How to Open a PPF account at SBI Bank

Most of us want to open a PPF account, but keep postponing it just because we don’t know the requirement of doing so? It seen that majority people open their PPF account with State Bank of India. Let us see 3 easy steps of opening a PPF account in SBI branch. The whole process does not take more than 30-45 minutes if you prepared in advance and go with all the documents that are required and there are no road blocks in between. The biggest advantage of opening the PPF account with SBI is the online transaction facility you can use to deposit in your PPF account online and dont have to rush to the branch every now and then. Read why you should open a PPF account in SBI even if you dont need it right now.

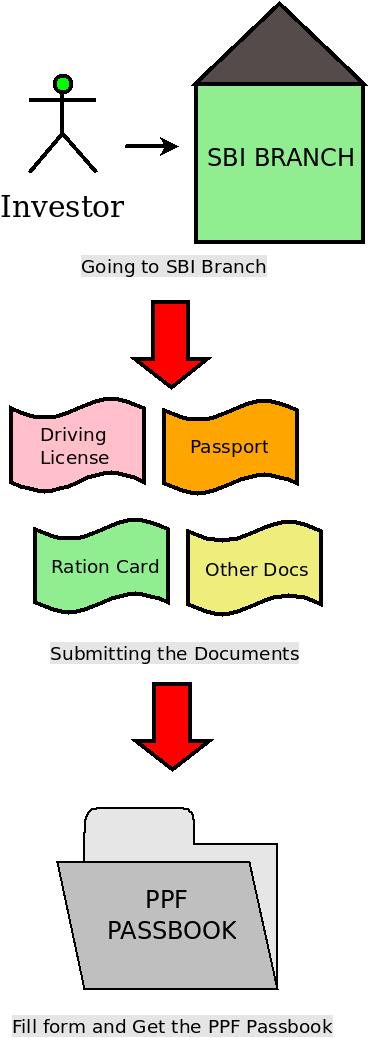

3 Steps of Opening a PPF Account in SBI Bank

1) Choose a SBI branch which is authorized to go government business.

Usually any ‘large’ branch with lots of customers should be able to this! Usually newer and smaller branches may not have this clearance facility. One doesn’t need to have a Saving Bank account in that branch. Locate your nearest SBI Branch using this

2) Procure and submit PPF account opening form and Identity/address Proofs

It would only 3 minutes to fill. Choose a nominee and get a witness signature. Now you have to submit anyone of following Proofs.

- Passport

- Pan card

- Driving license

- Voter id

- Ration card

- Two Passport Size Photographs

Any government issued identity card or address proof should work. Keep originals for proof in hand to simplify the verification if needed. That’s it. The bank should now be able to open the account. Usually it may take about 20 minutes or so.

3) Get PPF Passbook

A pay-in slip needs to be filled and the initial subscription needs to be credited into your account. A passbook similar to a Saving Book passbook will be issued with your photo affixed and the nominee’s name stated. PPF rules can be found on the back. This is all, your PPF account in SBI is opened now.

How to Link your Online SBI Account to SBI PPF account for Online Transaction

If you have an online SBI account, you can add the PPF account as a third party account for transferring money directly. As mentioned above the PPF account can be in any SBI branch. There are no processing charges for doing this transfer. When you do this online for the first time, go to the bank and update your PPF passbook and check if the transaction has occurred correctly. This has to be done since you cannot look at the amount in the PPF account as yet in SBI. This is a major drawback of SBI-PPF (and post office) accounts.

A standing instruction maybe issued from your online account for auto-credit to PPF. However there are two disadvantages

- Rarely there maybe system failures and the standing instruction may not get honoured. So you need to check if it has occurred.

- You cannot subscribe a lower amount if you need the cash for emergency use (this situation wont arise if you had an emergency fund )

- You need to go to the bank to cancel the standing instruction .

There are only 12 credit transaction allowed per year. So take care of this before issuing a standing instruction.

How to Transfer your PPF account from One Bank to Another

- Go to the branch where you want to transfer your PPF account and deposit an application with your PPF passbook

- takes 10-15 minutes

How to Submit Proof for Tax

Take xerox of the PPF passbook updated with all transactions and get it attested in the branch. (not sure if the attestation is really required) [ Update 5th Feb, thanks for Mithilesh ]

Other points to Consider

Subscriptions must be made before the 5th of every month for the amount to taken into account for interest calculation for that month. If you want to open a PPF accoun in the name of a minor in addition to yours, the total PPF investment limit is Rs. 1,00,000. The total tax benefit is also the same. This is a new rule and is not yet printed in the PPF passbooks! See Here, Here and Here for more detail

Comments please. Are you going to Open a PPF accoun this year? Do you feel one should open a PPF account at Post Office?

February 4, 2010

February 4, 2010