6 money lessons every investor can learn from Pradhan Mantri Jan-Dhan Yojana Posters

I recently was reading about Jan Dhan Yogjna and came across some really nice posters created by their team which is used to educate public in their financial literacy camps.

On looking those posters, I was really touched by its simplicity and how powerful they are to install basic foundation lessons. There were many posters in the PDF file I saw on their website, but I picked 6 posters which I was to show you and teach you some important and foundation lessons on money.

I request you to read what I have written for each of them (don’t skip them) to benefit most from them. I know some of you might feel, these points are not for you, but trust me – many of you need them as much as others.

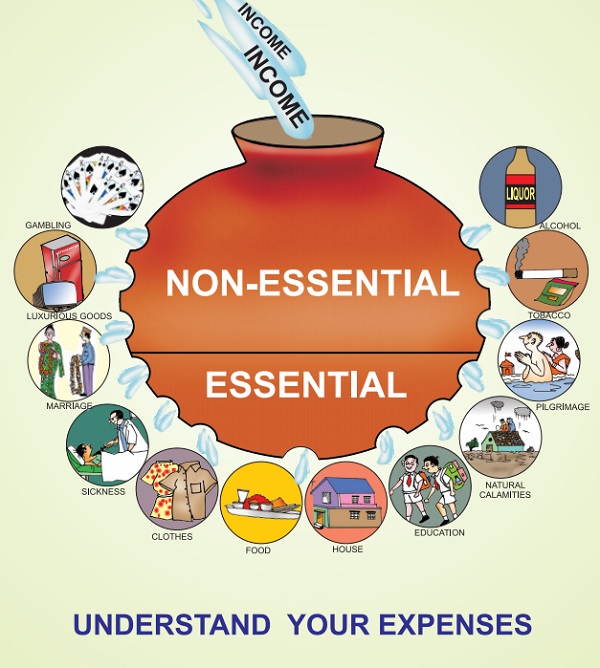

Lesson #1 – Essential Expenses comes first before Non-Essential Expenses

You always have two kind of expenses, essential and nonessential and whatever income you earn should first go into expenses which are extremely essential in nature like food, house, education, Medication etc .

If you see the porter above, it shows you a pot which in its bottom has all the essential things and all the non-essential things come about it. In the similar way, when you are investing or spending your money always ask this question – “Have I taken care of the essential first ?” .

I know this looks too basic thing and its assumed that even a fool knows this, but reality is very different. You will see lots of parents who have spent 30-40 lacs on lavish wedding of their children, who are now struggling to even buy a house.

There are people who have invested their money in land, which is locked and now they are struggling to pay high education fees for their children. There are parents who are saving for their car, even before they have any money accumulated for their kid’s school fees.

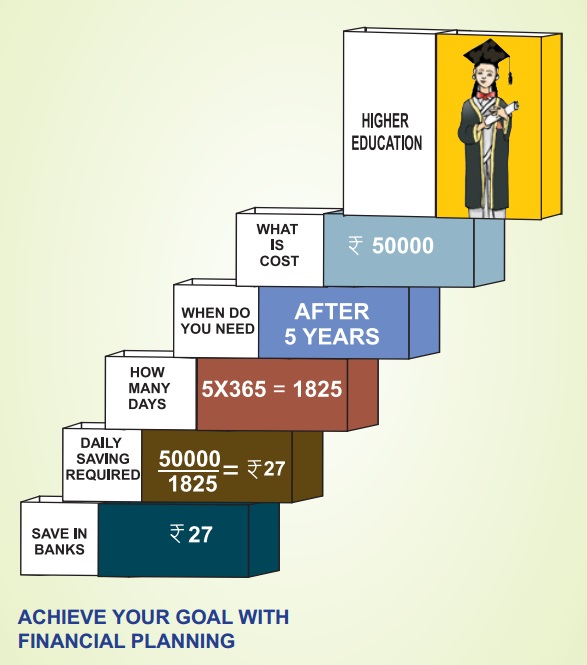

Lesson #2 – Financial Planning is extremely Easy – if you are ready

The next poster shows the simplicity of financial planning and how easy is it to implement. All you need to do is be ready beforehand and act on requirement. The above poster is created from a poor person’s perspective, but there are big things to learn .

Whatever is your future need, write it and then find out how much you need to invest on a monthly basis and then DO IT . There is no extra ordinary thing done by those investors who always meet their life goals, all they do is properly save with discipline.

Lesson #3 – Spend, Reduce and Avoid

You always have 3 categories of expenses in your life. Needs , which needs to be taken care of no matter what you do and you have to spend on those things, no matter what, like education, food, health, medicine. You should make sure you spend on these things and don’t cut on them provided you have the money for these things. Its essentials of life and they are critical for your existence

However there is another category called Wants, which are “great to have” things in life. Things like expensive clothes, entertainment, holidays – which is something where you have to define your limits. You don’t have to cut them out of your life, but always remember how much you need to spend on those things.

You have to REDUCE your spending on these things if possible and then at last there are VICES, which are bad for you, which destroy lives in long run. Smoking, alcohol , gambling etc which give a pleasure in short-term, but should be totally cut out from your life. Most of the people in lower strata of income always remain poor mainly because of these vices.

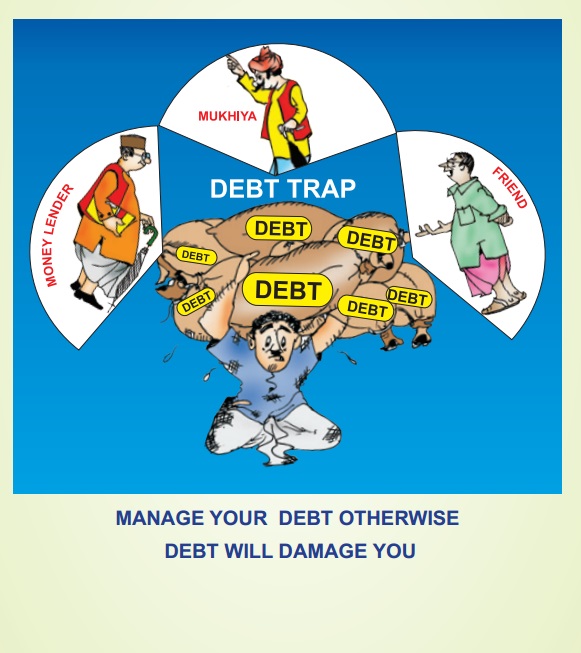

Lesson #4 – Debt will destroy you, if you dont handle it properly

I love this poster most because I know most of the people can relate to it more than other posters. Debt is like sugar – sweet for now, diabetes for future . Millions of people today are in debt cycle which started very small.

When their career started, they bought a bike on EMI , or they swiped their credit card because they need loan for some not so important purpose in life (and many times, very important) and then from that time, till date they are paying the EMI for some of the other purpose.

Availability of easy credit has made them addicted to loans and credit offers. One side when one has to save and grow their money, people in debt cycle are actually doing the reverse.

If you see the image above, you can see how poor people get in debt cycle, the easy availability of credit from sahukar or friend in their village makes sure that they are always in that debt cycle, because anytime they need money, they can get it (at small level) and the interest they pay does not look huge (because it’s in rupees terms) like Take Rs 1000 and give back Rs 2 every day , that is bloody 72% per year. Avoid it if you can

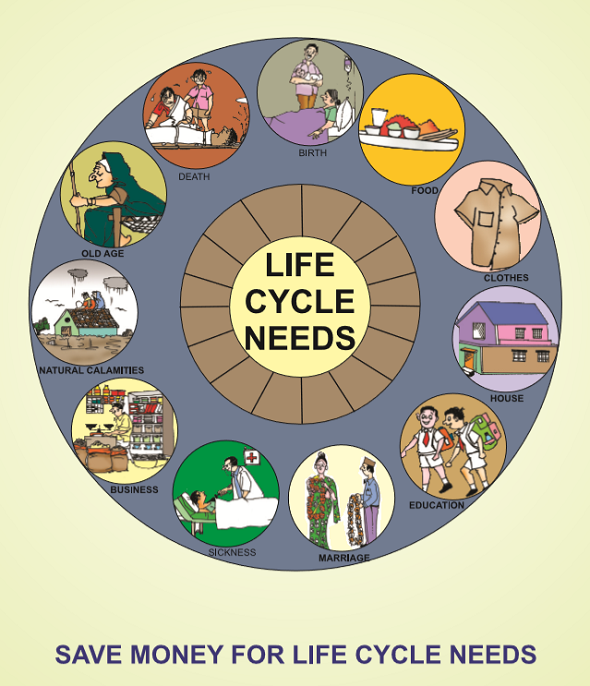

Lesson #5 – Save money keeping in mind your life cycle needs

Most of the people live as if life will always be great and they will always see happy days in life just because their current situation is awesome. Bad things happen in life and you can have it too . It’s important that you save for bad days keeping in mind all phases in life.

I came across a 53 yr old person recently who has spent on everything else in life, but has Rs 0 for him today and now when he is free from other responsibilities in life, wondering how will he manage in his old days since only 7 yrs are left before he will be “senior citizen” .

You will see change of jobs, birth of child, death of someone , lowering of income and many other things which will need money that time which brings an important question – “Are you saving minimum 20-30% of your income for your future needs?” . If not , think on this .

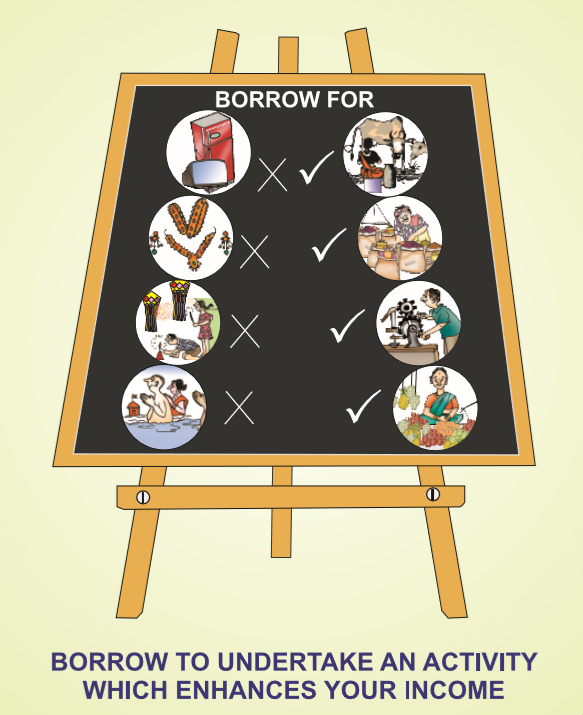

Lesson #6 – Borrow to undertake an activity, which enhances your income

I want you to stay grounded with that statement for a moment.

– “Borrow to undertake an activity, which enhances your income“

No statement can make it simpler than this. If you are taking loan, ask the question (unless its emergency) – “Will it be used for something which can enhance my income or build me a growing asset ?” . If the answer is YES – you can go ahead, else refrain from it.

Most of the people I came across have tons of personal loans, credit card debt, car loan which is not helping them build anything in life, it’s mainly for their consumption . To some level I am not too much against it personally, but when it’s beyond the limits – it really troubles you all the life because you never get a good enough start in your financial life in initial years.

Basic, but foundation lessons

Today’s article was a bit basic in nature, but I would say its very important one which builds foundation of every investor. Despite it looking basic, millions of investors don’t follow it and get into trouble. I want you to send this article to at least 5 people you know are starting their career, or you feel need some foundations in personal finance knowledge.

Would love to know what you think of these lessons and did you love these posters ?

January 5, 2015

January 5, 2015

Thank you very much for spending your time and energy to educate us on such important matter. Please continue your efforts to help those who desperately need such guidance as, sir, everyone does not have a true guide on financial matters to hold his hand and help him pass his life smoothly. Once again thank you sir.

Glad to know that Maninder ..

very very nice article to understand the basic requirement of investing money.

Keep updating on any new policy.

Thanks for your comment ranbir

Nice article… so simple and powerful…..

Welcome .. Glad to know that Hansraj Deshkar ..

Hi Manish,

All the lessons are really good. I would modify Lesson 2 a little bit:

1) If you assume the inflation and rate of return to be same, then you need to invest twice the amount than that shown in the formula (Rs. 54 daily in the above case).

– Reasoning: As the investment is on daily/ monthly basis (in case of SIP), the average period is halved.

2) If you assume the rate of return to be twice the inflation, then you can invest exactly the same amount (Rs. 27 in the above case).

3) For other cases, you may need a lumpsum calculator, which are available online.

Thanks for adding that points.

I never started till 35, because I was constrained by the support system in the family, their impact on me and my family. Best of all, I was the obedient son who toed the line all the way through. Had I started a PPF account at age of 25 years, it would have matured by time I was 40 and used to buy house.

To me, above was a learning in financial planning that is learnt for life, so future generations have more freedom to decide what they need to do. As elders, it is our duty to guide our children and make sure they learn from our situations.

Thanks to site like jagoinvestor and the internet as it exists today, we can share, so others benefit too.

Welcome Mahendra !

nice article … explained everything from birth till death … thans a lot. I consider myself lucky that i have came across ur blog in time

Welcome Anuj 🙂

Hi Manish,

Awesome article. The first point is the hardest fact in every ones life. I believe 100% population is covered with that point. Every family is spending too much for un-planned expenditures. Thanks for the shopping mall culture which actually surviving by exploiting this weakness of people.

Thats true .. these points even though are basic in nature, but create the foundation of any one’s financial life

Good one!

I have taken the print of entire posters and gave it to my wife to learn about the savings. Also sharing the same to my friends thru emails.

I am the new reader of your blog(Reading your blog from last 1 month)!

And eagerly waiting for your writings!!!

Thanks,

Suresh D

Good to hear that Suresh

I am also working on my 3rd book which is for beginners 🙂 . It will be a perfect read for your wife 🙂

Should I take personal loan for land?I have car loan already.

HOw can I answer that. Ideal answer is NO you should not take it , but if your situation does not allow you that, then what will you do ?

Simple , Honest , Informative, Way to go Manish !!

Thanks 🙂

Thanks a lot for such a valuable lesson. keep it on.

Good article.

People must save from their first salary-regularly and try to get benefit of compounding.

Spend only after saving and not save after spending.

Thats great tip Geevis !

Very basic but absolutely true. If you stick to this, does not matter whether you know the difference between equity n debt but you can lead a comfortable life. That’s a guarantee.

Well done Manish.

YEa .. thanks for sharing that !

Nice Article, This is simple posters for understanding to all.

I am suggesting to readers to read this good book “The Millionaire Next Door: The Surprising Secrets of America’s Wealthy” for expense planning as well financial planning.

Thanks for sharing that book Ramji .. !

This is indeed a good article. Financial discipline is a must in every stage of life.

It is rightly said that “Money Saved is Money Earned”. I also believe that today’s savings are tomorrow’s income. Sometimes unnecessary expenses and leisure expenses spoil the budget of the household.

Thanks for sharing your views Viral !

Very good for our improvement of living standard.

Thanks

Dear manish,

I was in the search of the things which can educate the basic principles of saving which some pictorial presentation, specially for my wife and my friends. you have reduced my energy to make them understand for it. i really appreciate it. keep it up.

tejash

Good to hear that Tejash !

Good article Manish

Thanks Ram !

Dear Manish,

This is an excellent article. Though very basic in nature, very powerful message for everyone. I would like to share my practice here. Every month, my first cash outflow is towards investment. I plan my other expenditure only after that. And any unexpected income, I put it aside (in a separate account) so that it does not mix with my regular income make my bank balance look artificially big. And at the end of the month, any excess funds is diverted to some sort of investment. I also keep some reserve liquid cash for any unforeseen expenses.

Thats great .. What you are doing is really inspiring and worth learning for millions of investors !

Hi Manish,

Its a really nice article, I just want to draw your attention to a small MISTAKE in the article.

The point about debt; it either has to be Rs 10,000 as the amount of debt or Rs 2 as the amount of interest per day.

Yes Jatin

I have corrected the mistake. THanks for pointing it out !

Nice and thanks

Welcome !