Are you willing to buy term plan? – Here are some important tips you should know before buying term insurance

We will today discuss some of the best practices and must do things while taking a Term plan.

Click here to read what is Term Insurance and its Importance

1. Take a policy just before your Birthday.

Term Insurance premium depends on your Age. So if possible try to avoid taking the policy just after your Birth date. What i mean by this is that try taking it before you turn +1 year in age. If your Date of birth is 10/11/1983, and you take the policy on or before 10/11/2008, you will be considered of age 24.

But if you do a delay of 2 days … and you take a policy on 12/11/2008. You will be considered 25 yrs old and hence your premium will increase by 4-5%.

Note : It does not mean that if your birthday just passed by and now you want to take Insurance, then you should wait for another year. that’s not what i am saying 🙂

For example:

For a male with DOB on 10/11/1983 (24 yrs old), the premium for Rs 50,00,000 cover with tenure of 25 yrs, is 10157, if the policy is taken on 09/11/2008 (just 1 day before the birthday). Where as if he takes the policy on 12/11/2008, the premium will shoot up to 10647 (Rs 490 more) .. though 490 is a small amount, but if we can avoid it by taking the policy little early .. always try to do it.

Even a small amount like 490 saved over 25 yrs in a PPF would give 45,000 and in mutual fund with 12% return will give 77,000.

Note : The gist of the point is that try to see this small point while taking the Term insurance, it does not mean that you wait for 8-9 months just to take the policy before a birthday.

2. Try to diversify your Policy

If possible try to diversify your policy amount over different Insurance companies. If you want to take an Insurance of 50,00,000, it would be better if you take 2 polices, rather than 1 single policy.

How it helps?

– If you hold a single policy and the company does not honour the claim, dependents wont get anything, but if there are 2 parts, then there are less chances that both the companies with not honour the policy.

– If your liabilities come down or you have less dependents after a couple of years and ultimately you need to bring down your Life insurance cover, you can simply stop one of the policies and continue the other one.

– It helps in diversifying the risks involved with the Insurance company.

3. Buy a policy early in life and for longer Tenure.

Its always recommended to buy a Term Insurance early in life and for maximum tenure possible. In your early life you are more healthy and hence your premium will be lowest. Also by taking insurance for a large tenure you are making sure that you are covered for a large period, but the premium will be marginally more.

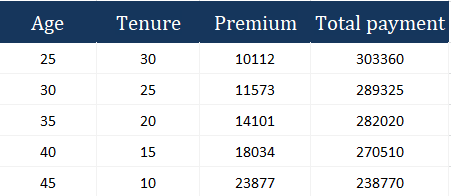

For example : For a cover of 50,00,000

You can see here that you have to pay marginally more for an extra cover of 5 yrs. So for example, a person with age 25 will pay 14,000 more than the 30 yrs old, but he will be insured for 5 additional years. So it always pays in long term.

Also taking a 30 years term insurance once will be very cost efficient than taking a 20 yrs term insurance now and then taking a term insurance of 10 additional years after 20 yrs. Because after 20 yrs, the premium you will pay for that 10 yrs tenure term insurance will depend on your Age that time and health that time.

Note : Premiums are from Aegon Religare Life Insurance.

November 12, 2008

November 12, 2008

HI Manish,

Thanks for sharing details and educating us for financial life.

I want to buy Term Insurance plan for myself. Could you please suggest best possible option for me including your recommendation for service provided and specific plan they have.

Here is my details

Age: 30 Years

No smoking habits

Looking for 30 years plan.

Sum assured range : 50L to 1 Cr.

Married.

Hi Tushar

We generally recommend HDFC term plan. We also have a tieup with them on this for our readers. If you are interested, we will connect you to them . Just fill up this – http://jagoinvestor.dev.diginnovators.site/services/life-insurance

Dear Manish,

I am an NRI and i work in qatar on employment visa..I have some doubts regarding term insurance(I want to take LIC Amulya Jeevan for 1crore).

1)Whether an NRI is allowed to take the above policy?

2)Whether i have to provide a permanent employment status for the above insurance as the jobs in middle east are not permanent??

3)If I change or lost the job from qatar whether the policy will be cancelled?

4)If I die anywhere in the world whether there is any problem for settlement??

5)May b i will move to canada in the coming year..So in that case any problem for the policy?

6)My wife is not working..whether she can take the term policy??Is employment is really necessary for taking term policies??

7)Whether the nominee will have to be a single person or joint(wife plus child)

8)whether there is any option to add second nominee if something happened for me and nominee??

9)I last smoked a cigarette before 2 months.. In previous years like once in three month..can this can be diagnosed in lab test??

10)If i start smoking after taking the policy how they get to know that??whether the ploicy will be cancelled because of that???whether there is any annual lab test for blood sugar,smoking ..etc???

11)I read ur blog and i know that i am in smoker category. If I tick smoker what are the benefits (as ticking nonsmoker category is slightly worrying as there is previous smoking history)

Thank you Manish

Hi Jitendra

NRI can take the policy and the only requirement is that you should be ale to provide the income proof and your regular docs. Thats all

You can smoke later, there is no issue after taking the policy.

sir

I am srinivas working as government teacher (telengana) . I bought pension plan in exide life insurance i have to pay 3000 per month for 27 years.is this better FOR investing in exide or LIC ?

Its ok . You can continue it

Dear Sir

I am having annual income of 4lac and my wife 4.5 lac , at present i have 20 lac cover through different LIC polices not term and on the name wife not single policy we both are of 32 years ,On wife name we have taken home loan of 26 lac liabilities, So i am thinking of taking term plan of 50 lac on wife and 40 lac of me i have some doubts regarding same we have one son 3 yrs

1. whether that much cover is sufficient

2. whether to take it in divided from means 30+20=50 and 20+20=40 lac

3.which company i should prefer i am thinking of LIC amulya jeevan, HDFCand max life insurance

4. shall i take also any health insurance policy if is there any which include preventive health check up

Hi Amit

You can take 50 lacs cover for both of you separately from HDFC . We are parterned with HDFC and we can pass on your information to them , they will take good care . If you are fine with it fill up the following form .

Also we will help you with health insurance

Fill up following forms

http://jagoinvestor.dev.diginnovators.site/services/life-insurance

http://jagoinvestor.dev.diginnovators.site/services/health-insurance

Manish

Hi Manish,

I had applied 2 term insurance, one with bharti AXA and second with Aviva 50 lakhs each.

These both companies issued me policies.

I had a conversation with one insurance agent . He told me that you must surrender one of the policy as either of insurance company must be notified of other policy. So if something happened to you then your family can claim only with one company.

Please tell me if his suggestion is correct and what to do.

He is incorrect. You can claim from both companies

Sir

I am a occasional smoker with 1 or 2 cigaretts per year.So shall i be treated as smoker or non smoker by insurance company.

Pl advicee

regards

Smoker

i just wnt to ask tht my father dies in 2013 he was a govrnmnt job and know my mother gets a pension so she is a house wife can take term insurance her age is 49 . and he has a child his age is 29.

Depends on the insurance company if they will give it or not .

Hi Manish,

Thanks for providing the basic insight on Term Insurance plans.

I Have taken quotations for Term insurance with the Sum Assured: 1 Crore for a tenure of 35 years from some of the insurance companies.

Aviva iLife Premium per annum: 8008

SBI Term Insurance Premium Per annum: 12000

Both Term plans has the same terms & coverage.

Why there is a premium difference of 4k between them?

Also Aviva being a foreign company and new to indian insurance market can we expect this company to be in the market(Who knows it may file bankruptcy) for the next 35 years?

In the case of bankruptcy from a private insurance company will there be any assurance of the Sum Assured from the Indian Government(I knew there won’t be any assurance from Indian Govt, Still I wanted to confirm this)?

Read this to understand the reason for premium difference – http://jagoinvestor.dev.diginnovators.site/2013/05/how-insurance-companies-work-and-the-business-model-behind.html

Regarding your other query, I can just say you need to trust IRDA the regulator on this . Other wise better go with pure indian companies, but how do you assure that they will not get bankrupt ?

Manish

Hi,

I would like to know any reviews/feedback on SBI eshield term insurance. How does it compare again HDFC Click2Protect? Any feedback would be highly appreciated.

Thanks.

Sonal

As its a new plan, I dont think there will be many reviews available !

hi

i am looking for sbi life e shield plan.

i m 27 year old..

Policy Term 20 years, Sum Assured of ` 25 Lakhs .& premium is 4233….

but i do not die then after 2o year… i get money or not???? if i get money then it is how much??? or,, if i do not get money then what??? pls give the suggeesion….

or full idea of this plan…

Bhavesh

I think this is a good article for you to read and clarify – http://jagoinvestor.dev.diginnovators.site/2009/04/return-of-premium-term-insurance-is-it.html

Informative article. I have one query on term insurance. If one is a social drinker ( say 1/2 pegs per month that too when there is some occasion) does he need to mention this in the policy application form ?

Once a drinker/smoker , always a smoker/drinker is the rule !

Dear sir

I want to know that how much term plan one sould take. Again annaul income for every individual is incresing yearly, so how to decide the amount. please guide me

Take a term plan which is suitable for current moment

Hi Manish

This blog is highly informative and detailed, Many thanks for this, appreciate the same.

However I have a question, if Suppose someone is holding a term insuarance policy and if the person travelled abroad & death occures then will the Insurance company still liable to honour the claim? does geographical boundries matter in this case??

I could not read entire blog so if this si repeat question then apologies but still require an answer for this..

many thanks in advance

Swanand

Yes, he will still be paid. Geography does not matter !

Dear Manish,

I am having term insurance from KOTAK LIFE worth 30 lacs cover from last 3 years. Now by considering safety and risk point of view, i want to change my term insurance from KOTAK to LIC..

CAN I CHANGE WITH SAME PREMIUM?

IF I CANT CHANGE THEN WHAT LOSSES I MAY FACE IF I CLOSE KOTAK TERM PLAN AND START NEW ONE WITH LIC FROM THIS YEAR?

Its not possible like this .

Where is the point of losses here ? this is no investment policy ! , its just pure risk cover, so you just close this and move to LIC . thats all

Hello Manish

My friend is running 43yrs and will complete it on 31st May. I want to gift him term insurance & health insurance before his birthday.

Few Facts @ him – Smoking-Packet a day for last 15 years, Drinks-Very Occasionally. Diebetes (only on pill but not regular checkup), No known health complications as of now. Earning -30Lac p.a. Monthly expenses – 75K., 3 dependents (Wife+2 Daughters <12yr old)

Would you guide for lowest but reliable 1) Term plan for about 1Cr(Can split of 50L each need Medical at this stage) 2) Suggest ideal health insurance for such lifestyle.

Hi Shree

Good to see your committment towards your friend. This is the best gift one can give in today’s time 🙂 . I will help you on this . First understand that your friends habits will make sure that the premium is going to be on a higher side and in worst case companies might decline giving the cover itself .

You can look at Aviva or HDFC as good options . Check the premiums for both on their websites . I guess the yearly premium would be around 40,000-50,000 after LOADING (fact that he drinks and smokes and already have diabeties) .

IN case of health insurance try Religare and Apollo .

Manish

Thanks a lot about all the information provided about term insurance. Have a question for you

In case of birth parent being different from legal parent , who’s name needs to be mentioned while providing details to the insurance company ?

In the candidates birth certificate , the name of the birth parent is mentioned .But since then they have passed away due to ill health. All other current documents have the names of the legal parents.

Kindly advice.

Hi,

Can you pl share your thoughts on online v/s offline term insurance? Are there risks with online policies? Are there statistics on which company best settles online policies?

Thanks.

No risk on online term plan .. just go ahead

Dear Manish:

I am a salaried person having 3 dependents-wife, 2kids (age:5 yr, 2 yr), No loan of any kind, own house. I had Kotak e Preferred term plan of 30lac with annual premium approx 9,500. I thought it was less, this year I bought another term plan of 100 Lac Aviva iLife with normal annual premium approx 19,000. Medical reports are normal.

I am bit confused- should I continue with both or stop Kotak term plan now?

If you feel that your insurance is more than required, then better stop the KOTAK one !

What happens to the term insurance plans taken by any individual if the company closed after some years???

That company will be surely acquired by other and your policy will move ..

I have Aegon Religare Term plan from almost 4 months. I & my wife have heard Aegon & Religare are separated now. Is it a good plan or should i move to different term plan??

No I dont think they are seperated . Who told you ?

i have read somewhere like this or Aegon is trying to be out like this. What about the term plan?? should i change it or should be continue with the same plan???

I have not heard anything like that as of now . Even if that happens , there is not much to panic .. these kind of mergers keep happening !

After reading your article i found that AEGON has the settlement ratio 66% last year. So should i stop this & take HDFC or ICICI term plan?? I want riders also with that. IF yes what is the procedure to stop this & take new??? Is Port also applies over here???

You dont have to do anything .. just continue with them .. the claims are rejected when there is some data hidden by customers !

Thanks, And also I want Health insurance plan of 10 lakhs?? SO should i opt for Apollo muniach or religare plan???

Hello Manish,

I am 31 (recently marriend, wife : aged 28). Planning to take 3 term insurance policies each SA 50 lacs (so total of 1.5 cr):

1st policy : until My age : 45 yrs

2nd policy until My age : 55 yrs

3rd policy until My age : 65 yrs

as the age grows the financial dependency reduces – this is the philosposy behind the above. Is it the right way to go ?

Thanks,

Neelesh

Well, does it make any difference than taking 3 policies for 65 years of my age and stop paying premium for one at 45, one at 55 and take the last one until 65 ?

You can do that ..

Why dont you take it all till 65 yrs and stop them when you wish to .. What will you do if at 45 you realise that you should need more life insurance .

Yes, this looks better option. Thanks Buddy.