Do you know how you can use Hindu Undivided Family (HUF) to reduce your overall tax liability? In this article I will give you tips and real life examples on how you can use HUF to save taxes legally.

Before that let’s understand what HUF is.

The concept of HUF says that apart from individuals there is another separate entity called “Family” which can also have its own assets and liabilities and even regular source of income, which should be taxed separately.

For example :

If an ancestral residential property is rented out, then the rent arising would be considered as Family’s income and not as income of individual. In real life this rent is shown as income of one individual and he pays the tax on it, however a HUF can be formed and the rent can be shown as the whole family income (HUF) and it can be taxed separately.

Until a few years, many Indians used to keep multiple PAN cards and used to show Income under different PAN cards and used these tricks to avail the benefit of slab rates by showing themselves as different persons. This however is illegal by law and is a punishable offence as one person cannot have more than 1 PAN Card.

But, one legal way of obtaining an extra PAN Card is to form an HUF. As the Income of an HUF is taxable in the hands of HUF and not in the hands of any Individuals, a separate PAN Card is issued for an HUF and the benefit of income tax slab rates can be availed on this PAN Card.

Formation of HUF

A false impression amongst people is that HUF needs to be created whereas the truth is that an HUF comes automatically into existence at the time of marriage of an Individual and no formal action needs to be taken for the same.

However, in case a person who wants to specifically register for creating an HUF, he can furnish a creation deed on a stamp paper (The Format of Creation Deed can be downloaded from here).

As HUF is governed by the Hindu Law and not by the Income Tax Act, individuals belonging to other religions are not allowed to form HUF except Jain’s and Sikhs who can create HUF even though they are not governed by the Hindu Law. Two entities are extremely important for you to know in HUF are the coparceners and members.

Coparcener is someone who has the right to demand the share of the property of family; coparceners are generally the Karta (Main decision maker of family, usually the Father, but Manmohan Singh had 5 years ago brought an amendment which stated that Females can become Karta & there can be an all female HUF as well), then sons & daughters, grandsons and great grandsons in order of their first right.

Wife of the Karta is not a coparcener or even spouse are not coparceners and hence can’t demand/ ask for any share in HUF, they are just merely members of HUF.

Example of Tax Saving by forming an HUF

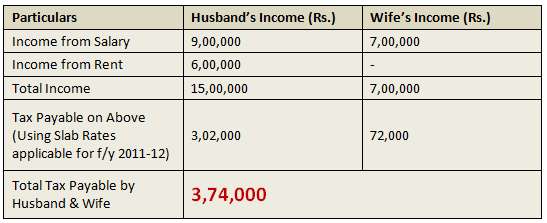

As discussed above, the main advantage of an HUF derives from the fact that an extra PAN Card is issued for the HUF. We’ll explain this tax saving benefit with the help of following example.

Lets say there are 4 members in a family

- Husband – Salary 9 lacs

- Wife – Salary 7 Lacs

- 2 Children without Salary

- Additionally, one ancestral property which fetches them an annual rent of 6 Lacs p.a

Now the Question is – In whose hands should this Rental Income of Rs. 6 Lakhs p.a. be taxed? In real life, the most sought after solution is to show the rent as income of wife or anyone who has no income or less income so that the tax liability is least. But is it the best solution?

Let’s see 3 different cases here in which this additional rental income can be shown and how tax can be saved!

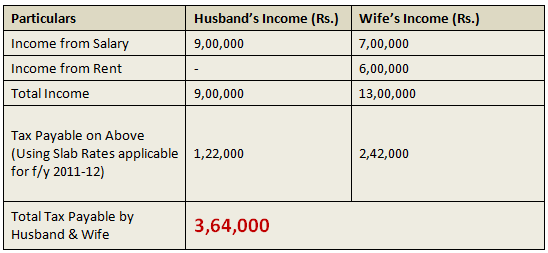

Option 1 – If this Rental Income is shown in the hands of the Husband.

Option 2 – If this Rental Income is shown in the hands of the Wife

As this Income is arising to the family as a whole, the Govt has also extended this option of taxing this Income in the hands of the whole Family. Although very few people in India know this fact family income can also be taxed in the hands of the whole family by forming an HUF.

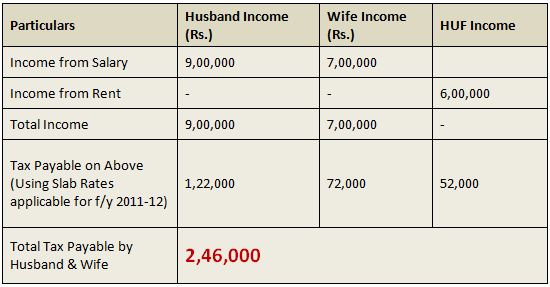

Option 3 – If this Rental Income is shown in the hands of the HUF

The above 3 options clearly indicate that Option 3 is the best option as the least tax would be payable by the family if the Rental Income is taxed in the hands of the HUF.

The tax saved by showing this income in the hands of the HUF is Rs.1,18,000 (i.e. difference between “tax paid if rental income is taxed in the hands of HUF” and the “tax paid if shown in the hands of the wife which is the 2nd best alternative”)

Please Note: For the sake of simplicity, Taxes have been computed without taking into account the “Deductions available under Section 80C“ and “Education Cess applicable on the Tax Payable”

Procedure to create HUF

These are the steps to create capital of a HUF.

- First one should open a bank account with the name of Hindu undivided family like “AJAY HUF” with a stamp, ID Proof and the proof of the members of the family of HUF.

- Important :- While opening a Bank Account in the name of HUF – Banks always ask for a rectangular stamp which states the name of the HUF and also the Karta who is signing it. A round stamp is not accepted as per RBI Circular. The same applies at the time of opening of bank account of Sole Proprietor as well.

- Next is to apply for PAN (Permanent Account Number) of the income tax.

- Now transfer money by gifts etc to HUF capital keeping in view the clubbing provisions and tax on gifts under Income tax act, Remember there is no Tax on gifts in kind though they may attract clubbing provisions in some cases.

3 real life tricks of saving taxes through HUF

1. Saving tax by getting gifts

One way of saving tax is by transferring the money received from strangers or family are taken as gifts in name of HUF. So if Ajay starts his HUF called “Ajay HUF” and he is getting some gifts from his father, friends or anyone else, he can ask them to give it to “Ajay HUF” and not Ajay itself.

That way the gift will be treated as income/asset of HUF and taxed separately.

One important point here, if some stranger is giving gift to HUF, there is a limit of Rs.50,000 on which no tax has to be paid, but actually it can go up to Rs 1.8 lacs as the taxable limit is that much, and if one also has to do investments of 1.2 lacs (total 80c limit), then one can afford to receive up to Rs.3 lacs of gifts in a financial year and there will be no tax liability at all.

2. Assign ancestral properties and wealth to HUF and invest it

If family is going to receive an ancestral property or any wealth, then it’s better to transfer it on HUF name so that whatever earnings happen in future in form of rental income or capital appreciation of assets becomes income of HUF itself and taxed in its own hands.

That way the total tax liability of family can be minimized.

3. Use HUF income for expenses and Insurance for Family

As HUF enjoys separate tax benefit under sec 80C, one can use the income of HUF for buying Life & health insurance for family and the permissible deductions can be availed for tax purpose in hands of HUF, so if the total premiums for insurance requirement of family is Rs.50,000 per year, then It can go from HUF income and also the individual can exhaust his 1 lac limit separately via PPF, ELSS and other tax instruments.

Also family day to day expenses can be used from HUF income and hence it will leave other members with more disposable income which one can use to service higher EMI’s if required.

Watch this video to learn more about HUF and Tax saving:

Some important Points you should know about HUF

- For creating the HUF one need to get married, there is no need to have child or children for creating the HUF.

- An HUF can recieve any amount in gift from bigger HUF’s (HUF of Father, HUF of Grandfather) or any gifts received by the members of HUF (birthday, marriage, etc.) can be treated as assets of HUF , but stranger can gift HUF, not more than 50000 rupees.

- Daughter also continues to be a Coparcener after her marriage of that family whether she also will be a member of HUF of her husband. So that way daughters can be co-parancers in two HUF’s 🙂

- HUF can pay remuneration to the KARTA of family for the interest and expenditure to run the family business.

Be cautious with HUF creation

While all the above points excites people on opening a HUF account immediately and start taking tax benefit, there are some caveats and one has to be little careful. Remember that HUF is a separate entity and represents the whole Family. So once some assets is assigned to HUF, then it becomes part of HUF only and one can be suddenly take money from HUF for personal purpose .

If other co-parceners of HUF demand the partition of HUF only then one can get his/her share of the HUF. Otherwise it will not break. Also for taxation point, a lot of people mislead the tax department buy using fake HUF transactions and therefore, HUF is looked with high degree of scepticism.

If the HUF is not formed properly and if the assets are income are fudged for evading tax, it can get you in trouble, therefore it’s highly advisable to hire a good CA and create your HUF in the best possible manner with right advice. There is no harm in paying 10,000-12,000 to a CA if HUF can give you 5-10 times tax savings.

It would be a great investment, not an expense!

HUF property cant be mentioned in the WILL

Though HUF is very useful tool but one has to use it very judiciously and thoughtfully. Don’t look for tax benefits only , but practical problems also. Be aware that you cannot make a will out of HUF property. Once transferred to HUF, the assets /property becomes of HUF and you no longer have any individual right on it.

To explain with example –

“A”, who has 2 daughters and a son.He long back ago purchased a house in the name of HUF and put that house on rent, so that the Rental income comes to HUF and will not be be added in his or his spouses’s income .

But now , he ‘s retired and wants that this property should be transferred to his son after his demise. But this is not possible as that property belongs to HUF. He can’t even write a WILL for HUF property and with the huge rise in Real estate prices, none of daughter is ready to leave her share in it.

Thanks to Manikaran Singhal to add this point

Who should actually go for HUF

HUF will be extremely efficient for those people who have a higher income and high saving rate and some form of ancestral assets which can be marked as “Family Assets”.

Evaluate if HUF can really give you that kind of tax advantage or not for people who do not have high salary or who do not have a big enough family. So make sure you can get the maximum out of the HUF and understand the limitations of opening HUF before you go for it.

This article has been authored by CA Karan Batra who blogs on charteredclub.com (Content added by Jagoinvestor with inputs from Karan)

Can you share how was the article and did it help you in understanding Hindu undivided Family? Are you going to open a HUF account?