Understanding Demat and Trading account relationship

Some of the beginners to online stock trading do not understand relationship between Share Trading account and Demat Account . In this short article lets see the relationship between Demat account , Trading Account and your Bank Account . We will also see how many trading or Demat account you can have in total .

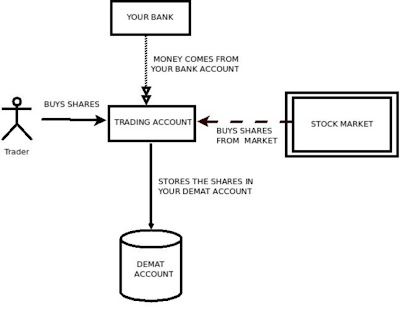

Work Flow

Below is a short chart where I have tried to give the flow when you buy a share . click to Enlarge

Demat Account : Account where your Shares are stored in electronic form .

Trading Account : An account which is used to place orders for Buying and Selling of shares .

So Trading account is an interface between your Bank account and your Demat account , when you buy something , Trading account takes money from your Bank Account (Its already taken from your Bank account and saved in Trading account) and buys shares and stores it in your Demat account . When you Sell something , Your trading account takes back the shares from your Demat account and Sells them in Stock Market and get back the money and that goes back to your Bank account (actually you manually transfer it to Bank account from Trading account most of the times .

Question : Does any one know maximum how many demat account can one open ?

September 5, 2009

September 5, 2009

I have trading account and demat account with SBI. Now can I change my trading account to any other company like Share Khan, Ventura etc keeping demat account same with SBI?

Yes

Thanks Manish Jee

I had opened a DEMAT account with an institution at 2011.I haven’t done any transaction and didn’t closed the demat account.

It is in deactivated status.I don’t want to pay the AMC for the same.I would like to know what are the consequence if i don’t close it and keep it like that.

1.Will that account be deleted once it becomes dormant

2.Do need to close the account.

I am not interested pay any AMC and they don’t have any ECS activated for the charges

Hi satish

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Does any one know maximum how many demat accounts & trading accounts can one open?

There is no limit I Guess

I have recently closed my hdfc demat account.They informed me by email …I just want to know e trading account is also closed by closing demat account

Yes mostly

I want to trading. tell me what is what is the whole process of trading after opening the demat account

If you can send us your phone , we can connect you to our trusted partner on this .

Since i was changing my resident status, ICICI suggested me to close the domestic trading account (keeping demat account active). This enables ICICI to convert my domestic savings account to NRO and open a new NRE account. I am told that i should now open PINS and Non-PINS accounts now and link the domestic demat account to the Non-PINS (NRO). When i look into the AMC for the PINS and Non-PINS, it is extremely costly. I am not an active trader anymore – hence, is it possible for me to keep the demat account active with holdings for a period of time – and open the PINS/Non-PINS when i would like to sell these shares – which may be a few years later? Also will i continue to pay the AMC charges for the demat account with my holdings?

I have limited knowledge on this , hence cant comment

Just 3 years ago I had open a trading a/c with hdfc security I took place single trade to buy then no transaction in it till today. The hdfc is charged me AMC in my hdfc linked saving a/c which amount (approximately Rs.4000/-) are more than my investment of share (Rs.1000/-but market value is Rs.720/-)in that particular trading a/c . I want to close it, but they would be debited amount in my saving a/c. & say ur a/c had deposited the amount of dividend is shown transaction in it, which status of a/c is an automatically operation in it so u haven’t telling this , we have right to recover the charges from ur linked saving a/c. till u would be paying a charges to clear from these a/c.

May I close this a/c without paying any AMC ?

May I change my bank account from hdfc to another without paying any charges ?

May I change my trading a/c from hdfc to any other without paying AMC ?

Pls. Guide me. When I open my saving a/c to hdfc they says me it is totally free & 3in1 a/c in zero balance saving a/c, dmat a/c, & trading a/ c. Now they can’t accepted my request of closing all these 3 a/c till the payment of that charges. What should I do action in legal ways? Pls. Co-op with ur right advice.

If you have not closed demat account, the transaction charges will surely be deducted !

hello can any body has join the market research consultancy ,please tell me how was thair service please suggest realy they are make a frofit or just a froud service

1. I want to open DEMAT Ac & Trade ac. So who is giving less brokerage and customer service and security?

2. IF i m doing trade for 25k. How much brokerage have pay for that (min&Max. in market)?

Hey,

I want to open trading account and demat account to two different place.

Is valid or is it good option to have?

As in demat account i am looking for security while as trading account i am looking for fee.

so i thought let’s open two different account?

Please let me know your thoughts for same.

Thanks,

YEs, you can do that !

Hey, I am Ishan. I am 23 years. I want to do trading in shares and mutual funds. Please tell me the process. Please tell me difference between Shares and Mutual Fund? Please tell me the whole process of purchasing the Shares and MF.

You first have to open a demat account for that !

I am new to Investment ,my age is 22. I want to open demat account which is more suitable?

I came to know that ICICI Direct is a bit costlier

Yea, its a bit costlier ..

Hi Manish,

Very useful post, I got clear about demat and trading account. I have question. Can I transfer shares between demat accounts? and if yes what is the process and charges for that ?

Hi Baibhav

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Yes, you can transfer securities between demat accounts held with the same depository or other depiository. The same is termed as off-market transfer as Stock Exchanges’ intervention is not required in that case. You just need to fill up the Delivery Instruction Slip and mention proper account details of the destination account where securities need to be transferred.

And before we buy share/place order do we need to manually transfer the money from Bank account to Trading account?

Yes

Is trading account necessary along with DEMAT account?

Is there any alternative where in one has only demat account and start investing via some Mutual fund distributor or SEBI registered stock broker?

I am asking because I want to invest in RGESS and don’t want to pay additional annual maintenance fee/charges for trading account. I have seen SK etc opens free demat and trading account and start charging heavy maintenance charges from next year onwards just to keep the account open.

Could you please tell where I can open only demat account which is free from any other hidden charges (annual charges etc)

If you have any other good suggestions, please let us know.

hiii sir

i am alok from sharekhan i hav the answer of your question . if u r buying securities than it is compulsory to have a demat and trading account while not in the future and option trading no need to hv a demat by only trading u can trade in this segment . yes we opens demat and trading account absolutaly free of cost if u want to know more about our procedure please contact me

8130446223 alok kumar

thanks

Yes, you can do the transactions in demat form even through application

It’s completely your wish how you want to trade. You can either trade direct with the online trading account or can get it done through some agent.

As far as your concern about free Demat and trading account is related, you can get these opened for free, but the companies charge yearly maintenance fees for keeping your shares and other investments in the account. If anyone claims to offer free account, they are completely misguiding you.

Yes, you can reduce the fees by selecting discount service brokers like My Value Trade. It gives you access to multiple banks and allows trading in shares, commodities, derivatives and mutual funds from the same account.

After doing some research, came to know about Basic Service Demat Account (BSDA).

One can open BSDA account with any DPs and as per law they cannot levi annual maintenance charge for value holdings upto Rs 50,000. I have seen many DPs discourage or don’t share any information on BSDA facility to prospective new customers.

I have opened my BSDA account with SBICaps. When I visited their Demat account manager, they were reluctant to open one or giving one pretext or other, but after repeated insistence, they agreed. With this account there is no annual maintenance charge for trade upto Rs 50000.

If traded more than Rs 50000, then they have some slabs for Annual charges.

Anyways my purpose was for RGESS which allows investment upto Rs50000 and it satisfies well with this objective.

May be this information would be useful to someone.

Thanks for sharing that Vinod

Hi…thanks….

However, is it safe to open a trading account with a discount broker ???

If i have Rs. 1 Lakh in my trading account ie, RKSV and suppose if tmrw the company RKSV shuts down. I know that my demat shares are safe but, what will happen to my Rs. 1 Lakh with RKSV..??.. will i b able to recover it .. ???

Hi viraf

Thanks for asking your question. However we do not have answer to your question.

Manish

HI

i plan to open a demat with MotiLal & trading account with RKSV. I wanted to know 2 things.

1) Will i b able to sell my demat shares directly using RKSV account ?

2) If i have Rs. 1 Lakh in my trading account ie, RKSV and suppose if tmrw the company RKSV shuts down. I know that my demat shares are safe but, what will happen to my Rs. 1 Lakh with RKSV..??.. will i b able to recover it .. ???

Its suggested that you open it with someone where you have both demat and trading . Its much simple that way

Hi Manish

I have ICICI 3-in-1 account and recently I changed my trading account to RKSV while demat account is same. I have shares in my icici account which I want to sell. My question is, how do I transfer shares from icici account to RKSV trading account and once I transferred those shares, how long they will be in my trading account. Also what are the standard charges for shares transfer?

Thanks & Regards

Vishnu agrawal

Hi Vishnu

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

hi,

mai angel broking me dmat and trading a/c kholna chahta hu. unka kehna hai k pehle muje 25000 ka trading a.c kholna padega baad me chahe to aap apni paymnt apne s/b a.c me transfer kar sakte hai aisa hota hai kya,

or is ki jo brokerage hoti hai wo per share hoti hai ya?

It all depends on the rules of the demat provider. Its not standard rules

Dear if I am having a Demat AC with any bank …if by some reasons bank get closed or bankrupt what will happen to my holdings…pl reply

Your holdings are with the NSDL Or CSDL , so nothing will happen to your units

Thanks a lot sirji…