Women & Personal Finance in India

Today, we’ll talk about Women’s involvement in Personal finance, especially in the Indian context. How many of us remember when our ladies at home took any decisions regarding banking, Insurance or Investments?

Their role has been always limited to household work and as caretakers of our homes & hearths, for decades and centuries now. Even in today’s world, when women are at par or even above par with men in all areas, they fall behind in this one.

Decisions (as far as finances go) are primarily made by men, & not women in general. In this article, we’ll see why it’s important for women, to know about Personal finance .

Women not accepting their Responsibility in Personal Finance

One of the big problems, with women, is that they do not treat Personal Finance as something that’s important for them. For ages, they have not participated in Personal finance, regarding it as the man’s domain, just as they felt cooking was theirs.

Obviously, this isn’t true now, in this day & age. Cooking is as much a guy’s activity as Personal Finance ought to be a woman’s. Women, in general, don’t show real eagerness for these activities, for some reasons like

Women treating their earning as time pass activity : The biggest reason for this, is that, since the dawn of time, Man has been the main provider and the primary bread-winner of the Family .

He was responsible for earning and managing money and taking care of financial goals, Women, on the other hand, were mainly responsible for raising children and taking care of household activities and to a big extent, maintaining relationships outside the house and in the community.

Many women in spite of being qualified enough, and having skills to earn money, view their earning as secondary compared to men. They “feel” that they are not at the same level, even though its not true; most of this is psychological.

Everyone handling her money but her: From centuries women’s financial decisions were taken care of, by their fathers, then their husbands and then their sons. They never got involved & were never encouraged to do so, because they were not considered smart enough!

Men have always shown dominance over women in this space. One reason, which could be responsible for this, is that women, hardly ever ventured outside house for these activities and never got time enough from their household chores.

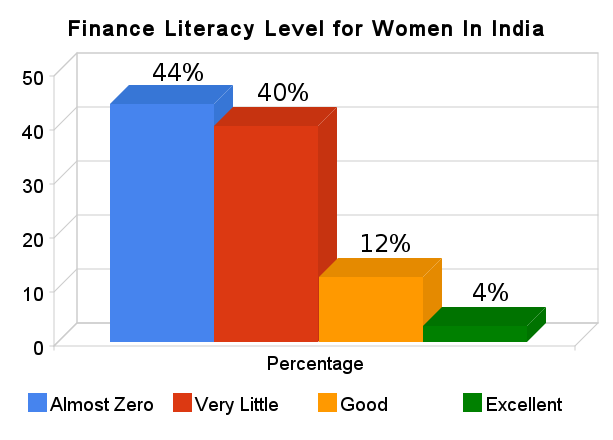

Current Situation Women Knowledge in Personal Finance [ Statistics ]

Why It can be trouble for Women to not Know Personal Finance

Sudden responsibility

A lot of women never learn about Banking , Insurance, Investments , how to grow money well and related topics throughout their lives .

They are smart, have a good job, high earning , but they never learn about Money and some day when sadly, things go wrong eg., they lose their husband because of accident or some other reason; apart from emotional pain, there comes bigger pains in life , i.e. taking care of your children and overall finances, that day she has no idea on how to invest money for making sure of child education , her retirement , her Insurance etc .

She suddenly finds herself in very tough situation and will have to rely on others, (relatives , friends etc.) This is not a good situation. Girls! Ladies! please learn about money, even if you don’t like it… Learn a bit, at least up to a level, where you can take charge of things and no one is able to take advantage of your situation .

More Divorce rates

Gone are the days in India when Women would keep compromising in a relationship! Women these days, are independent, and have a say in every decision. Because of this, they have more flexibility to move out of a marriage, if things don’t work out. Divorce rates are on rise in cities from last decade.

Women who get divorces, have to, at some point in life, look after themselves and take charge of their finances. So learning about money is important from start.

Women live longer so need a better Retirement Planning

Think Long Term! What does’t seem to be important today, might be very important tomorrow. Women worldwide, have a higher life expectancy than men, and hence have to live more than their male counterparts .

Women generally rely on their children, but they should be better planned and hence learn about things .

“On average, Women live 4-5 years longer than their husbands and over three-quarters of all women are widowed at an average age of 56. Women comprise a horrifying 87% of the impoverished elderly”.

Some Psychological Myths Women Face

- Somebody will manage my money for me : Yes, but only up to a certain age… If there is no well-wisher, don’t rely on relatives or friends! When it comes to money, no one is truly yours, and even if they are, you better learn things and manage things on your own. It’s not that tough!

- I don’t know enough to do this myself : This is patently false! If you can be an Engineer, Doctor, House Manager, then you can definitely understand and learn anything you set your mind to! There might be some topics which might scare you away, but there are always blogs like this and people like me to help you with doubts.

- I will make too many mistakes : So what? Everybody does! We make mistakes to learn in life. I would encourage you to make mistakes and learn from them, because, “Making mistakes is a privilege unsuccessful people don’t get in their life” . Computers can never become more intelligent then human beings , because computers never make mistakes, only humans do .

- I don’t have money to invest : There can be two things here… One is that you might not be saving enough. Do review your income and expenses, and find out where can you save without compromising your lifestyle. Try to live with 90% of your salary .The second point is that you have little money which is ok! Doing investments, does not mean you have to invest lots of money; every body starts small, & slowly we progress! So what, if it’s only Rs 500? Make a start, at least! Develop self-discipline and start learning things. Tomorrow, when you have more money, you will already be way ahead of the curve .

- I don’t have time to plan my money : This could be due to lack of interest. Review your monthly schedule and manage your time well. Even if you take out, couple of hours each month, to learn about money, its enough. Once you start learning things, you will enjoy it. If you make yourself believe that you don’t have time today, then you will never have it ever 😉

Women’s Personal Financial Dreams

For time immemorial, women have been dependent on their father or husband for money and to fulfill their dreams. If they want to go for some trip or buy some jewelry or anything else, for that matter, they have to ask (or demand) their husband for money.

Many times women have their own dreams, which they want to fulfill on their own, but they cannot . Women are good savers, but never good investors like men (even men are not for that matter.) Women diligently save money at home, but do not make best use of those savings.

That money is mostly lying idle, in the bank or at home. By learning about investments and how to invest well, women can grow their money and reach their goals. There is no need to always rely on men for everything.

I know many women readers on this blog who are excellent thinkers; they ask questions, get involved in discussions and given a chance, they’d give serious competition to their male counterparts in financial planning!

They have learned lot and can beat many women outside this space on Personal finance. Credit goes to their willingness to learn, and the time they take out in order to learn things . Here is a excellent Short Video from Manish Thakor , Personal Finance Expert for Women .

Even though its made for American Audience , everything applies to India Women .

Extra Benefits for Women

There are many Women only benefits like :

- Generally Lower Education loan by 0.5-1% for Women

- Lower Income tax for Women compared to Men

- Premium for Insurance Policies is lower compared to Men : Compare at Apnainsurance .com

- Lower Stamp Duty for Real Estate Registration in Some States

Role of Women in Personal Finance at Home

There are many men who do not involve ladies at home in the decisions regarding Insurance, investments , retirement planning, banking , budgeting etc , and it’s not a right. Women have better understanding most of the times, about the future goals of the family, especially child education related expenses.

We men, sometimes can not understand, long-term expenses like how our expenses will be at retirement and what kind of situation we would be living in. However smart we feel we are, there are many things that women outsmart us at. We should involve them in every decision we want to take in our life.

So next time when you think about insurance, talk to her about her needs after you are gone. Don’t shy away, feeling that this is taboo in this country. You have to plan things well and understand her needs.

Also while planning for retirement, take her advice and her views on what your standard of living would look like at retirement, what are your (and hers) post retirement plans are. She will give you many suggestions and it will help in planning.

Women are the queens of Budgeting and they are the real help in making the budget and what is needed and what is not . So you can’t do without her. They also save lot of money compared to men. When we men, go out to buy vegetables and if the Vendor tells us Rs 20/KG price, we buy it!

Whereas women, tend to bargain and bring the same stuff at a much lower cost. So whatever we bring for Rs 100 , the same thing Women bring at Rs 90 or Rs 85 .

Respect and Confidence

We men, have to make sure that we encourage our Wife / Mother / Sister / Daughter to learn about money. If they understand money well, your children will also learn about money from early life!

Just imagine how many mistakes you’ve made financially… Your children, will at least not make stupid mistakes, (hopefully) you have been doing all these years before learning better. An educated Woman means an educated Family. We have to make them confident that they can learn things very well, and involve them.

When you learn about something on this blog or anyplace else, try to teach them those lessons. Ask them questions, and see if they can answer them, and if they fail, then guide them gently.

I see a day, when one of the major reasons India will outpace other countries in, is financial literacy among women of this country. Also if women learn about money they can share the financial work of men and also do it themselves. We have to respect our ladies in this field .

There are many great women personalities, like Suze Orman and Monika Halan Personal Finance Space and each of our ladies can get there to that place, at least up to that level.

So if you are a Man and a true Jago Reader, make sure your Wife / Sister / Female friends / Girl Friend read this article and get motivated to learn about Personal finance. If you are a Woman, make sure more and more women friends of yours get to read this article .

Comments , Please suggest other tips to help Women increase their Financial Literacy levels , Any good links , websites for them ?

March 23, 2010

March 23, 2010

[…] Credits: Jagoinvestor […]

Hi Manish,

Thanks for the post. Most Indian women don’t actively participate in financial management because they don’t prioritize themselves. In most cases, women don’t invest in their financial literacy because they are so busy fulfilling the needs of others. I really hope that millennial women take control of their finances and invest in their financial literacy.

Regards,

ss

Thanks for sharing your views Seemantani !

Manish

Hi, Manish

This is great to part here, I really appreciate you for this post on Women Finance, Its great to read and analysis the personal finance needs of me as a women. Thanks

Glad to know that Madhuri Agarwal ..

Manish,

Hats off to you for bringing such a topic. I came to know about you first when I purchased your book from flipkart. Then there was no looking back – have been often reading your posts. Thanks to YOU only that I know more about how to save and invest money even more than my office male counterparts. 🙂 I feel proud.

Good to hear that Binny ! .. Its indeed a big compliment that I was able to help you on this !

There is also one more reason. From childhood, the present day women have been given money to spend, not to save. Lets face it, boys hadveto answer lots of question to get a 100/-, but girls could easily get 500/-. This creates a mentality of entitlement where they believe that the money they are earning is for spending as savings is the responsibility of someone else (poor husband :)). This is one of the major reasons why you will see that most women have huge credit card debt and almost no savings. I will probably get some brickbats but ask the credit utilization ratio of everyone and you will see that invariably womenfolk will have the highest utilization ratio.

Thats an interesting perspective Arghya ! .. thanks for sharing that ! ..

Wow! No brickbats :)..Actually, Manish, this thing is prevalent in the first generation working women of present days, whose mothers were homemakers. My mother was a working lady and she had to juggle her job while raising me. But she could not quit her job since she had five more younger sisters and a brother(all students), apart from parents to feed. Similarly, my father had a football team (5-6 brothers, sisters and parents) to look after. I have seen my parents making budgets at the start of the month on how much they have to send to their respective families, how much to save and how much to keep for the management of our three member family. Their used to be some bickering over sending money to in-laws but my mother knew it very well that she cannot just abandon her side of the family and so did my father.

My mother knew the value of money because she toiled for 9 hours a day and had hungry mouths to feed. She would sacrifice her plans of purchasing new things so that the exam fees or tuition fees for her siblings could be paid or money for the treatment of ailing parents could be provided. On the contrary, I had seen that the mothers of my school mates, who were homemakers, would not hesitate to ask for money from their husbands even if there was some emergency in the family, refusal bringing bitter resentments. These ladies did not work and so did not realize the hard work that went into getting the money. Of course, they worked hard at home (we could afford a cook!) but that is a different story altogether.

The daughters of these women, when they were growing, have seen only one thing – mom asking for money and dad either giving or denying. Another observation would have been mother hiding some money for her discretionary spending. So, the value of earned money is diluted, it is mostly seen as ask and give/denied kind of relation. The psychological impact of this kind of observation is a feeling that running family is man’s responsibility and whatever she gets is for her own expenditure.

The long and painful method of budgeting, making sacrifices to feed others is something the new generation of women have not seen as homemaker mothers did not contribute in their parents’ house. Give such a background, investment or financial planning always takes a backseat compared to instant gratification, a proxy of what they saw their mother not being able to do. The result is no savings, expecting men to pay for even their own share of bills and high credit utilization (men also have this problem as the pain of purchase is reduced in the concept of credit card, but they at least grew up with the notion that they are the providers, so need to make some savings!). I have observed this interesting thing among a lot of women. Any one, who had a working mother with responsibilities has a completely different look at money than someone whose mother is a homemaker.

That was really an amazing perspective . I agree with all of your points and its so good that it has to be shared with more and more people .. I am planning to share it in a post !

Thanks a ton for this !

Manish

[…] main reason why women don’t take investment decisions is that they are safety oriented and reluctant to take risk, the survey notes. Husbands also seem […]

Hi Manish

A very good article.

But my case is different.

I have more financial knowlegde and interest (abt investments and insurance) than my husband.

I have been reading your post for quiet somtime now.

I have now convinced my hubby to take a term insurance as well as personal accidental insurace …

Please continue the good work …. Kudos and God bless

Regards,

Minu

I would say you are taking the average up for women 🙂 .. kudos to you too !

Thanks Manish . 🙂

hi manish,

I was in talks with an agent to get Term insurance. And his initial reaction was “you need a term insurance??” I said YES (poker faced) then i was offered return of premium something.politely said no..and went ahead with term..thanks..to you manish.i do not fall for gimmicks.

A very thoughtful read Manish. Completely agree that more Indian women need to take up an active interest in money management and financial planning beyond the basic household budgeting both for the good of all as well as for improving their own financial security and safety.

AJ

Good .. Thanks for comment

yes .. if planned well , both men and women can have a wonderful balance in their money life and that in turn will somewhere contribute in their relationship too .. If both of them are clear of whats going on and why , it matters a lot . Otherwise there is always room for misunderstandings .. whats you take on this part ?

I agree on that . Money is one of the areas where there is lot of fights , having a clarity in that will really help

Manish

Well nice to see a post for women and I too have seen many women who are involved in managing the personal finance more efficiently.

Thanks Prashanth , so whats the learning for you out of this article ?

Manish

Thanks for letting us know that . Can you share a case ?

Hi Manish,

Thanks for this link.

You have hit the nail here. I have to re read it to get more inspiration.

(I am happy that I am not the only here who thinks handling money is not woman’s job)

I am keeping it in my drafts to reread it and I will share this with my female friends.

Nivedita

Thanks 🙂 . Please share it with more and more people

Manish

Nice post again regarding women and investments,

A few observations

1. Full time at home but splurging a lot of spouse’s income

2. Working but saying that my spouse earns well and he looks after the investments, so i only spend my Saary on myself (Total spending)

3. Working and giving full salary to spouse or parents to save and or invest ( They need not be doing what is correct.

4. Working or stay at home, but making sure that you understand the family financials and save / invest accordingly

Another point i wanted to make was that in case of women who are at home most instances i have seen, they are never given the information about financials, many don’t even know their spouse’s CTC. and the men in their lives always seem to say that i am there to provide for you, why don’t you just relax.

But the times are changing, literacy levels are increasing, the average eduactional levels of women is changing, exposure to the internet and educative blogs like urs is also increasing, Men are changing in their attitudes towards women, so things will change in the coming years …..

Kavita

nice observations, good to know ladies are getting more awareness and care about it . Good going . please send the article to all your friends

Manish

Manish,

A very true and honest article. I too was a complete duffer in investing till I actually started taking interest. Debt, Equities, Commodities were Greek and Latin to me. I would say that in the past one year my knowledge has grown from 5% to 30%. Things that I find helpful are:

1. Taking a keen interest in understanding financial concepts.

2. Talking to lots of people about how they manage their savings and investments. I think our generation is quite open to share.

3. Reading extremely simple books and newspapers. I now regularly read ET Investor’s Guide each Monday.

4. And last, but not the least: Asking really dumb questions:) Yes, people may ridicule you, but you will learn a lot just through asking questions.

Women should also maintain a neat record of their investments (Ms Excel). They should plan such that they get guaranteed returns every year. And the returns should be immediately invested in something.

Thanks,

Swapna

Swapna

yes , nice ideas from you .

If you want guaranateed returns then you have to settle down with debt , at a younger age , risk can be taken .

Manish

I think lot of girls are subscribing this mail list…

come on girls subscribe this, az sooooon az possible

Don’t miss any chance….Amazing list

here u’ll find lot of secret Suggestions which will make u an Xpert

women@jagoinvestor@com

This is really good blog buddy and your posts are awesome, thanks for sharing knowledge.

Regarding this post I would like to say that I am also an women and trade Intraday and I feel that women are in no way lag behind men.

Great

Nice to know that .. What all you trade and whats your experience ?

Manish

The Thing is Manish, Though the Women are good savers and investors by instinct..from the childhood, they are never brought with the idea of building money by themselves. So while Guys are given freedom or onus to learn and earn money, Girls tend to get restricted to study and work , lest thought about letting their earnings grow.

I have seen people commenting on only male should focus on how the household finance needs to be done, as it doesn’t sounds good for a lady to discuss and decide money matters regarding Home, Car, shares etc.

Sanghmitra

hmm.. i agree with you .. This is not they way it should happen , not just finance but every area, men and women should have equal chance 🙂

What are your interest areas ? Do you like equity ?

manish

r u frm VAYAM?

what is VAYAM ?

It is very important that every member of the family should be financially literate. Unfortunatly women don’t realize how important this is.

Ravi

You bring up an important point that Women sometimes do not understand the importance of learning things ,they dont think long term and dont consider the case or i must day , do not want to consider the case when things can go wrong and a situation can come when not knowing finance can be very troublesome 🙁 .

What do you think ? please mail this article to as many women you know 🙂

Manish

@ Sid

Really like the way Sid put it…. In those days (ur moms and my moms) KVP and NSC was enough. These days with the inflation you have seek other methods like MF, Equity etc.

@ Deepika

You or me or most of ladies on this blog are lucky that we get involved in the financially part of our families. That is why we read such blogs to gather more information. Manish is talking about the major chunk of women in India who are completely ignorant and even think they don’t need to necessarily get involved these tasks. Now do u think such women are uncommon even in cities like Mumbai, Delhi etc or do think those women (who wouldnt like to get involved) are not acadamically educated or dont go out work…

So lets all join him on his mission and forward this link to as many women as we know.

I am just so grateful to you for writing on this topic. I simply agree with most of the comments mentioned by your readers.

I had an upbringing of 70:30 rule. Where in 30%(minimum) of what ever you earn goes in to savings.(that is compulsory, if u know what you mean.)

Now add to it the enrichment done by Manish’s blog; The same 30 is divided into FDs,MFs,emergency fund and other instruments discussed on this blog.

Women are natural accumulators of wealth. They will do it by hook or crook 😉

But if proper planning and knowledge is imparted to them, they can do wonders to family wealth.

Mukul

yes .. if planned well , both men and women can have a wonderful balance in their money life and that in turn will somewhere contribute in their relationship too .. If both of them are clear of whats going on and why , it matters a lot . Otherwise there is always room for misunderstandings .. whats you take on this part ?

Manish

Manish: Is that like ideal ideal situation we are discussing.!! Just kiddin. Yes, just like in big organizations, when 2 partners are having same vision, their mission becomes easy. and organization grows big. same of personal life and money life. a balanced outlook and both being on same page really helps.

but like I said, both to AGREE. now that is a big thing to ask for!!!!

Mukul

Good analogy of companies 🙂 ..

Manish