Here are a set of 4 questions and answers asked to me on “Ask a question section” . These questions are on the topics on Insurance , Stock market and Futures and Options , ULIPs and Motivation. You can also look at other Questions and sections part here at Part 1 and Part 2

Question 1 # by Vishnu

I am 25, single and my parents are my only dependants. My Dad is aged 65 and mother is aged 55. I have a Group Health Insurance Plan from my company which is given as a part of my compensation package. The insurance cover is for 4 lakhs (2 lakhs for self, one lakh each for my mother and father).

Given the features of the plan and my current need, the coverage of 4 lakhs is sufficient. But, I don’t have any other health insurance plan. Should I go for an additional plan, personally? I also assume that I would be given similar health policies in all my future jobs.

Answer

This is often a question in people mind , you say 4 lacs cover is sufficient , what if you had 10 dependents ?

Then each one would have 1-2 lacs cover and would you say 10-20 lacs is sufficient , what you must see is how much is “each person” cover, For you , its 2 laks , and for your parents its 1 lakh , now this logically , what is chances of you getting any health issue than your parents who are old (55+)

So the real situation nails down to this . Parents has 1 lakh of cover each and they are Old (probability of health issue drastically high compared to you) .

Now there is another issue , which is psychological , people think that chances of bad things happening to them is low than others , which is totally baseless . God forbid , but suppose there is some surgery or any health issue , you can imagine how much does it cost these days .. Lakhs of rupees .

Conclusion :

U should seriously consider covering your parents, Because of old age your will face some issue getting health cover now, also the premiums will be high (good enough), now its you who have to decide if you want to save those premiums (which can go waste, as some logical people declare) or pay the high cost of Hospitalization or Surgery or whatever when it comes, but save those premium . your call 🙂

Question 2 # by Taranprit Singh

I am beginner in this stock world and doing trading just for earn money, money and only money. I can say I am doing good in intraday trading of equities. Now I want to enter in future and options but the problem is I have ZERO knowledge about them, so please it’s my humble request to give proper guide for the same by which I can understand FNO easily.

Answer

I want to congratulate if you are making money in markets with intraday, Keep it up. But !! if its just 1 week or 1 month that you have made money then wait, It can be because of luck or market may not have shown its real face to you.

I would suggest you to keep trading for 1 yr and see all the faces of markets, believe me, 1 yr is minimum time you should trade to see if you can do it consistently 🙂 . Take the greed out of your mind to make lakhs and crores using F&O. I am experienced enough to say that it would kill you badly if you jump into it.

I would suggest you this.

- Keep trading the way you are doing and see if you can do it consistenely for 6 months

- Once you succeed in that, then keep trading and slowly learn F&O, buy books and read on Net, practice a lot.

- Paper trade F&O trades , don’t jump into it with money

- Once you succeed, then do some real money trades with small money, Grow slowly 🙂

If you are a Fan of Jagoinvestor , Fill the Fan book to tell how much you like it

Question 3 # by (Name not allowed to Disclose)

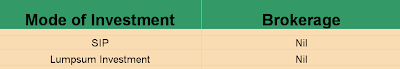

Have taken a new Aviva Lifeline,whole life plan(its still in free look period),i want your opinion abt it… details, Annual premium: Rs.25,000 Premium Policy Term:20years Policy term 72years (i m 28 years – 100 years policy max years) Invested Amt(for 20 years) Rs.5,00,000 Expected Return at 6% is Rs.8,00,000(at the end of 20 years) is this plan good from normal middle class person(of salary of Rs.15,000 per month) point of view?

Answer

Lets not ask a question “Is it good or Bad”, let us ask a question, Can we do better than this ourselves with simple things.

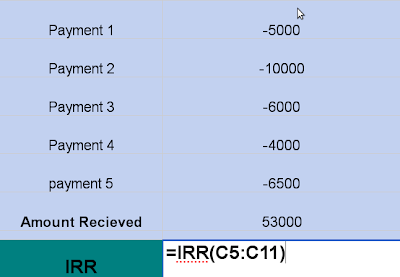

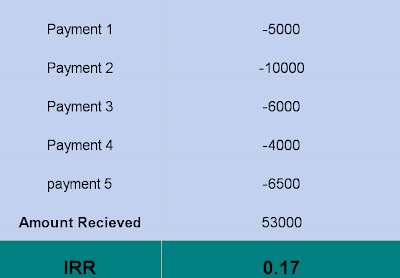

Equity Returns over long term have been more than 17%. Good Mutual funds over 10 yr of history have returned somewhere around 20%. If we think about future and assume even 12% return over long term, Your investment of 25k per year will become 20 lacs after 20 yrs.

>>> 25000 * (1.12)*(1.12 ** 20 -1)/.12

2017468.

If you think aggressively and assume 15%, it would be 29 lacs after 20 yrs

>>> 25000 * (1.15)*(1.15 ** 20 -1)/.15

2945253

At 6% , it comes out to be 9.7 lacs

>>> 25000 * (1.06)*(1.06 ** 20 -1)/.06

974818.

The reason why you were told 8 lacs is because of the charges and may be some mortality charges for penny insurance you might get there. Check it yourself.

Even if you take a term insurance of 30 lacs yourself now, it will not be more than 10k per year, remaining 15k you can invest in 2-3 good mutual funds for long term. at the end of 20 yrs, you will have at least 12 lacs assuming 12% return. Apply logic and maths and that’s it, you are your own financial planner 🙂

So my suggestion : Break this policy before the free look up period, and take what you get back, the amount spent on medical exam if any will be deducted.

Question 4 # by Vikas

I am 35 and haven’t had much opportunity to invest till 33 yrs. Now I have invested some funds in MFs (DSP Equity, Magnum Contra, DSP TIGER, HDFC Prudence and Sundarm Tax Saver).

I don’t have an established career and have taken any suitable opportunity that came along my way. Off late, I am jobless but have strong desire to start something independently of my own. However that “something” is what I am searching for.

I have to start small with no doubt due my financial restraints, but I know I have special liking for computer related jobs, exports, something creative like handicrafts etc.

Could you please suggest some books or articles or links or your own opinion how to translate this ” virtual something” in my mind to “real something”. I am absolutely sure if i strike the right chord, nobody can stop me, I have worked so hard for others in my regular job so I don’t see why I cant put my “everything” to get that elusive “something” 🙂

Answer

Great .. All the mutual funds u have are nice ones and keep continuing in them . Regarding converting your “virtual something” into “real something”, I have this to say confidence in yourself is amazing and worth appreciation.

To find out what you want to do, you may have to try out various things which may fail in start, but you need to have enough reserve of confidence to tell yourself that you will get it someday. “Making mistakes is a privilege which Unsuccessful people don’t get in life”, I said this one day to my friend and realized what a nice quote I made 🙂 .

“Believe in it.”

Most of the people are doing jobs which they hate or cant excel at, just because they don’t have that guts to start some thing on their own or change their jobs, you are much ahead of them, congrats on that.

Meet new people , try some ideas and make a list things “which you don’t want to for sure”. Prune out the things you don’t like. That would be a better way for finding what you want to do.

“One important thing” –

We many times think that just because we have lot of confidence and desire to do something on our own will make u succeed, but there are something which have no substitute like Hardwork, spending time reading about what we like, Jagoinvestor was not build in a day, or a month, It needs work and patience and confidence that it will succeed.

There have been instances when I wrote 20 posts in a row after doing so much reading and hardwork, writing in night, but there was no comment which said “Nice job”, that is kind of heart breaking sometimes and makes you feel that “You are going no where”.

But what you need is the “belief” that things will turn out well at the end, just do your karma and results will come, and when they don’t come, just get out and accept it and be ready to move one just like it happens in Trading or Relationship. Its all the same thing at the end.

I did Trading in Markets (options) and failed like anything.

I am still learning and my confidence and belief in myself does not allow me to quit. Best of luck to you in trying to find your way. Don’t get underestimated by the failures . Failures will come and they will teach you more than your success .

Its only the times when you feel like quiting is the time when you really need to keep up yourself. “Difference between Coal and Diamond is that Diamond takes a little extra pressure”, So don’t let that extra pressure make you quit 🙂

If you want to ask a question on any topic , Click Here Liked the post , Subscribe to Get Posts in Email or RSS Reader