ELSS vs PPF – where to invest for your tax saving? (20 yrs data analysis)

Most of the people who want to do tax saving in 80C are confused if they should invest in PPF or ELSS (tax saving mutual funds). Both PPF and ELSS offer taxation benefits of up to Rs 1.5 lacs under sec 80C.

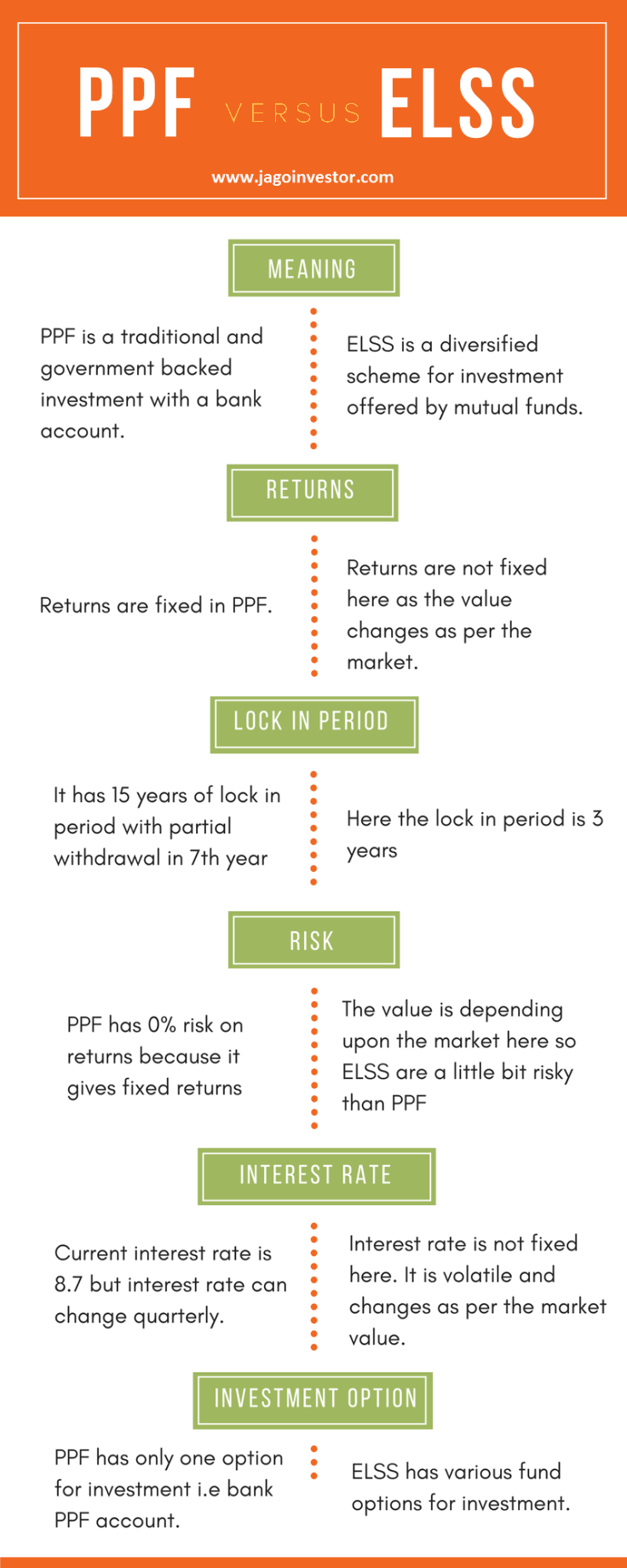

ELSS vs PPF – Meaning

Let’s start with their meaning and what exactly they are.

PPF means public provident fund. Its a govt scheme which is run by the post office and its a very safe financial product. There is no risk to it because it’s guaranteed by the govt of India. Its quite famous among investors for its safety and assured returns.

On the other hand ELSS (Equity linked saving scheme) is fairly new financial product in India (from last 15 yrs). It’s mainly an equity mutual fund that gives you an income tax benefit. Equity mutual funds mainly invest in stocks of companies, which makes sure that they deliver high returns, but at the same time they are risky (actually volatile) and their returns keep going up and down.

Now, let’s compare PPF and ELSS on various parameters.

#1 – Returns

The returns in PPF change every year and it’s around 7.5-8 %. Right now its 7.8% and it keeps on changing from time to time which is notified by govt. Earlier many years back, PPF returns were in a range of 12% and then it came down to 9%. But from the last few years, it’s hovering around 8%.

In the case of ELSS, it’s linked to the market and the returns are not fixed in the short term. Some years it can be 20 %, some times it can be 50% and in some years it can be -25% also. So you can see that the returns are totally dependent on stock markets and how well they perform. However, in the long term, you can be assured that you will get a return in the range of 12-18%. The returns are not at all guaranteed by anyone.

#2 – Lock-in Period

Your PPF investments are locked in for 15 yrs, but some partial money can be withdrawn after 7 yrs. So basically its a very long term product, and if you are investing in PPF, you should be ready to lock you money for a very long time. After 15 yrs, you can again extend your PPF for another 5 yrs (any number of times) and your money will again be locked for that 5 yrs.

On the other hand, ELSS has a lock-in for just 3 yrs. You can take out your money after 3 yrs. The important point to note here is that each investment is locked in for 3 yrs, so if you have a SIP running in an ELSS fund, then each installment is locked for 36 months.

So if you want money in 4-5 yrs, ELSS is a better choice compared to PPF from a liquidity point of view.

#3 – RISK

PPF is not at all risky because its value does not go down. PPF is also guaranteed by govt, so there are no changes in fraud. If you plot the graph of your PPF value, you will see a straight line going up. However, note that PPF has a totally different kind of risk, which is that it does not give inflation-adjusted positive returns. This means that its returns match the inflation and in the end, you do not have any net returns.

On the other hand, ELSS is volatile, which is often referred to as “RISK” . The value of ELSSS keeps going up and down depending on the stock market movements. In the short term, you might experience a downturn and loss in value, but over the longer-term, you will see good results.

As most of the investors are risk-averse and do not like to see a dip in the value of their investments, most of the investors stay away from ELSS or stocks in general and lose the chance to experience great returns at the same time.

#4 – Taxation

PPF is tax-free. There is no tax on PPF returns. Whatever returns you get in PPF is 100% tax-exempt.

Earlier ELSS was also tax-exempt after 1 yr, but with budget 2017-2018, now any gains in equity mutual funds or stocks are taxable @10% when you sell them, but you get an exemption of Rs 1 lac per yr. This means that if your profit after selling ELSS is 4 lacs, then you have to pay a 10% tax on 3 lacs. However, even after this taxation, the post-tax returns of ELSS are much better than any other investment option.

Here is an infographic that shows you a quick comparison between PPF and ELSS.

How to invest in PPF or ELSS?

If you want to invest in the PPF account, you can open a PPF account in a post office or any bank (generally SBI is very famous for PPF). Note that it does not matter where you are opening your PPF account, if you open with the post office, SBI, or ICICI .. at all the places you are going to get the same interest because ultimately it’s controlled by POST OFFICE only.

The banks are just a medium to invest and nothing else.

If you want to invest in ELSS, then you can choose any fund house (there are many AMC like ICICI, HDFC, SBI, Motilal Oswal etc). You can either go to their website directly or contact an advisor (You can also invest in ELSS through Jagoinvestor help)

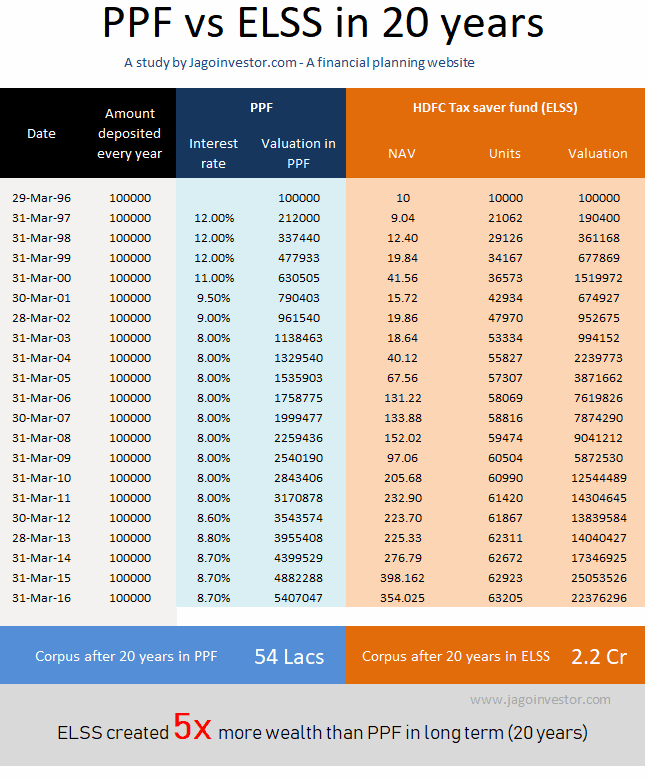

Returns of ELSS and PPF from the last 20 years

It’s important to check how PPF and ELSS have performed in the last 20 yrs (1996 – 2016) so that you get a fair idea on their performance and which one is better from a long term point of view. So we took one of the famous ELSS (HDFC Tax Saver) as an example along with PPF and calculated how the value in both will increase over time if someone invests Rs 1 lac in both the financial product.

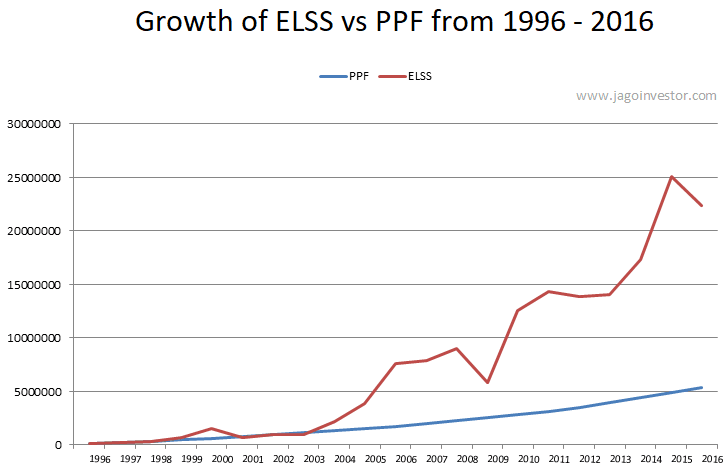

In the above table, you can see that Rs 1 lac of yearly investment for 20 yrs have accumulated to Rs 54 lacs in PPF, whereas it becomes 2.2 crores in the ELSS, which means that ELSS gave 5 times more returns than PPF.

However, this difference is more visible only after 10 yrs passed and compounding starts kicking in.

In the initial years, there was no big difference in their values. See the graph given below. You will get a clear idea of how ELSS has performed incredibly towards the end of tenure.

Important Note :

The example of HDFC Tax Saver is taken only for the illustration purpose. This is not a recommendation, and right now HDFC Tax saver is not the best option for tax saving. There are many other ELSS funds which can be chosen other than HDFC Tax saver. Kindly contact your Financial Advisor for any recommendations.

So after studying the table data and graph, I hope it becomes easier for you to know the difference between the returns from PPF and ELSS investments. If you still have any confusion or any doubt in your mind, feel free to ask us by leaving your query in our comment section.

May 3, 2018

May 3, 2018

this is great i watch in youtube about this

thanks sir for this article share with us.

Thanks for your comment sourav maheshwari .. Please keep sharing your views like this..

Manish

Hello

thanks for sharing this much-needed information. I really enjoyed this post. Keep posting such things.

Hey Prasad

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

PPF is giving return very similar to the inflation rate. It seems to be the tool of those faint-hearted people who don’t want to see any danger on their hard earned money but simultaneously want to protect their money from inflation hammer.

Thanks for your comment Piyush .. Please keep sharing your views like this..

Manish

I really appreciate the information shared above. It’s of great help. I am very happy to read your post.

Hey santhosh

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

thanks

Welcome 🙂

Hi Manish,

Thanks for this great article on the comparison. Mutual funds can give you good corpus over a long period of time.

Yes, incase you need mutual funds related help – talk to us at http://jagoinvestor.dev.diginnovators.site/mutual-funds

The article was pretty good! It gave a crystal clear idea about the difference between PPF and ELSS! Thanks and Kudos!!

Hey Dhiraj Patel

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

thanks for the information sir.

Welcome

I will invest in HDFC funds with 5X profits, Thank You

Good Article Manish. Also, your answers for all the queries are also wonderful.

You are eye opener for many..

when the Going gets tough , the Tough get going..

Keep it up.

Thanks for your comment ASHOK .. Please keep sharing your views like this..

Manish

Why is JagoInvestor making fool of ignorant investors. Just for the sake of commissions from say HDFC funds, why are you giving erroneous data. PPF is a low risk definite retirement instrument. In case you want to compare it with compare with a Direct fund or a retirement fund which requires the investment portfolio to be less risky. HDFC tax saver fund is 91.43% in equity. In case you are going for that, lets compare that with an equity fund. The HDFC tax saver fund will fall short of expectations. In case someone had to invest for 20 years, he would do in small cap/ midcap or theme based funds which will provide much better results at same risk profile.

So PPF comparison with ELSS itself is a wrong concept. Its like comparing a Train with a Ferrari.

For better analysis of the said fund, see the below links and you would understand how risky investment it is

http://www.moneycontrol.com/mutual-funds/nav/hdfc-tax-saver/MZU017

https://www.valueresearchonline.com/funds/newsnapshot.asp?schemecode=220&utm_medium=vro.in

https://economictimes.indiatimes.com/hdfc-taxsaver-fund/mffactsheet/schemeid-220.cms

They are compared because they both come under 80C and people generally compare these two when they are at the cross roads wanting to know which would yield them a better return over long term. Hence the comparision. In the article, we have clearly mentioned that HDFC is just an example and there are better funds than HDFC without even naming them.

Also, HDFC fund is risky … but only over a short term. Not over a long term period .. Thats the essence of the article.

Manish

In PPF compounding not considered. In ELSS taxation not considered. Plz redo the maths in your example considering these two aspects and then conclude.

Mr Balwan

Did you check the example in the article? each year PPF interest is mentioned and all calculations are done assuming the interest is given. That is compounding . Also, Tax was not there till 2017 end so past 20 yrs return does not have tax applicable. In future it will be there, but eventaully the conclusion is going to be same.

Manish

Hi Manish,

Thanks for this great article on the comparison. I am big believer of MFs as an instrument for long term investment.

On the return part – Don’t you think article is influenced by two biases ( Selective bias and survivor-ship bias )?

There might be few funds who performed worse.

Don’t you think it would be great to compare it with some benchmark index ( Maybe Nifty or Sensex, as ELSS are mostly large cap funds ) or average of few funds. Even though i feel returns would still be stellar.

Regards

Satender

Hi Satender

No Sir, there is no bias here . You can compare it with Nifty index or some other thing , but why do you want to compare it with them ? Are you going to invest in index? A common man will invest in ELSS only for his tax saving when it comes to equity , so we need to compare it with ELSS returns .

You are correct when you say that some other ELSS will exist whose returns are not that great like HDFC Tax saver which is there in example, but even the worst performer ELSS would beat PPF returns in this time frame. and Yes, the selection and monitoring of the fund will be crucial , hence you either need to have expertise and skills to do it yourself or have an advisor at your end who can do that for you

Manish

Enlightening article.

Just a clarification:

Did we take into account post tax returns on ELSS? Now in the new tax rules, even equity returns beyond 1 L per yr are

taxed.

PPF returns are not taxed.

No , I have not taken that into consideration . However the impact is going to be small on the conclusion. Instrad of 5X times, it would become may be 4.7 or 4.8X .. still valid !

Manish

Thanks for the article, indeed very useful. Few months back have started investing in IDFC Tax Advantage (ELSS) Fund – Growth option. Is this a good option to continue? Thank you.

Yes, its a good fund

Current rate of interest in PPF is 7.6% and not 7.8% as you have mentioned in your article.

Hi Kalyan

Thanks for update

Hi Manish,

Thanks for such a nice comparison between PPF and ELSS.

I have invested one time amount of 30K in ELSS- IDFC Tax benefit plan in 2011 year. current value of this around 90K. Can I continue in the same plan or redeem this amount and reinvest in another equity fund?

Please suggest.

Thanks

You can continue it .. NO issues !