How do Highest NAV Guarantee Plans work ?

Now a days, we are seeing a new “Innovative” product in the market. They’re called Highest NAV Guaranteed Plans .These products have come in, after the recent crash in the market, and companies are taking advantage of the fact that Investors are looking for some kind of a safe investment equity product. Hence, they’ve launched these Highest NAV Return ULIP’s which confuse investors and make them (the investors :)), believe that they are going to get the highest return from the Stock market in long run – generally the tenure is 7 yrs, for these plans .

In this article, we look at how Highest NAV Guarantee ULIP’s work, and you will understand, how any Guarantee product can be created by simple methods . The simple catch, here is that these schemes, are structured in such a manner, that the collected funds can be invested either in equities, debt instruments or in money-market instruments in proportions varying from zero to 100%

How Highest NAV Guarantee Policy Works ?

These plans use strategies like Dynamic Hedging and CPPI (Constant proportion portfolio insurance), which are advanced strategies used in Derivatives world. But, let me explain a simplified version of the whole process.

Supposing a policy starts today and is guaranteed to give highest NAV in next 7 yrs and we can control how money moves to debt and equity, its pretty simple.

In the beginning, let’s assume a NAV of Rs 10, and the Asset allocation is 100% in equity and 0% in debt . Now suppose, the market moves up and NAV goes upto Rs 15 by the end of the first year, at this point, try to understand what Insurance company has to provide – they have to make sure, that they provide at least Rs 15 as the return after 6 yrs . Now in order to achieve this, all they have to do is keep X amount in debt instruments which will mature in next 6 years and provide Rs 15 at the end of 6 yrs, so assuming the debt return at 7%, they need to put around Rs 10 in Bonds , so that the maturity of the bond is Rs 15 at the end of 6 yrs .

=> 10 * (1.07)^6

=> 15.007

They can now invest the rest Rs 5 in Equity as Rs 10 is allocated to Debt . So, now they’ve made sure that whatever happens to the market, they get Rs 15 for sure at the end of 6 yrs. Now, there are two possibilities

Case 1 : Market Goes down : If market goes down, the NAV will go down correspondingly, but as per the strategy, the maturity value will be at least Rs 15.

Case 2 : Market Goes up again : If market goes up at this point and the NAV rises above 15, for example say to Rs. 18, now again they will pull out money from Equity and allocate such an amount to debt, that the maturity at the end of total 7 yrs would be Rs 18 and so on…

Note :

- These highest guaranteed schemes do not provide wide range of product categories, such as equity-oriented growth funds, balance funds and debt funds.

- Guarantee on highest NAV is available only if you survive the term. If you die during the term, your nominees will get the prevailing value of the fund. This is inferior to even a regular debt product because of the high cost structure involved.

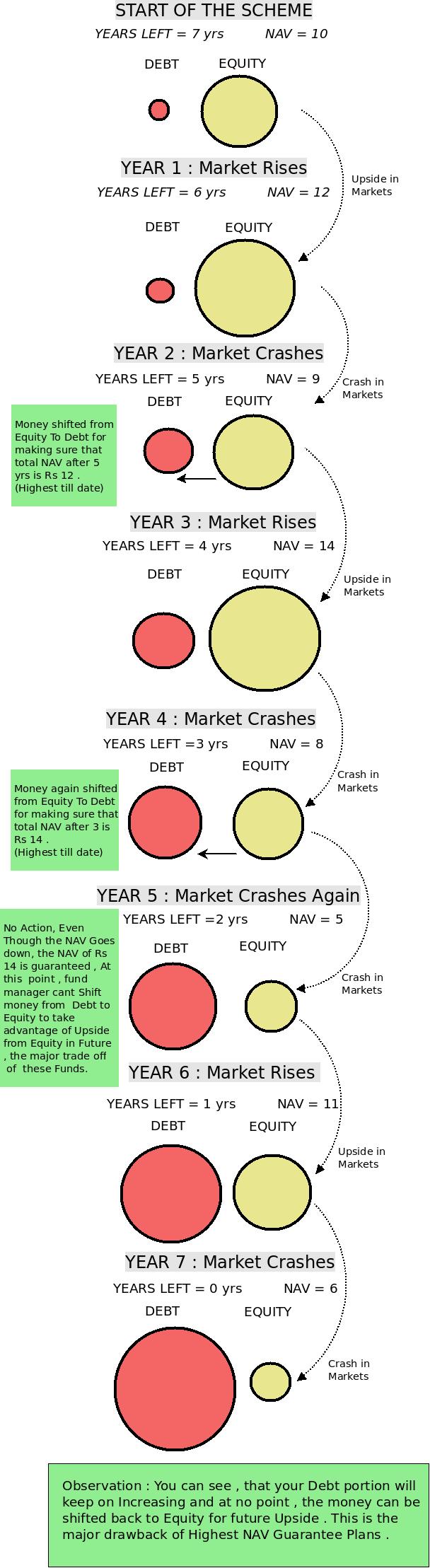

Following is a pictorial description of how the Guaranteed NAV plan works with assumption of a 7 year tenure.

How Investors get Confused

You have to read in between the lines; Investors need to understand that these schemes guarantee the “Highest NAV”, READ AGAIN! , it’s Highest NAV and not “Highest Returns” . Normal Investors don’t give much thought before buying these products and normally assume that the returns will be linked to the Equity Markets .

Returns from Highest NAV Guarantee Plans

So, what are the return expectations of these funds? We know, that long-term equity returns, are normally in the 12-15% range while, debt returns turn out to be 6-7%. So, considering the fact, that these products will shift most of their money to debt, by the end of the tenure , we can expect the returns to be in range of 9-10%. We do get some equity upside in these products, but that will be limited. After a point, this product will turn into a debt oriented fund with a major portion in debt . Also if you factor in costs, like premium allocation charges , fund management charges and other yearly charges, the returns will not be what you actually expect.

You will be amazed to know, that the returns expected from these schemes, may be lower than the returns offered by equity-oriented Ulips. The reason being, that the basic objective of protecting the previous high NAV of the fund, may constrain the fund manager’s ability to take risks while allocating funds. So if the market has fallen down, the fund manager can’t take the risk of shifting the money from Debt to Equity to gain from the potential upsides in future , because they have to provide the “Guarantee.”

Read : Important Questions you should Ask an ULIP Agent ?

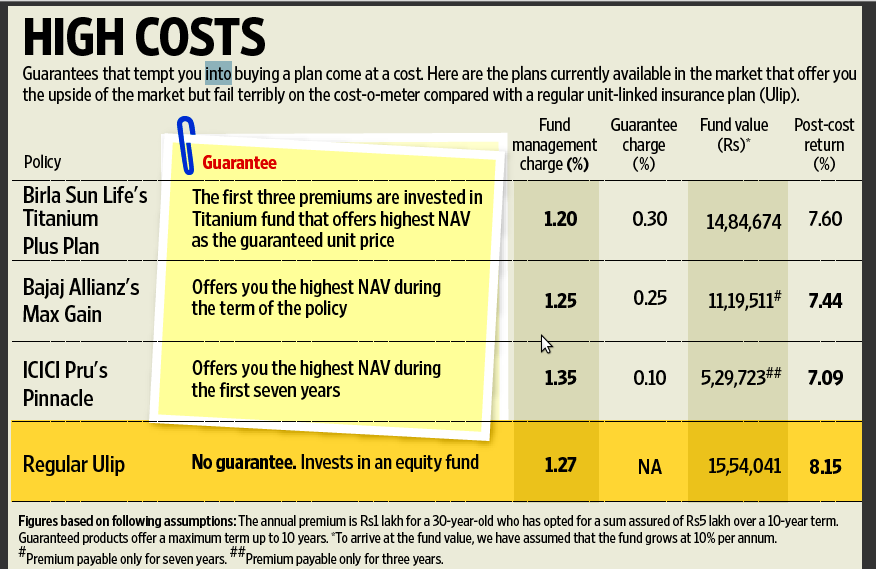

Source : LiveMint Research

Current Products in Market with Highest NAV Guarantee

- ICICI’s Pinnacle

- Birla Sun Life Platinum Plus-III

- Bajaj Allianz Max Gain

- SBI Life Smart Ulip

- Tata AIG Apex Invest Assure

- LIC Wealth Plus

- Reliance Highest NAV Guarantee Plan.

- AEGON Religare Wealth Protect Plan

Controlling your emotions with these products

Let’s talk about mistakes from the investors point of view. We, as investors, don’t think with inquisitive, susceptive minds. Getting good returns from stock markets is anyways a tough thing in itself. So when these companies come up with plans like these, which say “highest NAV in 7 yrs”, we have to ask, “How is this possible?” . Dont say it’s not possible at all, just ask how? How do they achieve it? Stop seeing dreams of getting high returns without looking at the risk involved, and try to find out – what is the strategy they’re using , Is there something in between the lines ?

We all want to get great returns, but we have to shed this belief that, companies come up with plans specially for us. All the companies out there exist to earn money, and their motive behind every product is to make money, & generate profits for their companies, so that they keep their shareholders happy. So next time a product like this comes up , you have to control your emotions before getting in and first investigate. The worst part of this whole business, (of guaranteed highest NAV products) is the timing and how it gives naive investors, high illusions about the product. Products like these, take major advantage of psychology of the ordinary saver. Many Investors in smaller towns have broken their Fixed Deposits and taken some loan to invest in products like these, especially SBI Life Smart Ulip and LIC Wealth Plus because of the trust factor with LIC and SBI . See How Agents are Misselling LIC Wealth Plus

Why you should be “Pissed off” At these Insurance Companies

- Do you Know that, The Securities & Exchange Board of India (SEBI) , the stock market and mutual fund regulator, does not allow mutual funds to guarantee returns. Therefore Mutual funds can not provide guaranteed products which are related to stock markets, but IRDA can approve things like these and all these insurance companies come under the ambit of Insurance Regulatory and Development Authority of India (IRDA). So any Insurance Company can come up with a new Plan , link it with market and start providing “Guaranteed products” . You have to understand that “equity markets” and “guarantees” are a very risky idea together , so please stay away.

- Do you observe when do all these “Innovative” products come up in Market ? The answer is around end of the year, which is a premier Tax Investment time (Jan , Feb , Mar) . Is innovation in Finance space limited to End of the year ? Why dont these products come through out the year? Why ? The answer is simple , if it comes after anytime other than last 4-5 months of the Financial Year (ie Dec , Jan , Feb , Mar) , no body will bother to invest in these, because no body is bothered to “invest” at all . Companies very well understand investors psychology and their helpless ness at the end of the year because they have to provide investment proofs for Tax exemption as soon as possible . This is not just limited to these products , its true for NFO’s , IPO’s in booming markets , More Sales calls at the end of the year, and other new products .

- The so-called “Guarantee” is a marketing gimmick and is implicitly a result of the way the investment is structured . what it means is that the strategy they use itself is such that it will provide you the highest NAV , even we can create our own Plan and do what they are doing . But they make sure that Investors feel like they have done years of research and came up with these amazing plans .

- Why The Tenure is 7 yrs ? I am not very sure on this , but here are my thoughts on comments area

- You have to understand that there is nothing “Innovative” in this product , the fact that 7 companies have come up with the same product proves that its not “innovation” because Innovation is unique . Aegon Religare has gone ahead in this stupidity and introduced their Guaranteed Plan which guaranteed 80% of the Highest NAV , Looks like they think that it makes them look different from others .

Who should Invest in These Products ?

If you are looking for modest returns, like 8-10%, you can invest in these policies. The return of these policies may be high in the beginning, if market does well; but when market starts performing badly, the returns can take a hit and then be in a tight range. Your NAV will be protected for sure, but the returns wont be, since over time the CAGR return will go down. Remember, if your NAV is 10 today and you highest NAV is 20, for a 2 year period, the return is a good enough 41%, but by the 4th year it’s just 18.9% and by the end of 7th year it’s a measly 10.4%. So what you really need, is protection of returns, not the NAV which is just a fixed number.

[ad#big-banner]

Comment on this Article and Subscribe to JagoInvestor and 1 Lucky Winner will Win

- TShirt OR Coffee MUG (Customised with your Picture or PunchLine)

- Prize will be give to “Best Comment” (Decided by Voting System)

- Valid Till 25th March , 2010

March 17, 2010

March 17, 2010

I invested in ‘HDFC LIFE SL Crest’ in 2010 with the following attributes.

SA – Rs. 500,000/-

Premium – Rs. 50,000/-

Premium Paying Term – 5 years

Maturity – 10 years

Premium paying term is over and the current value of fund is Rs.277,000. Can you please advise that should I surrender my policy and invest this money in some other plans or should I wait till it gets matured. I am not sure how much will I get after maturity (if we take an average what would be the amount after maturity)?

Hi Sidhesh

The best answer you can get only from the agent you invested through or just contact the company. The thing is your case is a bit personalised and other than company, no one can give accurate information

Manish

Dear Manish,

I want to invest 50000 every year…and i just read your article about Highest NAV schemes…now what do you suggest for me to invest..?

You can invest in mutual funds. If you are new to this, my team can help you to setup everything for FREE – http://www.jagoinvestor.com/start-sip

Dear Manish,

I had bought Reliance Highest NAV Guarantee program in 2010 & continued investing Rs 25000 in last 6 years. My agent tells me that if i have to avail the maximum benefit of this scheme i should invest in for at least 1 more year , which would make this 7 Years. Do you think i should invest for 1 more year or switch my Tax saving investment to some other instrument.

Regards

Hi Manish,

I have a doubt in MFs vs SIPs. Could you clarify me?

I have an HDFC bank-trading-demat (3 in 1) account. Instead of choosing SIP options provided by HDFCSEC I want to invest in MFs in disciplined manner and chose “DSP BLACKROCK EQUITY FUND – REGULAR PLAN – GROWTH”. Lets say if I buy and add to this MF every month for 1000INR for 3 years, at the end If I encash it how is tax calculated?

– Thank you,

Balu.

There wont be any tax after 1 yr of selling on profits.

[…] How do highest nav guarantee ulip’s works […]

Dear Manish

I have read your explanation about NAV and Policies… really it provides fact info., about policies… Many Thanks for keeping all your efforts to write these..and helping hands towards people…

Since longtime i am trying to explore on internet for some good policies, where i can invest…but got messed up with lot of them and confused..

Actually I am a techie, don’t have much knowledge about Policies…

Looking for anybody who has very good knowledge about all these Policies..

Really if you can help me, I will be thankful to you..

What is your opinion on “SBI Life – Smart Elite” which is a ULIP..for long term investment.., in this you have option to choose Funds were I can invest in %..

Here in this online there are NO words like Highest NAV or Highest Guarantee Returns..

Please guide me…Plus if you can give me u r contact info.. i wanna contact you for more information..

Better stay away from most of the ULIP’s , why not invest in mutual funds through SIP ? You can choose some good funds and then invest in them. Or you can also invest through our guidance under our financial planning program?

Many Many Thanks !!! Manish

I have started reading all of your articles in this website and I am observing a tons of knowledge about Insurance, policies, ulips, MF, etc…

Really I like most of your articles…

I will approach your financial planning program.. once after I complete reading your most of the articles and gaining with good knowledge about finance and planning…

Sure I will come back to you !!!

Please if can you provide your contact details and email…. so that in near future I can contact you for your guidance…in investment through SIP or MF …

Hi Faiyaz

Once you are clear you want the program, you can get in touch with us using http://www.jagoinvestor.com/services/financial-planning

Hi Manish,

i have invested 1,00,000 in last two yr in sbi smart performer daily protect iii.

i have three more yrs to pay. A total of 2.5 lac have to be paid.

They are telling i will get the highest of nav in first seven yrs. so can tell me how much will i get at the end of 10th maturity year..

Till date the highest nav is 16.5, assuming this can you tell me the amount which i will get?

also suggest should i withdraw the plan or continue, coming jan i have to pay my third year due.

Thanks in advance !

Highest NAV thing is just a marketing gimmick .. you dont get amazing returns in that .. have you read the article fully ?

This is a brilliant article! i had saved it in my inbox when i first read it in 2010. It is still relevant. Simply (Yet Wonderfully) explained

Kudos Team JI!

Thanks Ritesh !

Dear Manish,

I have ING Market Shield Plan started in nov 2012.

Sum assured : 4,80000

Premium paying term : 5 years

Total term : 15 years

Premium : 4000 per month

The policy completed 18 months this july 2014

Policy gives:

Guaranteed NAV

Flexible premium payment term.

Charge free withdrawals

Also,

Death benefit: In case the Life Assured passes away during the policy term, the beneficiary will receive higher of Sum Assured or 105% of the premiums paid deducted by partial withdrawals made in last two years preceding death will be deducted or special fund value.

Special fund value will be calculated based on higher of daily NAV or Guaranteed-NAV.

Maturity Benefit: The special fund value as a lump sum is paid to the policyholder.

Flexibility in Premium Payment Term: The time period to pay premium can be increased or decreased if the requirements are met.

Kindly guide on this manish. Should i continue further investment??

I am greatly concerned after reading your articles.

Your opinions are awaited.

Thanks.

Any ULIP , we suggest one should just stop and use the money instead in something more simpler

Hi Manish,

I invested in ‘ICICI Pru Pinnacle II’ in 2011 with the following attributes.

SA – Rs. 500,000/-

Premium – Rs. 50,000/-

Premium Paying Term – 5 years

Maturity – 10 years

‘ICICI Pru Pinnacle II’ claims to give returns based on the highest NAV recorded at any time during the 7 years, instead of that based on the final NAV.

Do they really keep up to their terms as stated OR is there any hidden clause that goes makes it a usual ULIP?

What percentage can I expect at maturity?

Thanks,

Jimmy

There is nothing hidden , things will happen as per the Document you got !

Hello Manish

As you have answered to Ashu “No , your HIghest NAV is only the one which happens after your investment date” , I think the highest NAV is recorded from the date of inception of the scheme and not when one takes the policy.

In my case, I took the policy in Dec 2011, the scheme was implemented in 2010, I was clearly informed that the highest NAV recorded so far is 10.something which will be guaranteed at the end if not higher. Now, the highest NAV recorder is 11.02

Please enlighten me…thanks

As per my understanding .. Its from the date you buy the policy . It cant be a fixed date , because its an ongoing policy .

@Mehul

Not only they hold your money for 5 years incase you stop further premium payment, they would also charge hefty surrender charges, rather penalty for discontinuing the policy.

I have already invested in this product around 50K, and thinking of stopping my next premium. But there is catch that then this 50K will stay for 5 yrs lock in and will earn me only saving bank interest. what should be done now. how can I get my 50K back now.

You knew it when you invested , correct ! . So now its your pick !

Again i found one more Point here

Highest NAV in between March2010 to March2013 was 11.02.

i found it from here “http://www.moneycontrol.com/insurance/ulip/life-insurance-corporation-of-india-LI/lic-wealth-plus-fund-ILI122.html”

actually i was started this policy on March2010.

But whats you question ?

i passed 3.07 year with this plan. still remail 3.05 year.

Hi Manish,

I am having LIC Wealth Plus Plan.

No. Of Unit – 27511.383

Rates Per Unit – 10.2362

I pay 3.06 lacs in 3 year. And then wait for return. As per your understanding and Experience? How much return I can get it with this plan.

Again ask a question that, can i stick with plan for 7 year or i can surrender it. Right now I am in loss of 25k approximately.

You can never know that because its linked to market. Also how much can you expect is already explained in article

Hi Manish

What are your views on the ICICI Pinnacle 4 Highest Nav B Fund?

The highest NAV has been 11.24, so 110percent of it is 12.36.

Current value is around 10.15.

The plan is to pay 50K or 1lac per year, for 5 years, and the maturity is 10 years.

They tell me that based on the current NAV and highest, a return of 23percent is sure. That of course is excluding the charges, but still with a guarantee, it could be 16-17 percent.

If this is true, it is a good idea, than investing in FDs. But is it really true?

Thanks

Rajesh.

PS: By the way am thinking about your 100 action program, and have send a query as well. And I really think your website is an awesome initiative, and hats-off to you for beingso dedicated and professional in trying to educate investors. I also respect the fact that you are so close to your reader, by replying to them so quickly – that it just feels that you are one of us, and not someone on the television who just speaks for some publicity or other goals.

Thanks Rajesh

I have sent you mail on 100moneyactions .

Now coming to your query , all the highest NAV plan are same , very minor difference. Highest NAV plans can beat FD over long term . But not pure equity funds.

I read your article and am wonder if I should continue paying my monthly premiums for Bajaj Allianz Max Gain Fund 1 (Pure Stock), starting from December 2009. Premium term is 7 years (December 2015) and Policy Term is 10 years.

I am thinking of surrendering it and payoff my car loan. What do you suggest? Out of Rs. 1,32,000/- till now current value is Rs. 1,13,000/-

Check out what is the return you have got till now and the prospects in future and then decide it .

Hi Manish,

I really don’t know much about Equity & Debt. I have a simple question.

i want to invest Rs 50,000 p.a. to a fund for next 5-8 years, and i want maximum return at last. i don’t need insurance as i already have that. So kindly suggest me in which fund i have to invest. I am thinking of SBI SUPER HIGHEST NAV plan. Should I invest in it or some other plan is better for me.

I would suggest a plan SIP in mutual funds , rather than a policy !

Thanks, can you also suggest me which SIP mutual fund guarantees maximum return.

Hi Manish,

I am only one year old in investment market and by mistake took ICICI LIFE STAGE WEALTH II plan for premium of 30000/- annum. i have paid 1st instalment only. should i continue or exist?

If I were at your place, I would not have continued !