All about SIP , systemetic Investment plans

SIP is a way of investing in Mutual Funds where you pay a fixed amount each month for a fixed tenure.

Like If you take an SIP of 5,000 for 1 year on Jan 1, 2008, you will be paying Rs 5,000 per month for next 12 months.

Please understand that its not a financial instrument, but a way of investing in mutual funds, some people confuse SIP with PPF, NSC, and mutual funds, they think they can invest in “SIP”, its just a mode of investment.

SIP CALCULATOR :

When to invest in mutual funds through SIP?

Investment through SIP must be done only when markets are uncertain or very volatile, when you don’t know which side they are headed to ..

Read Magic of SIP

SIP will be beneficial only if markets really are volatile or going down after you invested. If it happens that markets turns bullish and starts going up, in that case SIP will not be beneficial and will give less return compared to lumpsum investment in start.

SIP is a simple concept and hence very powerful, lets see some reasons why its worth investing through SIP

Reasons to invest through SIP in Mutual Funds?

More convenient for average person on wallet

Its more easy for a person to invest in small amount every month, rather than a lump sum amount. Investing through SIP is lighter on wallet. Its easy to pay Rs 5,000 per month for 1 years, rather than investing 60,000 at a same time.

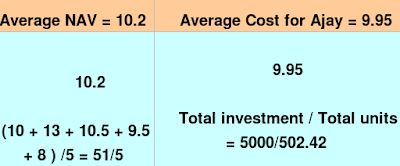

It brings your average cost price for unit down (in volatile market)

The biggest advantage of SIP is this part, There is a concept of rupee-cost averaging, In SIP you buy less when market and NAV are UP and you get more units when they are low. When this happens, the average cost of per unit is lower.

Lets take an example of “Ajay” who invests 1,000 per month through SIP starting Jan 2, 2007.

How SIP helps in this case ? See the result below :

ADVANTAGES of SIP

Makes you a disciplined Investor

The other advantage of SIP is that it makes you a disciplined investor. Once you start SIP, each month you have to contribute certain money in mutual fund and that habit is cultivated.

DISADVANTAGES OF SIP :

It will not work in bullish markets or when market goes up over time

When market goes up and keeps growing over time, the units bought every time will be at high price then the previous one, which will ultimately bring the average cost up , compared to the lump sum investment at the start.

In case of tax saving fund, the lock in period gets extended for every investment.

Tax saver mutual funds lock your money for 3 yrs, When you invest through SIP, each of your investment is locked separately for 3 yrs from the date of investment. So if you pay your first installment on Jan 2007, it will locked till Jan 1 2010, then the installment paid on Feb 1, 2007 will be locked till Feb 1, 2010 and like this each installment will be locked with the gap of 1 month.

April 21, 2008

April 21, 2008

Hi Manish,

I am in my late 30’s and have no idea on mutual funds ,SIP,etc but I am interested in SIP. Can you kindly tell me how to invest in the same? How to redeem it? Which one to choose etc?

Hi Sanju

I can see that you are interested in investing in mutual funds. I want to share that now you can invest in mutual funds with Jagoinvestor as your advisor

We create a FREE online account for you, from where you can invest and redeem online.

Our team will be happy to explain you more on this.

Find more at http://www.jagoinvestor.com/solutions/invest-in-mutual-funds

Manish

Hi Manish,

Thanks for the reply. I am interested in SIP not mutual funds (not sure if both of them are same, I am new into all this). But I do hope that through the link that you shared, your team would guide in investing in SIP,etc. Thanks again.

SIP is a way of investing in mutual funds . IT means setting up an automatic monthly investment in mutual funds on a given date. So you dont invest IN sip , but through SIP mode !

DOnt worry, just fill up the form and my team will do everything for you !

Manish

I have read about Variable SIPs. They sound interesting in such volatile market. However, I could only find Reliance MF offering a Smart STeP solution. Are there any other fund houses offering Variable SIP options? If not, how can one manually get investing by Variable SIP?

I dont have much idea on that …

Hi Manish,

Standing in April 2016, What according to you is better option to invest, lump sum or SIP in mutual fund, mainly for wealth creation and lock in of 3 years. As the funds invest in companies inside and outside India. I want to know about Variable SIP, wherein the SIP amount gets adjusted according whether market is bearish or bullish.

I think lumpsum would be a good choice right now !

Dear Sir,

My name is Nilesh and I am a salaried employee in a private company. I want to invest in SIP but I do not have detailed idea about mutual fund and SIP. I have my saving account with SBi. I can invest 1000-2500 per month. pls give me your expert comment which SIp wold be good for me and trend of return. I saw on sbi-mf website there are many products, but i am not able choose plan for me. pls help in this.

Hi Nilesh

just fill up your details here http://jagoinvestor.dev.diginnovators.site/start-sip . My team will guide you in setting up your free mutual fund account from where you can buy and redeem mutual funds

Hi Manish,

My name is Agnel. A.

Though i have been investing in mutual funds till date, i have not invested in SIP. But today self and one of my friend have planned for investment in SIP. I have read your above article regarding the SIP and also gone through the comments. The question now is ” You are very well aware of the present market situation now. Is it the right time to invest in the SIP?” please suggest

Yes, just go ahead and invest . Read this http://jagoinvestor.dev.diginnovators.site/2016/01/creating-long-term-wealth.html

Hi,I m a housewife.I want to invest rs 2000 to 3000 per month for 10 yrs and above in sip instead of rds.can I do so.Pls let me know the full process as I m New to sip.I want to invest it in low to medium risk.approximately howmuch I ‘ll get back comparison to rd.Pls answer

All you need to do is first do your KYC and then choose some funds and start SIP . What exact info you need on that ?

Hi Manish:

Your articles on all areas of financial planning are excellent! Whenever I want to do anything with my money – insurance, investment, etc – after rambling through multiple sites, I reach yours for clarity! Thanks

I am 36 and starting my MF investments. I plan to invest around 20K per month across 4-5 SIP MFs. I want this money for long term wealth creation – retirement, child’s marriage, etc. I am ok with Moderately high risk but not too high a risk of capital

The choice I have arrived at are:-

Franklin India Bluechip

Reliance Growth

Franklin India Prima Plus

HDFC Top 200

What is your review of the above? Would you recommend any other fund?

These looks good to me . You can start with these

Thanks Manish

Hi Manish,

I am 30 yr old married guy. I earn 50k Per month and want to know best investment plan for earning and saving for retirement. please suggest where to invest my money so get more returns.

Currently I am investing in LIC only.

Hi Naresh, seems like you are new investor and this whole thing is new for you.

I suggest going for mutual funds for your wealth creation.

Can you please let me know in detail it help me lot to do planning.

Naresh

You will first have to do KYC which will make you eligible for doing mutual funds investments. Then you can start your SIP in 2-3 funds like

1. ICICI Balanced Advantage Fund – G

2. HDFC midcap opportunities funds – G

HOw much do you want to invest on monthly basis ?

Manish

Thanks for your quick response.

I am new to this kind of things so. Where to fill the KYC form in any bank? and I want to invest 3000-5000 per month.

You can visit the mutual fund office with your photo , PAN and an address proof, and a cheque . They will help you do the KYC

can you please tell how to do MF portfolio restructuring based on the fund performance. I am regularly investing in diversified equity mutual funds and Equity ELSS funds for the past 5 years and would like to continue for another 15 years.

Please tell me how to switch from one fund to another fund inbetween. Suppose I have invested in SIP for 3 years in ABC fund and its performance is not good, so should I sell all the units and invest the money in some other good performing fund of same category in lump sum? In this case is it good to invest the money in lump sum? or I should reinvest in SIP?

Currently I am investing in the below equity funds in SIP,

HDFC Top 200 – Growth

Franklin India Bluechip – Growth

HDFC Tax Saver – Growth

ICICI Prudential Tax Plan – Growth

Canara Robeco Equity Tax Saver – Growth

There is no need to sell and repurchase, but you can just do the SWITCH which is available from AMC

Hi Manish,

I am 30 yr old married guy and having 3 Month old daughter. I earn 80k Per month and having below investment

Term Insurance – HDFC Click2Protect Plus of 1 Cr (Taken Last month)

LIC Whole Life Plan -(Taken in 2012) Premium around 24K/yr for 12 yrs to get 40Lac at Age 79.

Health Insurance – ICICI PruLife Health Saver Plan for 5L per Year for Me, Wife and Baby.

PF – Around 45000 per Annum + Equivalent Employer contribution (Since last 1 Yr)

HL – around 4Lac pending. It will be cleared by June 2016.

SIPs investment of total Rs. 8000/- per Month as below (All are planned for long term for around 20yr considering daughter’s education and marriege)

On my name

1) UTI midcap fund (G) Rs. 2000/- (From last 5 yrs)

2) ICICI Tax Plan Regular (G) Rs. 2000/- (from last 2 Month)

3) DSP Black Rock Tax saver fund Reg (G) Rs. 2000/- (from last 2 Month)

On Wife name

1) ICICI Pru value Discovery Reg (G) Rs. 1000/- (From last 4 yrs)

2) HDFC Equity fund (G) Rs. 1000/- (From last 5 yrs)

Please suggest on above investments and what kind of additional investment planning/modification should I do and where ?

It looks good to me at the moment. Try to increase your investments , thats it

Hi Manish,

I am Salaried person want to invest in SBI magnum tax gain (g) Rs.500/- per month, i want to ask that can i invest more than 500/- in a month, and can i claim that money for income tax relief. second thing is that if i complete 3 years of SIP and after that also i continuing with the fund then can i claim that investment for income tax relief. please guide me.

Paresh

1. You can claim it for tax benefit

2. You can claim the money in a financial year, only if you have paid in that particular year.

I hope you are clear

Manish,

I have another question for you if i started monthly 500/- SIP can i invest more than 500 in a month? and also please suggest me best Tax saving plan in MF

No , by default only 500 will be deducted from your account each month

Hi Manish,

I am a salaried person and new to mututal fund Want to invest total 10,000 Rs in mutual fund via SIP. Pls suggest 3-4 best funds

Hi Mohit

It will be decided only as per your risk appetite and requirement .We can help you in investing this money in SIP . let me know if you need our help !

Dear Manish,

I have recently invested in SIPs and noticed that most SIPs have an exit load such as “exit load of 1% is charged if redeemed on or before 730 days from the date of investment”.

I plan to keep these SIPs for a much longer period time, lets say 10 years. At the end of 10 years, if I were to redeem all my units, will I have to pay a 1% exit load for the purchases made in the last 2 years (i.e. 730 days)?

Please advice if it is the case as above. And how can I best structure the SIP withdrawls based on my life goals?

Warm regards

Shankar

Yes, you will pay exit load for units bought in last 2 yrs . correct !

If you dont want that, then just withdraw 8 yrs of units and withdraw rest of them later !

Hi Manish,

I am about to turn 23 and I want to start investing. My current salary is 24k/month. I also do some freelance writing occasionally which gives me around 5-6k per month. I currently have an RD for 5k/month and I additionally save 5k in my savings accounts. I am thinking of starting with investing 3k/month in SIP. Would that be wise? Kindly advise.

Yes, why not Savvy Aggarwal

I think you are going on the right path and saving maximum you can . The best part is that you already have RD in place and that is instilling the discipline part already . You can now start the SIP’s also . How are you planning to do that ?

Manish

Dear Sir,

i am 25 years old.This is the first time, i am planning to go for a SIP Plan for Rs 2000 per month, can you please suggest me which company SIP plan i should take it and for how many years i have to invest for a good return.

Priyanka

YOu can go with ICICI Balanced Fund. Its a good option !

Please details the mention…..

Sir .I am a new invester …I want to know that sip ‘s my net ballance would be less down ….?.?….I invest SBI ‘s sip per month 1500rupies .. I …any time I withdow my ballance…??? After 5years it whoulld be profitable or not………????

No always . In worst case there can be loss also !

Dear Manish

Very insightful posts. I have 3 questions whose answer I am not able to find anywhere

1 – I invest Rs 5000 every month in a SIP(with a very long horizon). After 2 years my real investment is Rs 1.2 lakh but my SIP’s value is 1.5 lakh. Say now markets crash and the NAV of all SIPs start going down. In this case does the value of 1.5 lakh also start coming down and probably might go below my total invested sum in few months.

2 – If I have a very long horizon and my SIP is falling consistently along with all SIPs due to bad market, shall I still stay invested hoping it will regain once the markets are up

3 – What should be a good exit criteria, like NAV falling below a certain percentage from maximum..or some other such criteria

Appreciate your response on these questions

Rehan

1. Definitely, it can happen . At any point of time, your worth of mutual fund is number of units X NAV , where you can see that if NAV falls, then surely the total amount will go down , but don’t think too negative on this . NAV fluctuates, but generally does not go so much down in most of the cases except in extreme conditions !

[…] Link in the slide: All about SIP […]

Dear Manish,

my portfolio consists of

1. franklin India blue chip growth 1000/-pm

2.icici prudential focused blue chip regular growth 2000/- pm

3. UTI oppertunities fund growth 2000/-pm

4. HDFC top 200 growth 3000/- Pm

kindly suggest if any modification require.

Regards,

Kahnu

Its fine !