2 reasons why you should stop investing in Fixed Deposits immediately?

Today we will discuss why you need to stop investing in bank fixed deposits.

I know you are a bit shocked by this statement, but my only attempt is to give you some understanding of why banks fixed deposits are not the best financial products in these times for your long term wealth creation. There are other better alternatives today if your focus is assurity of returns, near inflation returns and convenience of investing

You can either read the article or just watch this 10 min video below where I have share why you should avoid investing in fixed deposits.

Why we create Fixed Deposits?

Since our childhood, I think most of us have only heard about Fixed deposits and PPF as investment products. We saw our parents talking about fixed deposits all the time. They broke “FD” when they needed sudden money.

And FD’s become were like the default financial product for most of us and when we started earning, we just created fixed deposits because that’s all we knew about.

On top of it, the fixed deposits come with assured returns of 7-8% (though the FD rates are going down and down these days). Also, almost all the banks offer the online fixed deposits creation (not breaking it) and that fact also adds to our love to creating fixed deposits whenever we need to park our money for some months/years

But, now there is a great alternative for fixed deposits called Debt Mutual Funds. This article will focus more on fixed deposits disadvantage and we will touch upon debt mutual funds to some level, but this is not a deep tutorial on debt funds

TWO big problems with fixed deposits

The 2 biggest issues which make fixed deposits very lousy products for our long term wealth creation are as follows

a) High Tax on FD – Fixed Deposits do not have any special taxation benefits. If you are into a 30% tax bracket, you will have to pay the tax on the interest you earn in a year as per your tax slab.

So if you create a Rs 10 lacs FD and you earn Rs 80,000 in interest (@8%) then you pay Rs 24,000 as the tax if you fall in the highest tax bracket. That’s not the case with Debt mutual funds. While debt mutual funds are not tax-free, their taxation is much better compared to a fixed deposit.

The video below explains how fixed deposits taxation is different compared to debt mutual funds.

b) No real returns – While you get an 8% return on fixed deposits, it’s just artificial .. because, after inflation and taxes, you are just left with a negative real return of 1-2%. So while you Rs 100 become Rs 108 after a year, you are not able to purchase the same thing after a year because it would not cost Rs 100, but Rs 110 by now (On an average)

Now, let’s look at debt funds and what they are and how they compare with fixed deposits

What are Debt Mutual Funds?

There is a big myth among investors community that mutual funds always mean risky investments because they are linked with the stock market, however, it’s far from the truth.

Debt mutual funds are a good alternative to fixed deposits. Debt mutual funds are financial products offered by AMC’s which pool the money from investors and invest in highly secured instruments like govt bonds, certificate of deposits, and other highly secured bonds in which a single investor cant invest on its own.

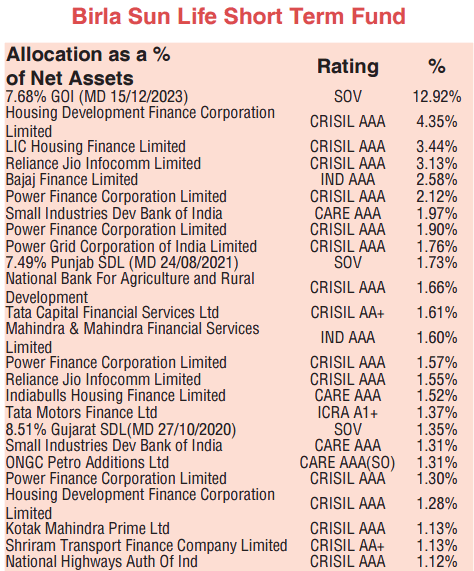

As an example, here is a sample top holding of a “Birla Short term fund” as per their factsheet

If you have done your mutual funds KYC, then investing and redeeming from debt mutual funds is online and very easy.

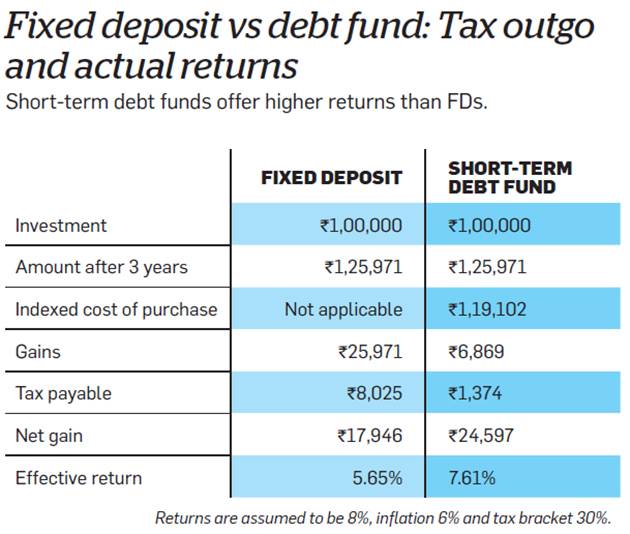

Debt funds also offer indexation benefits which means that you only pay tax when you redeem them unlike fixed deposits and you also pay tax on a lower rate (generally 20% after indexation). Below is a comparison by Economic times article on the taxation aspect of fixed deposits vs. a debt fund

When do Fixed Deposits make sense?

Fixed deposits can still be considered when you want to park your money for a short term period like 1 yr or 6 months and don’t want to go with mutual funds and also dont care about that extra 1-2% return. I think those investors who are trying to save money for the first time can look at fixed deposits or recurring deposits as open to start with.

SIP in Debt funds

If you are looking for an alternative of a recurring deposit, then SIP in debt mutual funds are the best option. The best part is that you can also top up your additional investments whenever you want unlike an RD in the bank.

Don’t use fixed deposits for long term wealth creation

While investing in a fixed deposit for a short term period is still ok, it’s strictly a no-no if you are investing for long term financial goals like retirement or children’s education or something. The positives of fixed deposits over long term are just a few compared to the negatives. Fixed deposits or recurring deposits are tools to just “save the money” and not wealth creation.

At best they can preserve your money purchasing power, but cant create big wealth for you (after adjusting for inflation and taxes)

So try learn more about debt funds, they are not at all that scary and much more easier to invest and maintain then you imagine. If you are looking to try out your debt mutual funds investments, our team can talk to you and help you save your money in debt mutual funds, Just fill up this form and we will call you

Let us know if you want to know anything about this topic ? Please post your comments and thoughts if any..

February 9, 2017

February 9, 2017

Useful topic. But computing IT for debt fund return particularly investing thru SIP for long period is cumbersome. Would u please suggest a simplified method of doing so ? I am conversant with excel sheets.

It is cumbersome 🙂 . No short cuts I guess !

Can grand parents give 50 lacs to Grand daughter as a gift?

Yes

Guys, please check if anyone can help with this case. One of my friends Mr M told me over a conversation that his father bought some shares in BlueStar, HDFC and ITC (before FY 2000) but he does not have the physical shares or folio number as they being lost long time back.

I helped him find the stocks in Blue star India and HDFC from the IEPF and unclaimed dividend data available from respective websites. He has good number of shares in Blue Star India, however the the trouble is, the parent company Blue star got split into Blue Star India and Blue Star Infotech in year 2000 (in 2:1 share split). Also Blue Star infotech was taken over by Infogain in May-2016.

Though he can claim his shares in Blue Star India, the problem is how can he claim his stake in Blue Star Infotech as their website is also closed and there is no investor contact available. Also no data or inputs are available at what price per share Infogain purchased Blue Star Infotech and what happened to unclaimed shares & dividends at this point or post sale is complete.

Also as per the current norms all the unclaimed dividend gets gets trasferred to IEPF ( Investor Education and Protection Fund). Can he claim all the dividend amount of the last 20 years (or only for some cut-off years)?

If anyone here faced/cracked similar issue, please provide some inputs.

Thanks!!

I dont think I have solution for this myself !

Money can still be lost even in debt funds….Just recently there was a bloodbath in debt mutual funds after RBI did not lowered the interest rate…..It’s very important to do proper due diligence and understand debt funds workings….

Yes Nimesh

There are categories of debt fund where this can happen in worst case, But we are talking about what happens in case of 98/100 cases

Manish

I suggest to have real data in the example in the recent years which will be helpful rather than assumptions.

Please add the info on where and when to get indexed cost

I am not sure if it will bring too much of difference in the results. But will plan an article around this soon

What is your take on arbitrage funds?

We have written about it here – http://jagoinvestor.dev.diginnovators.site/2015/09/arbitrage-mutual-funds.html

i still believe if we have a good exposure to equity then FD is still a good option

So you are agreeing to this ? Right ?

But calculation of taxation on SIP is cumbersome for accounting indexation

If you are investing a very small amount, then YEs, but otherwise its worth the calculation . A CA will do it for you for a small fees!

I don’t think that Fixed deposits can still be considered when you want to park your money for a short term period like 1 yr or 6 months

Thanks for your comment Dalal Stock

Hi Manish, as usual great article. Just one suggestion, the music in the video is very load and disturbing.

I think thats only in the start ? Right ?

For people who do not like volatility FD’s are best. We just noticed a 2% crash in Debt funds last week as RBI kept the rates unchanged. Moreover senior citizens and housewives do not need to pay any taxes if they submit Form 15 G/H.

Thanks for your comment Rakesh

Another good alternative to bank FD (besides Debts Funds) is the NPS Tier-II account

Thanks for your comment Arun Gupta

it will be beneficial for the visitors if we could see the time and date of the content when it was posted here.

The link has the year and month ..

However it depends of individual risk taking capabilities because to invest money in debt mutaual fund has higher risk then fixed deposits. FD are most secure ways to invest and fd are easy encashable.

To invest in mutual fund I think i need to research lot because there is lot of options and many companies. And also not recommended for small amount etc.

By the way debt mutual funds provides higher return and it expected that further reduction possible on rbi rate so there is higher chanses that reduce fd rate because bank has huge cash inflow.

Thanks for your comment Ashoksinh

Among various Health Insurance Company, which one is probably best in terms of their claim settlement, reputation, service etc. Please note that I have heard of IRDA,

Each year the data changes, and I am not aware of the recent data

Fixed deposits are a type of fixed returns investments, there ia actually an entire basket including corporate deposits (highly risky), debt funds, various postal schemes. Not counting PPF because it’s a long term option. Totally agree that FD in current times are only a short term parking spot! Try telling this to my parents!!

Thanks for your comment Ankur

For NRI- FD is a better option for tax purpose and repatriate the fund

Yes, There can be cases and class of people for whom FD Is better !

Can you discuss why a debt fund NAV shows up and down movement, and how much we should be prepared for, as its recommended to make lump-sum investments in Debt funds.

Yes, the debt funds will move and down , but the overall movement will be up if you look at a weekly/monthly data !

Nice article as always.

I have been investing in mutual funds sing 7-8 years, but I am not much aware of debt funds. I have few FDs that I would like to convert to Debt MFs. Also it would be better if you give more details on how to calculate return after indexation.

If you are interested in investing in debt mutual funds, our team can help you on that . Just fill up this link and my team will get in touch ! http://www.jagoinvestor.com/mutual-funds#sign-up

very nice and educative article, I want to know more about the debt funds. Also if good and stable debt funds can be compared in some of your articles, it will be really appreciated.

I am already a subscriber to Jagoinvestor news letters for a long time.

If you are interested in investing in debt mutual funds, our team can help you on that . Just fill up this link and my team will get in touch ! http://jagoinvestor.dev.diginnovators.site/mutual-funds#sign-up