You must have surely had an ice cream at Naturals!

But have you taken any inspiration from its story for your own financial journey?

Today I want to give tribute to Mr. Kamath for building Naturals Ice Cream and share some interesting numbers and their overall journey of building a Rs 400 Cr brand. This story can surely help you learn about long-term compounding and apply some of it in your own wealth-creation journey!

A Friday night of 17th May 2024 – as I was sitting to watch a nice movie with Natura’s Mango ice cream tub in my hand, my phone’s notification beeped.

The notification was of Mr Raghunandan Kamath, founder of Naturals ice cream, passing away!

A man who failed 3 times in 10th standard, with no money of his own, takes a loan of Rs 3.5 lakhs from his brothers as first investment and goes on to create a Rs 400 crore ice cream brand!

As an investor, here’s how you should study this company.

Suppose you have Rs 10 lakhs, at what stage would you invest your money with Mr Kamath

What Mr Kamath lacks

- No fancy college degree

- No big family business background

- Doesn’t understand accounts and taxes

- Doesn’t speak a polished English

- Doesn’t appear in newspapers for interview

- No pan India presence

- No fancy excel sheets to justify high valuations

What Mr Kamath has

- Intense focus on customers

- Has a cult-like following from his customers, just how Apple has

- Focussed on the quality of his product

- Spends most of his time in the production of ice cream

- Designs his own ice cream machines

- Understands the fruit market intuitively

- Keeps trying new ice cream flavors

- Only in a niche market

So now, when you read the rest of the story, keep assessing in your mind if you would have invested in his company.

By the way, it took Mr Kamath 40 years to go from Rs 3.5 lakhs to Rs 400 crores! Don’t look ath the returns, look at the time invested.

Honestly, when I’m asked to define Mr Kamath and Natural Ice Cream in a single frame – then for me, it’s just Customer Obsession!

Brief history of the company

From a single ice cream parlour in Juhu, Mumbai opened in 1984, Naturals has grown to 135 ice cream parlours across India today.

This might not seem like impressive growth, but it is fairly remarkable in the Indian context, where a majority of domestic brands have only a regional presence, due to inadequate infrastructure.

Moreover, Naturals made a conscious choice to be the best rather than the biggest.

Let’s talk about the founder – Mr Raghunandan Kamath

“In order to rise from its own ashes, a Phoenix first must burn.” ― Octavia Butler

Born in 1954 to a fruit vendor in the Puttur village of Mulki, in Karnataka, with a family of parents and 6 siblings. He lost 2 of the siblings because the village didn’t have adequate maternity services; sometimes the entire family would suffer from typhoid and there was no money to medicate them.

At twelve years of age, in 1966, Raghunandan moved to Bombay to stay with his brothers. The brothers had moved before his arrival, to work in the hospitality industry.

Unable to catch up with the English curriculum in Bombay, he flunked his tenth board exams three times, eventually giving up.

By then, his brothers had started a small Udipi—one of many South Indian eateries opened by those from Udupi, a town in Karnataka—called Gokul, which served ice cream along with regular fare such as idli, dosa, and the like. Ice cream was a small, less important part of their business.

In 1983, he married at age twenty-nine (considered late in India then), and he found the courage to back his business vision. As the brothers were planning a separation. Mr Kamath took full advantage of the independence and borrowed Rs. 3.5 lakh from his brothers and friends, and decided to start the ice cream venture.

Back in the 1980s, Bombay only had one, Yankee Doodle, which wasn’t a stand-alone parlour but part of Hotel Natraj.

This is a hallmark of visionaries who are slightly crazy.

Despite knowing these challenges, Mr Kamath saw an opportunity. He opened his first 400 sq feet store in Juhu Koliwada. The location had adequate parking, which was crucial back then because customers preferred being served in their cars.

Thus Naturals was born!

Initially, Naturals offered five flavours—sitaphal (custard apple), kajudraksh (cashew-raisin), mango, chocolate, and strawberry. Production happened in the back of the shop, and the two-hundred-square-foot front-facing area was used for serving. For seating, there were six tables in the verandah.

Just rewind your lives a bit

You are living in the 1980s.

- Televisions are a luxury

- Telephones and Mobile phones are the hallmark of success

- ACs are not common.

- Cars were less in number.

- Mumbai Pune Expressway is yet to be built.

- Amitabh Bachchan is your superstar.

- Indian cricket team wins the 1983 World Cup

- Sachin is yet to play his first game

- Modi is still figuring out his career in politics

And yet, there is one man who thinks Bombay is ready for an exclusive ice cream parlour.

“Here’s to the crazy ones. The misfits. The rebels. The troublemakers. The round pegs in the square holes. The ones who see things differently. They’re not fond of rules. And they have no respect for the status quo. You can quote them, disagree with them, glorify or vilify them. About the only thing you can’t do is ignore them. Because they change things. They push the human race forward. And while some may see them as the crazy ones, we see genius. Because the people who are crazy enough to think they can change the world, are the ones who do.”

― Steve Jobs

And because it was Juhu, Bollywood celebrities like Dimple Kapadia, Jaya Bachchan, Raj Kapoor, Shabana Azmi, and others became customers.

“Customers are the best teachers – Mr Raghunandan Kamath”

Mr Kamath would often seek feedback from his customers. They would suggest different flavours and what they would like to eat. Mr Kamath would work on it diligently. At one point, his unique flavour of Wild Mango became the bestseller across the city.

He would never keep his ice cream for more than 2-3 days because it would lose its freshness.

Caring for the customer began at the procurement level. When buying fruits he always paid for quality. Each fruit was purchased only from the particular region where it grew best. This approach ensured uniformity in the quality of fruit and hence also the flavour, all year.

The culture of customer obsession only increased over time even when it seemed detrimental to the business of Naturals.

Mr Nitin Churi who runs a franchise of Naturals shared a beautiful incident

“One time, we were waiting for delivery from the factory, and as soon as the tempos [a type of small goods carrier popular in India] reached, Kamath sir sent them back, ordering the entire consignment to be discarded. Later he shared that three days ago the factory staff couldn’t find one screw belonging to their machine. He suspected it may have gone into these ice creams and didn’t want to risk the customers’ safety.”

Personal Finance Implications

Now, when you are reading this story with the eye of the investor, it’s a no-brainer.

But trust me, it’s hard to spot such entrepreneurs early because they defy every rule.

So what should an investor do?

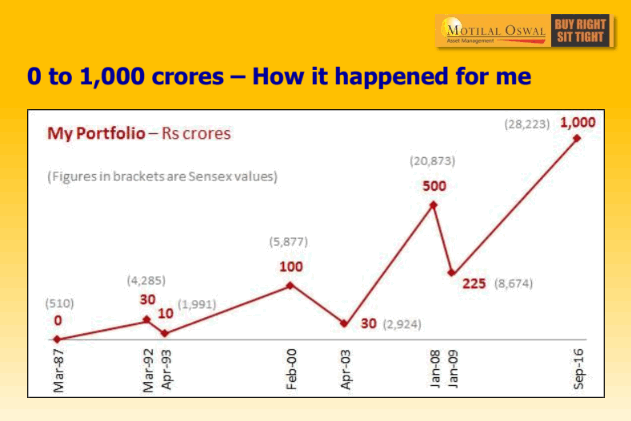

Firstly, invest for 40 years. If not 40, then at least go for 20 years.

Second, have a proper advisor in place because you need someone in this journey to spot such opportunities in the mutual fund space or direct equity.

Thirdly, create an entire portfolio. Not just 2-3 stocks. For even Mr Kamath his superstar ice creams can be 10 or 15 odd but he has tried 1,000 (thousands) different varieties and flavours along the way.

No one has the insight to only look at what can work and invest the entire money straight away.

Fourth, TRUST your advisor in the journey because you need Resilience along the way..

Here’s Resilience from the viewpoint of Mr Kamath

Mr Kamath had to undergo severe losses at times. These challenges came in multiple forms. Let me list down a few.

- A relative starting a competing ice cream parlour after learning the tricks of the trade from Naturals

- Income tax raid that hit the cash flows hard

- Machines that changed the taste of ice creams and the write-off on loans

- Finding good franchisee partners

These challenges may sound easy today (in 2024) for a young entrepreneur who is looking for collaborations. For a young businessman who is born in post-liberalized India, getting access to land, labour and capital is relatively easy.

When you consider the onslaught of private equity funds and venture capitalists, the ability to network and scale has become much better.

That’s why in the hands of the second generation Naturals is growing much faster than it’s ever been.

And one key reason for this growth is attributed to the resilience of Mr Kamath during difficult times. He evolved as an entrepreneur and Naturals earned a place in KPMG’s 2018 customer experience report because its customers rated it highest on personalization, time and effort, and integrity, and marginally above the sector average on resolution and empathy.

At the centre of it all, it was his childlike curiosity.

A few years back in an interview with his son Srinivas when asked about his father, he replied,

‘Full of ideas, he doesn’t stop thinking about how to pack better, how to take Naturals to the next level. . . Before you know it, he’ll have a carpenter create a prototype for some machine. Sometimes, as early as seven thirty or eight a.m., he calls me to discuss ideas, and his focus rarely slips, be it following up or implementation. It gets too much to keep up with him sometimes; he still has tremendous capacity. I wonder whether I’ll be able to live up to that level of entrepreneurship.’

May this kind soul rest in peace!

Jinay Savla, Jagoinvestor