Do not Invest just for Tax Saving

“Tax saving should be result of your Investment planning and not vice versa” . Understand this very well . For most of the people, saving tax is such a big thing , that they forget the primary rule of Financial Planning and concentrate all their energy into Tax Saving .

I see most of the people are trapped in idiotic products because of their obsession with Tax Saving . Most of the people today are invested in products which does not suit them, which they dont need, Which they do not understand .

All because of their idiotic decision of “Investing for Tax Saving !!” .

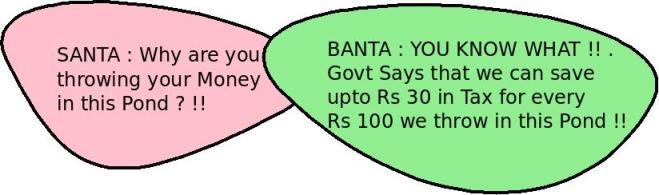

For some people the Products they buy for Tax savings are like This Pond , They are not sure what they will get from buying it , but they are happy about the fact that they are saving some money in Tax . Which is idiotic .

Typical Scenario

Most of the people dont do their Tax Planning in the start of the year . They just neglect The Tax Planning part. Somewhere at the end of the Year around Feb, They recieve a letter from their company that they need to submit their Documents for Tax savings so that they can avail the benefit of 80C and other Tax saving benefits like HRA , LTA , Medical Reimbursements , etc .

Even then they dont budge and most of the people wait till the deadline date to come very near .

Then finally comes the deadline date and now “Giving The proofs of Investment” is much more important than “Making Sensible Financial Decisions” . Its too late to Plan for things . ULIP agents , Insurance agents and Mutual funds agents are ready to take the charge and they will brain wash you with all their nice words , They themselves dont understand the product a lot of times .

You have no choice but to invest so that you save tax now . You cant even imagine a scenario where you dont invest your money and pay the tax . It feels like the most idiotic Decision ever . Which I feel can be a good decision sometimes .

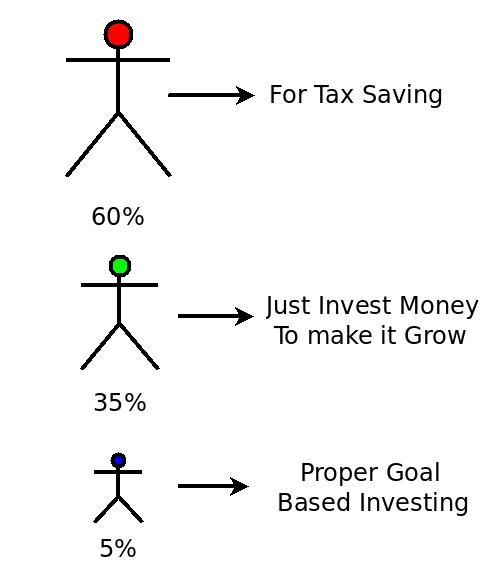

Top Reasons for Investing

Below is a small diagram which tries to show how what are the biggest reasons people invest their money . Please Note that this is based on my understand and experience with so many investors over the years . And this is what I feel depicts the scenario closest to actual .

Problems arising Due to This

- The worst Sufferers are those who invest in LIC and other companies Endowment Polices and Money Back Polices for the primary reason of Tax Savings. These people do not think that even though they are saving tax for this particular year , they are actually getting into commitment for next 15-20 yrs (or Policy Tenure) and Have no Idea how its going to meet their Future Goals . Read a Review on LIC Jeevan Tarang Policy .

- Similar problem is with people who take ULIP’s . They Invest for a year to save tax and then next year they have no idea if they would be able to even afford it or not !! . This happens with mostly new joinees in Companies .They have no idea what to ask their ULIP agent at the time of Buying the product .

- Next is “Liquidity Problem” . Most of the people do not think about the lock in period and do not take into consideration their Liquidity Requirement for coming Years . They Invest in ELSS and then next year they need money . They Invest in Tax Saving FD’s and then cry for any Expenses which were very obvious to arise down the line .

What we must Learn

Tax Saving is just a benefit provided when you Invest your Money, dont make it as a Primary objective to Invest. What you have to concentrate on is your Investment Planning , and after you have to restructure your Investment planning in such a way so that you also get Tax Benefits from them.

Investment Planning First and Tax planning second .If you are not able to save tax , its fine , Pay taxes . Its always better to avoid getting into messy products which dont suit you and suck your blood out . Tax Planning is Important, But the more Important things is that you don’t get to obsessive about it and do it only if its needed.

Its not a big deal to save tax at the cost of your Finances future . See an article on Gfactor , a decision making tool for Financial Products

I can relate this with “Not using Protection during Sex” and then suffering for a long time because of that small mistake . This is exactly True with all people who dont not need Crappy Insurance and then one single mistake, Investing in it for Tax saving and then every year , Suffer with it, Paying a huge premium for the Small Insurance not sufficient for you and for the Maturity Amount which is not at all exciting .

Make sure that you invest in some product only if matches these 4 criteria .

So are you one of them who tax Tax saving with High Priority ? Have you invested for Tax saving as primary reasons ? Share with us . We can talk about it and make sure that it does not happen again . Post your Views on this ..

If you liked the Post , then Subscribe to this Blog to get updated .

November 15, 2009

November 15, 2009

Hi Manish,

I have invested in Axis Long Term Equity (G) last year as part of my tax planning.

I again in need of investing in some tax planning MF. i considered below to invest in this year. Could you please suggest me these two are worth to hold for more than 5 years ? I also would like to invest in lumpsum as each SIP gets locked in for 3 years.

ICICI Pru Tax Plan

Reliance Tax Saver (ELSS) (G)

Please suggest me

Canara Robeco has a good one ..

Will this be good to start investing in Quantum Tax Saver fund also as i already have Reliance Tax saver fund started? And, it will also give me room to save tax. Or only there should be one Tax Saver Fund in the portfolio??

There is nothing like that . you can surely have 2 tax saver funds !

Thanks Manish.

I was going through moneycontrol and could see the fund HDFC Tax saver was rated below average. Hence had a doubt on whether to go with this fund or not.

Yes, the rating has gone down , so in that case you can take some other fund .

Hi Manish,

I would like to invest a sum of INR 10,000 in two to three mutual funds via SIP for almost 10 to 15 years. I would like to know if its advisable to start an ELSS now? As I have heard that there won’t be any tax rebate once DTC comes in place. Also, right now I can see that HDFC tax saver is not a good fund to go for. Is that correct?

Further, please let me know any other good mutual funds for investing apart from ELSS?

I am also investing in PPF and LIC. So I guess my financial planning is correct.

Regards,

Robin

Yes after DTC comes, ELSS will no longer be tax free ! .

HDFC tax saver is ok , Nothing bad about it

Hi Manish,

I’ve been a regular reader of your blogs and I thank you for sharing some of your insights on financial planning and so this question to you comes with regards to just that.

My monthly salary is about Rs 32,000 a month(net) and I’ve just invested in two mutual funds namely HDFC top 200 fund(growth) for a period of 10 years and Fidelity Equity fund (growth) for a year which I plan to reinvest again on maturity. Both have 5000 rupees as the SIP. Also with this I have my PPF account in which I deposit a 1000 rupees a month. So what else do I need to do in order to get my financial goals right? Am I on the right path here? As of this moment I do not have any LIC insurance nor Term Plan, neither health insurance. Please advise. Thank you.

You are going fine at the moment considering your goal right now is just to incresae your wealth in next 5-10 yrs .. I would be a good exercise to get your financial planning done if you want to do it in organised way !

Hey Manish,

Thank you for the thumbs up. For a novice that sure feels nice to hear for starters, lol. However as you’ve rightly indicated, my interest as far as financial planning is towards the organisational aspect and that’s where I’d like to have your guidance. Is there anything else that needs to be done besides the 2 mutual funds and PPF in my existing folio. In most of your articles, you’ve strongly advised going in for a Term Insurance as against any other endowment policy. Any recommendations on that front? Also would you suggest going in for any other mutual fund scheme targeting a 2-5 year short term returns? Please advise.

Kind Regards,

Yuri

Yuri

the 2 funds are fine, may be one more will not hurt . For short term i would say go for a balanced fund considering its a 3-5 yrs period

You can take term plan from any company you trust , like HDFC is one good company

Hi Manish,

Thank you for the timely advice. Would definitely act on it. Have just received your book from Flipkart, so am sure i’d get some valuable tips from there as well. Do tell me if you conduct any seminars on financial planning in Bombay. If so, then I would like to enroll myself for it. Thank you once again.

Kind Regards,

Yuri

Good to hear that .. read it and dont forget to write a review on flipkart 🙂 . We will conduct the workshops in Bombay in future, kindly register for it by clicking on “Workshops” link above

Hi Manish,

Would definitely write in a review of your book on Flipkart. At this moment, I’m still in the process of reading it and am almost half way through and it’s been of GREAT HELP. My brother and I go through your posts on the forum and each post is a revelation in itself. Have registered for the workshop as and when you conduct one in the near future in Bombay. Thanks a ton for your valuable insights on financial planning.

Good to hear that ! .. Will conduct a session in Mumbai but only next year now 🙂

“The worst Sufferers are those who invest in LIC”

Manish Why Have you written such Pinching Words against LIC

Do you know that every PLAN of LIC is better than all other private Insurance Companies.

The Track record of LIC is the best for insurance.

Your suggestions are good to listen but most of the suggestions misguide people off the track.

Example: you do publicity for bad track record companies like AegonReligare – ITerm. Do you know the Claim Settlement Record of Aegon take the Data and then Talk about their Favor.

pnagdev

read it again .. You have taken the partial sentence , the full sentence is “The worst Sufferers are those who invest in LIC and other companies Endowment Polices and Money Back Polices for the primary reason of Tax Savings” . I am saying it against Endowment and Moneyback policies from every company , LIC and other companies .

Also its for those who take it solely for the reason for “tax-saving” . So what you have said is incorrect .

Manish

Hi Manish,

Have you posted info on Infracture bonds as you had mentioned in your response on 2nd Aug? I want to udnerstand available options and their pros n cons.

Thanks,

Pankaj.

http://jagoinvestor.dev.diginnovators.site/2010/10/should-you-invest-in-idfc-infrastructure-bonds.html

My total package is 5.5lpa, and I have to invest to save the tax. But, wherever I invest there is a locking period of 3 years and more, which I can’t do. Problem is that – I have priorities like – doing MBA next year as I am already 26 years and planning to get married after my MBA and also I cant get any help from parents for my MBA and installments ( if I take any such plans). Kindly, suggest something that I can do to solve the problem.

After reading your blog, tax saving is not important. So, can I do the other way round, that I invest in mutual fund and from where I get more as compared to what I give as a tax.

please help.

Arpit

You cant do investment for tax saving and the other problem is you cant target huge growth in your investments in short term , in short term like 2-3 yrs , you have to settle with less returns like 8-10% , if you want more returns like 15-30% , then you will have to take risk and that might mean loss also

Manish

Thanks Manish,

That means, I can’t save tax as of now. But, that means large loss as the tax I would have to pay would be around 16-17k in tax.

As you written, if I understood correctly, then it’s dangerous to invest for good returns too.

So, is ther any alternative way, which can resolve the problem.

Arpit

Arpit

You have to ask what is more important to you right now , Is it tax saving or money availibility in next 1 yr . So from that point , its better to not lock in your money

Manish

I just started working and since I did not declare investments in my first month I lost a good amount of my prized first salary in tax. This led to a furore of I’m going to invest to save tax and now I’m feeling much more calmer about investing.I want to invest short term for about 2 years.What do u think about short term investment

Amey

I hope you are clear about the tax payment to govt , at the end of the day you will pay to govt only what you should be if you take correct action before the year end . So if you didnt declare the investments in start , more tax will be paid to govt in starting month , however if you declare the investments after some months , it will all get adjusted later. So nothing to worry much .

Manish

Hi Manish,

I want to invest some money for long term(5 years or even more) and I beleive infracture bond would be a good option as they give additional tax benifit over existing limit of 1L. So far I havent got any details on infracture bonds on net(rate of intrest, tenure, where to get, how to get etc).

Please let me know details available with you or any link that might have it.

Thanks,

Pankaj.

Pankaj

they would be good only from safety point , but not from returns point . There is no clarity yet on the exect return you would get because it would be offered from different companies and will depend on how they manage it . I have already written a post on it but havent posted it , keep visiting to find out when it comes , subscribe to email .

Manish

Dear Manish ,

I have taken SIP for 3 ELSS for Birla Sun life,Religare,HDFC. and I also have a non ELSS that is HDFC top 200. I also have invested some money in stocks. Plz suggest me if this is fine.

Np

Its not possible to tell if its fine unless your goals , risk appetite and time frame is known

Manish

[…] understand investors psychology and their helpless ness at the end of the year because they have to provide investment proofs for Tax exemption as soon as possible . This is not just limited to these products , its true for NFO’s , […]

Manesh,

I’m thinking of starting two SIPs from below ELSSs:

Canara Robeco Equity Tax

ICICI Pru Tax Plan

HDFC Tax Saver

Should I start investing or wait till the market goes down?

SJ

These are good plans ,you can go ahead , if you are going for long term investing through SIP , dont bother much about markets .

Manish

SJ

If its SIP for long term , start it .

Manish

[…] less than Rs. 90,000 ? Insurance is meant to cover risk of untimely death first and investment and tax savings are secondary criteria. But we the Indians, have been taught Insurance as an investment first, tax savings second and then […]

Recently 2 of my collegues did same thing. They were in a hurry to save tax so they got an LIC policy. First one purchased policy and second one got it simply because they are friends without thinking if it suits him or not. I thought that policy was not good (though I don’t understand much, only can make a judgement for yes or no) but they had to save tax. They even recommended same policy to me but I refused. First thing I was not satisfied second I knew I need money after some time, so better pay tax and keep the money instead of putting it somewhere else. That time they laughed at me, now I am laughing at them.

[…] Aadmi” , the middle class would not be gaining so much tax as there are absolutely no tax savings for the person earning up to Rs. 3 lakh p.a. and those who are earning up to Rs. 4 lakh would end […]

Manish,

Just a flash of a thought… will it be better to redeem the money from a tax saving fund after the mandatory lockin of 3 years and reinvest the same in the same fund so that we can save tax as well for that financial year…

In this way, if we start investing in a tax saving fund each year for the first 3 years and then on, just redeem and reinvest every year without putting any extra money :))

Of course , this will look good if we invest in lumpsum and also if the value at the time of redemption is more than the original investment value.

if we invest thru SIP, each monthly investment will have a lockin of 3 years :((

What are your views… what are the pros and cons ?

Shantharam

Shantharam

Yes .. this is a great idea 🙂 . Actually i was thinking about this for sometime myself 🙂 and trying to come up with a post .. good time you asked me , i will try to post it soon 😉

The main thing is that once your invest for consecutive 3 yrs . .you can make a chain where you invest a yearly maturity in same fund or other and then do this every year 🙂 , there by letting your money grow and taking advantage of tax benefit also 🙂 .. good one .. much appreciated 🙂

Manish

Manish,

But of course, if we are in a SIP, this idea might be cumbersome as we have to redeem each monthly investment after 3 years and then put it in the same or a new fund each month.

You have any solution for this … something like a SWP after 3 years linked to a SIP …? 🙂

Shantharam

Well , I originally thought of 1 time yearly paymnt thing , not SIP .

But even for SIP , we can keep investing per month for 3 yrs and then ask for SWP to our bank account and at the same time , have a SIP from there itself 🙂

Manish

Manish,

I already hold SIPs in Canara Robeco Equity Tax Saver and Sundaram Tax Saver. I want to build a portfolio with couple of equity funds, a balanced fund like HDFC Prudence and a pure debt fund like Canara Robeco Income. Do you feel that there is a need for equity funds like HDFC Top 200 and DSPBR Top 100 as i already hold two ELSS funds ?

Need one more help. Am still undecided on whether i should go for a pure debt fund now as my investment term is atleast for the next 15 years. I just wanted to put it to give some stability to my portfolio..

Your views…

Shantharam

Shantharam ,You can use these tax saving funds as your equity funds portfolio .No need to invest in HDFC top 200 andn DSPBR top 100 if you dont wish to .

Pure debt funds for some part would be good idea for a better asset allocation . You should be doing your asset allocation everyyear for it to work , I would suggest PPF instead .

Manish

Dear ,Shantharam

please be informed that for any investment in tax saving scheme has to be from your income. Of course the redeemed money from ELSS or any other scheme can be utilised for your consumption and redemption/withdrawl can be consumed. Planning is yours.

Manish,

This is exactly the same what I suggested my colleagues in my Company. Many MNCs are asking for submitting the Proofs of the Actual Investments they made for which they asked the Tax benefit throughout the year. Most of the companies wants their employees to declare the Investment amount in the beginning of the FY and asks the proofs at the end of FY say in December or January Month.

And it is this period during which many Insurance Companies come up with new plans tempting investors for claiming tax benefit and as you rightly said more than 60% people blindly invest in such products that they were neither understood or nor thought of long term benefit.

Really I cant belive this 60% of peoples who do their Financial Planning within seconds of time. They even dont know that they are loosing whole years Interest of not investing in the beginning of the year.

Thanks for sharing this.

.-= Nilesh Panchal´s last blog ..About AMFI Certification =-.

Yes .. most of the idiotic plans are launched during year end and people get into trap .

Nice points 🙂

Manish

THANX

i asked this question because if i invest in ELSS through sip every month how my tax exemption and 3 yrs lock in period would be calculated.after wat time i would be able to take my all the money back frm this ELSS fund if i invest through SIP.

ok , in that case .. each of your SIP payment will be locked for another 3 yrs of payment .. So any payment made on Date X will be available only after X+3 yrs . It applies for each payment in SIP . After 3 yrs , you will be able to get your money back each month after month (if you wish to withdraw) ..

Got it ?

Manish

Can i put money in ELSS through SIP as i dont have lumpsom amount.

kindly advise.

Yes vivek .

Even if you have lumpsum , you should invest through SIP only .. read more articles on SIP on this blog ..

Manish