Some easy steps to follow while buying a Life Insurance policy in India

Have you already bought Life Insurance ? Though you might have done the sin of being underinsured, I would say its fine, because today we are going to look at detailed steps of buying Life Insurance and we will also learn a lot of things.

Almost everyone has his own set of doubts regarding Life Insurance contracts, but in this article we will not just look at detailed procedure of buying Life Insurance, but also see why most of the people have the doubts which they have. This is probably going to be the last article on Life Insurance you would need.

So here we go. Today for the savvy life insurance buyer, it is possible to buy the policy on the web – it saves money for sure.

Choose company that suits you

The first step in buying Term insurance is to shortlist the company from where you wish to buy the product. There are many companies in India selling life insurance and almost all of them have a Term cover available. Let us call them companies A to M.

If you do not TRUST say five of those companies – or you do not believe that you wish to deal with them, you need not even look at them. Why you dont like Term Insurance and why you are wrong !

Inquire about insurance cost

Now let us say you like to deal only with A, D, F, G and H. Visit these companies’ websites and find out how much a term insurance for you costs. If you are 35 – look for a policy that will protect YOUR INCOME till the age of say 55 years (choosing age 65 will increase the premium) if your retirement age is 55.

However, if you think you will be earning till the age of 65 years, choose a 30-year plan.

Formalities to fulfill

If you are savvy and patient enough, you could fill up the form online – and a person will get in touch for the formalities. Or you could call up and ask for an agent. On an average the agent will not be very well qualified – but most of them will try to dissuade you from buying a term insurance.

Just say, ‘give me a term insurance form’. There will be other documentation like income proof (3 years IT return), one photograph, pan card etc.

#Filling the form

Next is the process of filling the form. This is one crucial thing that people are normally too lazy to do – so they delegate it to the agent. The life insurance form, the medical insurance form and the embarkation form when you are landing in the US or Israel should always be filled by you personally!

You know about yourself – not the agent whom you have just met. Many of them are worried that you will not be eligible to be insured. So in order to protect their commission (and to please you) will take short cuts, be careful.

#Fill details accurately

Every word, every column in the life insurance form is crucial – that is the reason why they are there in the form. All details should be accurately filled. Make sure that the name in your passport, pan card and the life insurance form are EXACTLY the same.

To the authorities K Balakrishnan is not the same as Balakrishnan Kumar. It may sound trivial, but let me assure you your nominee will not find it amusing.

Besides, check your height, weight (I have seen some agents argue with the doctor to show a few kilograms less and some doctors oblige!), number of cigarettes you smoke, the amount of alcohol you drink, parents illnesses before they were 65, and also your own medical history.

Watch this video to know the steps to buy LIC term insurance plan online:

Faith binds customer, insurer

Let us start from the very beginning. The Life insurance form that you are filling in is called a ‘Proposal form’ – which means you are proposing that you want a life insurance cover. Life insurance business is based on utmost good faith.

The Latin word for utmost good faith is Uberrimae Fidei – which means you (the applicant) is under a basic duty to disclose all material facts and surrounding circumstances that could influence the decision of the other party (the insurance company) to enter the agreement.

Non-disclosure or a partial-disclosure makes such agreements voidable – the insurance company can choose to ignore it, but they have a right to cancel the contract.

As per the contract, you are proposing and giving all your details that are asked for in the form. This includes your age, height, weight, your smoking and alcohol consumption habits.

#Be Truthful

You should be truthful because of two reasons – one it is necessary to be truthful. The second perhaps the more important reason is when you are not truthful and you were to die, your nominee will not get any money. If a person has taken a policy just say 8 months before the claim happens, there is almost a 100 per cent chance that the claim will be investigated.

Here the company literally looks at the application with a fine comb and anything that has not been correctly stated will be used against the claimant.

If for example: A person dies in a road accident – and what has been hidden was say blood pressure – Insurance companies have said ‘his blood pressure may have caused him some inconvenience while crossing the road…’

Think about your nominee

One very important thing which most life insurance buyers forget is that by lying on the proposal form they are telling a lie to their nominee, not to the life insurance company! If on death the claim amount is not paid (IMMEDIATELY), it is almost like the policy did not exist.

Cross-check copy of application form

Apart from the critical questions, there are some other questions like caste, spouse’s name, spouse’s occupation and children’s names, especially if the nominee is more than one person.

When the company issues a policy, they are bound to send you a copy of the application form – please check whether it is the same form which you had filled. A while ago I heard of a case where the agent had changed the form – and removed the illness clauses before submitting the application to the company.

As the case involved an employee of the company – the critical illness claim was paid without a murmur. What helped was the fact that the client had kept a copy of the application!

Take your time

Please remember even if you are paying a small premium (term premiums are not large), the sum assured is normally a critical amount and your dependents are waiting for that cheque to carry on their lives. It is quite all right for a person to spend some more time while taking a policy but any delay at the time of claim settlement is bound to unnerve the dependents.

Everything that you say in the form – your job, income, past illnesses are all critical to the whole process of underwriting of your policy. The life insurance company also collects data – if it finds that a certain occupation is prone to a particular type of illness, they may ask you to go through some more tests before they issue a policy.

Understand the contract

There is a big difference between a mutual fund ‘investment’ and a ‘life-insurance’ contract. In case of a mutual fund, the asset management company is making an ‘Offer’ to you. This means if you issue a valid cheque, units will be allotted to you. They are making the offer, and you are accepting.

In case of an insurance contract, you are ‘Proposing’ saying that you want life insurance. If your cheque goes through, then the life insurance company calls you for a financial and a medical underwriting process.

If they are satisfied that your life is a normal life, they will issue you a policy. Once a policy is issued by the company it means you have a contract that is binding. On you the liability is to pay the premium regularly, and on them is a duty that in case of death, they should pay the sum assured amount to the nominee.

This is critical and a very important contract which you should understand reasonably well.

Conclusion

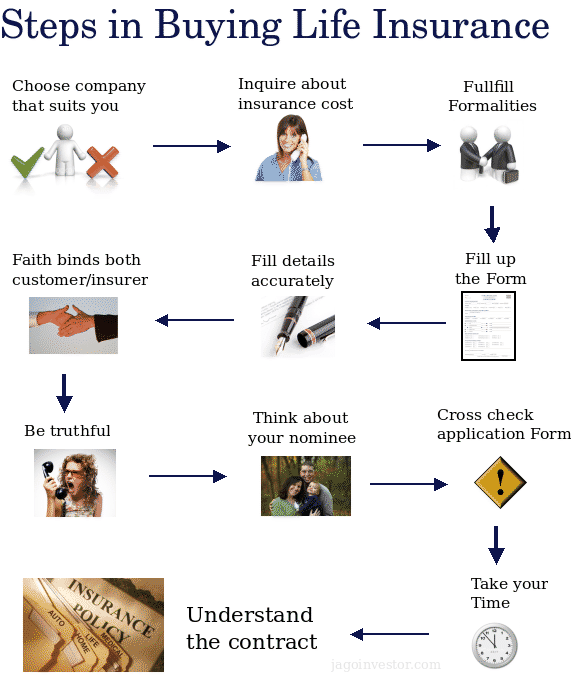

Life Insurance is an important decision in life and each step in this whole process is critical to make the whole decision successful and free of any hassles later. Lets look at the whole steps once again through the diagram.

(This article appeared on moneymantra.co.in and has been republished on this blog with their permission. The article is written by PV Subramanyam who also blogs at www.subramoney.com)

October 17, 2010

October 17, 2010

The correct policy name is “PNB Metlife Mera Tera Term Plan “

PNB Metlife Mera Term Plan launched recently pls advise if this is a good Term policy to buy as it has many features which are new in any term insurance product till date also what is your take on this company as their claim settlement ratio is around 90% ?

Yes, you can go for it

Thanks @Jagoinvestor Chouhan, Muthu Krishnan V, AJ.

As you said, any effort is worth it as the insurance amount would now mean a new life for them. I’ll ask her to work in that direction. Hope she gets lucky with that!

Once again, thanks to you all.

Regards,

Nisha

Welcome

This is for a friend of mine who lost her husband about an year back. She knows he had a life insurance policy worth a few lakhs which would be a blessing in her present financial condition. But the issue is that she doesn’t know the policy details, not even the provider name and the scheme.

It is certain that she is the nominee, but she has no documents of the policy. Is there any way she can get it? Could there be a central database from where she can find out the policy number, provider and scheme?

Hoping to hear from you,

Regards,

Nisha

Thats sad to know . This is exactly the reason I tell others to make sure they have arranged and organised their documents .. One has to create several folders and arrange things neatly into it, what do you say ?

True! We never know the value of organised safekeeping till a crisis happens.

But for now, is there a way she can retrieve information on the policies that her husband held? Any idea?

Regards,

Nisha

No , I dont think there is any way other than finding it in locker or at home !

check the bank statements or credit card statements. He must have paid the premium online/through cheque and there should be an entry. The insurance company can be found out from that entry and they should be able to pull out the details using this transaction.

Like Muthu Krishna V said you can check the statements, this will certainly give the leads. Worst case you can check with all major insurance companies and considering the circumstances they will be able to help. Lengthy and long process, but the insurance amount is something that one would need at this point of time.

Do write to me on [email protected]

It’s possible but not sure. Will need some details of the policy holder. Will try to work out something.

Nisha , check this comment http://jagoinvestor.dev.diginnovators.site/2014/03/how-i-arranged-my-financial-life.html#comment-137022

Thanks Dharm, will mail you.

@Jagoinvestor, thanks for sharing this on your blog. Hope it acts as a trigger to others like me so that we become more organised in our document management.

Regards,

Nisha

It seems people over 32 -35 year are more taking term insurance.but i am 27 year old so thinking weather it will be any beneficial ? rather than taking on 32- 35 years.

If you die in next 1-2 yr, will anyone be affected financially or not . If YES is teh answer, you take it ,else wait !

god forbid, you contract some illness/disease, insurance companies may not be willing to provide insurance for certain types. better to take insurance when one is young and healthy.

Hi Manish,

I like your comments very much. you doing a great job for all of us.

I need a advice from you.

I’m 28 yrs old and I want to take a 15 lakh term insurance for 25 years.

which is better for me in followings criteria (Goods Service & Premium):-

1-Kotak

2-HDFC

3-Aviva (minimum S.A. 25 lakh)

4-India First

Awaiting your prompt valuble reply.

regards

Sandeep Awasthi

I would recommend Kotak or Aviva first and then HDFC

thanks manish bhai

Hi,

This is not reg. life insurance but general insurance. I came to know that we can select our options to be covered in the insurance policy and get rid of unused ones, there by reducing premiums.

Any updates from your side

Really ? Where have you heard this , THis is something new to me !

Hi Manish,

I like your site, a lot of useful info. I need a bit of advice from you.

I’m 30 yrs old and I had LIC Jeevan Anand Policy for 20 yrs 3 years ago (premium a little less than Rs.49K p.a.). Now I know how you feel about endowment plans, but just hear me out.

For further investment

I want to take out a term plan along which would provide a cover of say 1 Cr. (approx premium 7-8k p.a.)

+

I would like to invest in PPF, I plan to start with around 48k p.a. for now and would later on increase the amount as and when my salary goes up.

Later on when the PPF matures I plan to open FD with part of the matured sum.

My goal is to secure my family (wife + 2 kids) in the future, whether I survive for a long period or not. In other words I’m trying to chalk out a win-win plan.

Do you think I’m headed in the right direction

or am I digging my own grave?

Please advise (be brutal if needed)…

Thanks

Yes . .you are thinking in right direction . Term + FD or PPF combination would be great .. Better put that 49k which you are putting in LIC in PPF only

Hi Manish,

Thanks for the reply…

I’ll explore my options of converting the LIC into a paid up policy and maybe put a larger sum inPPF (not that I have much faith but lets hope the govt. doesn’t drop rates for PPF)

Thanks for the advice again….

Wriju

HI Manish

Its been 2-3 months that i have been reading articles from your website. and I must compliment you and your team for such a great job.

These days, whenever i have some doubt regarding any investment options or insurance, i tried to find articles in your website and usually find 3-4 articles which complete erase every doubts I have.

Reading your articles only had helped me to realise how important is a Term Plan.

I will be taking a term plan by this month and i have selected HDFC Life CLICK 2 PROTECT plan.

and BTW.. I bought book written by you.. ” JAGO INVESTOR”.. ..these days just going through it.

Regards

Vivek Rawat

Nice to hear that .. would like to hear your review on the book

Thanks Manish for the prompt clarification.

Manish Bhai,

are you sure that he does not need to disclose his changed habits of smoking and drinking? I doubt. Because an Insured is supposed to intimate even the minutest detail, like change in telephone no, though the reason is different altogether. But an Insured is supposed to get himself updated with the Insurer. If at the time of Claim, the Insurer finds out that the Insured had died of ,say, Lung Cancer due to his excessive smoking habits which he has grown up lately; but the Insured has declared that He is a non smoker; would they settle the Claim? I Doubt. Same goes if the Insured has become involved with a more hazardous profession during the Policy Tenure. Please correct me if I am wrong. Please reply……….

Hi Manish,

This site is the place where I can find the facts not never disclosed by convincing ads of financial products, Agents, Fund houses!! Current archive of articles are excellent for financial literacy (also keeping cheaters away) for non finance people like us. In some articles discussions at the end became equally rich as the article. Thanks for your effort.

Let me clarify something from you about term policy:

Q1> I got term policy on 2005. Then I was not a smoker, didn’t take alcohol. After 2007 I developed the habit for both. Should I need to inform the insurer? Will they revise the premium then?

Q2> On 2005 my employer were hazardous chemical makers. My agent declared the same. So it must have some loading effect in premium. Now I am working for IT industry. Should I inform the same to my insurer? Will that reduce my premium?

Q3> Now I am planning another term policy from same insurer. This time I am going to fill up the form myself and disclose all the facts(credit goes to your advice of being honest with insurance company). But in that case work-place, smoking-alcohol habit will be contradictory declaration if compared with my previous policy (or may be not as I signed the form with date then and on that date those facts were true). Please clarify.

Q4> What is the procedure for getting the copy of application form. Because with application form I didn’t get any?

Q5> Why insurance company hides the calculation of final premium. May the are complicated. But common man goes through same degree of complicated information in any IPO/MF/Right issue forms and got habituated with them. Basically those calculations should be a risk quantification process plus some profit/charges for the company. If nothing is fishy why they don’t declare it ? or may be they are waiting for IRDA to make them do it!!

Please clarify these five questions separately and if possible with links of relevant IRDA/company practices.

BKM

BKM

1. NO you didnt need to inform anyone

2. NO , they will not reduce it , the better thing would be to close the old policy and take a new one , check if the premiums today are lower than your current premium or not

3. No , it does not matter .. you always give declaration as per today terms . it would be different from old policy , but thats ok .

4. Which application form ? Ask from agent

5. they dont declare it becasue you will never understand it . its a detailed actuarial process ,not so straight forward .

Manish

Hi Manish,

Thanks for sharing such a useful info. regarding term insurance and updating how useful term insurance could be for a person and his family.

I would like to know one more thing. Will the prospective insuree needs to pay any amount upfront (say intial premium) to the insurer co. before medical tests or the final decided premium amount would be paid on the basis of tests outcome?

Dheeraj

Yes , mostly you make the payment and then loading information is known ,thats irritating i know 🙂

Thanks for the clarity Manish…..

hello manish,

for doctor person(35y) of income 60,000/month with one child(2y) and working doctor wife(30y),

with no medical ilness ,drinking(monthly one pack) ,smoking(no) habbits,

q1.what factors are important in selecting company for term plan.

q2.can u suggest us company suitable for us for erm plan..

q3. why they dont disqualify the application at time of applying for wrong information rather doing it after death . is there any policy we can rely for sure will help dependent after death .

Amit

You can go for LIC or kotak . Make sure u fill up the right info

Thank You. Will do so.

Thanks Manish. I had taken for investment too. Shall i exit ?

Rajshekar

If you have just taken it and not using switching facility in it and you dont know how to do it and when ! . Better get into more simpler products !

Manish

Dear Manish,

I have an Birla Sunlife FlexiPlus ULIP with annual premium of 1,20,000/- (monthly 10k being paid) that was bought in Mar2007. So till date i have paid 4,60,000/- (have not switched from the beginning it is Enhancer fund -23lakh sum assured). However the present value is still 3,50,000/- only. I feel there is no use in continuing further (as i am taking a iProtect Term Insurance for 50lakhs). Please let me know should i exist or continue for some more period.

Thanks

Regards

Rajshekar

Rajshekar

If you had taken it only for insurance , then you can quit it and use future premiums for a better use . seems like too much allocation charges in this fund

Manish

i am basically from bharuch, Gujarat and logged policy in surat.

Right now i am out of country and as u know it is ulmost not possible to get policy from abroad.

Since long i am waiting for ULIP and Term+MF comparison. Specially after new IRDA rules after September. Dont you think ULIP is better option after Sept. ( considering my case where company is asking 17K for 50 lac sum assured for 30 year term plan.

Your advice is most valuable for me.

Regards

Jig

Hello Manish,

Surprised with no comment/suggestion from your side. well it is obvious from your side as you must be answering no. of person’s queries ASAP.

I am just waiting for your reply as your opinions/suggestions really does matter for me.

Regards

Jig

17k premium for term plan or ULIP ? If its term plan then see if that is the competitve price of not ? What is your age ?

Manish

Hello Dear,

17 K for 50 lac term plan for 30 year term. present my age is 30.

Company quote me for 17k after medical. Initially on website i caclucated about 11.5K for the same.

Very openly telling you the incident. One of the company guy suggest me to not filling up the smoking or drinking habit in form. the reason there is an IRDA rule that company has 2 years time to varify the reason of death if the death occur within 2 years of the policy. then after in any case company has no option/exuce to reject the claim. ( As they have 2 years time for checking all the details. )

How it sounds like???

Are you working on comparison with ULIP? ULIP can give now 100 times of premium life cover also. Is it true?

thanks for your reply once again.

Regards

Jig

No , I dont think you should do that . Mis-stating the facts will not help in anyways . that 2 yrs rule will not apply this part where a customer deliberately gives wrong information . Also what do you do if you die within 2 yrs?

Manish

Jig

I confirmed that the 2 yrs rule only applies on small mistakes which are defined as list of things . But such a big mistake is not covered in that , so dont do that

Manish

Manish,

How i track my posts? i am writing my exp below.you can shift it to the suitable blog post. i forgot where i put comments last regarding this .

well i like to share the info that i was very much impressed with kotak insurance so far. they keep their mouth word. As soon as i arrived in india they followed up for my request. So far i submitted my documents.

After excellent learning from this posts, i filled up form and surprised by the words of sales manager of city (such kind of filled up form he has seen first time). yep as i mentioned all details including tobacco & liquar, there are two seperate form customer need to sign with those details. even if we work inchemical company, it is always suggested to mention seperately. as there is a seperate signing form for hazardous working area.

Well but this all they followed up very well within very short period . ( i have limited time as need to go abroad back ) and soon i ll be called for medical( next 2 to 3 days).

Thanks Manish for sharing knowledge and educating the ppls.

Njy

Jig

Khatri

Great to hear that 🙂 . I am honoured that it has helped you so much 🙂

Hello Manish,

I think all private players are same. Yep i am taking my words back as got disppointed with KOTAK after waiting for a complete month and ending with cancellation of policy.

i have appeared for medical and after that i have called 2 to 3 times to signing documents which i did whenever asked.

now when time came to fly out of country , i still didnt get policy in hand. suprised when i got msg on my mobile on 28 nov to submit and sign one more form request by kotak, so i contact company guy directly. after long discussion with them, i came to know that they want to raise premium on medical basis.

Initially they were asking 11400 and they asked me to pay 5600 more on that for getting 50 lac coverage.

I didnt accept it and finally apply for cancellation.

the main reason for disppointment is i have asked a lady over mail communication before flying to india for any documentation required. i have filled up form clearly mentioning i am taking tobacco and liquour. even KOTAK has different premium for smoker and non smoker. now when after declaring i am smoker, how again they change the premium.

either there must be a single premium for all and later on medical basis they should raise the premium . but they have already different premium rate for smoker and non smoker, they how they should raise the premium again?

well all this take complete one month and ending with no policy in hand.

i would prefer ULIP if i have to pay 17000 per month for getting term plan of 50 lac coverage. please tell me your suggestion on this.

Jig

I dont think you should let this affect your original decision of getting a term plan , these kind of bad experience happens sometimes . Apply for some other term plan , get a good agent who helps you in getting the policy faster , which city are you in ?

Companies are not in obligation to give you a premium number before hand , even though they have illustration of smoker and non-smoker , the final premium is based on the declaration by you on what all habits you have like taking tobacco , alcohal or smoking .

Dont get frustrated and get into wrong things which you might not understand . Term insurance is the answer for you , get it SOME HOW !

Manish

hi manish

dude you are great and you have unbreakable knowledge abt life insurance

Coz i’m also working in life insurance industry bt the things you have for life insurance was fabulas and we wish you good luck for your bright future……

Satish

Thanks for the compliment 🙂

Manish

Very simple article. Most of the us dont do proper research for insurance policy. We purchase it in haste just to save tax and that at agent’s advice. Though internet has made research work a lot more easier then previous days.

Great to hear that 🙂 . Spread the knowledge

Manish