Have you ever pondered the consequences of losing the bank locker keys? In this article, I will share what to do when you lose your locker keys? What are the rules and charges involved in setting things right again?

What happens when you go to open the Bank Locker?

When you open a Bank locker, you are billed in advance for breaking charges and 3 years of rent (the former is to cover emergencies when the locker might have to be broken). RBI guidelines state that banks can charge this extra fee if they wish, but some banks might charge it later, only if the situation arises.

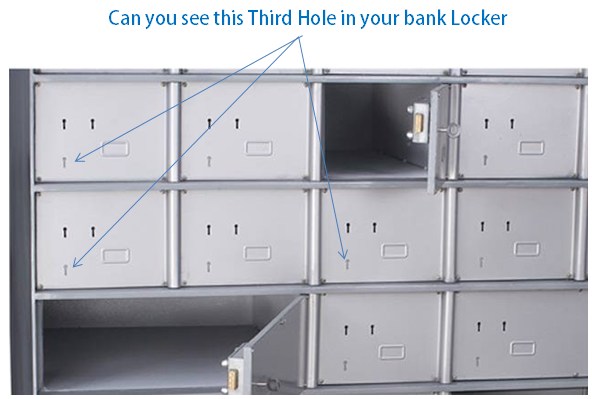

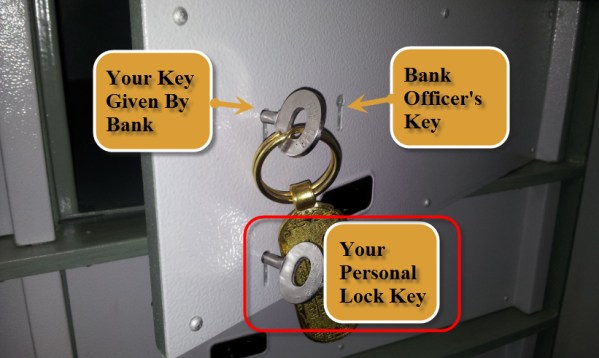

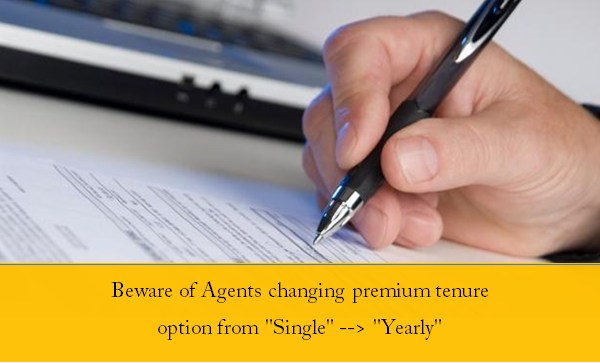

You get 1 single locker key only

When you open a bank locker, there are a total 2 keys to the locker; out of these, one key is given to you and the other is with the bank. The absence of duplicate keys means that it is very important to keep your keys carefully and not lose them. However, it is very natural that some people lose their keys or misplace them.

What happens when your locker keys are Lost?

When you lose your locker keys, the first thing you need to do is write to the branch manager informing them about the loss. They can then ensure that the locker cannot be accessed by anyone (for example, by someone who stole your keys).

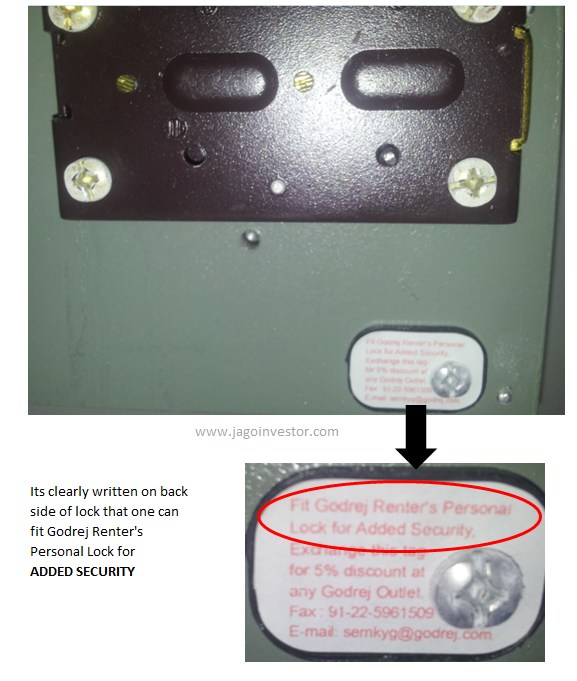

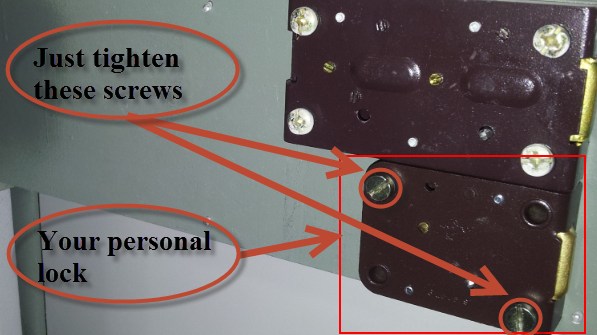

Once you intimate the bank about the lost keys, your locker has to be replaced by a new one (and keys) OR the duplicate keys have to be created and given to you. In either case, they will be contacting the company that supplied the locker to them (mostly Godrej).

A trained technician will travel to the bank office and cut open the locker in the presence of a bank official and the person who rented the locker. This is to avoid any dispute over the loss of items from the locker. If the person renting the locker is not available, the bank will go ahead and break the locker and move the locker contents to a sealed box, which can be passed to the customer later.

Do I need to pay high penalty If I lose my locker key? Here is a reason below

Bankers do provide a replacement of duplicate key of lockers in case the same is misplaced or lost. There is no duplicate key of a bank locker as such. The bank has to call the supplier of the locker (i.e. the company that has supplied the lockers to the banker) and the supplier provides the duplicate key.

This may entail a cost of about Rs.3000 per key. This heavy cost is due to travelling cost and other administrative costs that are involved.

Any expenses incurred will have to be borne by the person owning the locker – a sum that can run into the thousands. Just because it is “loss of keys”, one should not treat it as a trivial matter and assume that duplicate keys will be provided for free.

Penalty charges may vary from the size of the locker?

Note that expenses can vary as per the size of the locker. For small lockers, the replacement charges will be less and will increase to large amounts for bigger lockers. I think the high expenses act as a deterrent to ensure that locker owners do not treat the safeguarding of their keys as a trivial matter.

For complete clarity, I have set out below excerpts from bank T&C’s regarding this issue.

From ICICI bank website

The Hirer(s) is/ are permitted to operate the locker with the key provided by the Bank and no operation of the locker shall be permitted with a key other than the key provided by the Bank at the time of executing the Agreement.

If the key of the locker, supplied by the Bank be lost by the hirer(s), the Branch should be noticed without delay. All charges for opening the locker, replacing the lost key and of changing the lock, shall be payable by the Hirer.

From SBI Bank website

In case of loss of key of the lockers, a service charge of Rs.509/- has to be recovered from hirer in addition to the actual expenditure incurred in breaking open the locker and changing of key by manufacturer of lockers.**

From City Union Bank website

In the case of locker keys reported lost by the hirer, a written declaration shall be obtained from him/her. The bank shall obtain from the manufacturing company a fresh set of lock and key. It shall be delivered by the company in a sealed box through its technical representative.

The technical representative shall open the box in the presence of the Branch Manager and the Hirer and then in their presence the locker shall be broken open.

The contents shall be removed safely and a new lock shall be fitted thereon. Then the NEW key shall be handed over to the hirer after collecting the charges for fitting the new lock and key.

Why do we need to keep the Bank locker keys Safe?

We may face 2 major consequences if we lose bank locker keys. They are as follows –

- If the keys get into the wrong hands, then you fear to lose your locker contents. After all, you must be well aware how lousy bank officials are in checking the authenticity of the person opening the locker – all they do, is fill an entry in their register and that’s the end of it.

- Another issue is you will have to pay hefty fines if the locker keys are lost. The amount of hassle and financial loss you need to absorb to rectify matters is huge compared to the size of mistake. It is therefore suggested to be careful from the onset.

Let me know your views on this article. Were you aware of these rules or not?