Magic of SIP in Mutual funds , Part 1

Numbers Speak !!

Today we will see some characteristics of SIP (Systematic investment plans) . this is first part of this article, we will have part 2 of this as well where we will discuss other important things about SIP.

Assumption :

We are assuming that investments were started from year 2007, It has both a part of Bull markets and Bear market, So i chose that time frame.

Let us first see an example where investment was made in NIFTY ETF’s. There are two friends Ajay and Robert. Both of them want to invest Rs.50,000 in markets with 2 yrs of time frame in mind. Both of them do not have that much cash in the start.

Robert believes that Markets are in Bull run and hence it has good chances of Capital appreciation. He does not want to miss this chance and decides to borrow money on loan from friends and family or personal loan and invest it.

What are his Characteristics at this point?

Its just like any normal, average investor, where investment decisions are based on emotions, without foresight and too narrow. They do not understand the cycles of market and they do not understand that markets moves up and down in every time frame.

On the other hand Ajay is an informed investor and does understand cycles of Market, He knows that markets run from up to down and the bull market which started in 2003-04 has already run a long way and can turn any time now. He understands that its a better idea at this point to not get into debt to invest in stock markets. He controls his Greed and will invest only what he has. Also he decided to invest 50,000 in 2 yrs. but a small amount month by money systematically.

Now lets see the capital appreciation which happened for both of them.

Summary :

Robert invest full 50k in the start around Jan 2007 with 2 yrs of time frame. Ajay also decides to invest the same amount but he breaks it in smaller chunks and wants to do it using SIP on his own.

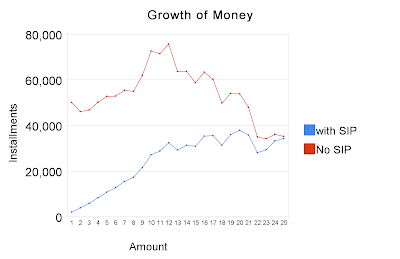

Monthly Investment Growth in NIFTY ETF from Jan 07 – Jan 09 for Rs.50000

Lets look at what happened ?

Markets continue to rise and Robert sees his investments grow from 50k to 75k within a year. Ajay also sees his money grow to 35k, on an investment of 25k. If you see at this point, Robert has made very great returns on his investment compared to Ajay.

But after that see what happened. Markets started going down and investment of Robert kept coming down with markets and at the end it was at 35k. With Ajay it was a different case. His investments went up and down both sides and finally ended at same point at 35k.

What is Drawdown ?

Drawdown is the drop in the value of investments from its High. If 10k investment go up to 15k and then fall back to 12k. The drawdown is High(15k) – Lowest point after that (12k) = 3k, OR 20% drawdown.

Things to notice

Roberts Portfolio :

You can see the behavior of Robert’s investments. It was too volatile. You can see it going up and down and here and there. I am not saying that it didn’t move and made profits, It made good profits at one point of time, but Robert must be smart enough and courageous to take his profits even if markets are going up and there are chances of making more.

People who want “more” and “more”, eventually not even get “what they had”. Have a target and BANG !! Once it moves at that point, be unemotional and take the profits. Markets is a place where money is flesh and everyone is Vultures. If you leave it open for a long time, It will be taken by some one of other.

The other thing is Psychological issue.

Because investment moved so high, and then so low, Robert must be feeling bad and too conscious. He must be regretting a lot on not taking the profits. This has bad effects on investment decisions.

Roberts Drawdown :

His 50k goes up to 75k (high) and then it moves down to 38k. Draw down of 41k which is 49.3%, this can have devastating affect mentally, as one sees his investment grow to 75k and then drop to 38k and finally end at same point 38k after some volatile movement up and down.

Ajay Portfolio :

You can see the consistency of Ajay portfolio. It moved up and up all year whee markets where rising. and once markets started going down and was volatile, his portfolio was also volatile, but not very high, Its volatility was very low and finally it was almost at the same point as in the start of the year.

Infact you can see that his portfolio was rising still when Roberts was declining.

Ajay’s Drawdown :

This highest Drawdown seen by Ajay portfolio was from high of 39k (20th payment) to low of 35k, which is just 10.25% drawdown. You can get a feel, How difficult or easy it must be for Ajay to see this.

The point here is not Who made more money or Lost more. Infact you can see that they both were in loss of 12k on an investment of Rs.50k, But the journey was not same for both of them.

While Robert worked too hard and saw wild swings. Ajay made systematic investment and continuously saw his money go up only with minor drawdowns, which was easy to handle psychologically. This is true for any investments weather it is Shares, Mutual funds or ULIPS investments.

Now’s let see and example for the same period, weather these two same investors have made investment in UNITECH.

Why UNITECH?

I have taken this example because it shows what I want to show, the power of systematic investment. Here both of them are investing Rs.1,00,000 (1 lac) in Shares of Unitech. Roberts invests 1 lac in the start of Jan 2007, where as Ajay makes weekly investment of a fixed amount in such a way that it adds up to Rs.1,00,000 at the end of 2 yrs.

You can see the behaviour of portfolio for both of them.

Robert

Investment : Rs.1,00,000

Mode : One time investment

Final Value : Rs 9,000

Time frame : 2 yrs

Drawdown : 91% (Rs 1 lac , from high of 1.1 lacs to low of 10k)

Ajay

investment : Rs.1,00,000

Mode : Weekly investment (weekly SIP by self)

Final Value : Rs.42,000

Time frame : 2 yrs

Drawdown : 70% (28k, from high of 40k to low of 12k)

Weekly Investment Growth in UNITECH from Mar 08 – Feb 09 for Rs.1,00,000

Conclusion :

Now the main question? What is good One time investment or SIP? The answer is both are good inp different conditions, and it depends on your Risk appetite too.

When you don’t have clear indication of trend and are not sure where markets can go, the best idea is to invest through SIP. That will save you from volatile markets and small down moves too.

SIP will definitely miss out on returns in BULL markets. But it will work best in Volatile markets and falling markets. SIP is not a way to avoid losses, its a way of investing, where you feel more disciplined and average your cost of investment of long term.

Watch this video to know the magic of SIP:

The examples I have taken were biased because of the idea I wanted to communicate.

Anyone who did one time investment in 2004 would have made more money than someone with SIP, till 2007 at least because of the rising markets.

You must have seen in first example that Ajay’s portfolio was at 35k in the start of 35k, and even at the end of 2009, it was at same point even though markets fell from 20,000 levels to 10k levels and was too volatile, there comes the power if SIP (the money you pump in fights the falls in markets at least).

Part 2 : This is first part of this article, we will have part 2 of this as well where we will discuss other issues and things regarding the second example we took (UNITECH)

Request from Readers

If you are on twitter, try to post this article there, so that your friends can read it. I also have a small complain from my readers. please recommend this blog to your friends and any one you know and needs it. I feel this blog needs more readership and deserves too. You can help me promote this blog to others, please pass it on to others. Thanks

Also, why don’t you guys and gals leave me messages and comments, please put your comments with your views on article and your own ideas, I should also get chance to learn from you all, don’t I?

Read continuation Part 2 of this post here

March 1, 2009

March 1, 2009

Sir,I am thinking to invest Rs1500 per month for coming 05years through SIP in SBI blue Chip mutual fund.would it prove good for me?how much can l except out of my total investment after 05 yrs? I am a new investor.

Yea .. 5 yrs SIP can give you good returns, but its not a fixed number but a range. You can expect an average of 10-15% returns , but thats again depends on market movements.

We can help you setup the SIP in mutual funds and can choose right funds for you. You can look at our Pro membership – http://jagoinvestor.dev.diginnovators.site/pro

Manish

Sir, I would like to invest Rs.20000/month in SIP. But i want partial money after 2 years (around 15000/month). But SIP will continue (Rs.20000/mth) for long term.

Kindly suggest me how to invest 20000 in different funds with above mentioned cretaria.

You can withdraw the money when you want.

Hi

Needed your suggestion on my current MF portfolio and future plan:

Current- Total Rs 10,000 monthly

1) HDFC Top 200- Rs 2500

2) HDFC Prudence- Rs 2500

3) HDFC Balanced- Rs 2500

4) IDFC Premier Equity A- Rs 2500

Going forward- plan is to invest Rs 25,000 monthly. Investment horizon atleast 20 years- I am 34 now.

a) Are the above MFs ok? HDFC Top 200 has been a laggard- should I continue or stay invested?

b) I understand I am invested in two balanced funds- hdfc prudence and hdfc balanced- should I exit one or continue investing in both? Should I increase my contri?

c) If I look at HDFC Top 200, balanced and prudence- am I right to say that I am overinvested in large caps ( ignoring the debt allocations of large caps) and trying to overheadge myself? I am 34 years now

d) I like HDFC stable- moreover I am an NRI and already created HDFC Direct account- so easier to open a new SIP through HDFC- am I being foolish by investing only in HDFC AMC?

e) I am planning to invest additional Rs 15,000 per month in SIPs and I am building a retirement corpus. Would adding more large cap and mid cap fund be good? my plans are as follows:

– HDFC Midcap- Rs 2500

– Sundaram Select Midecap- Rs 5000

– Franklin bluechip- Rs 2500

– Any others (including increasing SIPs in exisiting MFs….would like to add varied and MFs which divrsify my porotfolio and gives aggressive returns….)- Rs 5000

– For debt- I am looking at PPF + NRE fixed deposits 1-2 years (both tax free)- should I consider liquid/ short term debt mfs?

Looking for your kind reply

Regards

Rohit

Hi Rohit

I think HDFC top 200 is still a great fund. You can stop it if you personally feel that it has lost its steam

Also your new funds are good enough especially Franklin Bluechip and HDFC midcap opportinies !

Hi Manish,

I have read all the discussion above and seeking some suggestion from you on investing in these MF’s. I want to invest on some MF’s through SIP (Planning to have one). I am looking for short-term investments and I can invest a Max of 1500/- per month. is there a process I can operate my SIP through online(put my monthly investment/buy or sell any MF’s at a time when NAV is high for it/Do I need to have multiple SIP’s if I plan to invest in multiple MF’s). Please try to spare some time for my query and help me in finding answers to my doubts and also please tell me that is this the right time to invest in the market?

Thanks in advance for your help/suggestion.

Sagar

You are actually looking for something like “Flexi-SIP” where you can choose a high amount or low amount on a click of button . This is availabel with Fundsindia.com

Manish

Manish,

thought provoking article on Magic of SIP. After reading your articles I got convinced to invest in Equity (based on my risk appetite) and PPF. My SIP’s are running from last 3 months and I am happy with it. Jagoinvestor really woke up an investor in me :).. I have both the books written by you and they are like mini encyclopedia to me. Planning to buy Nandish’s book as well soon..

Great .. buy the nandish book and you will be amazed 🙂

Hi Manish,

I am a salaried person and have started SIP in two MFs. But recently I have come to know about VIP benifits.

Should I switch to VIP technique and do it manually by myself?

Thanks & Regards,

K C Rana

I dont think so .. VIP is still at nascent stage and just because its new thing, you should not switch from it . You better continue with SIP and check out VIP investing for some amount as of now

Hello Manish…..

at first thank u a lot for your valuable info. i want to invest in ur proposed SIP.

but, first i want to know where to go to invest in SIP mode and what are its return methods. can i withdraw my profit from SIP at anytime??? Don’t mind, for my ignorance,as i’m a novice to these investment types…so plz consider above queries…

Hi Krishna

You can invest in mutual funds SIP through various means discussed here – http://jagoinvestor.dev.diginnovators.site/2010/04/what-are-different-ways-of-buying-mutual-funds.html and also ask all your questions on our forum to learn – http://www.jagoinvestor.com/forum/

Hi Manish,

I have been investing in the mutual funds since more than a year. The selected Direct funds are HDFC balanced growth fund, franklin templeton india bluechip growth fund. my plan is to invest for more than 10 years. i am planning to add more funds like Quantum long term equity growth fund, HDFC Mid-Cap Opportunities

and IDFC Premier Equity. my risk appetite is average (more into conservative type), however i want to accumulate more money through MFs. can you take a look at my portfolio and guide me if i am wrong?

I think you are investing in more than required funds, Just have any 2 funds . I would say HDFC balanced and Quantum are good one’s .

Hi Manish,

I am planning to go with “SBI Emerging Businesses Fund (G)” for a long term as a SIP (2000 per month). If this is the right decision to go with this fund? Or i need to select a differ one. Please suggest.

Regards,

Sameer

How old this fund is ?

It was launched on 17 sep 2004.

Hi Manish,

Hope you are doing well. Manish could you please help me to select a mutual fund to invest in gold i.e. Gold ETF. I want to invest in it as a sip of 1000 Rs.

Please Help!

Regards,

Sameer

For gold ETF, you can just go with Kotak ETF or Benchmark

Hi Manish,

Thanks for providing such the valuable information for the new investor.

Manish, i have a confusion regarding the “Compounding Power” in Mutual Fund. For example i started to invest 1000 Rs per month at a NAV rate of 500. After the ten years, my capital amount will 12000 and the NAV value is 550.

At this time i have a total of 250 units. And if i will redee it the value that i received will be 550*250 = 137500.

It means i achived only 137500-120000 = 17500.

Could you please confirm on my calculation.

Many Thanks,

Sameer

This is not how you should look at it , see what is your CAGR return . see this – http://jagoinvestor.dev.diginnovators.site/2011/02/calculate-insurance-policies-returns-video.html

Thanks i will check the video.

Hi Manish,

I checked the video but my question is still the same “compounding power”in mutual fund.

Through the video we can estimate the return ratio, But in mutual fund we dont know the estimated return.

Could you please help me in understanding the compounding power with an small example.

Many thanks in advance,

Sameer

Hi Manish,

PLease help me to understand this.

Thanks,

Sameer

This will answer that http://jagoinvestor.dev.diginnovators.site/2009/08/what-is-irr-and-xirr-and-how-to.html

Nicely written , My manydoubts were clear.

Thanks

After going through your website i started taking SIP seriously, recently i took Axis triple advantage – growth fund and started investing 1000/pm for a tenure of 3 years . Is long term investment is possible in MF – (equity and growth). Can i continue with my fund for next 15 years depending upon its performance . Pls reply soon…..

The fund you have is not an aggressive fund, it takes a balanced approach and will have balanced return and risk potential , if thats your motive , then you can invest in it, also its too new fund, cant comment on it right now with such a small track

Thanks Manish….. Could you suggest what factors need to keep in mind to buy a new fund?

Just make sure that they are pure equity funds if you are investing for long term . And those have a consistent record

Awesome!!! lovely lovely lovely article!!! you are doing a great favor to people like us who get caught in the fear in security and end up investing in wrong policies!!! cannot thank you enough!

Thanks Sushmita !

Hi Manish,

As a new investor, i want to start with HDFC Prudence (G) fund with a 1500 sip for 10 yrs. Could you please let me know if i have taken a right decision on this fund?

Many thanks in advance,

Sameer Goel

Sameer

Its a really good fund, you can continue it !

thanks!!

Hi Manish,

3 yrs back, i purchased a birla dream plan. This is a Individual Life – Enhancer (ULIF00213/03/01BSLENHANCE109) plan. Fund type is SFIN. I am investing 1000 rs per month for this. But when i checked the fund value at present, it is showing just around 24000 while around 38000 i have already paid. In the three yrs i am in loss of 14000 rs.

Could you please suggest me should i continue with this plan or withdraw it?

Many thanks in advance.

Regards,

Sameer Goel

Sameer

The loss is because of bad performance of market (might not be the fund) and the high charges . You can get out of it, if you feel its not serving you.

Manish

Thanks Manish.

Hi Manish,

First of all thank you so much for providing the readers such a valuable information.

Myself Sameer Goel, age 31 married and have a daughter. I have a term insurance of around 35 lacks and a couple of LIC policies.

I have read a lot about magic of SIP in mutual fund. Now i want to go with that.

FYI: I am just a new candidate entered in the mutual fund class and i dont know any thing on it. Just have some information after reading your blogs. I wan to invest 1000 rs per month for a period of 10 yrs but want to go with a safe/very low risk fund (with a good return after 10 yrs).

Could you please help me on this.

Many Thanks,

Sameer!!

Sameer

There is nothign like that .. very good return can only come when you take a risk , else FD is for you or debt mutual funds ,which will not deliver high returns .You should look at HDFC prudence fund a balanced fund to start with .

Thanks Manish. Could you please elaborate a little about the risk factor for 15 yrs term. Please let me know some of the funds on this.

Sorry I feel I have started reading your article to late, but it is good to get started at any point of time…

Good that you started atleast , go through all the old articles and just go through them .

hiiiii,i am new to mutual funds and want to invest nearly 5000 in mutual funds through SIP and 2500 through gold etf.i have a long term investment perspective i.e.(>15 yrs).So.can u plz suggest some of the good funds.i have sorted out a few of them hdfc top 200,franklin india bluechip,hdfc prudence,sbi contra.can u also tell what is the procedure to redeem the investment if one want to do so……..

Ashutosh

You can invest in those funds which you have choosen , the redemption part is very simple , see http://jagoinvestor.dev.diginnovators.site/2011/09/mutual-funds-redeemption-process.html

Hi Manish,

your articles are just great and full of all the info a beginner like me need. I am planning to invest and i have just started working. I earn 15k monthly but i want to start investing soon as i don’t have much expenses right now so i can afford to invest little amount regularly. But i have no clue on investments. Your guidance would be of great help.

Bhawana

First you should start learning about personal finance , this blog will be a good start , I also recommend you my book . You can start mutual funds SIP in some balanced funds

can you please name some good balanced funds where i can invest and what amount should i invest?

http://jagoinvestor.dev.diginnovators.site/2011/04/balanced-funds-and-equity-funds.html