Friendship and Marriage, are two important things in our life .. The principles of good Friendship and good Marriage also apply in Investing also.

Whether its Mutual funds OR Direct Equity. key is having Small group of good friends (Mutual funds) and giving enough time and trust to your Partner to have a long lasting and successful Marriage( Mutual Funds or Stock Investing).

Friendship

“One loyal friend is better than ten thousand family members.”

We should have some good quality friends who are there with us for long term . They are not 1 month or 2 month friends, they are friends who are there us for long term, like Years !!

There are some people who we need to make friends with but for short term, may be because they are there for us for small time or they are good with us for short term, once they show there true colors, better search for better ones, Its too difficult to change nature of a friend.

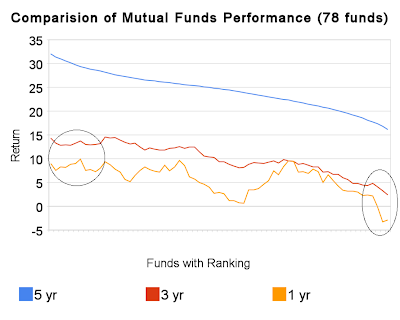

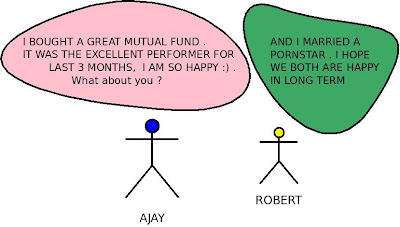

Mutual Funds are like Friends, Have less of them and have long term friendship, There are many people/Mutual Funds, which look very attractive in short term, they will be very nice to you, will give amazing returns to you in 3 month or 1 month, and this will attract you, make you feel that “he/she is a good one”, but give some time and they show you the true colors.

Just like you need to have 2-3 very good friends, they same way have just 4-5 very good Mutual funds, whom you have seen for long term, reviewed from some website (valueresearchonline), have done your own study and saw there long term performance (5+ yrs). You have to understanding long term performance of Equity.

If you have 5 friends, still there are thousands of other people who can become your good friend if you give time and spend some effort, but that does not mean that you will leave your old friends and start making new friends with others every year.

You have to understand that there will always be some people who are good, potential friends, but you have to skip them and not think about them. Just concentrate on your current friends and deepen your friendship with current one’s.

The same way, there are hundreds of mutual funds in market and you cant just choose the best of them, All are good and potential long term investments, all you can do is to choose some of them and develop a long term relationship with them, understand them, Trust them in bad times and be with them, Juggling between friends will leave you no where but with an impression that you are choosing the best.

Therefore, just have 2-3 Friends and 4-5 good Mutual funds (max 6-7) .

Tip : So if you have more than 6-7 mutual funds in total, Better say bye bye to some of them, not because they are bad, but because you cannot give proper attention to all of them. Have some of them and have them for long.

Marriage

“The secret of a successful marriage is always a Secret”

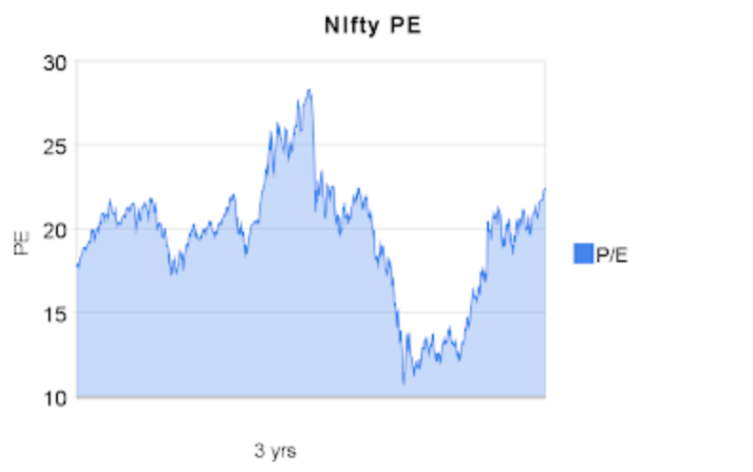

I have seen most of the Marriages/Relationship breaking or “on the rocks” f0r mainly one reason, “Not giving enough time to understand the other person”. This is my view.

Most of the people be in a Relationship/ Marriage and within months or maximum 1 year, Judge the person and loose patience. They do not give appropriate time to the other person to actually show their real face. Everyone in this world has many different faces/moods and you cant know a person in a short span of time, You have to give them time and trust them that they can be your dream spouse.

There are good and bad times in Marriage , You see both the times and have to trust your partner in bad times also, that there will be some time in future when you will see good days too, provided that you have chosen your partner carefully. There are times when you are there with wrong person and then you have to suffer all your life :).

I have seen many people do similar kind of mistake with there mutual funds and shares, If their mutual funds and shares have given good return, Great !! If they do down in some loss without giving them any returns in start, They are just “Bad mutual funds”.

What you have to understand is that you have to give enough time to your mutual funds to see their actual performance and what they have to offer. Good and bad times come and go, You have to trust your Mutual funds or shares. See list of Best Mutual funds for 2009

“Take time to choose your partner and after that, be with them, trust them, grow with them, Talk to them, try to understand them, and communicate, DON’T second guess and suspect there performance”

Tip : If your mutual funds have given bad returns or less than expected return, ask your self, if you have choosen them after lot of consideration and trust, If not, remove them, if Yes, then dont worry, give them time, they will come up with the returns you have expected from them, they just need some time to show what they are 🙂 .

Comments

Let me know what you think about this, Can you suggest something else which teaches us from real life about investing.

Note : I will be in Delhi for 4 days from 22nd – 25th and then back to Bangalore on 26th 🙂