Do’s & Dont’s for filing your Income Tax Returns

With the tax-planning season about to end, most individuals are rushing around to make investments to minimise their tax liability.

And although, the last date for filing income tax returns is just a few months away (July 31), some of us are still unaware about the procedure and guidelines. Have a look at recent changes in the Income tax slab and how it affects the common man.

Q. I have a Permanent Account Number (PAN). Do I still need to file my tax returns?

A. Just having a PAN number does not mean that you have to compulsorily file your tax return. As per the Income Tax Act (1961), you are required to file a “Return of Income”, if your taxable income exceeds Rs 1.60 lakh for the financial year 2009-10 (Rs1.90 lakh in case of women and Rs2.40 lakh in case of senior citizens).

However, you need to have a PAN in order to file income tax returns. Read more

Q. What are the benefits of filing income tax returns (ITR)?

A. Filing ITR is really beneficial for an individual. Apart from the legal obligation, it is mostly required for purposes like:

- Availing any kind of loan, like home, personal or education.

- Visa and immigration processing

- Income proof / net worth certification

- Refund claims (in case of excess taxes paid)

- Applying for a higher insurance cover

- and ultimately, “Peace of mind!”

Q. How does one plan for better investments under section 80C ?

A. Section 80C is the most important provision under the Income Tax Act (1961). Making use of the available tax deductions can go a long way in helping individuals accumulate wealth.

Benefits of tax planning (for FY 2008-09)

| Income (Rs) | Tax Rate (%) | Maximum tax savings |

after 80C deductions (Rs)

Savings invested

@ 8% pa for 20 years (Rs)

Savings invested

@ 15% pa for 20 years (Rs)Upto Rs 1.50 lakh

Nil ———Rs 1.50 lakh to Rs 3 lakh101030048008168575Rs 3 lakh to Rs 5 lakh202060096016337151Rs 5 lakh and above 3030900144024505726

The amount saved in turns can be invested in various, in order to gain maximum benefits. Prime examples:

- Real Estate

- Gold

- Insurance

- Mutual Funds

- Fixed Deposits

- Equities

Case in point: Consider an individual, in the highest tax bracket, with a gross total income of Rs 6 lakh. If he chooses to ignore the tax sops available under Section 80 C, his tax liability will amount to Rs 87,550 (for AY 2009-10).

Conversely, if he chooses to make eligible investments/contributions of Rs 1, 00,000 under Section 80 C, his tax liability will be Rs56,650 i.e. a saving of Rs 30,900.

Look before you leap – Tips for better and effective planning of your investments:

Every tax saving investment scheme has inherent advantages and disadvantages; & each individual has to decide his investment strategy based on:

- Lock-in period and safety of the investment

- Return, before Tax / Return, Post Tax / Tax Free returns

- Whether interest will be treated as fresh investment under Income Tax Act

- Age and risk appetite

- Liquidity, surrender charges etc.

Some tips to plan your finances better:

- One should by default set aside 10% of his/her income; Start living with your 90% of salary

- Avoid waiting to invest a lump sum, at the last minute, as most of the times we tend to run short of money, resulting in a loss of tax benefit, besides the savings and long-term capital appreciation.

- Last minute decisions mostly result in investing in unwanted and futile schemes

- Use ECS / Direct Debit facility offered by the bank for investments; this will help you invest, without fail, regularly.

- Invest monthly or quarterly as it provides long term capital appreciation

- Monthly or systematic investments also provide a check against market volatility

Watch this video to learn everything about Income tax return:

Q. Since tax is already deducted from the salary well in advance as a TDS, then why does one need to file Income Tax Return?

A. Although tax has been deducted and there is no further liability to pay tax, an employee has to compulsorily file his/her income tax return if he/she exceeds the maximum amount, not chargeable to tax.

It is, in essence, a declaration to the income tax department that you have derived only income from salary and not any other source (if you do have income from other sources, then the same needs to be incorporated).

Note. Many a times, employees do not include the interest that they receive on their savings bank account. The entire interest earned on the savings bank account is taxable.

Q. Can you please explain the complete procedure to file ITR?

Step 1: Gather all the necessary documents.

These are:

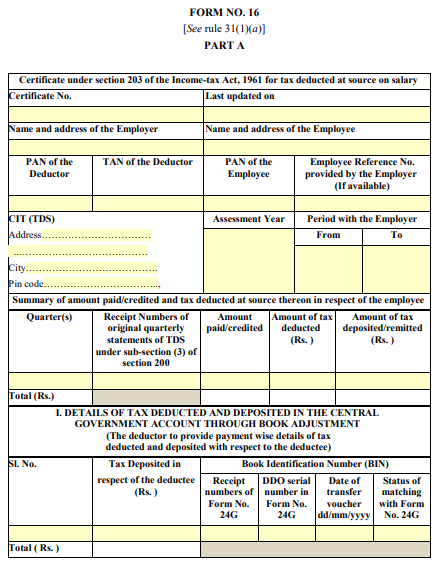

1. Form No. 16: This is issued by the employer, stating your income from salary, and tax deducted by your employer from salary income.

2. Form No. 16A: This is received from all the payers, who have deducted tax, while making payment to you, during the year. For e.g. banks and companies.

Summary of all bank accounts operated during the year: This summary will give an idea about all the interest income earned during the year.

Details of property owned during the year: If you have bought some property during the year and put it on rent, then you will need details of rent received and receipts of municipal tax paid during the year.

In addition to this, if you have bought such property through a loan, do carry the loan details and a copy of certificate of interest paid during the year.

Sale & purchase bill/documents/contract note in respect of shares transactions during the year: You will also need purchase documents corresponding to the sales made during the year. In case of a large number of transactions, it is advisable that you prepare a statement of sale and corresponding purchase of these investments and arrive at the amount of profit or loss, before actually calculating your taxable income.

Details of tax payments made during the year: This is required only if you have made advance tax or self assessment payment during the year.

Step 2: Select the proper income tax return form i.e. ITR, which is based on the nature of income earned.

FOR INDIVIDUALS: Form No. Applicability

ITR 1 Meant for Individuals, who have

a) Income from salary

b) Interest income

c) Family pension

- ITR 2 Individuals/HUF not having any income on account of business or profession

- ITR 4 Individuals/HUF having income from a proprietary business or profession

Step 3: To file your tax returns:

You can file your returns either Manually or Electronically.

Electronically: The Income Tax Department has introduced a convenient way to file these returns online. The process of electronically filing your Income tax returns, through the Internet, is known as e-filing of returns. This is a really convenient facility, since it saves you the hassle of traveling all the way to the IT office.

This facility is available round the clock and returns could be filed from any place in the world. It also eliminates reduces ‘friction’ between the assessee and tax officials.

Manually: For manual/physical filing, the individual takes a print out of the respective ITR form , from the income tax site, along with the acknowledgment form, and after duly filling it, files it with the respective income tax office. Forms are available free of cost too

Q. What are the documents required, which has to be attached with returns of income?

A. Under the new procedure, be it is electronic or physical filing, individuals do not have to attach any documents or enclosures with the return of income. However, one should preserve the supporting documents as they can be called for, at a later stage by an income tax officer to check the accuracy of the claims made.

Some of the documents are:

- Detailed calculation of taxable income and amount of tax payable/refundable

- Form No. 16/16A (original)

- Counterfoil of all the tax payments made during the year

- Copy of documents, concerning sale of investments and properties

- The Copy of bank statements

- Copy of proof for all the deductions and exemptions claimed in the return of income

In case of a refund, the bank account details needs to be filled in accurately. In case the refund is opted to be received via ECS direct into the bank account, adequate care should be taken to correctly fill in the MICR code.

PRECAUTIONS THAT ONE NEEDS TO TAKE

Filing returns at the eleventh hour often lead to a lot of inconvenience. Also Filing online, very close to the last day, is risky, as the peak load on the servers of the e-filing website during the last few days may make the whole online filing quite frustrating, causing needless delay.

Filing return after the due date, may lead to empty the pockets of the taxpayer who have incurred losses; which he wants to carry-forward to future years. Under the tax laws, some losses are not allowed to be carried forward for being set-off against future income, unless the return has been filed by the due date, even though all the taxes have been pre-paid.

Similarly, if a paper return is filed, the acknowledgement slip should be preserved carefully.

SOME TIPS TO AVOID LAST MINUTE RUSH

- Step 1: Select and get the appropriate forms from the Income Tax site or offices

- Step 2: If a professional is handling your taxes, meet him and make an appointment early before your accountant’s schedule gets completely booked. If you’re preparing your own taxes, set a day aside on your calendar for preparing taxes.

- Step 3: Review your tax documentation before submission

- Step 4: You can file your returns offline or online. However, before doing so, check whether you still have a tax liability. If you are still to pay taxes, do so through Internet banking or through cash/cheque at any bank along with Form 280. In both cases, you have to furnish challan details in the income tax return (ITR) form.

- Step5: Prepare your taxes. Now that you have all of the necessary forms and documentation, you can prepare your taxes without waiting for the last minute.

PENALTY FOR FILING RETURNS LATE

For details , you should look at the article “How to miss your tax return filing deadline and still Enjoy”

Conclusion:

A little extra care, planning & precaution on the part of taxpayers can help them avoid committing mistakes, while filing the tax return and keep away, unwelcome visits from the taxman.

It was a guest post by Rishabh Parakh, who is the director of Money Plant Consulting

March 14, 2010

March 14, 2010

Dear Sir,

i am house wife. i have worked for 6 years as lecturer in some private college. i have saved those earnings and little savings from my husband’s salary and have put it in Fixed deposits. my total income from interests does not exceed the limit. still i want to file IT returns. if i file this year, whether my income (coming from FD interests) will be added to my husband’s income or it will come under my name as individual?

IT will come under your income

Dear Manish,

Please let me know if it is necessary to delcare all of your assets while filing the income tax. Thanks in advance.

Regds

Sanjay

No , You dont have to declare your assets in any particular year 🙂

Dear Sir,

Pls advise me that NIL (ITR 1) for Ass:Yr:2010-11 & 2011-12 will be send under which section of Income Tax Act 1961.

thanks in advance.

Regards

Ashu deep Kaushik

Please ask it on http://jagoinvestor.dev.diginnovators.site/forum/

I am salaried person. After TDS is completed through my DDO, I find that I have to pay some little more tax for bank interest etc. Shall I have to pay any interest on that tax as I am going to pay after 15th March? what challan should I need? Another Question. I have redempted some MFs (held for more than 1 yr) this March. Can I use ITR-I for filing return?

Sanjay

Challan 280 will apply in your case. YOu dont have to mention about your mutual funds as they are redeemed after a year . I hope its equity mutual funds

Manish

Hi,

I am soft eng. working full time in a mnc company. I have additional income in the form of commission from selling mutual funds & insurance. Also, i run a website from which each i earn a lil on the advertisement.

Will the whole commission which i have paid will be accounted for income? How about the expenses incurred on the Mobile phone, petrol & renting webspace for website?

A friend of mine suggested me that it is special income in my case. According to IT dept, i am liable to add only 8% of the income in my total income as only 8% will be computed as profit & no additional Deduction is applicable. Can you please re-confirm me on this? Is it true?

Plus can you also tell me how this special income will be shown? under which ITR form it is covered? i am filing IT return thru easyitfiling.com & there is no provision for declaring IT return through special business income…

I ll really appreciate a timely response.

Dear Rajesh, If you want to opt for non aidit non accounting route for your other income the eligible form for you ‘ll be ITR – 4S where S stands for sugam.

in case your actual profit from the activies mentioned by you is less than 8%, you may file in regular ITR – 4 form.

Please hurry up as to avail certain losses & adjustments, 31st July 2011 is the last date to file ITR for non audit cases.

Thanks

Ashal

Rajesh

A better reply will come from our forum : http://jagoinvestor.dev.diginnovators.site/forum/ . I dont have much idea on this

Gaurav Sharma said:

I worked with two emplyer in FY 2010-11. With first one till 22.02.2011. Then joined another on 01.03.2011. I have recieved form 16 from both of the employers. My current employer has not cut any tax on my one month salary for month march 2011. My gross salary is not more than 5 lakh. as well as ass per form 16 total tax deducted by my previous employer is Rs 5474 while Total tax payable is Rs 2493.

My question is

1. how should i fill ITR for FY 2010-11.

2. Will i get refund form IT dept for excess tax ?

Please reply and thanks in advance.

Regrads

.

Dear Gaurav, You w’d have to file your return in ITR-1 form. First of all download the excel utility from the following site –

http://www.incometaxindiaefiling.gov.in

Fill the form. For salary income – put the total income from both form 16.

In the schedule TDS fill the details from 1st Employer. On the last page fill your bank account details. Click on the calculate Tax soft key on the first page. Save the XML file & upload the same to the above mentioned website.

In case you are unable to follow the above – ask Manish to provide my mail ID & I may file for you. In case you want to e-file through me, please send following info to my mail id. In case you are already registered for e-file, please update me for the same in the mail.

Name in full

Father’s name

Mother’s name

Your D.o.B.

Full Address with PIN Code

Mobile No.

E-mail ID

Bank account with MICR Code to receive refund through ECS

Thanks

Ashal

My previous employer has refused to issue me Form No. 16 for the Financial Year 2009-10 (Ass. Year 2010-11). Please advise me how i can obtain the Form No. 16 or process to file the Return of Income for the AY 2010-11 without Form No. 16.

Vishwanath

Its not mandatory to have form 16 to file returns, you need form 16 to extract the details while filling the return form .

Manish

Hi

I have generated the ITR-V form and want to do physical filing

Do I send it to the Delhi ITO address or the Bangalore CPC office ?

Regards

Roopesh

Roopesh

send it to the city where you are working

Manish

At Bangalore CPC

Dear Sir,

If the employer has not given Form 16 to his employee, then in that case can an indivudual file his return without form-16 ???

If so please inform me how to do with it

Why are they not giving ?

http://www.hindu.com/2007/05/04/stories/2007050403750100.htm

Manish

If I were you, I would have logged in to the incometaxindiaefilling.gov.in and downloaded my “Form 26”. Using this, I can retrieve TAN of Employer and total income for same. subtracting the allowances offered to me and putting this information in my ITR-1 form. Form 26 is generated referring from similar repository as that of Form 16, i.e. TRACES (https://www.tdscpc.gov.in)

Form 16 is the proof that the TDS from Employer is well deducted from the salary and treat as employer certificate that the TDS amount is well deposited inside TDS (TRACES) account associated to the PAN card holder, same details can also be referred from Form 26 that everybody has an access of (free of cost).

Apart from this, Form 16 can be used to understand the exact income one have earned and the allowances that offered to him/her during the year. (Nobody cares as long as you are sure of utilizing them well in time else add it to your GROSS income and proceed)

Hi Girish

Can you share more about this to me ? Seems like there is so much others can learn from this ?

Dear Manish, Rishabh

I have a doubt regarding home loan interest exemption for 2 houses

I own a property in Bangalore and it is not rented and there is a home loan for the house.

I work in Mumbai and stay in rented property. I claim HRA benefit since i actually pay rent

Since my own house is not in my working place, it is deemed to be self occupied and i claim principal & interest paid in my IT (no rent received – notional rent is not shown)

I recently booked a new flat in coimbatore (joint ownership – my wife is first owner and i am the second owner). Home loan is also joint but full EMI will be paid by me.

My wife is a house wife and not earning any income & hence no IT filing is done till date

I have following questions

1. Whether i should show this in my IT filing (> 30 lacs purchase) or should i shart filing for my wife and show in her return (since she is the first owner)

2. If i give for rent, where should the income be shown – against my wife or against my name (even if it is not rented i suppose i should show notional rent for the house so that i can claim full interest paid (without 1.5 lacs limit)

3. If i need to claim IT benefit (since i will be paying EMI) is it mandatory for me to show rental income (or notional income) against my name

Thanks

JP

1) No need , a person has to file return only when their taxable income is more than the limit .

2) It should be shown on the name who is recieving the rent , so even if she is joint owner , you can receive the full rent.

3) I am not sure

[…] Tax return mandatory ? 16. How to Miss your Income Tax Returns (ITR) Deadline and Still Enjoy 17. Do’s & Dont’s for filing your Income Tax Returns 18. Cost Inflation Index (From 1981-82 to till year) Posted in […]

Hi Manish,

I have been filing tax returns since 2005. However, while filing these returns, in the previous years, I did not disclose the interest earned from savings from a particular bank as the amount included was from a gift from my relative. During those years I also invested part of the savings in mutual funds over a period of more than one year. If I want to disclose this undislosed income now in my tax return can I do so now and what are the formalities I will have to undertake?

Thanks

Francis Paul.

Paulo

Rishabh should be able to tell you more on this . I am cc’ing him .

Manish

Thanks Manish for your help.

Hi,

Last year my wife had resigned from her job and earned less than 50000 for the entire year. This year onwards she will be joining a new job.

Now, is it necessary that she should file a return for the previous year even though she did not pay any tax? If yes, what is the procedure and what are the documents needed?

And, am I right in assuming that IT returns can be filed even one year after the last date for the particular financial year? Please let me know.

Finally, I have been filing returns myself these past 2 years through the IT dept website without anyone’s help, and it has been very easy. I only need to take a print out of the ITR-V form and mail it to Bangalore.

Prasad

These two articles will give you all info .

http://jagoinvestor.dev.diginnovators.site/2009/07/when-to-file-your-tax-return.html

http://jagoinvestor.dev.diginnovators.site/2010/01/how-to-miss-your-income-tax-returns-itr-deadline-and-still-enjoy.html

Hi Manish,

Thanks for the clarification. Those two articles were comprehensive enough to cover my doubts.

hi sir ,

i have no more knowledge about ITR i did b.com so i wanna fill return of my father like income from business so plz tell me how i can fill itr acnowledgement form……………i will thanks for u

Gurucharan

Thats really a detailed thing to tell on comment section , why dont you pay an agent and get it done

Manish

is there any other easy way to file tax?

mynameisnotkhan

I think the easiest way in that case would be to hire some one to file your taxes , you can go through Rishabh Parakh himself , he does tax filing .

Manish

krish,

right, there is no need to file in India till you do not exceed the basic limits

Thank You Rishabh for a quick response….

Good article again Manish…

I have one Question…Currently I live in US. Since I work for an Indian company and my base location is India, every month I get small portion of my Salary in India (which is less than 1.60 Lakhs per Annum).

Do I still need file Tax in India? Pls Clarify…

Krish,

till the time income is less than the basic exemption limit one is not supposed rather obligated to file his or her IT return, in case if the income crosses the limit then all the other provisions related to resident or non resident would accordingly apply.

are you filing your IT returns under NRI status?

Had the same question as Krish. Till 2008, I was able to file the returns in Bangalore Income Tax where my taxable income was less than basic Exemption limit .

But in 2009, Income Tax folks did not accept my IT Returns filed through my Financial Advisors in India indicating that taxable salary is less than the basic limit.

I am NRI getting small amount of money everymonth from my Indian company..

MG,

strange, one can always file IT returns Voluntarily if the income is less than the basic exemption limit, IT dept do accept returns like yours and the “taxable salary is less than the basic limit” cannot be the ground for non acceptance.

Thanks for the reply Rishabh.

No, I am not filing the IT Returns in India under NRI status.

Since I work in US, I file my IT Returns here in US. But I am also getting small portion of money (less than 1.60 lakhs per annum) in India, so I wanted to confirm regarding this.

In my case, I donot need to file the Tax in India right?

Great job Manish and Rishabh,

How does it works when a person joins a new company. for e.g. in my case i joined new company on 12-jun-2009… my current employer income tax calculation doesn’t take income from previous employer.

what i should take into considerations before filling returns?

Marshal,

ideally the new co. should take in to account the previous income, in case they do consider that income then you need to calculate tax on the previous income and pay the self assessment tax thereon and at the time of filing IT return attach the tax paid challan info, this makes you save from the last minute computation and interest penalty u/s 234.

did you talk to them as generally cos. do include the previous income.

thanks rishabh for replying, i will check my current co. if they are willing to consider as we are in mid of march..:(

i think they may not consider now, make sure to calculate the balance tax and pay it asap to avoid last minute rush and interest charges, as if the tax payable is of a considerable amount you may have shell out more towards interest.

have you paid any self assessment or advance tax earlier?

rishabh,

my previous employer used to pay TDS, they have given me provisional Form16. i have rec’d basic salary, gratuity, leave encashment, incentive from previous employer and all is mentioned in provisional form16. Current employer is also paying TDS.

But if i combine income from previous employer, i think i have to pay more income taxes.

now what should i do? when i file my IT returns(before 31st july-10), should i ask consultant to combine both incomes previous + current and calculate tax. Should i give balance tax via cheque ?

Please suggest!

thanks

marshal

Marshal,

you are right that you have to pay taxes if you combine both the form 16 and the excess tax can be paid through cheque or you can easily pay it through net banking also, please ask your consultant to do the computation and help you know the exact tax liability and they only will help you out in making the balance payment else you can do it directly also as follows:-

log on to http://tin-nsdl.com/

Select following options:

• e-payment

Next Screen:

• Challan No. 280

• AY – 2010-11 (or the respective one)

• Income tax other than companies

• Self Assessment Tax

• Fill in your PAN, Name & Address &

• select bank for online net banking

Bank Website:

• use your net banking userID & password & amount of tax to be paid

The receipt will be generated online towards the tax payment.

thanks rishabh for inputs! appreciate it.

Ashal

Rishabh has cleared the doubt , I have changed the line “AY 2009-10” to “FY 2008-09”

Manish

Dear Manish, Just a small correction in the article, the zero tax slab for a male age below 65Y is 1.6L Rs. for AY 2009-2010 not 1.5L as stated in the article.

Thanks

Ashal

hi Ashal,

tax slab for AY i.e. assessment year 2009-10 is 1.5L only and Rs. 1.6L is applicable for AY 2010-11 (i.e. Financial year 1st april 2009 to 31st march 2010).

i think you got confused between the AY & PY for 2009, good news is that the direct tax code has proposed to remove this distinction.

Well, this did not get said in the comment. Webink for – Income tax slab and how it affects the common man – .