Secret of Extraordinary Financial Life – Taking Actions

If asked, “Do you have a lot of knowledge about personal finance?” You would say “Yes, of course!” Now, on the next question, “Is your financial life great?” For most of you it would be “No”. We all know term plans are required, we need to start the SIPs to meet financial goals, we need to cut down on our expenses, etc etc. But, how many of us actually go ahead and implement what we all claim to know! A very small percentage!

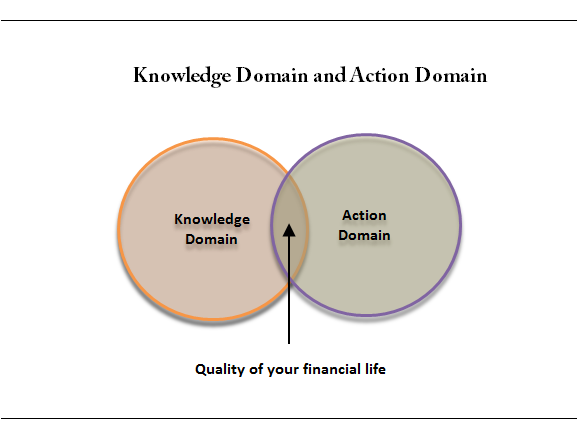

In this article, me and Nandish will talk on how taking actions is the real thing to be done in your financial life and just by accumulating knowledge about personal finance (what most of the readers on this blog do!) does not add up much in our financial lives! . In the video above, we are sharing – how two of our clients have given a new direction to their financial lives. Watch the video above to hear some action-provoking conversations between me and Nandish. There are two domains each person has called ‘Knowledge domain’ and ‘Actions domain’ .

Knowledge Domain

This domain is filled with the knowledge aspects in your life. When you read a blog, magazine, watch a show.. etc…etc, you are increasing your knowledge domain. You knowledge expands and you know more and more things. Your clarity on various subjects increases. This part is very important because it gives you confidence and understanding along with reasoning ability. If you are following a blog from long, your knowledge domain might be very high. But guess what! Your knowledge domain has very less impact on your financial life

Action Domain

Action domain is very simple to understand. All it means is how much action you take after increasing your knowledge domain. The more proactive you are in implementing what you know; it will have direct relation with the quality of your financial life. Increasing your knowledge domain will be of little or no use if you don’t expand your action domain.

In our financial coaching program, we concentrate heavily on taking actions and moving things in our clients’s financial life. We see people have good knowledge, but the one place where they are stuck is “Actions”. Somehow they don’t move forward by implementing what they know. Take yourself, many of you know that you need to take a term plan , you need to start your SIP, you need to start exercising (that includes me as well), but we don’t Act! and that’s where our big knowledge domain is of no use! Start taking actions!

I see so many readers on this blog who keep sharing their actions and how they started their SIP’s after reading an article . How they took the term plan after reading my article on online term plan , how a lot of readers got in action and started exploring options for their health Insurance, after reading one of my recent articles on Health Insurance

Financial Life as a project

One of the biggest reasons why most of the people fail to take actions in their financial life is that they dont look at their financial life at a project which needs a completion in all areas dont take a lot of actions in their financial life .

If you are stuck in your financial life and feel that you need an extra support which helps you be in action, you can register for our paid Financial Coaching program

Conclusion

Which of the two, knowledge and action domain is important? I personally feel that action domain is much more important than knowledge domain, because once you choose to act, you are bound to learn things and find out ways of completing somethings.

Please share what actions you have taken in your financial life? Which domain is bigger in your financial life ? Also let me know how was the video and if you liked the conversation ?

Also wanted to know your opinion on “Financial Action Day”, when we celebrate a week or a month as “Action Month”, when we as a group take massive actions in our financial lives and complete the long pending tasks ! . What do you say ?

June 26, 2011

June 26, 2011

Hi,

Aftre watching your video I have signed up for 8 SIPS (for two life goals) i have been postponing for the last one year 🙂 Thanks Manish and Nadish !

– Srini

Welcome !

Hi Manish,

Great article and you are doing a great job enlightening many peoples financial lives. Even I have commited some mistakes that you have mentioned , like just taking LIC policies only to save tax.. and investing in FDs and too much exposure to direct equities. After reading your articles now I realise those mistakes (Knowledge domain 🙂 ) and to start with actions:

1. I have started a SIP for rs 2k with HDFC top 200, uti retirement benefit pension fund.

2. Planning to start with some mid cap SIP either Sundaram SMILE or HDFC mid cap opp

3. Also planning to start SIP with some good FMCG fund (As I see too much of happening in the FMCG space) – Please help me out here to choose a right one..

4. Looking to make all my Jeevan anands, New bima gold and jeevan saral as paid-up.

5. Waiting for online LIC term plan to take one for a good amt of coverage.

Please let me know your comments on my action pointers and your suggestions to invest in some other areas as well.

I am also looking to hire a Certified Financial Plannner, I am bit worried whether I may end up chosing a wrong CFP . Sometimes that makes me to think, instead of some CFP screwing up my financials I can decide my own destiny by doing it on my own. thanks again…

Thanks for this great post. It doesn’t just concern financial life but once you start taking actions, your character as a whole starts growing.

Karthik

True .. you are looking at it from right perspective 🙂

Thanks Manish.

HDFC prudence is kind of cushioning to this equity prone portfolio.

AKP

Hmm.. Not sure . How much cushioning is it giving . If you remove HDFC Prudence, what is the equity allocation ? And how much is equity allocation when its present ? If thats some good difference then you can call it cushioning . Not sure how much it would be . I assume it wont be much difference unless you are putting a lot of money in HDFC Prudence.

Check and let me know.

Manish

Hi Manish,

Taken Action after glued to your blog for last 2 months. This is my FIRST STEP in Investment beyond few FD and SB A/C. Yes Taking action is most important. It took some time to do KYC compliance and you know for NRI is NOT EASY.

I really appreciate your writings and user comments in Ji and FundsIndia. FundsIndia is a great platform for online investment for us.

Presently started with INR 11000/month (~250$) (10% of take home)

1. HDFC Top 200: INR 5000

2. HDFC Prudence G: INR 2000

3. HDFC Midcap opportunities: INR 2000

4. DSPBR Top 100 Equity Growth: INR 2000

How do you feel about this portfolio?

Is it well diversified?

I’m interested about Reliance Pharma Fund (G). Its doing great for last couple of yrs. What’s your view?

Thanks. Waiting for your valuable comments.

AKP

Looks good, the best part if you have not overloaded yourself with the funds ,. Not sure if you should keep HDFC top 200 and Prudence , both have same Funds manager .

I am not able to comment on Reliance Pharma Funds, not tracking it

Manish

Good article. Loved the concept of “Action Day”. You can set an action day once a month and urge readers to complete their pending investment work. I am surely going to follow one in the future.

Swapna

We are going to do something like this soon . watch out for it !

Manish

Manish,

I read many of your articles and they are very informative. I think a better combination of both Knowledge and Action domain is required to lead a good financial life.I think more knowledge of any single domain will even do worst to your financial life, so a balance is required.

All the best and keep writing these good articles.

Pankaj

Thats a nice thought . More of knowledge will do more damage ! . Right !

Manish

Hi, I am in 30s.

I surrendered ULIP, Endowment, pension policies.. I took 50L term policy with LIC(Even though having high permium) & started SIP with good funds in my name & my wifes name. I did not take mediclaim as my company is providing 5L coverage for my family .

The only thing pending with me is Starting a PPF with SBI. That too I will start soon after completion of wood works in my house..Everything is due to Jagoinvestor..Thanks to Manish..

TS Ashok

Simple and powerful , just make sure you have good amount of emergency fund and thats all you need .

Manish

Hi Manish. I am 29, with no liabilities/loans and single. Starting from November this year I will be able to save approx. Rs 1,00,000/- per month but I will be living abroad for 1-2 years. I plan to get married in 3 years and buy a house 1 year later. Also I have no health/life cover as of now. Can you suggest the suitable investment option from abroad? Regarding the life/health insurance, will I have to take them in the country that I am emigrating to?

Vaibhav

No , you wont have to take it in the country which you are living in , if you take it in India before you go . All your goals can be met with the kind of saving you have

Manish

Yes Sir

Again Your Article is excellent

As far as knowledge domain is concerned it is very high in my case as i m following several blogs from last 4-5 years. but action is slightly less

Started Intelligent investing after proper analysis from last 2 years only when i taken term plan and SIP etc…after evaluating financial needs and goals

I advise others to learn this thing and start as early as possible because savings at an earlier stage gives more accumulation…and less deistance from your goal

By the way thanks again for such an informative article

Sushil

its working now

Manish

Sushil

Thanks for appreciaiton 🙂

Manish

Manish….by the way why u r editing the comments

it restricts free flow of ideas

Sushil

You can mention the link of the blog while putting the comments , but not in the comment area . Thats the reason for editing .

Manish

Hi Manish,

After reading your blogs, for the first time i came to know about the term plans. Since i am a NRI, currently dealing with SBI smart sheild insurance plan for NRI’s, may be next month when i visit India, i will finalise the medical test (pls let me know your comments about this plan). Unfortunately couldn’t do much with my ULIP’s, which i have alreday paid full premiums (3 Yr). But stopped paying premium of Jeevan Tarang.(2 yrs already paid). Invested small amount in MF & Started SIP aswell since last month. Have 1 small FD aswell. What do you say ?

Joy

I dont see lot of equity investments , not sure how old are you , but I think more investments should go there . SBI smart shield is pure term plan and looks good to me . Any pure term plan will actually be ok .

I think you should look at the whole financial life of yours and evaluate them in a better way

Manish

Hello Manish ,

A very good and motivating article..Infact , I would like to let you know , that the articles in your blog has always prompted me to take “actions”. I would like to share an instance.You have always mentioned that Term plans are the best , as compared to money back LIC plans.Myself and my husband had just invested in a couple of money back plans (obv by looking at the figures and bonuses which were shown to us by the agents , and now a days they have another way of convincing people that mutual funds are risky , whereas LIC gives you guaranteed returns).Unfortunately after paying one premium we read ur blog , and now we have not paid the next premium due , and have taken a term policy straight away.The agent also asked us to take a term policy with return of premium option ,but we denied and took a term policy without return of premium.This action of ours is because of the knowledge which we got from your site.Thanks a lot 🙂 I am sure I will have more instances to share , in future also…Good work!

Priya

Thats great to know . Actions move things . Knowledge make things stronger . Keep going !

Manish

Manish,

Nice article. good job.

Rakesh

Rakesh

thanks , Whats the key take away for you in this article

Manish

I have taken lot of actions after reading your blogs. many thanks to manish

1. Closed empowerment policies, and took term plan

2. Closed ULIP

3. Started more SIP and reduced exposure to direct equities.

4. Trying to maintain asset allocation.

Marshal

Thats amazing to know . Why did you share it all with us earliar 😉 . I am sure you can acknowledge that once you started taking actions , there must be lot of things you learned on teh way and you didnt knew before taking the actions . So do you think taking the action with some basic knowledge is better than becoming an expert and waiting for the perfect time to take action? I am asking from financial life point of view !

Manish

basic knowledge is not enough to take actions… there are many ways to learn either easy way or hard way… i started investing in 2004.. but there was no direction.. i didn’t have time.. but in 2008 when i changed job i did spend time on financial planning by reading blogs and news article. and your blog was major contributor.. and then it helped me to take actions.. today am seeing many friends who are afraid of taking actions just sheer because of lack of knowledge or lack of confidence. ..

Marshal

By “basic knowledge” I mean knowledge which can trigger actions . If you take Mutual funds , one way is to know about what is mutual funds , how it can help on in long term and how the investments are made , with this much knowledge , the next thing a person should do is take actions and start SIP’s . But a lot people want to becomes super expert in MF with each and every detail , thinking that after that their actions will be more fruitful , which is true to some extent , but it only blocks the actions for majority and nothing else !

Manish

Nice post manish!!

Action no doubt is very important but action without knowledge some times leads nowhere. but that doesn’t mean that one should keep on gathering knowledge only…One should always have a basic plan or guide like you to take people forward in financial Life.

Manikaran

Yes , I agree , definately one needs some ground knowledge, but the point is one need not be an expert to take actions , basic knowledge + Actions is better than great knowledge + delayed actions

Manish

I once read a conversation between Charlie Brown and his friend in the famous cartoon Strip “peanuts”

Charlie – “I want to ask God , “why you do not do something to improve my life, to solve my problems and to make me happy when you know the solution and have the abilty to do it”.

Friend – “Then, why dont you ask?”

Charlie – “I’m afraid, God might ask the same question.”

I think, this describes in very few words the disease of inaction among educated people. We know what to do but somehow we do not do it …….. GOD Knows 🙂

Pramod

Wow . that was really great lines and hidden meaning inside it !

Manish

Hi Manish,

Good Post (as usual) … I have a plan to take the Term Insurance years ago.

I have all the information (Which Plan, Tenure, Policy Amount, etc) related to my TERM Insurance but (I agree) i am not action it.

Another think is excercise 🙂

But I am sure, I will start soon (both) and let you know ….

Thanks Manish …

Regards

Nagarajan Santhan

Nagarajan

Yes , We are interested in just action . You should take some kind of oath like the next comment you will do on the blog will only come after you complete the action now ! . What say ! . I look forward to see your reply after 10 days here ! . I am watching you !

Manish

If you are committed to your financial life, the first thing you wil

have to do with all of the great information you learn is to get it out of your head and into the physical world.- nandish

Excellent post….Action is most important…you have hits the bulls eye by pointing out that many ppl are aware of wht they need to do..but just they miss out due to some reason or other on implementing it in their life…

I have a term plan on my name, invest regularly in SIP Mutual funds for past couple of yrs, company has taken care of health insurance..which i feel is adequate…but will have to decide on taking additonal health insurnace in coming yrs.

rgds

Nilesh

Nilesh

The way to move forward in your situation is to make a list of “Complete” things and also list of “Uncomplete” . then put a deadline to each and define the actions to be taken ! . Now just start ! , Just start ! . Take the move .. just start , no rubbish , just start .. go , stand up , call someone ,just start !

Manish

Very True Manish,

I’m following your blog since long time now and i found it very informative. But when it comes to action, the ratio comes to around 20/100. which is bad.

This article explained my situation and provided the solutions too. I’m taking this seriously now…

Vicky Nimbalkar

Vicky

Ya . Even 20/100 ratio is decent enough, if you learn 5 things , u act on one . I would say thats great . Some struggle at 50/1 or 100/1

Manish

Agree with Manish, action domain is more imp. I have seen people agree with most of fundas and advices. But they JUST do not ACT.

The foremost advantage of this blog to me has been that ‘I took this up as a project which needed to be executed in a x time, using y resources and z expected returns’.And most importantly, I revive it every year (I do monitor regularly but revision or change happens only after careful evaluation)

It is tragedy that I did not know about term plans and SIP earlier. But once I did, I implemented it without further delay.This blog also helped me expose to not so conventional ETFs.(means that parents do not know and do not advice)

Mukul

Thats amazing to know ,you are a live example for what we wanted to communicate above . I liked you approach of I took this up as a project which needed to be executed in a x time, using y resources and z expected returns’

Manish