This post is most probably the one on which i didnt worked hard . This is just an email reply from my side to one of my friend who queried me regarding his Endowment Policy package which an agent has created for him .

The policy looks like this … 15 small polices of 1,00,000 each which will mature one by one every year after 27 years and will act as yearly pension in his old age

His mail :

>>>

On Wed, Oct 15, 2008 at 9:37 AM, ajay patel wrote:

15 policies of Rs. 1 Lakh each, starting from sept 2007, first policy matures in 2034 and others follow every year from there on.

Cover of 15 Lakh is for life time. There is an extra Rs 500,000 accidental insurance along with it till the age of 70(2053) (if the world exists till that time).

Annual premium of Rs. 42,000 till 2034, a total amount of 3,400,000 will be received from maturity of these policies.

Say after ten years, I see myself earning around 2.5-3 lacs per month. with one child (if i get married :))

My Reply :

OK

now lets see some of the facts for you to ponder .

Starting from 2007 you are paying 42,000 each year till 2034 (for 27 years) . You will receive money starting from 2034 – till 2049 (15 years , each policy matures) .

Points to note :

– You are paying 42,000 and then its locked for 27 years

– You are getting maturity value of each policy per year , just like a annual income(around 2.25 Lacs/year ie : 34/15 , which is not taxable (you keep all the money).

– You are getting Tax exemptions under sec 80C for this.

I think these are the points you have to agree , because they are not opinion , they are facts .

Some of the flaw or issues with this plan are following , which you never considered at the time of taking this .

– The premium you are paying each year equals to your current monthly salary , also you said that you see your self earning 2.5-3.0 lacs (6 times , your current) per year just after 10 years from now . i am not sure what kind of figures will it be after 27 years . At that time , the money which you get from the policy should not last even 2 months . Considering your expenses currently at 25,000 per month (considering you are married and have children) . the same expenses will rise to 1.2 lacs assuming 6% inflation (also remember that the expenses will keep rising each year ie : 1.66 , 1.77 , 1.9 … 4.2 lacs , whereas the money you get each year will be around constant 2.25 lacs only , this may look unimaginable , but ask your father to grandfather about the monthly expenditure of family before 25 years , i am sure it should be 5% of current, people always forget inflation).

– The insurance provided by this policy is so less that you are highly under insured . What can your loved one do with 15 lacs today ? Will it be sufficient to replace you ? If you consider time after 10 years (when you think you will earn 2.5-3 lacs / month , will the insurance money be sufficient to cover the dependents ? When you will be of age 60+ , the insurance amount is able to meet not more than 9-10 months expenses .

Having this policy is as good as not having it . The issue is not that Can there be policy better than this? ,The main problem is what kind of value is this giving to you . Is the benefit provided by this policy after 27-42 years is much less than than the pain you are getting by paying hefty premium now .

With the same money (42,000) , let me see what can i plan for you with same money .

Lets first take a most conservative way (which is undebatabely safe).

You take an insurance of 50,00,000 (50 lacs) for 30 years and pay a premium of just 10.5k per year . You are left with 32k per year which you put in

1. PPF account

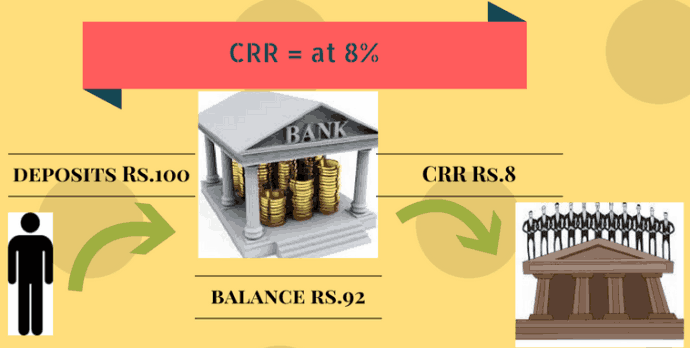

In PPF the money 32k @8% will become 2,55,000 in 27 years and you will get this money every year (total 38 lacs till end) , till age 66 ( In Endowment policy it was 2.25 lacs)

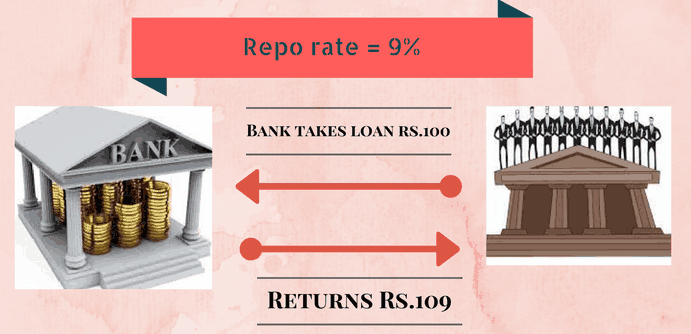

2. In MF considering 12% return

32k invested will become 6.83 lacs in 27 years , so you invest every year 32k and get 6.83 lacs just after 27 years of payment . so it can provide a regular income of 6.23 lacs after 27 years for continuous 15 years till you are 66 .

3. In Mutual funds considering 15% return

The amount would be 13.93 Lacs , every payment of 32,000 will become 13.93 lacs.

Question: How realistic are these mutual funds returns ?

Answer : Over the history no asset has returned more than equity over long term . India Equity markets have returned 17.5% CAGR annually (since inception) . 15% is a very realistic return considering the money is invested for long term like 15+ years . Equity investments risk are inversely proportional to tenure of investments .

After 30 years you will not even need Insurance , because this money will be available every year . and i am assuming that you will earn enough till than that you don’t need insurance .

Some other things to ponder are :

Investing in your Endowment policy does not give you any flexibility of stopping or missing your premiums . In case of PPF or mutual Funds , you can be very flexible and stop for 2 years if you want money to be utilized some where else .

The plan which i told you has everything which you had in that endowment policy , even more than that . its like Buying Nokia 2600 @20,000 when you have iPhone available at same price , you just didn’t knew where you can get it 🙂 . Ok , i know that was pathetic analogy , but i need some platform to show that i can think .

So better stop those policy and take the loss of premiums which you paid , anyways you are not going to be affected now , and life will be normal as it was .

I have done nothing extraordinary here , but some calculation based on some common sense , which is not common .

disagreements are welcome .

– manish

—

Manish Chauhan

Bangalore

https://finance-and-investing.blogspot.com/

Lets understand some basic things here . No matter what people tell you or design things for you , Always calculate and apply the simple formula’s which will give you certain numbers, which can be used as benchmarks by you .

Some must know formula’s : https://finance-and-investing.blogspot.com/2008/09/3-most-important-formulas-you-should.html

Please post your comments .