This article is dedicated to Late Rakesh Jhunjhunwala Sir. The article is not about him or on him, I just felt like dedicating to him.

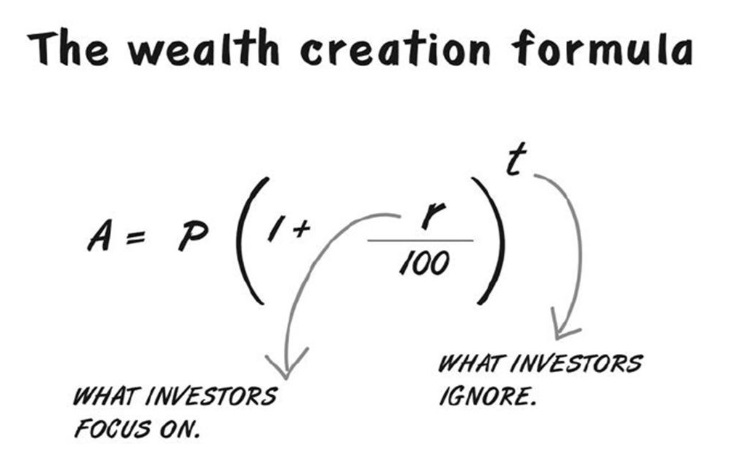

The article is written on health and trust me it has a direct connection with your overall life and wealth journey. We have trained hundreds of investors on retirement planning and our session starts with the conversation around ” Life Expectancy”. How long is the post retirement phase going to be after 60?- and we get answers like 80-85-90 yrs and and some claim they are going to live till 100 yrs.

Most investors are working hard to build a bigger corpus that can last till 80-85-90 or till hundred years of age. But are our body and habits truly aligned or prepared or are we preparing ourselves to live till 85-90-100 yrs?- is the question we all have to ask ourselves. If the answer is no, why have the retirement goal in the first place, why build a huge corpus in the first place? Why save and invest bigger amounts to secure monthly income till 90?

If you are not taking great care of yourself, if the stress levels are high, you stay very busy and there is very little or no time for yourself then this article will act as a wake-up call for you.

Health-worth vs net worth?

You may be shocked to know the way people treat their body is atrocious because we get our body for FREE, it is actually very bad and I can say that because I was doing the same for many many years. Most people are actively seeking to destroy it. The most natural state of vitality, aliveness and longevity is unknown because every person is actively engaged in destroying their body.

Take a pause and check your habits, your relationship with food and exercise and you will get your own answer or look around and examine people closely. I can say this because I was doing the same, no exercise, unhealthy food habits, no fixed time to sleep and working late nights. Make a list of things you are currently taking for granted.

There is really no excuse for abusing your body. Your body and your wealth are like your left and right foot on your journey to create an awesome life. Your relationship with your body shows how much respect you hold for yourself, taking extraordinary care of your body is the primary requirement or condition to create an awesome life.

We witness people in our life who suddenly go bankrupt ( diabetes , blood pressure , etc ) in the area of health, boom they have achieved their goal of destroying their body. We get so busy in our day to day life, the body becomes like a non-stop machine and in that process our health takes a back seat very easily.

It has been 5-6 years since I became conscious about my own fitness and health, I became a student of health and wellness, I started reading and applying things to my life to check what impact it can have on my quality of life. I am writing this article to share some of the health and fitness rules of my life.

This blog is about personal finance but trust me one breakdown in the area of health and all your wealth and the biggest of the corpus can lose its meaning.( Now, you know why the article is dedicated to Late Rakesh Jhunjhunwala sir)

Why take care of your body? ( In the first place)

Your body is a place for you to see and experience the world. It is the vehicle which helps you to experience being loved and for you to give love to others. You would not throw a televisIon set down a flight of stairs and then expect a clear picture from it. Yet you treat your body worse than you treat the television set and you expect exquisite performance from your body.

Our body comes without an owner’s Manual and so you must take it on yourself to learn about how to take great care of your body. The neglect of learning about your body is itself a way you neglect your body. When was the last time you learned something powerful about your body and you also put into practice what you learned? Unless you can say that you do that everyday, you are abusing your body through neglect.

Check for yourself are you addicted to some substance? Are you putting things into your body which you know is difficult for your body to handle? If you are committed to living an awesome life and you want to enjoy the corpus you are creating then you have to give that up, right now.

If you are unwilling to give that up, you are not serious about living an awesome life, you do not want to enjoy the wealth you are currently slogging for. It is possible that you may find this article “interesting”, a lot of people are interested in fitness and health conversations, they read, discuss and have all the world’s knowledge of health and fitness. But I give a damn to people being interested, being interested is lousy.

I want you to get off your back-side and start taking actions regarding your health. If you choose not to take actions , please know that you and I are not in the same reality. If you want to get on my wave-length there is more required than passing your life being interested in living an awesome life.

Oh come on when you give-up something( laziness, casualness, habits) there will be pain but do it anyway. This article has to be a turning point in your life, write to me [email protected]

10 learnings from my personal fitness journey

Now, let me share top 10 changes or learnings from my personal fitness journey:

1. Intentional movement

What is important here is the word intentional, bring some intentional movement in your life. From morning till night you get many such opportunities to bring intentional movement in your life. I never use elevator in my office

2. Morning Regime

For years I started my day by consumed tea in the morning, instead of tea I now consume the green smoothie. It has kale, celery and other herbs which helps me to rich start my day very powerfully. Having a powerful gut is critical, our gut is like our body headquarter and we have to take care of our gut. Most diseases starts or are connected to a bad gut.

3. Break-up with Sugar

It was very hard for me to give-up on sugar. Trust me it is not going to be easy to quit sugar. An average Indian consumes more than 70 KG of sugar in one year. Sugar carries empty calories and puts you on a slow poison.

4. Stop Dieting

I think the word dieting is dangerous, it puts you in a temporary zone where you get results but you fail to hold on to those results in the long run.

I am not on diet, I have made some lifestyle changes which I can stay consistent with all my life. You will find many fancy diet programs and books on the internet, trust me you do not need any of them.

All you need is, ” Whatever you put into your mouth has to be high in nutrition”- Simple

Every plate of mine has – 40% Protein, 20% carbs,40% fibre ( Have these three in all your meals and you will start seeing the results)

5. Calisthenics

I spend time doing body weighted exercises, you actually do not need heavy weights or fancy gym equipment. Our body weight is enough for us to get the desired results. There are some basic movements one needs to understand, craft a simple daily schedule and follow it. I think every alternate day 30 min workout is all you need to keep yourself fit.

- Push movement – Eg. push-ups

- Pull movement – Eg. pull-ups or hanging exercises

- Legs – exercises like squat or hinge

6. Breathing

Breathing is life and we have forgotten to breathe properly. Three times a day I do the 5-5-5 Breathing exercise. In this exercise you inhale at the count of 5, hold your breath on the count of 5 and release on the count of five. You repeat the same 3-5 times in a day. Let your colleagues watch you, don’t think about what they will think , practice breathing as and when you find time.

7. Water intake

If you want to enhance your fitness you have to keep yourself hydrated throughout the day. I think water is the key ingredient in weight loss and it helps to enhance your overall fitness level. Drinking 8-10 glasses of water is extremely important, make this a rule in your life. Stay hydrated, have clean water and most importantly no soda or clod drinks or packed juices. They are liquid but not really good for you.

8. Skip breakfast

For years I was told breakfast is the most important meal of our day and we can’t dare to skip it. Well, I did not find the same in my research, it suggests that I skip my breakfast and it has worked for me. If you think having breakfast is vital for you then you can continue the same.

It is also important what you eat in your Breakfast, avoid cornflakes and cereals and watch for the ingredients. Do not consume things you do not understand. Have fruits at the start of the day or have some hot water and lemon in it to kick start your day.

9. Weight is a wrong measure

Most people are weight watchers, they measure their overall fitness by how much they weigh right now and what is their dream weight. Your weight is just one of the measures, you have to check how much muscle mass you have, what is your BMI and other internal parameters. When you get your body profiling done you get to know about so many hidden things about your body. If you want to take care of your body, get your body profiling done once every month. You can also buy a good weight scale which does body profiling on amazon or some other website.

10. Intermittent fasting

Fasting is truly magical , it is very powerful and it helps to reset your body to its natural rhythm. Start small , no need to go for long fasting windows, learn to first ride the wave, fast for 5 hours or 6 hours and slowly increase the window of fasting. Intermittent fasting is about giving a break to your internal machinery so that healing can take place. Instead of reading a lot about intermittent fasting just start implementing.

Here is a short fitness test video by Himali Desai for you.

Let me know in the comment section, if you were able to finish it or not?

And do share the article with others who can benefit from this article.

If you want to join a webinar I am doing next weekend on 18th Dec, 2022 at 10 am to share more about my fitness journey, here is the link to sign-up, and we will send the joining link (zoom).

Happy Health and Wealth to all!