6 simple reasons why you should get serious about Savings starting today?

Think for a moment that you have 3 yrs worth of your salary in your bank account.

How does it feel?

So if you earn Rs 10 lacs a year, you have Rs 30 lacs lying in your savings (other than real estate). If you earn 20 lacs per annum, its 60 lacs!

But in real life, most people do not take enough effort to save more money. It’s on their wish list to “start saving from next month”, but the motivations soon fizzles out. Most of the people are so busy and stuck with various problems in life that with each day, saving money for the future remains a distant dream for many.

Are you one of them?

Life has various dynamics.

Many people are stuck in a bad job, while some people are in a bad marriage which is draining all their energy and time. Some people are running around to arrange for a house down payment, while some are wondering if they should have a second kid or not!

Life keeps throwing so many things at us, that we forget where we are headed towards and we are not able to see how our actions today will shape our future.

We keep dealing with the NOW, only to realize many years later that our FUTURE is almost there waving at us. And then suddenly we realize that we have so much to catch up in life. More health, More money and more happiness!

We start our jobs in our 20’s, then settle by the end of the ’30s, move to next level in our lives while we are in our 40’s and then in this journey we realize we are approaching our 50’s and if we have not done a good job of saving enough money then we PANIC !

And we tell ourselves – “Oops .. I could have handled my life in a better way, if only …”

As per an HSBC report, around 47% of the Indians have not yet started saving for their retirement or have stopped it after starting.

6 reasons why you should save money and create wealth

Today I want to do a deep conversation regarding saving money. I know you might feel, is there a lot of it to talk about that?

Today I want to make sure that this is the last article, to get serious regarding saving & investing more money in your life (I will refer to “saving and investing” as “saving” in this article henceforth).

Almost all people feel that “saving money” is only related to securing your future. The equation for them is

Save money = Lead a better life tomorrow

But there is more to it!

[su_table responsive=”yes” alternate=”no”]

| Reason #1

To secure your future |

Reason #2

To do what you love in life |

| Reason #3

To spend and live a better lifestyle |

Reason #4

To be financially independent |

| Reason #5

Peace of mind |

Reason #6

To pass your wealth to next generation |

[/su_table]

There are various other angles you need to think about, and that’s what I want to discuss today. So read this article with all our eyes open!

Reason #1 – To secure your future

Let’s start with the most basic and core objective of saving money. You save money to accumulate the money and use it for your future requirements.

Let me give you a surprise – “One day, your salary will stop coming in your bank account”

There will come a time when you will be left with 40 more years of your life and there won’t be a regular salary coming into your account like it happens today. You need to create a big enough corpus, which helps you to lead a life you desire for the next few decades till you die.

You should not be worried about “death” in today’s world, It should be “living enough”.

Some people think they can avoid creating their wealth because their kids will take care of them. However, it’s up to you to decide if that’s the right approach towards life or not.

Savings and Investing definition by a 9 yrs old girl

Long back, Subra had asked a 9 yrs old kid to read a book on money and summarize what she learned about “saving and investing” and she gave a very crisp understanding about it. Please appreciate the simplicity of the girl’s thoughts.

Saving: Saving money is very important. We should save money because if one day suddenly we need money we will have it with us. If we just keep on spending all the money that we get and one day we need money we will not know what to do. I am also saving all my pocket money because I might need it in the future. I have kept it in a bank account and I get interested in that every year.

Investing: Investing makes our money grow. Just as a plant grows from a seed to a plant. When we keep our money in a savings bank we get interested but if we will invest our money in fixed deposits, shares, mutual funds, public provident funds, etc. our money will grow from a small amount to a big amount faster. Real money takes more time to grow whereas a plant grows within weeks.

Start saving some money for future

If you can’t manage to save enough money, at least start saving some money starting next month TODAY. Let me share with you some numbers on this. If a 30 yrs old person invests Rs 10,000 per month for the next 30 yrs consistently, then @12% average return over the long term, a total of approx Rs 4.4 crore can be accumulated.

I know a lot of people who can surely start with Rs 10,000 per month investment. Don’t worry if you can’t do that much?

What about Rs 5,000? Rs 2,000 ?

Anything is a good start! , upgrade later – but at least START.

Our team at Jagoinvestor helps our readers to start their SIP in mutual funds and track their goals on an ongoing basis. If you are interested to start your wealth creation journey with us, just leave your details here and a mentor from Jagoinvestor team will reach out to you in the next 24 hours

[su_button background=”#FFA52F” size=”6″ url=”https://www.jagoinvestor.com/mutual-funds” target=”blank”] Start your SIP in Mutual funds with Jagoinvestor Help [/su_button]

Reason #2 – To do what you love in life

Do you love what you do?

No, I am not talking about pursuing your passion for living or doing a full-time job in the area which you love. All I am saying is do you have enough time and money to do things you love for a few hours each week? Something which you truly want to do other than your regular job work?

- Do you love traveling to new places, but you are stuck because the EMI needs to be paid first?

- Do you love photography, but those costly lenses seem to be out of your budget?

- Do you want to socialize more by throwing a party for your friends, but worried about how you will afford to do it?

- Are you afraid to tell your boss that you want to go on a month-long road trip, with your best friend which was planned years back?

- Want to go on a weekend trip with your friends, but oops. it’s out of the budget!

It’s going to be very tough to achieve all the points mentioned above if your bank balance is very low. Less money means less power with you!

While you cannot afford a lot of things, you can’t also arrange for a lot of time to do all these things, because you can’t make some tough decisions because you are so dependent on monthly paychecks.

You need two things!

You need money or time to pursue your hobbies and both of these will come only when you focus on creating wealth.

I understand that you will not be able to achieve all these things right now, but If you don’t start your wealth creation right now, you will NEVER be able to achieve the above. Enough wealth in your kitty gives you that power to do things you love.

If you are so much dependent on your monthly paychecks, it’s going to be very suffocating going forward. A lot of wonderful people are dying slowly inside because they have no wealth created.

Reason #3 – To spend and live a better lifestyle

A lot of things in life do not require money. A great nap, a conversation with a good friend, a simple meal with your loved ones.

But then there are things in life which require money.

Yes, I am talking about those materialistic things.

- A better Car

- A better house

- Dining in a great restaurant

- Partying with your friends

- Buying that gadget

- Going on that trip

- Redesigning your house

- That Ladakh road Trip

- That DSLR Camera

- Travelling to exotic places with your family

You will spend money on various experiences and possessions, only if you have the money in the first place (not always, but most of the times), and you be able to do it only if you have money saved at your end at the first place.

Your lifestyle will improve only if you have created enough money.

While you can always take a personal loan and upgrade your car or go on that vacation and earn all the facebook likes, I am not talking that!

I am talking about, the real upgrade in your lifestyle which does not increase your EMI or stress level and does not compromise your cash flows to a big extent.

It’s easy to upgrade your life from a bike to a car and a rented apartment to the first house, but then beyond that’s it’s not as simple as it was earlier. It takes a good amount of money and dedication because we get stuck with EMI’s and mid-level crisis in our 30’s

So see, what are your aspirations for yourself and your family? What kind of life are you looking forward to in the coming times? Is your wealth enough to lead you there? Are you doing enough for that?

Reason #4 – To be financially independent

Don’t confuse financial independence with retirement.

- Retirement happens “when you don’t work anymore”

- Financial Independence happens “when you don’t work for money anymore..”

While retirement is linked to age (which is generally around 60), financial independence is a function of wealth and not your age. Financial independence can happen even at the age of 35 (My best friend at age 32 is already financially independent)

Where do you stand in your financial independence?

Financial Independence is often referred to as financial freedom. Nandish likes to describe as “A situation where your passive income equals your desired lifestyle expenses”

For a normal investor, financial independence can happen only when you start your wealth creation journey well at the start of your life and are disciplined enough not to disturb it for a long time.

Do you always want to keep doing the same job you are doing? And wait desperately for that “salary credited” SMS at the end of the month? How dependent are you on that monthly inflow in your bank account? How will your life look like if that SMS that does not arrive (I mean the money) for the next 6 months?

Millions of people go to their jobs in the morning with different moods depending on the day. They are happiest on Friday and very sad on Sunday night. You need to seriously start investing for the goal of financial independence if this is the case with you.

You need to also reduce your dependence on your active income (salary) as you move from age 25/30 to age 45/50. You should have created enough wealth in the first 10-15 yrs of your life that some part of your expenses can be met by passive income your wealth can generate if things go wrong.

I am not saying that you should create wealth and then start the passive income right away, but you need to create that situation for yourself. It will bring peace of mind (which I am going to talk in detail next)

Reason #5 – Peace of mind

Not have enough money brings a lot of stress. If you need peace of mind, you need enough wealth on your side which can comfort you!

You will keep worrying about the future now and then and every small financial problem will give you goosebump and force you to think about your scary future.

Imagine a guy who is around 45 yrs of age, and has not to create any significant wealth to show. By this time, he should have ideally created a corpus of 1 crore, but he has just 2 lacs in an FD which might get broken if some financial emergency happens!

This is bound to cause a lot of stress.

Various thoughts will cross the mind …

- How will I meet my financial goals?

- What if I lose my job?

- What if I suddenly need a lot of money?

- What if I am not able to give my kids all the things they want?

A respectable amount of money saved at your end might not end your worries, but it will surely bring some peace of mind and lower the stress. You know you are not in that bad shape and have arrived somewhere in the middle at least.

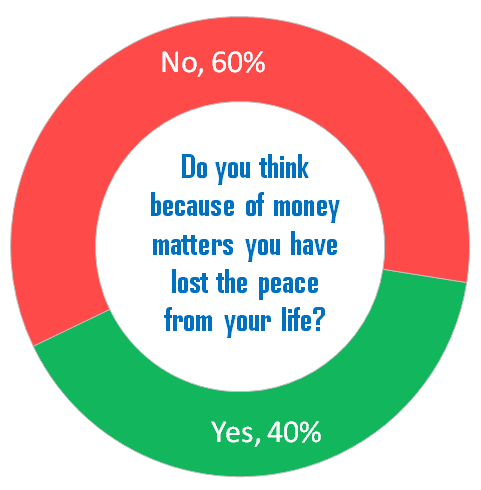

We surveyed with as many as 2,440 investors and we found out that 40% of the investors in our survey reported that the money matters have taken away their peace of mind.

As a general rule of thumb, If you have worked for X yrs in your life, you should at least have X/2 years worth of basic expenses saved at your end. This I think is the minimum one should aim for.

Our team at Jagoinvestor helps our readers to start their SIP in mutual funds and track their goals on an ongoing basis. If you are interested to start your wealth creation journey with us, just leave your details here and a mentor from Jagoinvestor team will reach out to you in the next 24 hours

[su_button background=”#FFA52F” size=”6″ url=”https://www.jagoinvestor.com/mutual-funds” target=”blank”] Start your SIP in Mutual funds with Jagoinvestor Help [/su_button]

Reason #6 – To pass your wealth to the next generation

A lot of families struggle for money generation after generations. The grandfather worked for money all their life, then father and then the son is also doing the same.

Many people who struggle financially set a goal in life that their kids should not face the same. They want to teach them money lessons and make them responsible, but also want to leave them a house and some wealth which makes their start a little easier in life.

Is that the right approach?

It’s a debatable topic if that’s the right thing do to or not. Many people believe that they should not handover anything to kids and let them create their own life out of what they have learned. Let them see the struggles and only then they will appreciate what they earn in life.

While that’s the correct approach for many people. I am sure we have many others who will not agree with that thought process in the same way.

Anyways, coming to the point, if you create wealth in your life, you can leave some part of it for your kids so that they can pursue things they truly wanted to do and not work just for money to bring food on the table.

A lot of wonderful people are never able to do things in life which they truly want to do. They are not able to live their own life fully because of the money matters. You need to check for yourself, if passing wealth to your next generation is part of your plan or not?

What will happen if you don’t save enough money for future?

So to summarize this article, there is a great possibility that one or more things mentioned below will happen to you if you do not get serious about saving money in your life going forward.

- You will have hard time maintaining a good standard of living

- You will depend too much on others (your kids maybe) for money

- You will be spending a lot of time worrying about the future and how will your life end

- You will be too dependent on your active income and will be forced to keep working even when you don’t like it

- It will be hard for you to focus on things you love to do because you don’t have enough money or time

- You will find it tough to lead a better life compared to current lifestyle

Final words

If you have still not crossed the age of 45, You still have a good chance to create a respectable corpus by the time you retire, even though you have lost a lot of time for compounding. Our team can help you in getting your financial planning done if you are interested to do leave your details for a small chat!

Just make sure you do not reach your pre-retirement age of 50+ without doing anything because that’s the zone where it’s going to be very tough creating any sizable corpus.

March 14, 2017

March 14, 2017

thanks for reasons of savings

Thanks for your comment swathisingh

Hi Manish,

Great Blog!! really vital information and inspiring as well, its very important to do savings as well at a very young age.

Thanks for sharing

Thanks for your comment Srinivas Chandran

Really nice article it motivated me to think about my future and start saving it’s been 2 years since I started working I’ve saved nothing it’s time for me to be more responsible and start saving. Thanks Manish for this article.

Glad to know that Suresh Patel ..

Great article. Investing makes it easier to put savings into a better use.

Glad to know that RupeeVest ..

Hi

I am 31 years old single working in IT company with a salary of Rs 60000 per month now, it was very less before, however even i am working from past 9 years i am not able to save anything so far, instead of paying EMI of rs 19000 per month & will continue to pay till March 2020 for my personal loan.

I do agree that i have totally spoiled my financial condition but now i am very much worried about future . My family/parents are depended on me , have to get marry , i am getting mad when i am thinking about future how me/my family will survive in future & what will happen after retirement.

Please guide me how can I place myself in a financial safe place & can assure my future

Hi Deb

First thing is that its good that you are serious about working on your financial life. I think the main issue with your case is the low income . Unless you work on increasing your income, its going to be very tough to improve the situation.

The second best option is the plain old suggestion of starting to save atleast 10% or 20% of your income, but I know its easier said then done. Thats why your main focus has to be on increasing your income so that you have some good surplus amount.

Truly speaking I dont know what else to say. But have you started your SIP’s ? Is any money getting deducted from your account automatically ?

YOu should look at this article and read it – http://jagoinvestor.dev.diginnovators.site/2015/11/reason-why-you-cant-save-money.html

Manish

60k per month salary is low income? Seriously? When you speak like that, you are demoralizing a lot of people you know. Many of us only earn half as much as him but are still able to save something after incurring living expenses. It’s all about proper money management I guess.

Hi Anjan

I am doing a conversation with Deb, its about his financial life. So when I said “the main issue with your case is the low income” . In this case, its the low income for him. He is not able to do manage his financial life with that kind of money, so is it not low income in his case?

Trust me, I very well understand that 60k is not a low income for many, while it is for many others.

Manish

have provided contact details, hope will get proper advise to shape up My messy Financial Life

Yes you will get a call soon

Thanks Manish and everyone in Team, I did receive call. Investment starting this month. Feeling good.

Thats great !

Dear Manish, (First of All i Like ur personality. and way .. A IT engineer became financial advisor.. )

As I seen since last many year the inflaction rate is so much high.. so what will be the power of 4.4 cr, Rs. after 30 year? As I simple say my father got a policy for me before 25 years. for Rs. 25,000/- @ 250 Rs. quaterly premium.. Today what is the value of that 25000? so the purchasing power is reduce.. & if suppose I calculate it & try to do saving at that level.. may b i have to save more than 50% of my income.. can u suggest a method which gives 12% secured return in today situation.. ? (off course after deduction of all expenses like consultancy charges and itax)

Then you need to invest in an equity product like a mutual funds.

In case you are new to this, my team can help you with setting up everything from start to end. Just fill up http://jagoinvestor.dev.diginnovators.site/mutual-funds#sign-up

I am totally impress with this article, i will start saving right now for future concerns, once again thank you for the post.

Glad to know that Epic Research ..

What would you suggest for someone who is 26yrs old with some investments in PPF, FD, SIP, KVP ? What are the assets once can purchase if she/he has 25k income per month with no dependents ?

I didnt get it ?

Are you asking which assets to buy ? It has to be very personal and there cant be a generic answer for this. Do you want house? If yes, then buy !

Retirement happens “when you don’t work anymore”

Financial Independence happens “when you don’t work for money anymore..”

Golden words.

Awesome post. Keep Going.

Glad to know that Ashok ..

Awesome article as always.

Thanks for your comment Mahesh Deshmukh

Very nice article as usual!

Glad to know that Himanshu ..

Manish,

any PF calculator?

dont see much on internet on this. for salaried people, PF is a big savings and should contribute 2/3 cr of your portfolio if you are earning decent money and never taken it out.

Calculator for what purpose ?

to understand what the future corpus can look like with compounding taking effect. or are you suggesting, refer to the sip calculator with 9% return assumption.

You can just do basic maths in Excel and find out /!

For salaried people PF, super annuation & 80C(1.5 lac) consist more then 10% of salary. Do think for retirement additional planning is required ?

You should do the numbers and see if the final future corpus is enough with these investments?

Simply great..Awesome this one..

Thanks for your comment Dhawal Sharma

Hey Manish, It is always better to choose your own stocks and invest. You will end up with Rs. 5.5 Crores (Direct stock investment@ 14%) vs Rs. 3.5 Crores (Mutual Funds @ 12%) after 30 years if one invest 10k every month; without incurring 2% portfolio maintenance charges by mutual fund. You can earn approx. 20-24% consistent returns from a Hedge Fund Manger or a personal portfolio manager after the management charges. What do you think about this?

Hi Vinoth

I think you have put up the “choose your own stocks and invest” in such a way that it seems like a piece of cake 🙂 .

Trust me its not at all as simple as it looks like. Just see the mutual fund portfolio, copy it and save the expense ratio and keep doing something like that for 30 yrs and create 50% more wealth ! … Its surely a fantasy for a common investor.

I do not say that one cant do that, but only if you are part of that less than 1% people who have all the time and brains to keep doing this year on year with discipline and great amount of accuracy. You are actually trying to do what fund manager does and gets paid few crores for what they do .

Effectively you are saying that you can work for a fund in a way because you have that skill. Think about it. I do not want to be rude , nor I want to demotivate you, but try to recheck if you have over simplified this investing process.

There are lots of things goes into managing a mutual funds and a an average common investor like me and you can not manage all the risk involved in the game of equity investing.

Let me know your thoughts.

Manish

If everyone had the acumen to choose the right stocks for direct investing, then there would be no need for Mutual Funds in this world. One can copy a Mutual Fund portfolio and invest in direct equity as per the allocation % specified but this is akin to a full time job since the fund manager changes the allocation and adds/removes stocks from the portfolio on a daily basis depending on market conditions. If somebody has the time to do this on his own then he can go ahead and save the 1-2% expense ratio. But most of us have other jobs to do. The time spent behind this exercise would be much better spent on upgrading one’s skillset and enhance his income.

Most working class invest in property and consider that their retirement is covered. All the money is converted to bricks and in later years they plan to do the reverse i.e convert brick to cash. They have seen this work in the past and believe that it will work for them as well. I just wonder what happens when the next generation is not willing to pay for these bricks?

YEs, correct. . a lot of people have over simplified many things and suffer later due to that !