How to save and invest money for your Child’s Education? – Ready 5 easy steps.

Child Education is one of the biggest goals of parents these days because of the tough environment and high expenses involved.

Most of the parents start saving for Child Education right from the birth of Child, which is a great! In this post we learn how you should evaluate the target cost of Children Education and how you can achieve the targets within expected deadline. We are mainly talking about Higher education in this article.

Many Companies come up with Child plans and other products which are nothing more than ULIP’s bundled with special features like Wavier of Premium option and some other features. However Planning for Child Education is not a big task and you can do it yourself, given you have some interest and eagerness to do it.

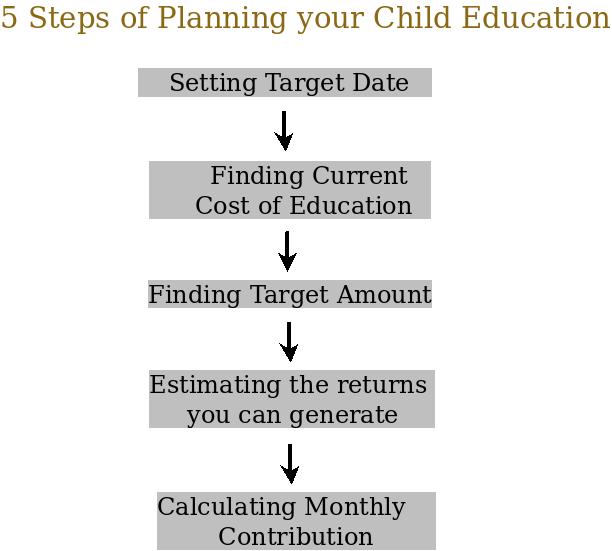

So following are the 5 steps you can do yourself to plan for your Child Education:

Step 1: Set a Target Date

The first step is to find out the target date for the child education goal. I feel the that average age when a child goes for Higher education can be taken as 21 or 22. You can take your own target tenure depending on your expectations and situation.

If you are not yet married then find out the estimated time left for your marriage and when you want to start your family (i mean children) and add target years to that number. For me personally it would be 4 + 21 = 25 yrs. what about you?

Step 2: Set a target amount in today’s term

The next step is to determine how much does it cost in today’s value for giving education to your child. All of us have different aspirations when it comes to our child education, courses like MBA, Engineering, MBBS, Software related courses are on our minds.

So let’s say for example you determine that Rs 10 lacs is good enough to provide a good education to your child in today’s value. Now you can jump to next step, but before that make sure you understand the effect of inflation on our Money. Here is another good article on Inflation

Step 3: Find out the amount you need on target date

Next step is to find out how much amount you actually need in the end. For this you first need to determine the rise in education cost per year. As per the recent year numbers, Education costs are increasing at 10% per annum.

A decade ago you could have done an MBA at 1.25 or 1.5 lacs, but today it costs more than 4 lacs. That’s more than the average inflation. Education cost in our country has been increasing at higher speed than other things. so you need to consider some figure. I would like to take this as 10%.

Now, you can just inflate the today’s cost using simple compound interest formula. Understand Compound Interest and other important Formulas.

Target Amount = Amount today X (1 + rate) ^ Tenure

Example: Considering myself, the amount I would require today is around 8 lacs. My tenure is 25 yrs and rise in education cost I would like to take as 10%. So

Target Amount I need after 25 yrs = 8,00,000 X ( 1 + .10) ^25 = 86 lacs (approx)

So, I can see that I need to make around 86 lacs in 25 yrs. Please note that this figure is based on your assumptions. The actual Figure you might need may be more or less to this amount. But still this is good enough, as we have a plan at least and we are near the goal.

Step 4: Estimated the return which you can generate over your investments

This is an important step where each investor has a different level of risk appetite and knowledge. Depending on those factors one can choose different products for investments and can generate some return through it.

One who is not much interested in finances and has lesser risk appetite can choose Balanced Funds or Debt Funds and can generate around 10-11% returns. On the other hand a person who can take more risk and have more interest in finances can invest in products like Equity Mutual funds, ETF’s, Direct Equities etc and can target close to 14-15% returns.

Getting more or less return is fine. All it matters is, does it suit your risk appetite?

There is no point in investing in risky products if you are not a risk taker. As a rule of thumb, a person who is investing for long-term like 10+ yrs should take Equity route because over that kind of time frame Equity has performed the best with maximum returns and with small risk.

So for long-term, Equity is what you should invest in and for short-term prefer equity only if you are great risk taker. Your range of return expectation should be from 8% – 15%. Anything above that is a bonus but getting more than 15% is tough for general investors like us.

Anything like 20-25% should be the target of more professional investors who have advanced knowledge and who are full-time into stock market and related fields. So better be satisfied with suitable returns which will be able to achieve your goals.

Understand Equity and Debt here

Step 5: Calculate per month contribution

The next step is to find out what is the monthly contribution you need to do. For this you have to use this scary formula.

C = [FV * r] / [(1+r) * { (1+r) ^ t – 1 }]

Where

- C = contribution per month

- r =Rate of return you expect to generate on your returns .

- t = tenure (It would be multiplied by 12 if payments are monthly)

- FV = Future value of your goal (this is calculated in step 3 .

You can Use this Calculator to calculate these figures. Just fill in your details and get the output. Now you can invest this money in product you have chosen.

Important Points to Remember

- Apart from these 5 points, there are other points you have to consider which will make your Child Education planning more strong and successful.

- Make sure you are Insured Properly because in between if you die prematurely the amount of insurance your dependents get should be good enough to achieve your Child Education. Make sure you buy a good term insurance plan to cover this risk.

- When you are near the end of the goal, when still 4-5 yrs are left then you should better start withdrawing your money from riskier products to more safer products, so that you do not get surprise drop in your Corpus. If another subprime crisis happens at the same time when your kid is ready to go to college, it will be a tough situation. So better start withdrawing your money every month from Riskier products to safer products.

- Make sure you review the performance of your Child Education plan every year and make sure that things are going as expected. If not, find out why? See if you need to change your numbers, if you do it’s fine. No one can plan for things in advance with accuracy and it’s totally find if things go little off track. Just be ready to adopt the changes.

- At the end, sticking to this plan is the deciding factor of whether you are successful or not. The consistency in Investing for this goal is the main thing. Returns will follow when you follow the plan.

- Make sure the Asset Allocation is right and make sure you stick to same asset Allocation.

- Make sure you do not force your Child to adapt as per your Plan. Make sure you don’t have anything rigid for Child. Let him/her decide what they want to do, You are mainly a motivational parent who are paying for cost of what your child wants to do in their life. A successful Child Education plan won’t make any sense if he/she is not able to pursue what they are passionate of and love doing.

Conclusion

You have several products in market which claim to be Child Plans. They are costly and complicated for most of the general investors. The simple funda for successful financial planning is “Dont buy if you dont understand it”. Planning for Child Education can be a step by step designed simple plan which we can do ourselves.

Please leave your Comments to let me know how did you like the article? Which one of these steps is the most challenging part? What do you suggest is the rough estimate of Child Education expenses today?

January 11, 2010

January 11, 2010

Hi Manish,

I have two child, they are just below the age of 2, one is of 1.5 and other one is of 6 months.

so iam much more concern about their education.

so please let me know good option for this to secure there future.

i dont have a knowledge of securities market.

Please let me know the name of the investment plan or any suggestion in this regards directly.

Regards,

Sajid.

Hi Sajid

I would suggest mutual funds for their long term future. You can get in touch with my team who will guide you on everything .

Just fill up this – http://www.jagoinvestor.com/solutions/invest-in-mutual-funds

Manish

Thanks for your help.

I surely go for long Term MF. but is there any other option that best suit my need.

Please let me know.

Regards,

Sajid

Hi mannish

I have son who is 8 yrs old. I have taken taken ULIP policy from burla sun life thinking it will generate 15 lakh at 18 yrs time. The premium is 48k started from 2009. I am seeing that my returns are not that great and risk of not achieving the goal. Two queries

1. What shall I do with existing policy.?

2. Knowing I have 10 yrs till gets 18 and still wants to get 15-20 lakh what should I do .. Will ppf is good option still? Or need to move to some other options

I can invest 1.5-2 lakh per annum

Please suggest

I would rather suggest Equity mutual funds SIP . ULIP are costly products and are not suggested.

I suggest you take our help in setting up your SIP’s , we will help you with investment and also help you in tracking it

http://www.jagoinvestor.com/services/financial-planning

This article is really helpful. I really like it how you guys have explained it. Recently my mom recommended a website where you could estime the cost of your childs education and how much you need to save for their near future . I really liked it . I know you guys must be thinking that i am trying to promote this website and all but i am just a common guy who likes helping people and giving free advice . Well the website is http://www.bigdecisions.com where there are various calculators and one of them is education calculator. This is the exact link.

http://www.bigdecisions.com/education

Glad to know that Parth ..

My daughter is 2 months old. I would like to plan for her education. The amount that I am targeting is some where between 20-25 lacs. which one is the best suitable equity plan to go for it. Would you also let me know how should I go about it

You can look at HDFC mid cap opportunities !

hi,

My daughter is one year old. I would like to plan for her education. The amount that I am targeting is some where between 20-25 lacs. which one is the best suitable equity plan to go for it. Would you also let me know how should I go about it

Hi Neha

Its not a small planning. You should either go for a financial planning exercise or learn a bit about it yourself. I suggest SIP in mutual funds for that. You can also check our service for this – http://jagoinvestor.dev.diginnovators.site/services/financial-planning

Hi Manish,

Further to my query if i discontinue the policy i end up losing around 50K.

I want to build a corpus of around 1c for my son in 15yrs time. but i cannot afford the heavy investments wich i have to do. can you please guide me in reaching near my goal.

IN that case you should continue your payment in same policy

Hi Manish,

Very informative blog. I have a query should we invest in endownment policies. I have a endownment policy in my sons name. he is 4yrs old . i have taken birla vision life for 15yrs. i am just 7 months into the policy. My monthly taken home is 46k and am 40yrs old.

and am a single parent without any liabilities. recently i have invested in axis bank MF and have some amount in ppf and FD.

My question is should i continue with the policy for its term or make it paid after 3yrs. I am thinking of buying a flat for invcestment in mumbai. please advice.

There are too many things you have asked here 🙂 . I think you need to first concentrate on the security part like term plan, health insurance etc and then invest for your goals. Have you broken downs your goals in a list ? I suggest get in touch with a good financial planner to help you on overall issue .

Manish,

Its a very nice article. I want to invest for my son’s higher education. He is 5 now and in my view, he need lump sum by his 18 years when he complete his higher secondary. if we take for eg MBA which costs 8 lakh per annum roughly as per today’s market. I don’t understand how have you calculated the required amount …Target Amount = Amount today X (1 + rate) ^ Tenure ..what is this ^ ?

and roughly if we take inflation as 10%, I assume it as 30 lakh is needed . Now my question, to achieve this target, should I consider any child investment plan or SIP or MF or ULIP. Can you please advise ? I appreciate it. if its SIP, the return amount is taxable right ? …incase its ULIP / Child plan there is no tax on the withdrawal , correct ? Please advise I am getting confused what to choose and how to start ? I am 35 in IT, planning for his higher education lump sum.

Thanks again .

If its SIP , then the returns are not taxable . You can do it in FD also , but then it will be taxable .

Manish

Hi Manish,

I have a 4 year old son, and for now am investing into two PPF accounts, 1 Lac into each account. And also hold FDs which we intend to keep on renewing for long term ofcrouse. As you can see we have not invested into equity so far and are keen on creating a corpus in the next 15 years. We could stretch for 20k+ per month on a SIP, any suggestions on what MFs to go for, obviously for a long term basis.

Thanks

There are various mutual funds to choose from .. What kind of fund you need, how much risk you can take ?

I’d be a medium-risk taker and was thinking of having a SIP in established equity funds with a long track record. However i see Sensex is touching a high these days, presumably a SIP would buy units at high levels? so should i wait it for a while. What do you say? or invest a lump sum in one of the MFs?

I would say jump in if you are looking at very long term , the more you want to wait , the more time you will loose !

Hi Manish,

I want to invest for 1 year old daughter.

Expecting good returns after 15 to 20 years for her higher education.

I am ready to invest min 2000 – max 3000 per month.

Can you please suggest me good plan?

Thanks in advance.

As I must have mentioned in the article itself , for a 15-20 yrs period , I suggest mutual funds, ETF or any equity based product ! . PPF is also a choice !

Hi Manish,

Very informative article, Thanks for that..!!

My son is just two month old. Considering the cost of education now a days right from Playgroup and then collage and then higher education, feel like we should start planning for each stage of child’s education and not only of 15 or 18 years later of education.

One thing I’m still confuse after reading the article is though the SIP and debt investment are good options for securing child education, why not various education policies products offered by insurance companies to go for? or should have mix of both? Just a thought…

Regards,

Jagrut Khairnar

p.s. – reading the comments of this article was also a good learning for me

Jagrut

Yes, you are correct that one should be planning for all stages of child education. Regarding the “child plans” they are not that good considering traditional options for investments like mutual funds, PPF , FD !

Hi Manish,

My son is 5 years old. I am looking at the following plans and unable to chose the right one. I would like to invest in guaranteed schemes only for child education.

ICICI Smart kid, Met Life Bhavishya, AVIVA Young scholar and LIC Jeevan Tarang are the choices i am looking at. With my limited knowledge, i would like your opinion pls. Thanks for the updates on changes effec Jan 2014 on Life insurance. Looking to hear from you.

I dont suggest for these kind of policies, here is an article you should read –

http://jagoinvestor.dev.diginnovators.site/2010/03/how-do-highest-nav-guarantee-plans-work.html

can someone explian me the below formula

Target Amount = Amount today X (1 + rate) ^ Tenure

what does this ^ sign means??,,i am uable to calculate with the formula

Regards

Tejas

It means to the power . Ex

2^1 = 2

2^2 = 4

2^3 = 8

2^4 = 16 .

Hi Manish –

I have two kids. one 6 year old and other one 9 yrs old. I have LIC Term plan of 25 lakh (others offer more but i am not sure whether they are good, suggest better one please which is reliable). I do save about 10 K per month in PPF.

By seeing the cost of education going high, now I am interested in saving more for my kids and create good amount of money by their college time. kindly suggest the BEST approach.

Let me know your thoughts on,

– investing in properly

– Investing in PPF than Equity or MFs. Do guide me here.

– Good SIP plan

Thanks,

Ravi

I think you can take some insurance from AVIVA , the premiums are really low .

Also you can look at some equity funds for long term through SIP route . Like DSPBR top 100 , HDFC Equity

Hi Manish,

Thanks for the excellent article for savings for a kid’s education.

I have a son who is one and half year old. I have 5 lacs as fd which I will get next year. I am plannning to take a plan for my kid. As you suggested I amy need 60 lacs when he becomes 20 year old. Is it better to proceed with fd’s or any other plan. I dont have much knowledge of mutual funds. ulips and also I have a sbi smart ulip, which is not generating any returns. Please suggest. What about ppf savings ?

Better take route of FD’s and mutual funds. You can start with HDFC prudence mutual funds to get comfortable in few years !

Hi Manish,

My daughter 3 months old and now i am thinking for her education plan. i have a term insurance of Rs. 30Lcs. Can you please tell this is the right time to take Education Plan for My child. If Yes, then please guide me with best option.

Thanks,

Manoj Prajapati

the right time to invest is NOW . so do it at this moment itself , just that you might want to avoid “Child Plans” . Read this – http://jagoinvestor.dev.diginnovators.site/2012/02/create-best-child-policy.html

Thanks Manish for this information.

I already opened PPF account for my dauther’s name and putting 1000/ pm. But this PPF is fixed for 15 yrs. But I also want plan to get money in her school interval every 4 or 5 yrs. So i can fulfill her dreams on time.

Manoj

Then PPF is not a suitable investment . you need to then get into FD’s !

then RD is Good Option for this

Yes .. anything which can be liquidated when needed

thanks Manish.

All your advise is usefull to everyone.

Again Thank you

Thanks

Hi Manish,

Thanks for the great article, as always.

I just was wondering what you would suggest for my situation. I’m currently chalking out a plan for the education and marriage of one of my cousin sisters who is 14 years old. The idea is that 3-4 of us cousins (all independently settled) will make a monthly contribution for this goal.

I’m looking for a financial instrument which:

1. will be under my cousin’s name, but should make it convenient for us to add monthly contributions. Online payment / NEFT/ ECS will be great.

2. preferably be more equity focused in first 2-3 years and more debt focused subsequently. I can do this switch manually too (say from a balanced fund to a debt fund).

3. should be relatively illiquid, to discourage pre-mature withdrawals.

What would you suggest for such a situation? Thanks in advance and keep up the good work!

-Nikunj

the best I can think right now is to open a joint bank account with your cousin as primary holder and the other guys as secondary holder, and then setup a SIP from this account for Rs 3X to a tax saver ELSS fund or a tax saving 5 yrs FD , all you 3 people contribute Rs X to this bank account .

Manish

Hi manish

nice article..

please suggest some child plan also..

i have calculated .. i need to invest atleat 7000 per month for my goal

I dont think child plan is a good idea, read this – http://jagoinvestor.dev.diginnovators.site/2012/02/create-best-child-policy.html

Hello Manish,

I just read your article about child Insurance plan its very nice. Decided to buy a child insurance for my son he is 9 months old. As you suggested we need money only when he pursuing higher education. We both parents decided to see him as Software Engineer or Dr. don’t know exactly, what will be the expenses in present scenario. Estimated i may need 10 Lacs and term 20 years to complete his education.

One more thing is few years back i have bought LIC sigle policy for 3 Lacs sum assured and term is 21 years and yearly payment is 15,000 which i think is too much when compares to Religare iTerm Insurance. i wanted to close or sell this na buy new religare insurance but dont know how to do.

Please suggest what will be the amount after 20 yrs for 10 lacs and procedure for closing the present insurance.

Regards,

Ganesh

First you do some number crunching using this calculator http://jagoinvestor.dev.diginnovators.site/calculators/html/Goal-Planner.html

JUst stop paying the premiums , the policy will become paid up

Hi,

I want to invest for my child education and marriage, what kind of investment plan i should go for.. I thought of investing in Mutual funds for longer term around 15 yrs so that risk is less… Is this the right way to go for ….. could u give any suggestions

Yes . I think thats a good idea .