companies and everyone else but not himself! He cribs at every one and about every thing around, from how he was mis-sold an endowment policy 8 yrs back to how IRDA never responds. The biggest mystery is how the agent “forced” him to pay! Did he shoot him or what! You can find him on all the reviews site complaining about some product and how he was cheated.

Cribbing Investor : This investor always find problems with the system, he keep on blaming Regulators, agents, companies and everyone else but not himself! He cribs at every one and about every thing around, from how he was mis-sold an endowment policy 8 yrs back to how IRDA never responds. The biggest mystery is how the agent “forced” him to pay! Did he shoot him or what! You can find him on all the reviews site complaining about some product and how he was cheated.

I-want-everything-Free Investor : This one needs everything for free or at throwaway price. He’ll say “It’s very expensive, Will get back to you later” to a financial planner after hearing their fee, and then he’ll buy a ULIP with 100% allocation charges in first year! . He won’t find this expensive enough! You might be the right advisor for him and they badly need your help, but the moment you tell them it would actually cost something, they would say “Ohh .. Tab to nahi chahiye” ..

I-want-everything-Free Investor : This one needs everything for free or at throwaway price. He’ll say “It’s very expensive, Will get back to you later” to a financial planner after hearing their fee, and then he’ll buy a ULIP with 100% allocation charges in first year! . He won’t find this expensive enough! You might be the right advisor for him and they badly need your help, but the moment you tell them it would actually cost something, they would say “Ohh .. Tab to nahi chahiye” ..

Lost Investor : These are the investors who have literally no idea about anything! He gets confused between Filing Tax returns vs Paying Tax. They get confused between IRDA, SEBI and RBI! If an agent comes to them and shit jargons on their face, they will most probably buy it as they feel bad to admit that they are dumb in the area of personal finance. This guy also thinks that 80C is compulsory and keeps buying unsuitable products every year with personal loan.

Lost Investor : These are the investors who have literally no idea about anything! He gets confused between Filing Tax returns vs Paying Tax. They get confused between IRDA, SEBI and RBI! If an agent comes to them and shit jargons on their face, they will most probably buy it as they feel bad to admit that they are dumb in the area of personal finance. This guy also thinks that 80C is compulsory and keeps buying unsuitable products every year with personal loan.

Fun-Making Investor : These investors are very naughty. They are experts and make fun out of situations. If they get a sales call, they ask tough questions like “Can you tell me IRR of this product?”, which leads to a call escalation to the senior manager and fills the trainee with guilt! This guy also records the call and posts it on youtube and facebook (example). For them, sales call they get is nothing but a way to practice english speaking, its free and no one points out their vocabulary mistakes!

Fun-Making Investor : These investors are very naughty. They are experts and make fun out of situations. If they get a sales call, they ask tough questions like “Can you tell me IRR of this product?”, which leads to a call escalation to the senior manager and fills the trainee with guilt! This guy also records the call and posts it on youtube and facebook (example). For them, sales call they get is nothing but a way to practice english speaking, its free and no one points out their vocabulary mistakes!

Virgin Investor : These are fresh entrant in the area of money, who don’t even know what’s CTC and Take-home salary and choose the jobs based on CTC figures and cry later. When it comes to personal finance, they have no idea of how customer cares irritates, why disclaimer is written in small fonts, how agents look at them as targets! . They also feel that CFA or CA are great in personal finance.

Virgin Investor : These are fresh entrant in the area of money, who don’t even know what’s CTC and Take-home salary and choose the jobs based on CTC figures and cry later. When it comes to personal finance, they have no idea of how customer cares irritates, why disclaimer is written in small fonts, how agents look at them as targets! . They also feel that CFA or CA are great in personal finance.

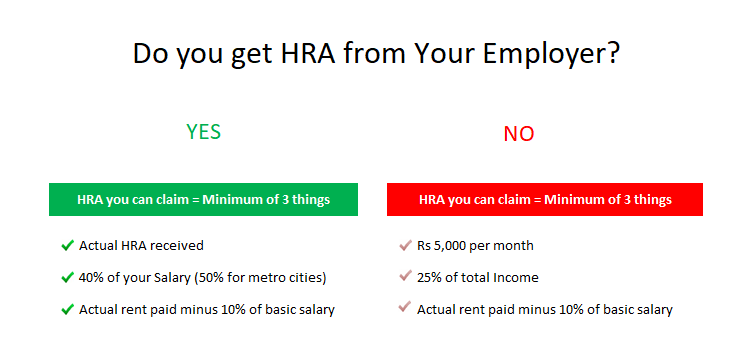

Not Interested Investor : They are just not interested in Investments. Only at the gun-point you can force them invest and even then, they will start an SIP of Rs 1000/per-month and start skipping their breakfast ! . They dont claim their LTA, medical bills & even HRA, it’s too much of documentation and you have to physically move from one place to other, not worth the effort! And why take term insurance for spouse, they can always re-marry.

Not Interested Investor : They are just not interested in Investments. Only at the gun-point you can force them invest and even then, they will start an SIP of Rs 1000/per-month and start skipping their breakfast ! . They dont claim their LTA, medical bills & even HRA, it’s too much of documentation and you have to physically move from one place to other, not worth the effort! And why take term insurance for spouse, they can always re-marry.

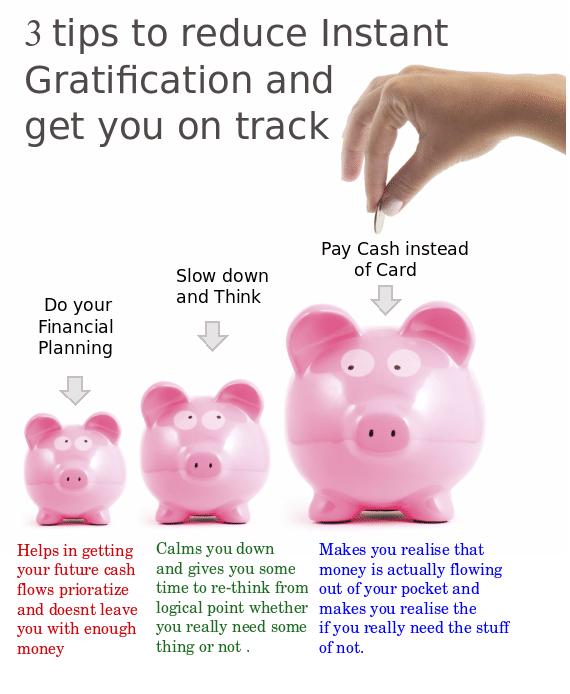

Fantasy Investor : These investors live in fantasy world when it comes to money. Even in today’s world their aim is to become a “crorepati” (calculate). Misselling a product to them is an easy thing, make product illustration with unrealistic numbers & present it to them, make sure you have cute children pictures on it, it helps!. They also learn Forex/Currency trading or Future & options and think they can do it part-time. They also have many investment books with bookmarks !

Fantasy Investor : These investors live in fantasy world when it comes to money. Even in today’s world their aim is to become a “crorepati” (calculate). Misselling a product to them is an easy thing, make product illustration with unrealistic numbers & present it to them, make sure you have cute children pictures on it, it helps!. They also learn Forex/Currency trading or Future & options and think they can do it part-time. They also have many investment books with bookmarks !

Pissed-Off Investor : These investors get pissed off with everything. If Insurance company increases the premium because they are smoker, they get irritated . If their demat account charges him a yearly fee, he is irritated. He is also irritated because his mutual fund now ranks 3rd, which was a top performer when he bought it. They get pissed off at ICICIDirect site for not opening at right time and they are forced to sell their stock at Rs 156 instead of Rs 157 sometime back ! .

Pissed-Off Investor : These investors get pissed off with everything. If Insurance company increases the premium because they are smoker, they get irritated . If their demat account charges him a yearly fee, he is irritated. He is also irritated because his mutual fund now ranks 3rd, which was a top performer when he bought it. They get pissed off at ICICIDirect site for not opening at right time and they are forced to sell their stock at Rs 156 instead of Rs 157 sometime back ! .

Informed Investor : Tele-marketers really cut their name from their lists, as they get embarrassed each time in front of these investors by talking something non-sense. These investors happily let their SIP’s run irrespective of markets. They were able to conclude that term plan is the only insurance product they should buy and not Endowments, as they know maths and are open to use their common-sense. They dont go for the free coffee mugs at investment seminars conducted here and there!

Informed Investor : Tele-marketers really cut their name from their lists, as they get embarrassed each time in front of these investors by talking something non-sense. These investors happily let their SIP’s run irrespective of markets. They were able to conclude that term plan is the only insurance product they should buy and not Endowments, as they know maths and are open to use their common-sense. They dont go for the free coffee mugs at investment seminars conducted here and there!

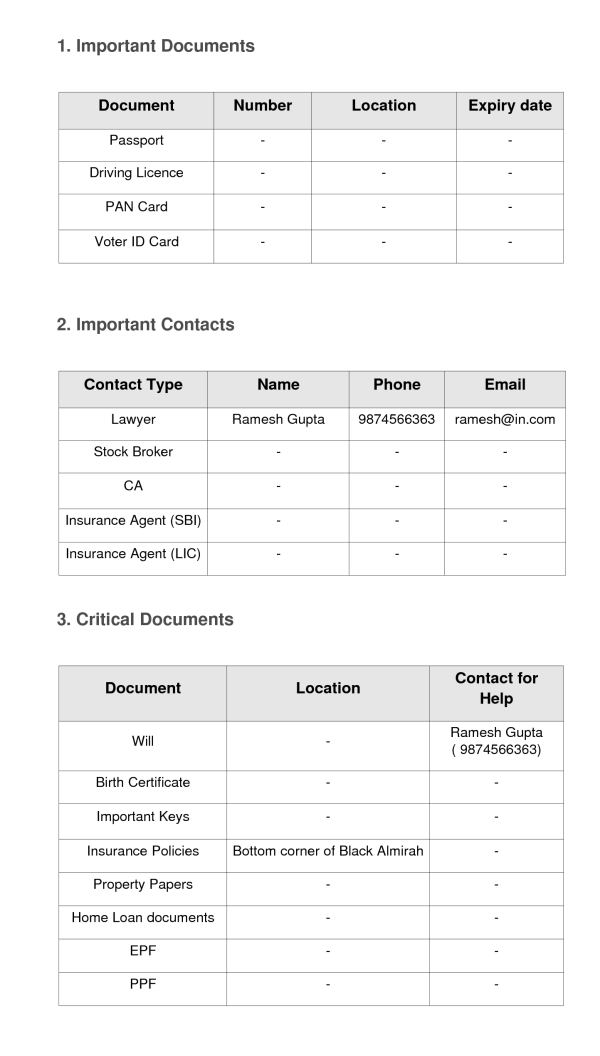

No-Idea Investor : These are investors who have no-idea about things in their financial life. they often find their insurance policies and other important papers here and there. They struggle to mention the funds name in their portfolio . Their Policies get lapsed often,They have no idea why they are saving, Their demat accounts are active from years and they have no idea that they are paying yearly charges . They never match the actual spending and their credit card bills, ever!

No-Idea Investor : These are investors who have no-idea about things in their financial life. they often find their insurance policies and other important papers here and there. They struggle to mention the funds name in their portfolio . Their Policies get lapsed often,They have no idea why they are saving, Their demat accounts are active from years and they have no idea that they are paying yearly charges . They never match the actual spending and their credit card bills, ever!

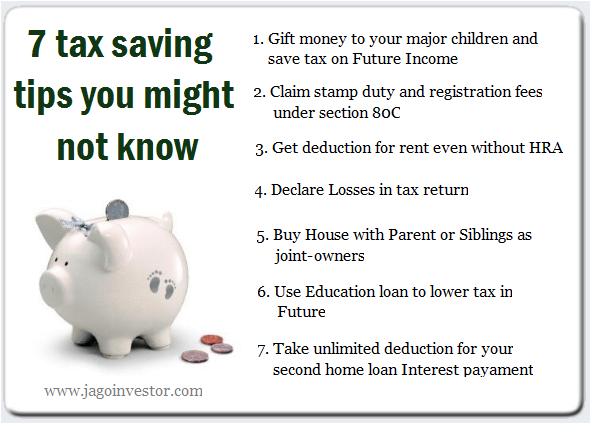

Tax-Saver Investor : These investors are really mad about tax-savings!. Their financial life is at mercy of tax-saving products. You can suddenly see a new energy in them after Jan 1st each year. If you need blood, you can get it from these investors provided you convince them that they can get a tax exemption on that. Mention a section like 80K or 80Z for faster response. His last wish in life is to find out everyone involved in designing Direct tax code and then kill them to death one by one, slowly!

Tax-Saver Investor : These investors are really mad about tax-savings!. Their financial life is at mercy of tax-saving products. You can suddenly see a new energy in them after Jan 1st each year. If you need blood, you can get it from these investors provided you convince them that they can get a tax exemption on that. Mention a section like 80K or 80Z for faster response. His last wish in life is to find out everyone involved in designing Direct tax code and then kill them to death one by one, slowly!

Read these 7 tax saving tips with Video

Mirror exercise to change your financial face

I am sure you were able to identify which face above resembles yours 🙂 . Do you think you were born with that face ? No ! . We all are born with same face and while we were growing up and finally entered this stage , something happened ! and we got a face and there are many factors which resulted in it . Starting from our upbringing , our relationship with money and how kind of memories we have about money .

Lets do a short exercise which would help you change your face and give you a new direction. Make sure you do this exercise seriously, else just skip it.

Step 1 : Look into a mirror and think about all the situations like investing , thinking about hiring a planner , when you got to find out those hidden charges in the ULIP , when customer care does not entertain you etc . Note down what are your expressions.

Step 2 : Go back and see which faces above resemble your expressions , It can be a single face or mix of some faces , which is fine .

Step 3 : Now look at your own financial life closely. If you look deeper I am sure you will be able to identify some things in your financial life which would are just not working, you feel stuck at it . It can be “not able to save more” , “Fear of loosing money” or something like “I keep delaying taking actions” .

Step 4 : Now ask yourself, how do those financial faces which you are carrying from years is helping you to in solving your financial mess ? How do you use the energy from your current financial faces to transform your financial life ? I am sure you will not have any clue because that the blocking point ! . You financial face which you are carrying from long time , would not help you in coming out of your stinking financial life.

Step 5 : You need to change your face, now ask yourself which is that face/faces above which if you had would help you ? Which would make sure you slowly change the way you look at your financial life . Try to change your face soon , slowly , but do it !

Note that this small exercise is for you to realise that its only you who is responsible for your current financial face and your financial life . So let me know which expression will empower you as an investor?

Conclusion

When it comes to your financial life, Have a good face. Go for a facial. Hire a financial counsellor or mentor in your life, who can guide you and show you the possibilities which you have never imagined. Read some stuff which would help you transform your financial life . So which face resembles yours out of these 11 faces ? Which one do you think are negative faces and which one’s are positive? Share your thoughts ?

If you are reading this page on email , click here to vote for jagoinvestor as best blog.

Conclusion

Conclusion