The Chemistry of Equity and Debt

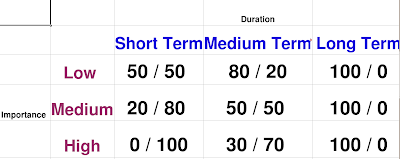

Following is a small Table which discusses the Equity and Debt allocation for your Investments . (Click on the chart to enlarge it). It will tell you how Equity and Debt should be used for long and short term financial goals .

It has two parameters .

1. Importance of your investment goal (Left Downside)

– Low : Buying an a/c for you car , Going for a vacation .

– Medium : Buying a Car , Saving for a second home

– High : Retirement , Child Education , Family health Related things , Down payment for Home Loan .

2. Time Duration of your Goal . (Upper Right)

– Short term : 1- 2 years

– Medium Term : 3-7 years

– Long Term : 8+ years

Basic Idea : It is based on the following facts .

– Equity is extremely risky in short term

– Equity is highly rewarding in long run with almost no risk

– Debt is safe always

– Debt eats away your money purchasing power.

So on based of these observation. Your Equity : Debt allocation should be based on both parameters of Importance and duration of goal , not just one one them

Some Examples

Example 1 : Ajay wants to invest 1,00,000 for his brother Education in next 1 year .

His Action : This is extremely important thing and cant be risked with , also its a short term goal. Equity should not be used . He should invest in anything giving him pure protection of his money (even though he does not get high return) . A plain FD for 1 yr will be good enough .

—————————————————————————————

Example 2 : Robert want to save some money for his house down payment in next 4-5 yrs .

His Action : As this is an important thing with time goal of medium term , His investment should be mixed in both Equity and Debt . He should invest 35-40% in Equity (SIP in mutual funds) and rest in Debt products like Tax FD’s and Debt funds% .

Alternative : He can also choose to invest his money Balanced mutual Funds (as they have mix of both Debt and Equity built in)

—————————————————————————————

Example 3 : Ankit wants to retire in next 25 yrs .

His Action : Now this is a important thing , with a goal tenure of around 25 yrs . There is no reason why Debt must be involved here at all . The matter that Equity is risky does not apply here its true for short – medium term , not for Long term like 25 yrs . (probabilistically only , If you are extra unlucky , what can one do) .

He must invest 50% in some good 3-4 Equity Diversified Mutual funds though SIP route and and he can invest 50% of his money also in some very good fundamentally strong mid caps and large caps stocks directly .

Note : Understand that , your definition of “Importance of Goal” and “Duration” depends on your situation , For me buying a Car is “Not Important” ,whereas for some one with a family of 4 and requirement of often going places can be “Important” .

January 28, 2009

January 28, 2009

[…] Understand Equity and Debt here […]