Hey Married Men – Do you know about buying Life Insurance under MWP Act?

Do you have any life insurance? And are you really very sure that it will protect your family?

Majority of people who buy life insurance in India, buy it for the sole reason of protecting their family’s future. But is taking the life insurance a sure shot way to protect your family (I mean your immediate family here, which is spouse + kids)?.

If the primary breadwinner dies because of any reason, the family will have to suffer in absence of a regular income. The spouse will suddenly not get any income and might have to start earning. Your family and kid’s future is also at risk.

Let’s see some risk your family has

- What if you are businessmen and you owe money to someone? After you are dead, the creditors will approach the court and they will get the money out of your life insurance proceeds

- Consider you have a big home loan which you have not accounted for while taking a term plan. If you die, the first right will be of the home loan lender because the loan is on your name. The right of the family comes only when your loans are paid off.

- What if you have not created your will and there are family members who claim their right in your life insurance proceeds?

- What if you yourself change your mind later and don’t want to give the insurance proceeds to your own family?

Are you prepared for this situation? If not then think about it. There is a way which will help you at some points if this such situations appears in-front of your family in your absence and the solution is MWP Act.

Have you heared about MWP Act?

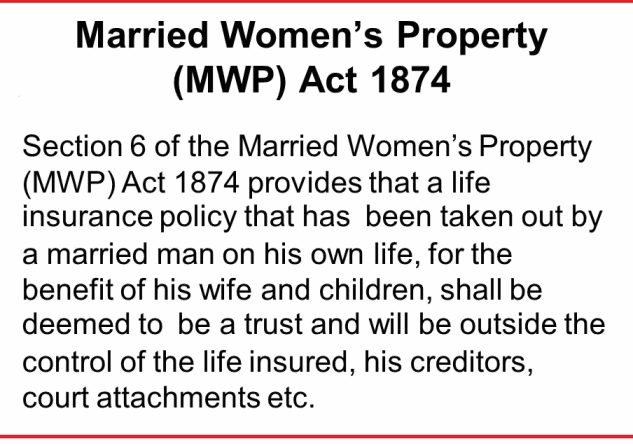

MWP means Married Women’s Property Act. This act is prepared by taking into consideration the rights of a married woman on her property. According to MWP Act . the earning of a married woman in India is considered as her own property and this Act Protects the property owned by a woman from Creditors, relatives and even from their husbands.

Buying Life Insurance Policy under MWP Act

MWP Act 1874 under which Section 6 deals with life insurance. If you buy a life insurance under MWP Act, then it will protect the women’s right on the life insurance proceeds money in all the cases. Even the husband can’t do anything about it once the buying is bought under MWP act. This applies to all kind of insurance policies be it a term plan or an endowment/money back plan.

Who can be the Beneficiary and Trustee?

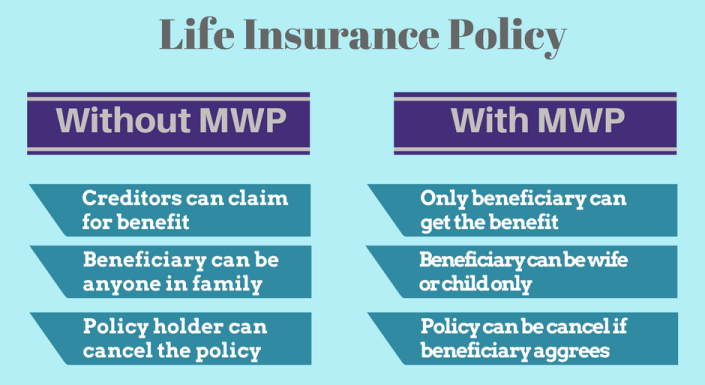

When a policy is bought under MWP Act, the policy is treated as a TRUST and its guarantees that the proceeds from life insurance policy are free from any creditors or court attachments.

The first right is of the family only (women and kids). Imagine if you buy an endowment plan which matures in 20 years and you bought it under MWP Act. Once the policy matures, then even the person who started it will not be able to claim anything. The first right will be of the beneficiaries mentioned in the policy.

Beneficiaries can be:

- The wife alone

- The child/ children alone (both natural and adopted)

- Wife and children together or any of them

Trustee can be:

Unlike beneficiaries, having trustee is not mandatory for this MWP Act. The policy holder can mention one or more trusties. Having a Trustee is not compulsory but if the beneficiary is minor then in that case it is compulsory to have a Trustee. The Trustee should not be minor. The Trustee can be change whenever the policy holder wanted. The Trusties can be –

- A person

- A bank

- An institute

- Beneficiary herself/himself

How will the beneficiaries get benefit ?

When something wrong happens with the policy holder and the insurance is claimed by the family, the creditors can claim for the insurance benefits. In this case the family members will get less benefit of the policy. Or sometimes the other family members can also claim for the part in that policy if the policy holder does not have will.

But if the policy is covered under MWP Act then the whole benefit will go to the wife or kids (whoever the beneficiary is) of the policy holder.

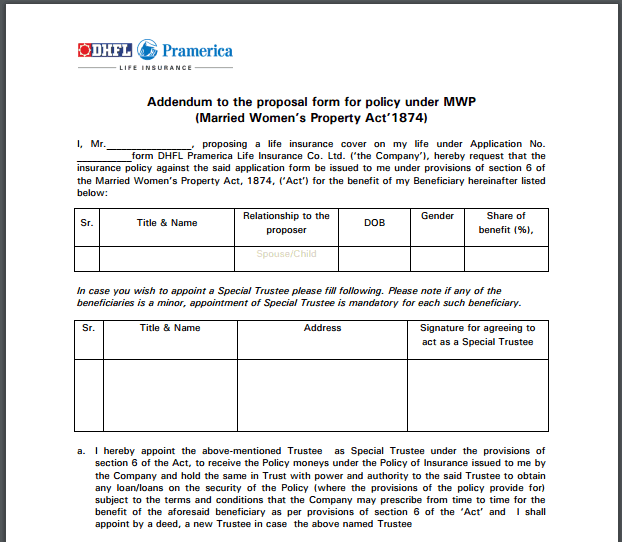

Procedure to buy life insurance under MWP Act

The process is very simple. All you have to do is fill up a MWP addendum form separately at the time of buying the policy. Your agent can help you with that form or talk to the company in case you are directly buying it from the insurer.

However note that it can’t be added separately once you have completed the process of buying the life insurance (means you can’t add the MWP act later)

Who can take a Life insurance policy under MWP act ?

Any married man can take a life insurance policy under MWP Act. This includes divorced persons and widowers. The policy can be taken only on one’s own name, i.e., the life assured has to be the proposer himself. Any type of plan can be endorsed to be covered under MWP Act.

Difference – Insurance With MWP and Without MWP

There is not a lot of difference in taking a life insurance under MWP Act or without MWP Act but we can see some points which shows the difference. See the following picture.

Are there any disadvantages of buying policy under MWP Act?

Yes, There are disadvantages to signing the MWP addendum as well

- The Beneficiaries cannot be changed. In case at some point you decide to change the beneficiaries . It won’t be possible if you sign a MWP addendum.

- Loan cannot be taken on the basis of the policy. The policy could not be used as a security against loan.

That makes it also necessary for loan providers on Life Insurance policies to check before taking it as a mortgage for lending whether the policy does not contain any MWP addendum, as they will not get the benefits from its proceeds.

Let me know if you want to know more about this?

July 3, 2017

July 3, 2017

suppose husband takes policy with mwp act and beneficiary and trustee both as his wife. what if the wife dies before husband. now who will receive the claim amount on the death of husband?

In that case it will go to legal heirs

I filled the MWP form along with my application but due to mistake from the company’s end, my term insurance did not get linked with MWP. Now the agent after connecting with the branch superiors, says it can be done provided I return my policy and I will be issued with a new policy document with MWP linking. Is it possible and how legit ? Please respond, thanks in advance.

Yes, I think that’s how you will have to do it ..

You can return your policy as it must be in free look up period. So you will get back all your premiums and just redo the whole process!

Manish

Hi Manish,

I have already bought term life insurance 2 years ago. Can MWP be submitted with next renewal premium.

Any online option to change the current situation?

Hi Ashutosh

As I know, you can not change your policy to MWP once you buy it. Though it will be better to ask your agent before renewing your policy.

Thanks So Much,

I’ll check with my Insurance company. I had bought it online so I’ll have to visit their office.

regards,

Ashutosh

Sure !

This article came as a surprise. Has anybody have any experience with this ? how easy or difficult. Did you find the customer care cooperative ?

Did they even know ?

This is a very less used feature. But I am sure the customer care will be able to find out more info and share with you later.

Manish

Very useful information about MWPAct & it’s advantages & disadvantages.

I was not aware of it.

Thanks for your comment REKHA

Very informative content. Thank you, Manish.

Thanks for your comment Rhitansu

Hi Manish,

Can this be added to HDFC term insurance taken earlier in 2015.

Thanks

Hi Vijay

As we mentioned in article, you can not change the policy to MWP once you buy it. Still ask your policy agent or any representative of that company when you renew the policy.

this is very helpful for people like me

Hi MKVTVSERIES

Thanks

Be VERY VERY CARE-FOOL of this…..with so many gender biased laws and the news(with NCRB data) of their misuse being rampant….you do not want to fall into a situation, where your own wife has evil intentions with her “well-wishers”(family or friends).

We have draconian laws like Domestic Violence Act, 2005 – where a woman can get her husband evicted from his own house —and these things happen when women do it just on some provocation, even though no violence was done. So, men must be really careful lest a unscrupulous woman/family destroys his family.

Now you might say it is a small percentage of the families getting affected….but then see the percentage of accidents vs the policies taken….

Thanks for your comment Kshitij

What about the term insurance which any one has bought already ? Can they inlcude MWP with thier existing policy ?

hiii

Thanks for this beautiful article.

literally, i don’t know about MWP exactly. but from your information, I know everything.

Thank You.

Thanks for your comment Money Classic Research

Thanks for eductaing on this act. Have a question on beneficeries ‘as in family members’ who can claim the benefits

If I have nominated any 1 person from my family (be it wife/ father or mother) against the policy taken without MWP act, is it possible to someone else from the family to claim for any benefits?

Hi Abhishek Jain

In your case the beneficiaries will be your father, mother or wife because you have nominated them. Other relatives can claim only if the nominees are not there.

HI, Very useful article. What if I divorced my wife after bought a insurance under MWP? Consider that I don’t have children.

Hi Jaya Prakash

In any case your wife will have the authority to claim for the benefit. That’s what this policy means.

Sir does the premium change if a policy purchased earlier is brought under the MWP act?

Hi Apoorv

Premium will be same for both.

First of all, thank you Manish for such an informative article. This article adds in my knowlegde about life insurance.

I want to know one thing

Is there any change happens with the premium amount or any other policy terms due to MWP ?

Hi Raghav

No there won’t be any change in the premium. The only condition that changes is in any case only your wife will have the authority to claim for benefits.

Hi Manish,

Thanks for the very important update on life insurance…MWP.

I have the following questions.

1) Do we have bear additional premium for this MWP ?

2) How easy getting this MWP online term plan with insurance compared to regular insurance online.

3) I have taken 2 term insurance one with ICICI and 2nd with HDFC, how to convert this..

4) As already taken can insurance company issue one more policy with MWP with the same premium as existing term plan and stop the regular term policy.

5) If we apply term policy once again for MWP do we have to disclose the existing policy, however we may want to discontinue the regular policy after getting term polic.y with MWP.

6) Could you please let us know how to get the MWP term insurance online. is this applicable for any insurance company or specific to some insurers.

Please suggest.

Thanks,

Shravan

1. No

2. Its fairly easy, all you need to do is fill an additional form

3. Talk to customer care for converting

Dear manish, I have never seen such beautiful explanation about MWP.

Thanks for your comment BRIJESH

Thank you for this information. I have few questions.

1. What will happen to the insurance plan taken under MWP Act if the couple gets divorced?

2. If a child is born after the insurance is taken, can the child be added as a beneficiary?

3. Can the list of existing beneficiaries be altered under any circumstance?

Hi Aniket

1. If you take a policy under MWP then in any case your wife will have the rights to claim. After divorce too.

2. If your wife is not there only then your child can claim.

3. Beneficiary can not be changed.

What if we stop paying the premium after divorce? Does the policy lapse?

Yes, the policy will lapse for sure !

This is great news!

Is it true that even in the case of divorce also the husband cannot change the beneficiary? If true, then it unnecessarily complicates an otherwise useful law.

according to this economic times article:

the beneficiaries mentioned in a policy endorsed under the MWPA cannot be changed after the policy is issued. Thus, even if the husband and wife divorce after the policy is taken, the beneficiaries (wife and/or children) will continue to remain the same.

http://economictimes.indiatimes.com/tdmc/your-money/what-all-married-women-should-know-benefits-of-husband-buying-a-policy-under-mwpa/tomorrowmakersshow/49469332.cms

Yes, it can not be changed ever !

Hi Manish,

Great post as always!!!

My limited understanding of the MWP Act suggests that even policies purchased under MWP Act can be challenged if the creditors can prove that the policy was purchased with an intention to defraud creditors. Mentioned in III (6) of MWP Act.

Believe this will be more of a problem with traditional plans and ULIPs because creditos can put a case that the borrower kept paying insurance premium while not repaying them.

Term plans should be safe.

Your views?

I am not very clear on this. It might be true if its already written in the MWP Act!