Why is Decision Making so Hard in Financial world?

“Secret of Happiness is low expectations” In this article we will discuss why it is so hard for us to make financial decisions and what factors play role in delaying our decisions?

When we have to make a decision, there are lot of choices offered to us, which makes our life difficult and hence it results in delayed decision. We will see how can we change our thinking and help ourselves to make our decision making a smoother and better process.

We will also have a look at some examples which will make reading this article better for you.

What makes Decision Making Hard?

The top most reason why we are unable to answer decision making questions is having Lots of Choices. As per Barry Schwartz in his excellent talk

When we want to choose a particular product from a group of products, it’s hard to decide because of more choices that we are exposed to. More choices means more data to process and more data to process means less chances of finding the best product that is suitable for our needs.

What is the reason Behind it?

As per Decision Theory: We want to make the best and accurate decision given a lot of choices, because we don’t want to be guilty later when we find that we missed out on the best choice. This is called “Opportunity Cost”. We don’t want to blame ourselves for not picking up the best choice. We often try to avoid that regret which can arise later because of the outcome.

The point to note here is that many a times, just because of the comparison we make, the satisfaction level goes down even though the results are good. Haven’t you felt bad when you saw giving 15% return and others gave an average of 23-24%. But you didn’t ever appreciate the fact that 15% in a year is a good return and you should be happy about it.

Next time while choosing the fund to invest in, you make sure that you buy something which is among the top performers. Watch this Video on how to choose a good mutual fund

Example

One of the example is my close friend Chetan Chouhan from Pune. I advised him Sundaram Tax and SBI magnum Tax saver as tax saver funds in early May 2009 he shouted on me after seeing my post on Best Mutual Funds for year 2009, because of the “Opportunity Cost”.

He wanted the “best” fund and now compares the list with what he has currently. He should appreciate that what he has is a good fund and can fulfill his requirement… One should try to get the best fund and maximize his returns but if you give your mind and soul for it .. its just not worth it.

What exactly is the Confusion now a days:

- Which is the best mutual fund at this moment?

- Which is the right ULIP policy for my Child?

- Which Bank will provide me best Home Loan that suits me?

- Which Bank has the best FD rates for my profile?

- Which Term Insurance is best?

- Which Shares should I invest in so that I get maximum return?

Check this ebook if you are new to Stock Market

Some Statistics of Indian Financial World:

- 3800 Mutual funds in India (Approx Data as on 31st July 2009): Source

- 36 Different Mutual Funds AMC in India: Source

- 86 Banks in India (Public , Private and Co-operatives, Small , Big): Source

- 22 Life Insurance and 21 Non-Life Insurance Companies (most of them are common to both Category): Source

- 1319 companies registered in NSE [Source] and more than 10,000 Companies listed with BSE

- There are 100’s of Insurance Policies and ULIPs from Different Insurance Providers

- 293 Insurance Brokers: Source

- 59 Commodities for Future Trading on MCX: Source

A Different World!!

Now with so many choices and lucrative offers, it’s too hard for us to choose the best one. Even in my list of Best Equity Funds, you will find it very difficult to choose 1 or 2 funds to invest in. But I gave you just 2 funds and asked you to choose 1 fund. It would be so easy for you because less the choices higher the chances that your choice will be a good one.

Just Imagine a world where there were 2 Term Insurance products, 3 ULIPS, 5 type of Mutual funds and 3 Banks providing Home Loans. What a wonderful world it would have been! I am sure everybody would have a desire of that kind of Environment.

Then we will have very less information to process and there will be less changes of Regret and high chances of Satisfaction.

Do we delay our decisions?

Ask yourself…

- Are you not delaying your Investments just because you are not able to figure out which is the best Mututal funds or ULIP?

- Are you not trying to find the least rate of interest for your Home loan so that you don’t regret later that you didn’t get the best deal?

- Don’t you want to stop your existing mutual funds because now there are other funds who are top ranked and more talked about on television and magazines, even though your Fund returns are very good and it has potential to achieve your goals?

- Are you not confused on which stock will move higher and may be don’t invest at all?

There are so many websites, newspapers, blogs out there giving reviews, recommendations about products that a common person’s mindset is now totally confused because of all this. In case you really think you want take your decisions, you should consider Hiring a financial planner?

Is common person really confused or Am I talking Nonsense?

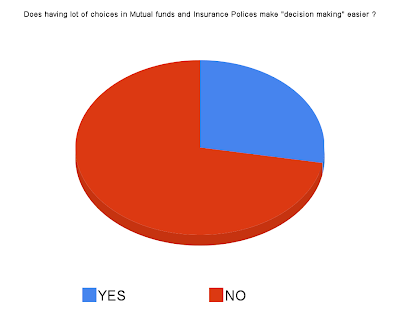

At the time of writing this post at 1:30 in morning… Here are the poll results with 97 votes which I conducted over last 3-4 days and here are the results. 72% people think that “Having lot of Choices in Mutual funds and Insurance Policies does not make “decision making” easier?

In case you are one of the person who voted for YES or NO please leave your comment and let every one know what was the reason for your Vote.

What is the Solution for this Problem?

How to made a decision making process an easy process? It can be to some extent solved using these ideas.

Change your Focus

By this I mean that we are here for achieving our financial goals comfortably, without compromising our family future and smoothly without much tension. That’s the real goal of Financial planning. Once your mindset is set like this, you will automatically not run behind the “best” funds.

What you will try to do is to find out a good product which suits you, just stick to it.

Filter out the Bad policies

Choosing the best product is not an easy task and not worth too. The easy thing would be to filter out the bad products which is easy to do! So in mutual funds you already get rankings and lists of top 10 or top 5 funds or Best policies from ULIPs or good Home loan from a Bank.

I would say they are worth a look and finally you should decide soon enough on one of them but for this you must have shifted your focus from choosing “best” product to “a suitable” product. People who want to Buy good mutual funds for long term can Choose any one of mutual funds listed in my article on Best Equity funds for year 2009.

Think Less and concentrate more on Fundamentals

There are more Important things than Best timing and Best product which you have to concentrate on. One of them is Consistency in your Investing and your Plan, your Asset allocation, your Diversification. Once you concentrate on this and forget all other materialistic things, it would be a more peaceful activity to manage your Finances.

Conclusion

So we can say finally that it was never like this before. Now a days we have too many things to choose for which has made like worse than even. Hundreds of products do exactly same thing but they all claims to be better than another. We have to narrow down our choices and choose any one of them and not try to hunt for that exactly best product for our self.

Readers, please share your experience of being in a situation where you had to think a lot before making a decision or had to delay your decision. What are your suggestions on this problem? Please post comment.

September 2, 2009

September 2, 2009

[…] decisions we can make in life are “simple” and “extremely tough” to take. We get confused because of lots of choices and the simplicity of products. It does not fit with our complicated environment these days. All […]

@Direct shares

Yeah .. Once we are content with our returns which are enough to help us acheive our financial goals .. we will be happy .

Manish

Deciding what is best for us is really difficult. As what you have said, we tend to avoid the opportunity cost. If we picked out an investment that has less gain than others, more often than not, we feel a tinge of regret for not choosing it rather than be contented on our yield.

So I think that before investing we should think and learn more about our options and choose the one that matches our interest. Most importantly we should accept that there are really people who will have more yield , success and money than us. Our consolation is that, we have a chance to achieve what others have by seeing time as our ally and not one of our challenges.

@Maurya

Great , your reasoning for MF is perfect and for Home loans part you are correct to great extent .

My reasoning was based on the nature of changing environment actually . Bank A is the best at this moment , but what about the fact that tomm or after 4 yrs some Bank B (which was 3rd best at the time of evaluation) decreases its Interest rate and with other parameters becomes the best Bank , and then same thing happens for next 20 yrs ..

Just like Mutual funds , U cant be sure that the Bank you choose now will turn out to be the best at the end . However , i agree that at that current moment choosing the Bank A was the best thing to do .

At the end , Its more of a "How much of effort you want to put and how much result you want to get" ..

Even in Mutual funds case , What I suggested is a great simple method which will work 95% of the time , now it depends on the person if he is ready to get 95% by putting in 2% work or he wants to get 99% with 15% efforts , its a personal choice ..

We are discussing a case which is concerned to an average person , who has too little knowledge and time to do all this but still wants more than average results .. we are trying to discuss about how to achieve "better than average" results for 95% of mass .. For people who have time , knowledge and eagerness to find the best for him , He can do more work than average .

I have to agree with you for that case 🙂 . I hope we are on the same ground now 🙂 .. What do you say ?

Manish

Sorry for the confusion between category vs. comment.

I need to explain further. I agree with the conclusion of your post(that too only for category 1 financial products, e.g. MF). But I disagree with the reason.

Your valueresearchonline method is reasonably good and for the sake of argument, I can even agree that it is perfect. But then you go on to say: which may not be the "best" choice. By saying this, you suggest that there is a best choice. My argument is – unless you have a crystal ball to know future returns, there is no best choice. At best, you can know that if I were investing 5 years ago, this MF would have been the best choice. Hence too much research is futile and thumbrules, like your valueresearchonline method are perfectly fine.

But in category 2 of financial products like home loan, there is a best choice, to a certain extent. The starting interest rate, unchanging interest rate period, transparency in increasing interest rate in the future, processing fee, pre-payment penalty, missed instalment penalty, and many more features; have direct impact on your finances. Research can help a person understand these features and choose the "best" one for himself. Any amount of research is not futile here, as long as it concentrates on features that can be known now.

@Maurya

I know it was a single comment, Just for replying i called them 1 and 2 🙂 .

Regarding your comment , I think there is some interpretation . I totally agree with you on what you said .

If one can take that decision fast enough by filtering out some of the choices , thats great .. thats the ideal situation . I never said that if we have a single product and no competitor at all ..

In this real world what we can do is filter out most of the bad choices and then only from handful of good choices , choose a good product for us , thats am ideal situation .

But most of the people are not able to choose products by comparing them in a way you have done … and hence they keep on delaying their decisions most of them time in future which is the real problem .

The gist of what I wanted to say was more choice = More confusion and more data processing , even though we can get better choice , but that does not beat the average choice by very very huge margin .

I would agree that this may be least applicabl to home loans , but in Mutual funds , if you want to buy a equity fund , the best way i would suggest one with least work is go to valueresearchonline , search for the top 10 mutual funds based on 5 yrs , 3 yrs and since launch return . And then choose any one of them and start SIP , this is the simple method using which one can choose a very good fund , which may not be the "best" choice , but considering the time and mind spend, it would be a desirable choice .

I agree that I was little harsh on Home Loans , but most of the people seem to agree with it i guess . What do you say Maurya ?

and thanks for bringing up this point .. it helping clarity 🙂 . and your example was a nice one ..

Manish

These are not comments 1 and 2. In one single comment, I have categorized financial products into 2 categories. These are "category" 1 and 2. This is clearly written in my comment above. I was saying that your post is applicable to only category 1 financial products.

home loan amount: 25 lakhs

interest rate: 10%

processing fees: 1%

duration: 20 years

total payment: 5815240

If the person had spent 2 days learning about other products, negotiating with banks, etc he could have ended up with:

processing fees: 0.5%

interest rate: 9%

total amount: 5410820

Amount saved: over 4 lakhs.

I'll be surprised to meet a sensible person buying a home of 30 lakhs (5 lakhs downpayment, 25 lakhs loan) who will not care about these 4 lakhs (or even 1 lakh) if they can be saved after research of a few days to a week.

The above is a simplified example to illustrate the point.

On the other hand, all the research in the world cannot accurately predict a mutual fund's future performance. Hence your post is perfectly applicable to mutual funds, and only a few thumb rules should be used to select MFs. Like you say, too much research wastes time, develops indecision and doesn't get you anywhere.

@Maurya

For your comment 1 , i agree with you that too much choice prevents decision making .

For your comment 2 , Why do you say that Home loans end up with differnet cost , how significant the differnce is , if its less than 5% , its not significant which will happen always , not doubt about it .

You need to tell me in detail where i am confusing people , i really didnt understand that part .. thanks for taking the pain of telling that .. please givemore info

Manish

There is too much choice in 2 different categories:

1. Future performance is the only thing that matters to a person e.g. mutual fund. Past performance can just give some indication of investment strategy of the fund. Hence thinking too much is harmful: too much choice prevents decisions and future performance cannot be predicted with much accuracy anyway, even if you have infinite knowledge.

2. Current features of a product: Home loan is the other category. Here, at current state and next few years, different loan product end up costing differently. Unlike mutual funds, thinking too much is not futile in case of loans. In fact, it is necessary because banks hope that you will not study the details of your loan product and end up getting charged more. Banks have complicated things by introducing different types of charges at various stages of loan. The only way to defeat their strategy is by learning more about home loans.

Even here some part is in the domain of future e.g. interest rate movements and the bank's reaction to them to change your rate of interest.

You are confusing these 2 categories and painting them with the same broad brush. This is very dangerous.

We should always think in Simple terms. And to take any decision it should not take much time. Since simple decision will not take much time anyways. More choice will not help anyways but they will make thing more complex.