Hindu Undivided Family – Save more tax by creating a HUF in India

Do you know how you can use Hindu Undivided Family (HUF) to reduce your overall tax liability? In this article I will give you tips and real life examples on how you can use HUF to save taxes legally.

Before that let’s understand what HUF is.

The concept of HUF says that apart from individuals there is another separate entity called “Family” which can also have its own assets and liabilities and even regular source of income, which should be taxed separately.

For example :

If an ancestral residential property is rented out, then the rent arising would be considered as Family’s income and not as income of individual. In real life this rent is shown as income of one individual and he pays the tax on it, however a HUF can be formed and the rent can be shown as the whole family income (HUF) and it can be taxed separately.

Until a few years, many Indians used to keep multiple PAN cards and used to show Income under different PAN cards and used these tricks to avail the benefit of slab rates by showing themselves as different persons. This however is illegal by law and is a punishable offence as one person cannot have more than 1 PAN Card.

But, one legal way of obtaining an extra PAN Card is to form an HUF. As the Income of an HUF is taxable in the hands of HUF and not in the hands of any Individuals, a separate PAN Card is issued for an HUF and the benefit of income tax slab rates can be availed on this PAN Card.

Formation of HUF

A false impression amongst people is that HUF needs to be created whereas the truth is that an HUF comes automatically into existence at the time of marriage of an Individual and no formal action needs to be taken for the same.

However, in case a person who wants to specifically register for creating an HUF, he can furnish a creation deed on a stamp paper (The Format of Creation Deed can be downloaded from here).

As HUF is governed by the Hindu Law and not by the Income Tax Act, individuals belonging to other religions are not allowed to form HUF except Jain’s and Sikhs who can create HUF even though they are not governed by the Hindu Law. Two entities are extremely important for you to know in HUF are the coparceners and members.

Coparcener is someone who has the right to demand the share of the property of family; coparceners are generally the Karta (Main decision maker of family, usually the Father, but Manmohan Singh had 5 years ago brought an amendment which stated that Females can become Karta & there can be an all female HUF as well), then sons & daughters, grandsons and great grandsons in order of their first right.

Wife of the Karta is not a coparcener or even spouse are not coparceners and hence can’t demand/ ask for any share in HUF, they are just merely members of HUF.

Example of Tax Saving by forming an HUF

As discussed above, the main advantage of an HUF derives from the fact that an extra PAN Card is issued for the HUF. We’ll explain this tax saving benefit with the help of following example.

Lets say there are 4 members in a family

- Husband – Salary 9 lacs

- Wife – Salary 7 Lacs

- 2 Children without Salary

- Additionally, one ancestral property which fetches them an annual rent of 6 Lacs p.a

Now the Question is – In whose hands should this Rental Income of Rs. 6 Lakhs p.a. be taxed? In real life, the most sought after solution is to show the rent as income of wife or anyone who has no income or less income so that the tax liability is least. But is it the best solution?

Let’s see 3 different cases here in which this additional rental income can be shown and how tax can be saved!

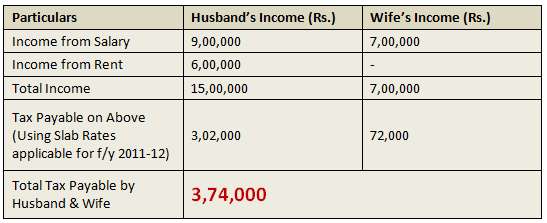

Option 1 – If this Rental Income is shown in the hands of the Husband.

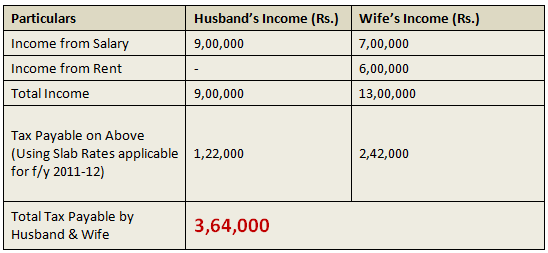

Option 2 – If this Rental Income is shown in the hands of the Wife

As this Income is arising to the family as a whole, the Govt has also extended this option of taxing this Income in the hands of the whole Family. Although very few people in India know this fact family income can also be taxed in the hands of the whole family by forming an HUF.

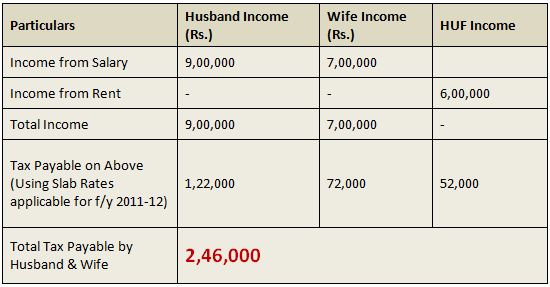

Option 3 – If this Rental Income is shown in the hands of the HUF

The above 3 options clearly indicate that Option 3 is the best option as the least tax would be payable by the family if the Rental Income is taxed in the hands of the HUF.

The tax saved by showing this income in the hands of the HUF is Rs.1,18,000 (i.e. difference between “tax paid if rental income is taxed in the hands of HUF” and the “tax paid if shown in the hands of the wife which is the 2nd best alternative”)

Please Note: For the sake of simplicity, Taxes have been computed without taking into account the “Deductions available under Section 80C“ and “Education Cess applicable on the Tax Payable”

Procedure to create HUF

These are the steps to create capital of a HUF.

- First one should open a bank account with the name of Hindu undivided family like “AJAY HUF” with a stamp, ID Proof and the proof of the members of the family of HUF.

- Important :- While opening a Bank Account in the name of HUF – Banks always ask for a rectangular stamp which states the name of the HUF and also the Karta who is signing it. A round stamp is not accepted as per RBI Circular. The same applies at the time of opening of bank account of Sole Proprietor as well.

- Next is to apply for PAN (Permanent Account Number) of the income tax.

- Now transfer money by gifts etc to HUF capital keeping in view the clubbing provisions and tax on gifts under Income tax act, Remember there is no Tax on gifts in kind though they may attract clubbing provisions in some cases.

3 real life tricks of saving taxes through HUF

1. Saving tax by getting gifts

One way of saving tax is by transferring the money received from strangers or family are taken as gifts in name of HUF. So if Ajay starts his HUF called “Ajay HUF” and he is getting some gifts from his father, friends or anyone else, he can ask them to give it to “Ajay HUF” and not Ajay itself.

That way the gift will be treated as income/asset of HUF and taxed separately.

One important point here, if some stranger is giving gift to HUF, there is a limit of Rs.50,000 on which no tax has to be paid, but actually it can go up to Rs 1.8 lacs as the taxable limit is that much, and if one also has to do investments of 1.2 lacs (total 80c limit), then one can afford to receive up to Rs.3 lacs of gifts in a financial year and there will be no tax liability at all.

2. Assign ancestral properties and wealth to HUF and invest it

If family is going to receive an ancestral property or any wealth, then it’s better to transfer it on HUF name so that whatever earnings happen in future in form of rental income or capital appreciation of assets becomes income of HUF itself and taxed in its own hands.

That way the total tax liability of family can be minimized.

3. Use HUF income for expenses and Insurance for Family

As HUF enjoys separate tax benefit under sec 80C, one can use the income of HUF for buying Life & health insurance for family and the permissible deductions can be availed for tax purpose in hands of HUF, so if the total premiums for insurance requirement of family is Rs.50,000 per year, then It can go from HUF income and also the individual can exhaust his 1 lac limit separately via PPF, ELSS and other tax instruments.

Also family day to day expenses can be used from HUF income and hence it will leave other members with more disposable income which one can use to service higher EMI’s if required.

Watch this video to learn more about HUF and Tax saving:

Some important Points you should know about HUF

- For creating the HUF one need to get married, there is no need to have child or children for creating the HUF.

- An HUF can recieve any amount in gift from bigger HUF’s (HUF of Father, HUF of Grandfather) or any gifts received by the members of HUF (birthday, marriage, etc.) can be treated as assets of HUF , but stranger can gift HUF, not more than 50000 rupees.

- Daughter also continues to be a Coparcener after her marriage of that family whether she also will be a member of HUF of her husband. So that way daughters can be co-parancers in two HUF’s 🙂

- HUF can pay remuneration to the KARTA of family for the interest and expenditure to run the family business.

Be cautious with HUF creation

While all the above points excites people on opening a HUF account immediately and start taking tax benefit, there are some caveats and one has to be little careful. Remember that HUF is a separate entity and represents the whole Family. So once some assets is assigned to HUF, then it becomes part of HUF only and one can be suddenly take money from HUF for personal purpose .

If other co-parceners of HUF demand the partition of HUF only then one can get his/her share of the HUF. Otherwise it will not break. Also for taxation point, a lot of people mislead the tax department buy using fake HUF transactions and therefore, HUF is looked with high degree of scepticism.

If the HUF is not formed properly and if the assets are income are fudged for evading tax, it can get you in trouble, therefore it’s highly advisable to hire a good CA and create your HUF in the best possible manner with right advice. There is no harm in paying 10,000-12,000 to a CA if HUF can give you 5-10 times tax savings.

It would be a great investment, not an expense!

HUF property cant be mentioned in the WILL

Though HUF is very useful tool but one has to use it very judiciously and thoughtfully. Don’t look for tax benefits only , but practical problems also. Be aware that you cannot make a will out of HUF property. Once transferred to HUF, the assets /property becomes of HUF and you no longer have any individual right on it.

To explain with example –

“A”, who has 2 daughters and a son.He long back ago purchased a house in the name of HUF and put that house on rent, so that the Rental income comes to HUF and will not be be added in his or his spouses’s income .

But now , he ‘s retired and wants that this property should be transferred to his son after his demise. But this is not possible as that property belongs to HUF. He can’t even write a WILL for HUF property and with the huge rise in Real estate prices, none of daughter is ready to leave her share in it.

Thanks to Manikaran Singhal to add this point

Who should actually go for HUF

HUF will be extremely efficient for those people who have a higher income and high saving rate and some form of ancestral assets which can be marked as “Family Assets”.

Evaluate if HUF can really give you that kind of tax advantage or not for people who do not have high salary or who do not have a big enough family. So make sure you can get the maximum out of the HUF and understand the limitations of opening HUF before you go for it.

This article has been authored by CA Karan Batra who blogs on charteredclub.com (Content added by Jagoinvestor with inputs from Karan)

Can you share how was the article and did it help you in understanding Hindu undivided Family? Are you going to open a HUF account?

October 3, 2011

October 3, 2011

Can government employee creates huf and starts business ?

Hi Sandip

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Sir, u have stated in the first part that wife will be a member and she can’t be a co-parcener, whereas in the last part u have stated that daughter can be co-parcener in two huf? Daughter can be Co-parcener in her father HUF and how she will be a co-parcener in her husband HUF ? pl clarify

Sir,

I want to know “How should I go about forming a company on HUF basis”? What are the things to be done? I have a plan to start a trading company dealing with products for domestic and international markets. I want to know to set up an organization in India which can get funds internally as well as internationally. How much time does it take to start functioning for such a company? and the expenses for the same.

Hi Krishnan

You can go in for legal advise regarding it.

I am salaried and have the following scenario. Let us assume I take out 5 lakhs from my salary income and transfer that to my HUF account, and create a 5 Lakh Fixed Deposit. Now if we assume that this 5 lakh FD fetches me an annual interest of say 20,000/-.

Now, will my tax liability be calculated on 20,000/- or 5,20,000/-.

Because if it is 20,000/- then there is a point for me to open an FD from HUF. But if it is 5,20,000/- then there is no point because I am already paying a tax on that 5 Lakh as TDS from Salary.

Please help.

Thanks

Nitin

Very well written article! I had a query though… I’m a salaried person employed by a firm. However, I do take part time lectures at a college and wanted to know if I can claim tax benefit of this income under HUF?

Hi Dilip

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/solutions/ca-services

Manish

My father had an individual PPF account. I was the nominee of the PPF account. He expired and since I was the nominee, I got the amount credited to my individual bank account. I want to make multiple fixed deposits. Please let me know if I can make these deposits under HUF PAN or my individual PAN.

You can use any PAN to do that. Depends on what is your requirement

Hi

As a life insurance premium for my Mom doesn’t under IT exemption, if I form HUF and shall I pay towards her premium.

Whether am I permissible to do that. Please suggets

I think premium payment for mother comes under IT exemption

Hi team, it was indeed an information served in breakfast plate… i coupd digest it all… 🙂

However i have a small scenario to clarify.

1. My Father had bought two houses at his native AMD now he has passed away and rent is collected by my elder brother bi annually. (obviously on behalf of my mother who’s alive)

2. My elder Brother has bought a House here in mumbai on his own and has rented that and lives in a rented small house himself.

3. My wife and I have also bought a house in navi mumbai now.

4. So overall we have Rent Flowing in from 3 houses and 2 new houses bought on loan from banks.

5. My wife and I earn approx 4 lacs each anually from our salaries and pay taxes as per slabs.

6. Can My Elder Brother (who is actually a Karta of the family) form an HUF and we all (listed below) be members of it, and will it benefit us (brother, my wife n me) in Saving our taxes.

List of Faimly Members:

A. Elder Brother

B. Sister in law

C. Elder daugher of brother

D. Younger daugher of brother

E. Youngest son of Brother

F. Our Mother

G. Me

H. My Wife

I. My Son

J. My Daughter

Awaiting for ur valued guidance or information.

Hi Yogesh

I wont be able to answer that due to limited understanding, Its better to consult a CA on this .

In huf, karta can pay his/her(self) insurance premium for his/her individual policy

suppose me and my wife has an individual income of rupees 7 lacs and 7 lacs each…. now we have formed an huf…

so can we show both incomes are of huf,with 7+7=14lacs income of the huf…..and pay tax of this 14 lacs through huf pan card only…….

Hi shivam

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

hi,

i put my flat on rant a rented person want to create a HUF in my rented property .should i allow him to create huf on my rented property ? pl. advise

No you should not

Please advise whether HUF can take a LIC policy if yes then who will be the beneficiary

I dont think they can take it

Hi,

I have made an HUF. I have a pan card and a bank acc .

I have 3 questions –

1) my father wants to gift some money to my HUF. Some tax consultants told me that this will come under clubbing provision. Your articke says otherwise. Please confirm that the rule is still valid.

2) do i need to prepare a gift deed for every gift that i get? Is there a format? Does it have to be on a stamp oaper? And notarized?

3) i stay in mumbai. Could you suggest a good tax consultant pls.

Gaurav.

I think you should go with the words of tax consultants only. We will not able to comment on this .

We have opened new HUF, whose member are myself my husband and my son. We both are salaried pay my individual income tax. I have a bigger chunk of investment into FD. The interest of the FD increases my tax liability . Can i dissolve the FD’s and move that money into the HUF and then create FD’s in the name of HUF to save tax.

Also what should be the right procedure to transfer the money into the HUF.

Hi Punam

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

We( Me and my wife) sold our apartment last and received funds which was put in bank FD’s. The apartment was bought under our individual pan cards.

We got our HUF pan card few days ago and wanted to understand, if we could transfer the FD funds to HUF and then create FD’s in HUF & save on taxes?

Thanks

Yes, you can do that

Were you able to transfer funds from your individual accounts to the HUF? Did you do this using gift to HUF or how exactly you moved your individual assets (the FD money)to HUF. I have a similar situation to handle , hence wanted to understand.

How do I apply for a Credit card on my HUF PAN?

I am not sure if thats possible

Dear Manish

can me and my wife open and HUF together without adding our sons.

If yes can my wife continue this HUF account after my death also?

srrk

I am not sure on this , talk to bank

I would like to understand from Life Insurance point of view. What if HUF is in the name of Father and members include his wife and daughter(got married). What if Insurance took in name of Daughter and premium is funded from the HUF Fund and after the death of Father what will be the status of HUF. 1. Will it be dissolved? or Continue. 2. Will the 2nd eldest person being mother be a Karta of the HUF in her Name? 3. Can Being a Female after death of Husband she can continue her HUF like after her death next Karta is her Daughter. As per Manmohan Singh new law only female members can form a HUF. Daughter dont have HUF at her in-laws side and she wants to continue with HUF in her name after the death of her mother (2nd eldest member after her father death).

B) If insurance is given on life of member of HUF (Wife & Daughter) funding is being done from HUF fund and as long as father is alive premium would be funded from HUF Fund after his death will the funding would discontinue?

As HUF is involved, I think you should consult a good CA on this

Hi,

Me and my wife both are working, and we dont have any extra income from ancestral property etc.

Will it help to open an HUF account, So far looks like HUF is good only if we have extra income directly in name of HUF, but in this case me and my wife both has separate income.

Please elaborate if there is any benefit of HUF in this case and if so, then what are those specific benefits.

Thanks in advance.

Hi Ashish

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

My father had a Huf account, now after he expired i am operating it in addition to my individual pan and drawing income in both. Please note i am not married yet. My question are:

1. If i transfer the income recieved directly in to HUF ac to my/other family member account for various purpose like paying bills, premium,.etc. Whose income will that be considered?

2. I have not informed IT dept. about transfer of HUf ownership except the bank .Is it ok?If not plz tell what to do?

3. Is tax limit for HUF is more then an individual?

Also a piece of advice your captcha code is far more difficult for humans forget about machines.

Hi kapilanand

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

Dear Kapil

1. Its better if you directly pay the expenses from HUF Account rather than transferring to your personal account.

2. You should inform this to the Tax Dept as well as the Karta will change.

3. The tax benefits for HUF are not more than the tax benefits to individuals.

I have a rental income 50% in my wife’s Name & 50% in my name. Can I transfer this rental income to my HUF.

Other than above , what other income can I transfer to HUF

By transfer if you mean you will take the income in HUF account directly, Then yes its a good idea . You can do that

If the property is in your name and the Rent is being received in the name of the HUF, this is a clear case of avoidance of tax and provisions of clubbing of income will apply in this case.

However, if the property is in the name of the HUF, then provisions of clubbing of income will not apply.