Yes, you read it right ! . Most of the people do not know that they can withdrawal partially from their EPF account even when they are in the job for some specific and important reasons in life like buying house, marriage and paying for education fees.

Today I am going to share with you this very hidden and not so known information about EPF partial withdrawal. EPF is an important part of most of the salaried individuals, but there is lack of awareness of how it can help you at times when you are pressed for money in life.

If you have worked for several years like 5-20 yrs already, you have accumulated a good amount in your EPF (Employee Provident Fund), but most of the people feel that its locked in and they will only be able to get it only at the time of retirement or will be able to withdraw/transfer it when they leave their job.

6 situations when you can withdraw money from EPF account while you are working

Here are those 6 major milestones in life or reasons for which you can take out the money from EPF account

- For Marriage Purpose of Self, Sibling and Children

- For Education of Self + Children

- Purchase/Construction of House or Flat

- Repayment of Existing Home Loan

- Repairs/Alteration of Existing House

- For Medical Treatment

Different rules for different situations

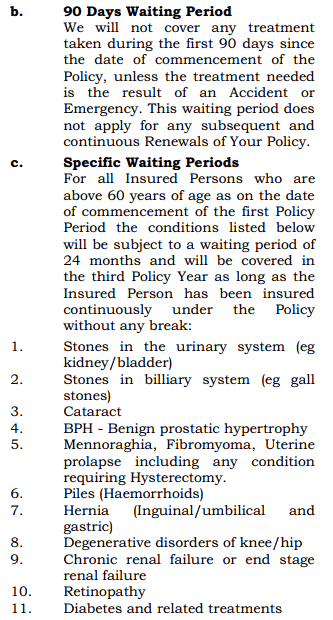

Para 68 of Employee Provident Fund Act 1952, defines how much you can withdraw, under which condition, after how many years of service and finally how many number of times. But before you move forward, its important to understand two important terms – which are “wages” and “years in service”.

You should know these two terms because how much you can withdraw for some reason has some restrictions and defined like this – “You can withdraw maximum 36 times your monthly wages, only after 5 yrs of service”. So you will get confused on the terms like wages and years of service .

Most of the people confuse “wages” with the monthly take home salary or gross salary and do not understand how to calculate “yrs of service” because they have changed their jobs and keep moving from one company to another and have not transferred their old EPF account to new one.

So lets understand these two critical points

What is the meaning of “Wages” ?

Wages means Basic Salary + DA (if any) . So if you are earning Rs 80,000 per month take home,. but your Basic Salary + DA is only Rs.25,000 per month and rest 55,000 is other components, then for calculation purpose – “wages” will be Rs.25,000 only and not Rs.80,000 which is generally confused with.

What is the meaning of “X yrs of Completed Service” ?

How old is EPF account is the sum total of how many years you have worked. Do not confuse it with how long are you are employed in current job.

Because Employee Provident Fund (EPF) is a centralized pension system, if you ave worked for 3 yrs , 4 yrs and 2 yrs in 3 different companies, then your EPF account would be considered as 9 yrs old, provided you have transferred your old EPF accounts to the current one.

So in this example which I just gave, even if your current job is 2 yrs old, if you have transferred your old EPF to your current one, your “yrs of service” will be 9 yrs, and then you will be eligible for many benefits which we are going to talk in this article.

Incase you have not transferred your old EPF account to current EPF account, then in that case you will be at loss, because there is no data of your past employment in the current EPF account and you suddenly might not be eligible for various withdrawal benefits, because many of them require atleast 5 or 7 yrs of service.

So the first step you should do is transfer your old EPF to your new EPF account. Incase you have been facing issues while transferring your EPF account, file a RTI now and get it done !

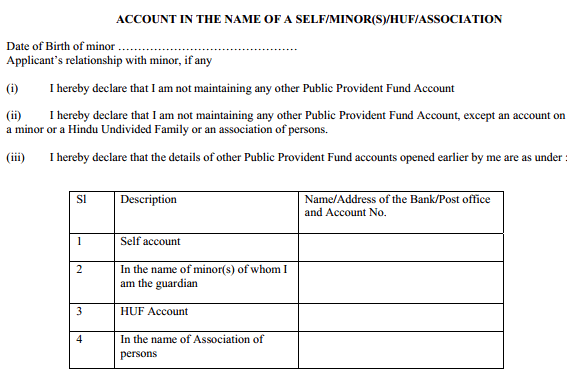

What is Form 31 ?

Form 31 is the main form which one has to fill and submit to employer inorder to withdraw money for various important situations mentioned above. Along with form 31, you also need to provide specific documents depending on the case. You can either ask for Form 31 from your employer or download Form 31 from EPF website.

Fill this form and submit it to your employer who will then verify it and process it. Note that you should not send it directly to EPFO office, because it has to go through your employer only. Below is the form 31 attached if you want to have a look at it.

How will you receive the money from EPFO ?

When you fill up the form 31, you need to you need to fill up your bank details and also give a cancelled cheque and once your employer and EPFO verifies it and process it, you get the money through NEFT or RTGS in your bank account.

Incase the amount is less then Rs 2,000, you also have option to get it via money order.

6 situations when you can withdraw from your EPF

Below are those 6 important reasons for which you can withdraw from your EPF , now I am going to explain each of them in detail. Here they are –

Reason #1 – Marriage for self, children and siblings

You can withdraw from your EPF account for the occasion of marriage if you have completed 7 yrs of service. The interesting part is, you can avail this facility 3 times in life (during your service) and the maximum amount you can withdraw can not be more than 50% of the “Employee share” in EPF account.

You should be clear that even Employer contributes to your EPF account and that is not considered for this withdrawal. So even if your EPF account total balance is Rs 10 lacs, that whole amount is not considered for calculation purpose, only your own contribution and interest on that amount is used for calculation purpose.

This is applicable for the marriage of

- Self

- Son or Daughter

- Brother or Sister

So for an example, lets say you have been working for 10 yrs and your sister’s marriage is coming up, you can withdraw money from your EPF account for this purpose.

You will need to provide the full address of venue, marriage date in form 31, and also attach some proof of wedding like Marriage invitation or the bonafide certificate of the fees payable and give it to your employer for verification and processing.

Reason #2 – For Education of Self + Children

You can also withdraw for education expenses for self and children. This is valid only for post matriculation educational expenses. By post-matriculation, it means after 10th standard .

So if you are admitting your child to any college or university for graduation or post graduation or any other professional course, you can withdraw from your EPF account. But this can be availed only after 7 yrs of service and the maximum amount you can withdraw is 50% of your own contribution.

This can be used for maximum 3 times in your lifetime, but this 3 times also includes the “marriage” as the reason. So the point is , for Marriage or Education purpose, you can withdraw for maximum 3 times in total.

Reason #3 – Purchase/Construction of House/Land

If you are planning to buy or construct a house OR purchase a land, you are eligible to withdraw some limited money from your EPF account once in lifetime. Here are some of the rules which you need to satisfy

- The house/land should be on your name or your spouse name or jointly in the name of you and your spouse (no other combination is allowed)

- You should have completed 5 yrs of service.

- If you are purchasing land, the maximum permissible amount is 24 times monthly wages.

- If you are purchasing or constructing a house/flat , then the permissible limit is 36 times monthly wages (including the acquisition of land also)

So for example –

If you are buying a flat and your salary per month is Rs.80,000 , but your basic salary + DA (wages) is only Rs.25,000 per month, then for calculation sake, your wages is Rs 25,000. So as per rule, you can withdraw upto 36 times your monthly wage, which is 36 x Rs.25,000 = Rs.9 lacs from your EPF account.

If you do not have that much money, then you will get less than 9 lacs. This is not a small amount if you think about it. When you take the home, there are so many costs involved and one is so hard pressed for money that time, Even few lacs is a big enough help.

The property in question should be free from any dispute or emcumbrances to avail this facility (here are 20+ terms you should know about real estate). Also the property should be registered and a proof of registration must be given to get this facility.

Reason #4 – Repayment of Existing Home Loan

This one is surely going to move a lot of you readers I know :). If you have a home loan, you can even withdraw some part of your EPF money to prepay your current home loan, but for that you need to have 10 yrs of service. However you can avail this only once in your lifetime, and this one time limit is clubbed with the last reason (3rd) above.

So one can either withdraw money from EPF account for purchase/construction of house or repayment of house loan, not both !

The property must be in the name of self, spouse or jointly registered with spouse.

A lot of people have a joint home loan with father, mother, siblings – but in those cases, you wont get this benefit. The amount you can withdraw will be 36 times of your monthly wages.

The money you will get under this clause, can be taken from self contribution and employer contribution in EPF. You will need to provide the proof for house agreement, sanction of house loan and some other documents as asked by the EPFO office.

Also the money will be issued directly to the lender bank, not to you (incase you thought you can trick the EPFO and enjoy the money for some other purpose). Next, you can use the money from your self + employer contribution.

Reason #5 – Repairs/Alteration of Existing House

At times, when your house is little old (after many years), there comes a time when you want to make some alterations and changes in current house and it burns your pocket. You might want to do some construction work, or lets say change your home tiles, or add a new room in existing house.

In all these cases, you can use EPF money for this purpose. However there are few rules

- The maximum money you can take is 12 times your monthly wages

- The house should be more than 5 yrs old after construction completion date.

- You should have completed 10 yrs of service

- You can avail this facility only once

- The house should be in the name of self, spouse or jointly with spouse

Note that this money can only come out of your own contribution, not employer’s contribution

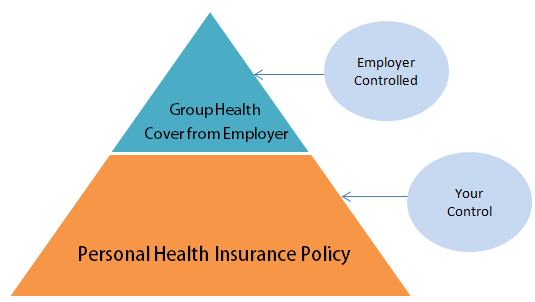

Reason #6 – For Medical Treatments

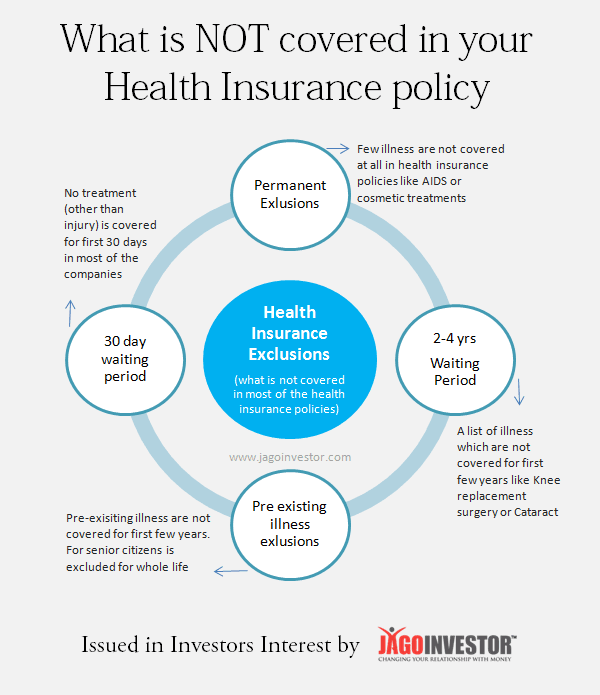

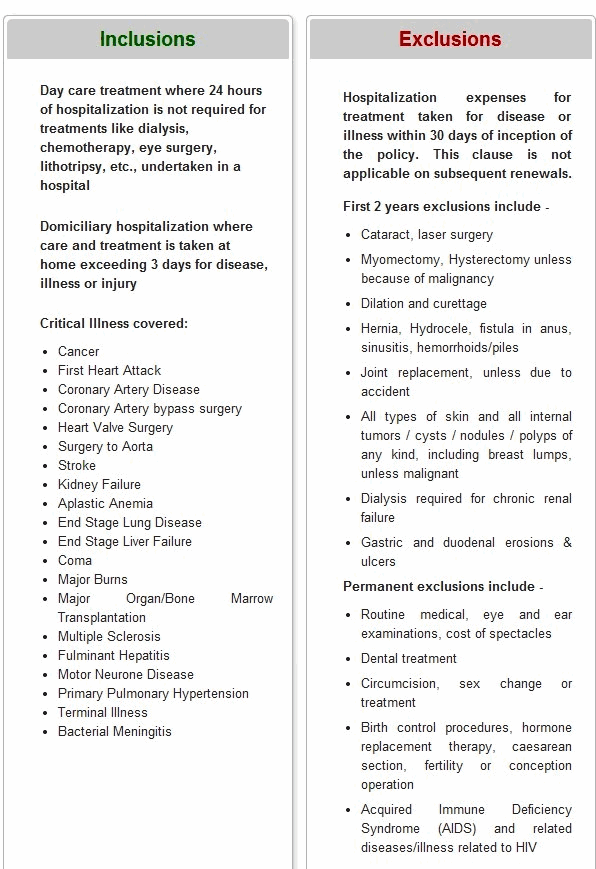

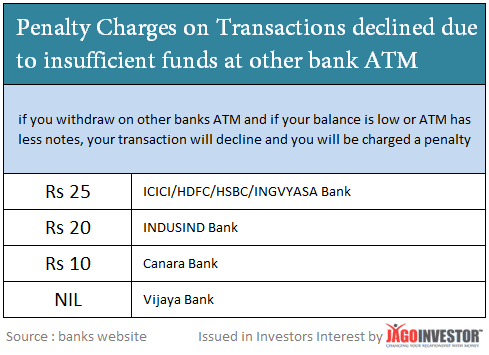

If you have health insurance, then well and good, but if you don’t have it and if you are hospitalized or have to undergo some major surgery, you might have to shell out a lot of money, but your EPF account can be of some help to you partially.

You can withdraw money from your EPF (Provident Fund) for a medical treatment for self or anyone is family in following 3 situations (any one, not all)

(a) The hospitalization is for more than 1 month (for any reason), or

(b) major surgical operation in a hospital, or

(c) if one is suffering from T.B., leprosy, paralysis, cancer, mental derangement or heart ailment and having been granted leave by his employer for treatment of the said illness.

The best part is that you can withdraw the money anytime in your service.

There is no requirement that, you must have completed X number of years in service. Even if you have been in service for just 1 yr or 2 yrs, you can still withdraw money for medical treatment – But at the same time, the maximum money you can take is limited to 6 months wages, which is not a very big amount, but still atleast you get some help and this option is there.

This benefit can be taken anytime you want and for any number of times during your life time. So in a way, your EPF will come to your rescue in times of need, at least partially if not fully!.

But, there are few documents you will have to produce and give along with Form 31 and those are

- A certificate from your employer which states that the Employees’ State Insurance Scheme facility and benefits thereunder are not actually available to the member or the member produces a certificate from the Employees’ State Insurance Corporation to the effect that he has ceased to be eligible for cash benefits under the Employees’ State Insurance Scheme

- A certificate from eligible doctor stating the fact that hospitalization of one month is required or there is a requirement of a major surgical operation or certifying that one is suffering from the mentioned illness – i.e T.B, leprosy, paralysis, cancer, mental derangement or heart ailment.

All the rules mentioned in a single chart

So that was all the rules I wanted to tell you, I also want to give you a single chart which has all the above points at one place.

An example of someone with 10+ yrs of experience

To give you a more clear picture, here is a simple example which will help you understand how much a person is eligible to withdraw in money terms. I have assumed that a person has completed 10 yrs of service and his wages per month is Rs 20,000 and his current EPF balance is Rs.10 lacs.

Conclusion

Your EPF account is primarily for your long term wealth creation, Do not use it only because the money is available through that because its a place where your money gets accumulated each month without your intervention.

However in case of crisis situations and when you are not able to arrange for money from anywhere, its a good place to chip in and withdraw the money.

Let me know if you want to share any new information or have any doubts. I would be happy to answer them incase I know more