In this article, we will see various features of Apollo Munich Optima Restore Health Cover policy. We will be covering its benefits, exclusions, eligibility and premiums details.

Apollo Munich is one of the most respected and well known health insurance company in India, which offers different health insurance plans for family, individual and senior citizens. Optima restore is its flagship health insurance plan, which has recently got some more features and we will discuss that in detail.

Let’s start.

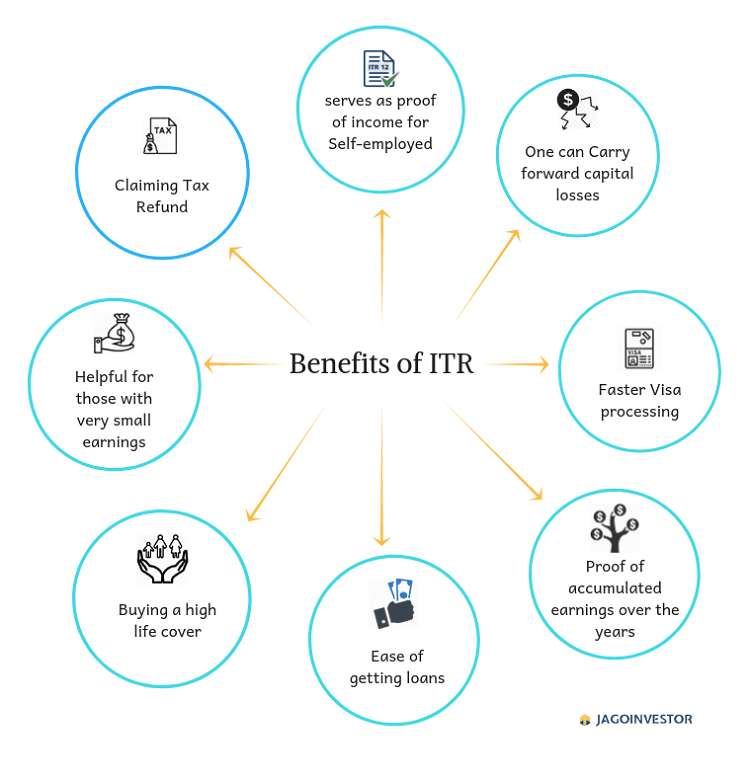

Benefits of Apollo Munich Optima Restore policy

Below are the benefits you will get as a policy holder.

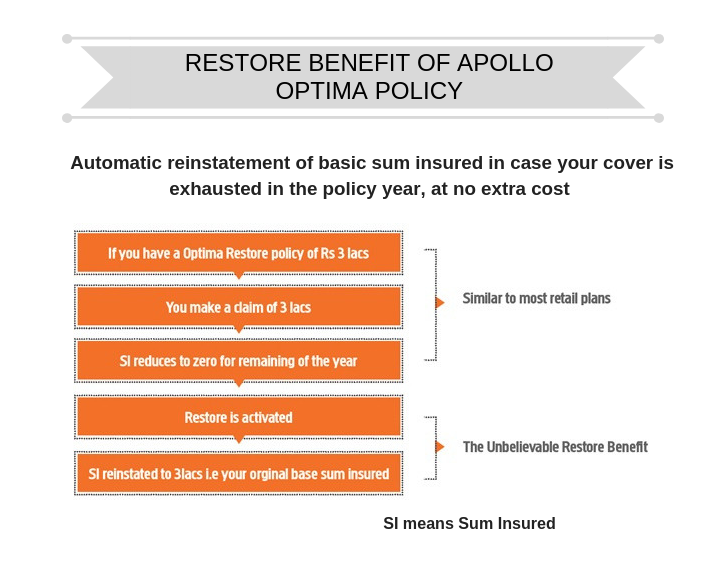

Benefit #1 – Restore Benefit

In Apollo Munich Optima Restore policy there is restoration benefit, which means that when you file for a claim in any year and the sum insured (plus the bonus, if any) is totally exhausted, then it will automatically be refilled to the extent of your basic sum insured. So in a way you get the full sum assured benefit again in the same year.

Let’s take an example – Suppose you are having health insurance of Rs. 5 Lakhs per year so, restoration benefit will work as follows –

[su_table responsive=”yes” alternate=”no”]

| Cover Amount | Claims made | Restoration Benefit |

| 5,00,000 | Claimed Rs. 3 Lakhs after 5 months of policy in force | Zero – as balance health cover is still there |

| Balance Left 2,00,000 | Claimed Rs. 1.5 Lakhs in next 2 months after first claim (7 months over) | Zero – as balance health cover is still there |

| Balance Left 50,000 | Claimed balance Rs. 50,000 in next 1 month after second claim (8 months over) | As the whole sum assured is exhausted, the restoration benefit will trigger now and the sum assured now will again be Rs. 5,00,000 – for next 4 months |

[/su_table]

So, as per the example, you can again claim up to Rs. 5,00,000 in remaining 4 months of your policy without paying any premium or any charges. If restored sum insured is not utilized in a policy year, it will expire. Note, that the restore benefit is available once in a year and it will be available to all Insured Persons for all claims under In-patient Benefit during the current Policy year.

**Restoration benefit is different from recharge benefit offered by different health insurance policies. Recharge benefit says that, your sum insured will be refilled to the amount of basic sum insured, every time when your sum insured amount is utilized for any claim, it does not matter what amount has been reduced from the total amount of sum insured cover.

Benefit #2 – ‘Stay Active’ – Get discount for staying healthy

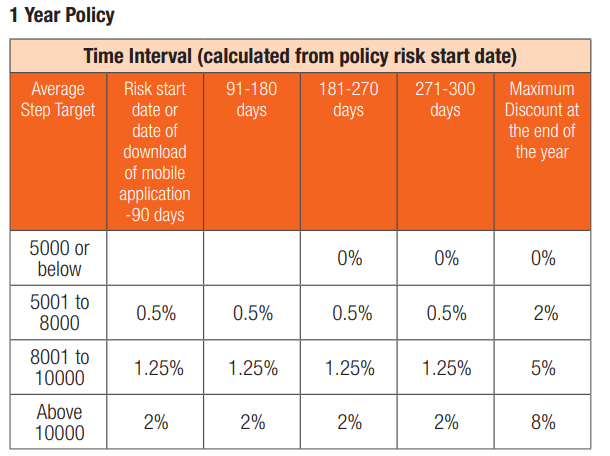

In order to encourage policyholders to stay healthy, this policy provides stay active benefit which says that, if you walk certain number of steps on daily basis, you will get discount at the time of renewal. Your activity will be tracked on a mobile application provided by them (Health Jinn app). The discount can vary from 2%, 5% or 8% depending on average steps you made during the year.

They have defined the time intervals of 90 days starting from the date of policy to average out total walking steps taken during this period. The year is broken down into 4 parts as follows – 90 days, 91 – 180 days, 181 – 270 days and 271 – 300 days. You can refer following table to understand how this benefit will work –

In year 2 of policy, calculation will be bit complicated but, the point is, if in a year you can manage to have average walking steps of 10,000 and above, you will be able to avail 8% discount on renewal premium, provided that, the mobile app must be downloaded within 30 days of the policy risk start date to avail this benefit.

In an individual policy, the average step count would be calculated per adult member and in a floater policy it would be an average of all adult members covered whereas, dependent children covered either in individual or floater plan will not be considered for calculation of average steps. So, dependent child is not eligible for this benefit.

For this you simply need to download an app called Health Jinn app on your phone, sync it with Google Fit or Apple Health and aim to walk 10,000+ steps every day to earn the complete 8% discount. Walking is one of the most beneficial things one can do for health and fitness. So, you will enjoy discount on premium amount as well as be motivated to exercise regularly.

However, we are not sure how many policy holders will have this level of discipline to track their walking steps and buy all the equipment’s, so in a way it’s a benefit only tech savvy policyholders will be able to enjoy who can also be disciplined for the whole year at the same time.

Benefit #3 – E-opinion (Second Opinion for critical illnesses)

In Apollo Munich optima restore health insurance, if insured is diagnosed with any critical illness (listed in policy) then he will be able to take second opinion from a medical practitioner appointed under penal of medical practitioners. Following illnesses are covered under critical illness –

- Cancer of Specified Severity

- Open Chest CABG

- Myocardial Infarction (First Heart Attack of specific severity)

- Kidney Failure requiring regular dialysis

- Major Organ/Bone Marrow Transplant

- Multiple Sclerosis with Persisting Symptoms

- Permanent Paralysis of Limbs and Stroke resulting in permanent symptoms

However, this benefit is available only once in a policy year.

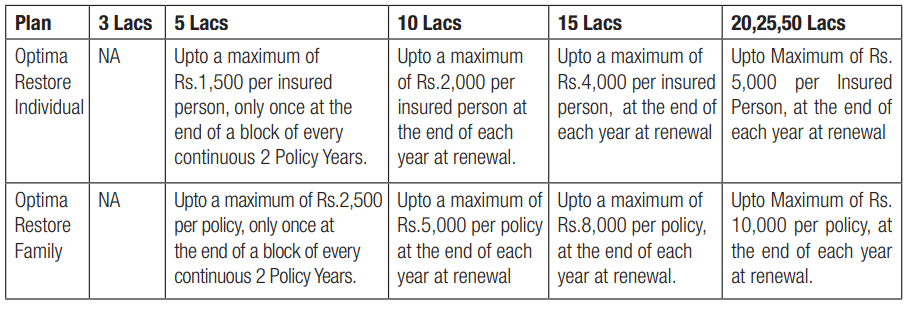

Benefit #4 – Preventive Health checkup

We all know that health is wealth but, even after knowing this, we tend to neglect regular health check-ups. In this policy, the health checks costs are included, which in a way gives the policyholder a great push to do their health checkups.

So, in this plan, the policyholder will get the cash reimbursement for taking preventive health checkups.

In Optima restore, for a sum assured of Rs. 5 Lac they provide cash reimbursement at the end of a block of every continuous 2 Policy Years and once a year on the sum assured of Rs.10 Lac or more.

You can refer following to know what amount of cash will be reimbursed –

**Preventive Health Check-up means a package of medical test(s) undertaken for general assessment of health status, it does not include any diagnostic or investigative medical tests for evaluation of illness or a disease.

Note that these checkups are great for people because if you keep doing these checkups, then you will be able to detect any illness or major issue before it becomes critical.

Benefit #5 – Daily cash Benefit

Daily cash is the cash benefit, which you get by the insurance company on a day to day (in case of hospitalization above 24 hrs.) basis, if you have been hospitalized in a shared accommodation in network hospitals of insurance company for more than 48 hours.

This cash benefit is already decided amount irrespective of your actual daily expenses. In this policy, you will get Rs.800 per day as daily cash which has a limit of up to Rs.4, 800.

For example: If “A” and “B” both get admitted to a hospital (both of them are covered under this policy). Suppose A’s daily expenses are Rs.600 per day and B’s expenses are Rs.1000 per day, in this case, though the expenses are different, both of them will get Rs.800 as a daily cash because it is decided previously in their policy.

So here A will save Rs.200 and B has to pay Rs.200 extra from his own pocket per day.

In another case, a person “C” is hospitalized and his daily expenses are Rs.800, but he has to stay there for 7 days. Here the total daily expenses of the person will be Rs.5600 (for 7 days)but as it is mentioned in his policy clearly, he will get only Rs.4800 as daily cash and the rest he has to pay by his own.

However, daily cash benefit is not given for an insured admitted in Intensive care unit. And the limit is higher for higher sum insured i.e. it is Rs. 1000 per day up to Rs. 6000 for sum insured of Rs. 20 Lakhs, 25 Lakhs and 30 Lakhs.

You can watch this video given below to know the plan details of Apollo Munich Optima Restore policy:

Benefit #6 – Multiplier Benefit

There is something called as Multiplier benefit under this policy which gives additional sum assured to policy holder when there is no claim in any given policy year. It is like a bonus included in sum insured amount in case of no claim made during a year.

One can get a bonus of 50% of the basic sum insured for every claim free year, accumulating up to 100%. In the event of a claim, the bonus shall be reduced by 50% of the basic sum insured at the time of renewal. It simply means insurance company will take back benefit of bonus on making any amount of claim.

Example : Suppose you had a policy cover of Rs. 10 Lakhs for a year, but you didn’t claim anything in that year. So, policy sum insured will be increased to Rs. 15 Lakhs (10 Lakh + 50% of 10 lacs). And next year again, if there is no claim then it will be increased to Rs. 20 Lakhs.

But, once you claim any amount against your insurance, then renewal amount of sum insured will be reduced by 5 Lakhs (50% of 10 Lakhs) and it will Rs. 15 Lakhs.

It’s a great thing, because this way you are actually getting upto 20 lacs of health insurance even if you have taken just 10 lacs at the time of buying the policy.

Benefit #8 – Cashless Service

Like most of the policies, there is cashless service in this policy too, which means that the insurance company will make payment directly to the hospital provided it’s within its network and there was prior approval taken for the hospitalization at least 48 hours before.

In case of unplanned or emergency hospitalizations, one can still do all the expense from their end and claim for reimbursement later.

Benefit #9 – Pre and Post hospitalization

Apollo Munich Optima Restore policy covers pre hospitalization expenses up to 60 days immediately before hospitalization and post hospitalization expense of 180 days immediately after hospitalization.

Whenever a person is hospitalized, before that he might have gone through various tests/consultations and even after getting discharge from hospital, he will have to pay bills of medicine and other tests.

Benefit #10 – Organ donor Expenses

When insured is having an organ transplant surgery then all the expense related to that will be paid by insurance company. But it will exclude pre and post hospitalization expense of donor. Provided the undergoing of a transplant must be confirmed by specialist. However, any other expenses incurred by an insured person while donating an organ is NOT covered.

Benefit #11 – Domiciliary Expenses

Apollo Munich Optima Health Restore policy also provides for domiciliary expenses which means medical treatment for an illness/disease/injury which in the normal course would require care and treatment at a hospital but is actually taken while confined at home under any of the following circumstances:

- The condition of the patient is such that he/she is not in a condition to be removed to a hospital, or

- The patient takes treatment at home on account of non-availability of room in a hospital.

Benefit #12 – Portability

If you are insured with some other company’s health insurance and want to shift to this policy on renewal, then without starting a new cycle of waiting period, you can shift to this policy. Apollo’s portability policy is customer friendly and aims to achieve the transfer of most of the accrued benefits and makes due allowances for waiting periods etc.

Benefit #13 – Day Care Procedures

This health insurance also provides for Day Care Procedures i.e. Medical treatment or surgical procedure (eg. cataract), which require admission in a Hospital/Day Care Center for stay less than 24 hours. Treatment normally taken on out-patient basis is not included in the scope of this definition.

Indicative list of Day Care Procedures that are covered in this benefit is as follows-

• Cancer Chemotherapy

• Liver biopsy

• Coronary angiography

• Haemodialysis

• Operation of cataract

• Nasal sinus aspiration

Other Rules of the Policy

- Maximum Age – The maximum entry age is 65 years, however, there is no maximum cover ceasing age in this policy.

- Minimum Age – The minimum entry age is 91 days i.e. children between 91 days and 5 years can be insured provided either parent is getting insured in this policy.

- The validity of the policy and Discount – The policy will be valid for a period of 1 to 2 year(s) as opted. If a 2-year policy is chosen then an additional 7.5% discount is offered on the premium

- Eligibility for buying the policy – An individual or his family members such as spouse, children, parents/parents-in-law are eligible for buying this cover on an individual or floater basis.

Exclusions – What is not covered in this policy?

- Any treatment within the first 30 days of cover except any accidental injury.

- Any Pre-existing diseases/conditions will be covered after a waiting period of 3 years.

- 2 years exclusion for specific diseases like cataract, hernia, hysterectomy, joint replacement etc.

- Expenses arising from HIV or AIDS and related diseases.

- Abuse of intoxicant or a hallucinogenic substance like drugs and alcohol.

- Pregnancy, dental treatment, external aids, and appliances.

- Hospitalization due to war or an act of war or due to the nuclear, chemical or biological weapon and radiation of any kind.

- Non-allopathic treatment, congenital external diseases, mental disorder, cosmetic surgery or

weight control treatments.

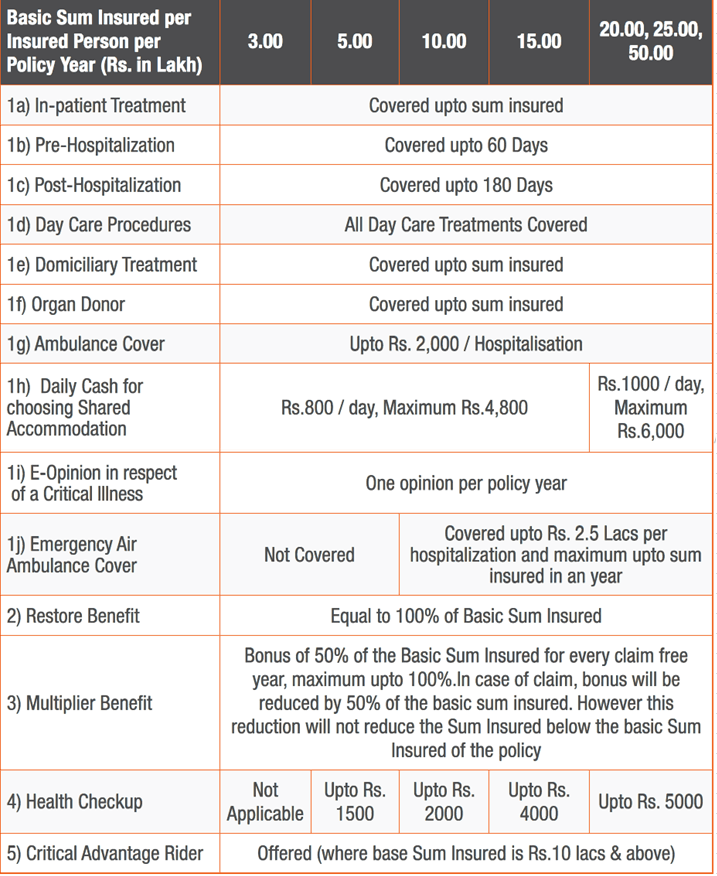

Details of individual policy –

If you are buying health insurance for yourself then following table will be helpful to understand what all benefits you will be having for different amount of sum insured.

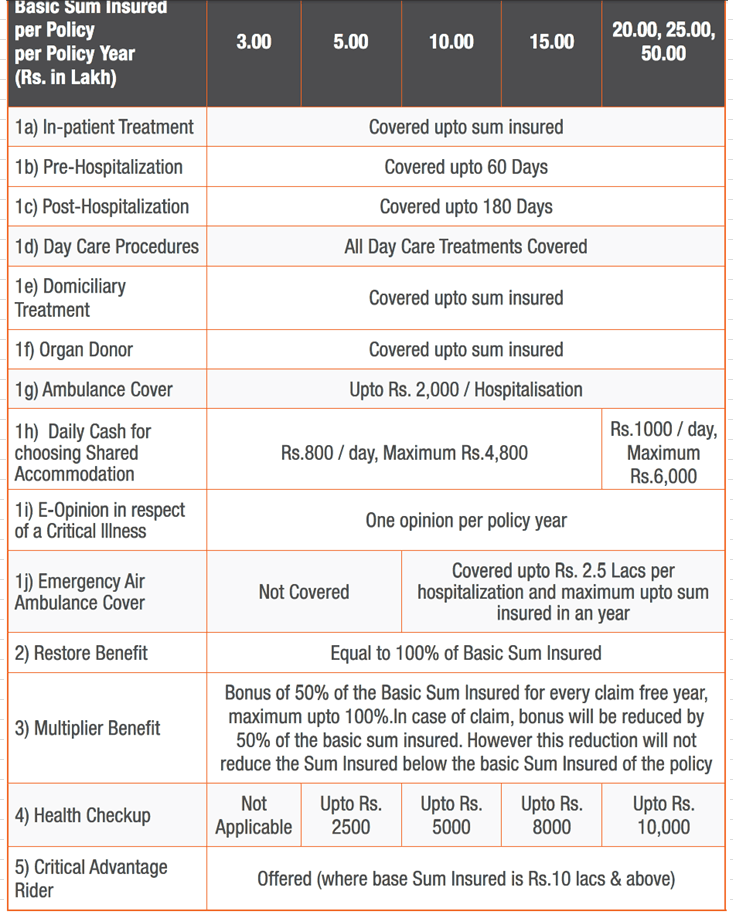

Details of a family floater –

If you are buying health insurance for you and your family then following table will be helpful to understand what all benefits you will be having for different amount of sum insured.

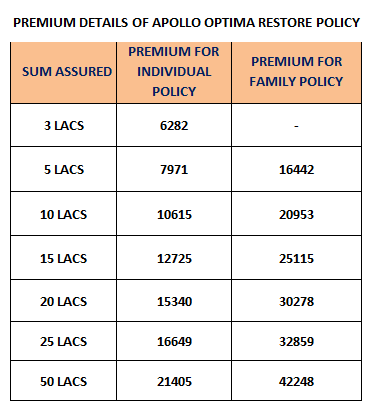

Premium details of individual and family policy:

You can refer below given table to get an idea of the premium amount of this policy. The table shows followings –

- Premium details of a man aged 30 years for an individual policy.

- Premium details of a family policy, comprising of an individual (aged 30 yrs.), his wife (aged 30 yrs.), son (aged 8 yrs.) and daughter (aged 10 yrs.). The family policy starts from 5 lakhs of sum assured.

**This is the premium details of 1-year policy including GST and excluding the critical illness cover cost.

Conclusion

We feel that overall this policy has all the standard features, however there are many other policies which can also be looked at before making the decision.

If you have any doubts regarding this policy cover, you can leave your query in the comment section.