8 most Important Stock markets Rules that every beginner should follow

In this article we will discuss the 8 Key points which a new comer should understand before entering in the world of stock markets.

It may happen that you already have all of this in mind and you do understand them at a subconscious level but let’s go through them again and discuss it.

This is Part 3 of “How a newcomer should start in Stock Markets” series. Read Part 1 and Part 2 before reading this article. We have some so called Cosmic Rules in Stock Markets which if broken will eventually ruin your someday is not immediately.

Let’s see them very briefly.

1. Don’t put all your money in stock markets:

Never ever, put all your money in stock markets. If things go wrong you will be ruined for ever. If you have 50 Lacs and you choose to put all your money in markets because “you are sure that its going to double in 4 months” this means you are also saying that “I am ready to get ruined if the markets crash and goes down to 10 lacs”.

Most of the people like to see the first picture but don’t expect second one to happen even though probabilistic the second one is more likely to happen. Better look for “low risk-or-good” returns, rather than “fatal-or-exceptional” returns. Any money which you want to throw in trash can be used for such high risk Investing or trading.

2. Cut your losses Short:

I know telling you this gives no surety that you would follow this. It takes time to understand by making mistakes over and over again and learning from it. But still, “Cutting your losses short” is the “Rank 1” Rule in Stock Markets. One who can master this single rule can rule markets.

When you start making losses, your emotions come into play and it says to you “Its coming back and once its back to Rs XXX I will get out”. Don’t listen to it to this voice. The simple rule is “You were wrong, accept it and get out and look for something else” and its damn too tough to understand this in the initial stages.

Mistakes in Stock markets are fantastic if you learn from them. They are more valuable then the right things you do in markets.

3. Getting your priorities Right:

This means having clarity about who you are, what you want to do in markets, Read part 2 : ” Understanding What exactly you want to do in Stock Markets” for this.

4. Do not fight the Trend:

We know that markets move in zigzag fashion, up-down-up-down like this and its true. But some people wire this in mind in such a way that they always try to force market to reverse from its path and justify that it moves in up down fashion.

If markets are going up, in their subconscious mind they feel like markets will now reverse “because they move in zigzag fashion” and hence it should now reverse, this belief entices them to invest or trade in opposite direction. The interesting thing is that people don’t understand what encourages them to go against the trend.

My one and half years of trading experience (not very beautiful one) tells me that this is the reason why we do against the trend and once we control this, it can change our luck. There is no luck in stock markets, it’s simply your thinking. “Change your thinking, your luck will change”

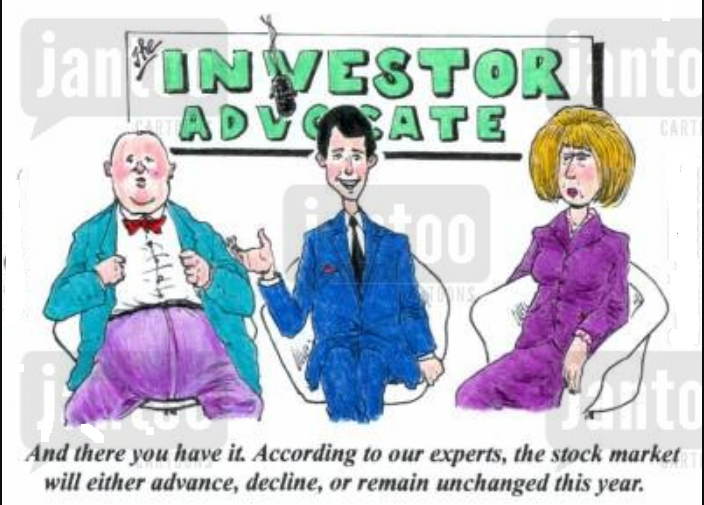

5. Everything is Probabilistic here:

“Buy RELIANCE above 255, Target 273, Stop loss at 245”. Now our Mr. Newcomer will read this in newspaper or listen it from the GOD a.k.a “Markets Expert on CNBC” and take the trade, things will go weird or may go the way predicted but most of the times things will go wrong.

He will be wondering who is wrong? Market? That expert on TV? His Dog? Mr Obama? whom to blame? Everyone in the world but not himself. He will never look inside himself. Everything is probabilistic here, Out of 100 times things may work 60-70% (depends) of time and not work rest of the times.

When it does not work, you have to control yourself and accept that its not working rather than forcing markets to work for you.

6. Don’t listen to Stock Markets Experts on TV:

Why do I say this? Markets “Calls” are least important things in Stock markets (i believe) and you only get that least important information from TV experts. What you don’t get is vital things like psychology to trade, Money management rules, Discipline to follow every time you take the trade. Those calls are in isolation.

They are not generated by a consistent rule, you can get calls from here and there and all of them will be kind of random to you. Other problem can be that you don’t know the time frame of the call. If you don’t understand all that I just told the easy way to understand is to answer this

- “If listening to TV experts was really worth, Why am I not making money”

- “How many people do you know who make living or earn exceptional returns by trading what experts tell them”

At last, the point is not that the ‘calls and advice’ works or not? They may work but not for you. There is lot more than getting calls and acting on them.

Another important thing why you should stay away and avoid listening to them is because most of their calls are for “forcing you to trade more” which will eventually generate more brokerage and commissions for trading companies.

Read this article from Shyam Pattabi to understand more on this.

Question : Why do experts give more of BUY calls and very less of “SELL” calls?

My Answer : When some one “SELLS”, he is out of trap, he is out of stock market, he pays commission once. But when Someone “BUYS”, he is trapped in markets, He already paid once and has to pay one more time to get out, so SELL = Commission 1 time and BUY = Commission twice for sure :), Ohh.. Did I discover something here 🙂

7. Have realistic Expectations:

One of the important reason for failure in stock markets is setting unrealistic goals. You see 100% made in a week, 50% in a year, 10% in a day and you think: If 10% is possible in a day or a week then 100% in a year is a child’s play OR you think like if I buy this I will sell only after its tripled.

Once again I say “We learn from History that we do not learn from History”. Have you seen what is the best long term returns from stock markets all over the world. That’s around 15%-20%. That’s it. I am not saying that you can’t get 50% in a year ever, you will get it and everybody gets it, but sometimes.

Over long term you should have expectations of 5-10% more than what safe instruments return or have a target of 4-5% more than what markets give. So anywhere from 12%-20% is good return to expect from long term. In short term there will be chances where you get exceptional returns like 50% in a week or 500% in a year.

But let them come to you don’t force them to happen. Unrealistic Expectations force us to meet them by hook or by crook and that’s when we do mistakes and take unnecessary risk to achieve them and burn out hands badly.

“Want to understand markets, have a girlfriend and try to understand her psychology. People who are already in relationship (males) have an edge I think as Markets and Girls are very much same”

8. Be ready to Make mistakes and Learn:

Some of the best Traders and Investors who are successful today and are multi-millionaires didn’t become one overnight. They Failed miserably in Markets but never quited. They learned, learned and learned from their mistakes. Markets like Life give us opportunity to make mistakes and learn.

As I like to say “Making Mistakes in a privilege which unsuccessful people don’t get in life”. Making mistakes is Great, if you are ready to learn from them.

Part 4 : A small Guide for newcomers in Stock Markets

Don’t forget to comment on which one was your favorite and why ? I am sure we can learn a lot from individual comments 🙂

June 25, 2009

June 25, 2009

Very important article for beginners like me who want to enter into trading. All your articles about trading very helpful.

Thansk for sharing ! .. Enter the trading , but always make sure you do not bully the market 🙂 . Markets are supreme !

Manish Bhai Based on your Article I would like to ask

How To Make Girlfriends?

Any Tips .

BEtter you dont make any 🙂

Really Appreciating !!!

I liked the way you have written the blog,. The writing is very interactive and purpose is also commendable.

Wonderful posting, hope to have more on this topic.

Well I am also providing free tips to my blog visitors and liked the topic “Everything is probablistic here”

Abhishek Nagpal

http:\yourstockquery.blogspot.com

[…] risk , You have to see potential losses , not just profits . This is a very common and one of the biggest mistake in stock markets , so big that it will be among the top mistakes investor and traders do . Buying more quantity was […]

[…] are others PartsPart 2 : Understanding What exactly you want to do in Stock MarketsPart 3 : 8 most Important Rules in Stock MarketPart 4 : A small Guide for newcomers in Stock […]

[…] of the beginners to online stock trading do not understand relationship between Share Trading account and Demat Account . In this short […]

[…] and can go up or down very soon , there is always risk of loosing a big chunk of your investment (Learn about Stock Markets) . Take a case where you want to invest 10 lacs in Equity Mutual funds and suddenly market crashes […]

Manish,

Basically I have a hybrid approach.

I am investing from a long term perspective and into trading as well, although not a very active trader and only trade in Stocks (not in EFT or Futures).

– Sachin

Sachin

Nice to know that .. what is your trading strategy ?

Manish

Hi Manish,

Commendable work done is various articles all over the website….

Good job, keep it up…

Following is very well said in this post:

“Want to understand markets, have a girlfriend and try to understand her psychology, People who are already in relationship (males) have an edge I think as Markets and Girls are very much same”

🙂

Regards,

Sachin

Sachin

Thanks for your first comment 🙂 . Seems like you are a trader yourself , right ?

Manish

thanks..learnt a lot from this…all the points are right..because some of them even striked me when I trade in markets..thanq..

@Kiran

Thanks man .. What were those points .. share with us

Manish

@Satyaseelan

Thanks P:) .. go over all the articles on stock market , i am sure you will like them 🙂

Manish

Hi, It is very useful post with good insight into the market. Thanks for sharing your wisdom.

Regards

Satyaseelan

I liked the fourth part most….good information and directions given… i have read so many articles and few books related to stocks..(reading "the intelligent investor" these days)…and i noticed that one can get some trading stratergies out of books,but no one tells their investment stratergies in articles or on t.v ,internet.

people give rules and guidlines but no one give stratergies and investment ways,which i feel is the very important.eg :if some one wants to learn driving a car…he should know first how to drive the car…not how avoid the accidents.first he will learn to drive a bit then the next step will come.same way in stock market people tell you the second step and they NEVER TELL THE FIRST ONE.

unfortunetly you are doing it the same way.

@RK

Thanks for the appreciation . Usually it takes me 2-3 hrs, but the idea grows in mind from many days . Its really a hard work to put everything in easy language which readers and new comers would like.

I am glad you are liking it .

So which one did you like the most ?

Manish

simply superb!! excellent piece of advice. like the way you write these posts -how much time does it usually take you?

rk

http://thedumbinvestor.blogspot.com

@rakesh

Extremelly nice point . What you say is very true . If you note closely , you will realise that the calls are never on any large or midcap stocks . Have you ever heard this happening to Reliance or TATA MOTORS or any company of that size.

The calls are generally for small cap companies where the volumes are significantly low and very much possible to hit upper or lower circuit if a handful of investors get in or get out very fast .

So if a stock has volumes of around 10000 , it only takes 50-100 people to move the stock in one side significantly and no one knows individually that they have contributed to it 🙂 .

Manish

Hi Manish,

Nice post. I just want to highlight a point "Don't listen to Stock Markets Experts on TV". It might seem strange but sometimes i have noted on CNBC is that once an analyst makes a call the stock just zooms. There is this guy called Ashish Chugh who comes with his calls on Hidden Gems. Most of the time when he makes this call the stock has hit upper circuit. I wonder how this happen. Do common retail investors who are watching just buy it blindly.

Rakesh

Hi, Smart Investor was indeed an enlightening read.

We at Onion Insights

(onioninsights.blogspot.com) are always happy to come across bloggers like you. We are also glad to inform you that your writing skills can now be put to good use and you can make some extra money too.

Sign up as a freelance Mystery Shopper – go to http://www.sassieshop.com/2eyp and select New Shopper Signup with Onion Insights – A Boutique Mystery Customer Experience Management firm and get paid for telling us your shopping or dining experience.

You read correctly – you get paid for shopping!

For more details log on to

www. onioninsights.blogspot.com, read our blog and give us a call on +919769781001 or shoot us an email at support @onioninsights.com.

An OI Team Member will get in touch with you as soon as possible! There are many Mystery Shopping assignments available in your city.

Looking forward to working with you.