New LIC Term Insurance relaunched with low premiums

This is a bit old news now – but a lot of you might not know that LIC has relaunched their Term plans (offline) few weeks back. LIC has two term plan policies now called Anmol Jeevan II (below 25 lacs sum assured) and Amulya Jeevan II (Above 25 lacs sum assured) , and now both of these are relaunched (earlier one was Jeevan Anmol I and Amulya Jeevan I) to make sure that they comply with new IRDA regulations which came some months back.

The main change in the new term plan and the old term plan is – that SINGLE premium option has been removed from these term insurance policies and the premiums have dropped due to change in mortality rates, which was due from long time for LIC to adopt (that was the main reason why LIC term plan premiums were very high compared to other companies)

Lower Premiums for New LIC Term plans

For the simplicity purpose, in this post we will just talk about LIC Jeevan Amulya (Sum Assured above 25 lacs) and not LIC Anmol Jeevan.

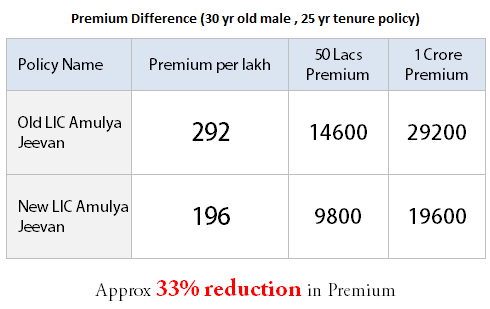

So now the premium is lower. Consider an example where a 30 yr old person wants to buy a 25 yr policy . In this case the old LIC Amulya Jeevan premium was Rs 292 for every Rs 1 lac sum assured, however in the new Amulya Jeevan , its only Rs 196 , which is a reduction of approximate 33% .

Now with this new rates – if a person wants to buy Rs 1 crore term plan with LIC – then it can be bought at only Rs 19,600 , compared to Rs 29,200 earlier !

Is LIC Term plan premium lower than other companies?

No , LIC Term plan is still one of the highest even after reduction in its premium rates, but if someone is hell bound on buying a term plan from LIC only, then its a great news for them. If you consider other private companies – then the premiums are much lower for other companies like Bharti Axa, Aviva or HDFC Click2Protect . For example – A policy of 1 crore sum assured (25 yrs tenure) , most of the other companies will charge below Rs 10,000 per year, however in case of LIC its Rs 19,600 which is almost double .

Already bought old term plan from LIC long back , Will your future premiums be lower?

I dont think so, if you already have bought LIC Amulya Jeevan Term plan some time back, you will be paying higher premium which was decided at the time of buying and you will continue paying that only. So now its your choice if you want to re-purchase a new term plan or not, But better check the premiums difference in case you plan to repurchase it now , because if you re-purchase it now, your current age will be considered and it might happen that the premium difference is not much for you.

So now – if you still have not bought a term plan , and if you are only interest in LIC term plan, then its a good time to buy the term plan from LIC – go ahead !

April 14, 2014

April 14, 2014

Hello,

I need your guidance. My wife passed away this Aug 2016, I had taken a HDFC life term plan, however, i missed to pay the premium this year. When I went to HDFC life they told me that my policy is lapsed and will not get anything from the company. Let me know, if I have any other option?

If the policy was not renewed and it was lapsed, then why will you get the money? There is no option here. The contract is over. Its that simple

Manish

Hi,

Is it Mandatory to show Pay Slip and 3 Years IT Returns to take 1 Cr. Term Insurance Plan …..Please advice.

Yes

hai manish ji

i’m a student,

a company ask me to do life insurance. tell any insurance which has low premium

Hi nashapatel

I can see that you are thinking of buying a term plan. ALl you need to do is leave your details at http://jagoinvestor.dev.diginnovators.site/solutions/buy-life-insurance-plan

Our team will get in touch with you

Manish

Sir, I want to take a term plan for my wife who is aged 42 years. The cover should be Rs. 5 to 6 Lakhs and period should be 15 years. My wife is basically a home-maker. But she runs a beauty parlour from our apartment. The beauty parlour is not registered and no income documents are available. However she earns 12 to 15 K per month from the beauty parlour. Kindly suggest some way of getting term plan for her.

You can catch an agent for this or do it online ..

I am aged 52 and want to open a Policy in LIC for I crore .This policy period shall be for 10 years , then, what will be premium for 1/2 yearly .After 10 years, what amount will be received and any monthly payment also . SPECIFY The policy name.

If i pay one time for 1cr Policy , how much amount i should pay.

Is it all policy is Accident COVERED? If any other Insuarance doing much better than LIC Poilcy

Hi Dhamodaran

Do you want to take mainly an insurance cover or you want to invest your money ?

Dear Manish,

I’M 38 and planing to buy a term plan of 1 Cr.

Kindly suggest suitable plan which will help my family,when I’m not around.

I’m more inclined to off line policy,coz the agents are accessible .

The policy should have riders and least premium possible.

Take a term plan online

Hi I applied for a term policy with lic in the month of feb now it’s almost two months still the policy has not come me the agent says as it’s a term policy it takes time the Intial premium amount as been debited by lic so kindly advise thank u

Hi Prakash

It should not take this much time if all documentation is complete. Check for exact status and where is it stuck exactly ?!

Hi Manish,

Need your advise please.

I want to purchase online plan and i dont want to continue my offline plan. So shall I surrender the policy as per procedure or stop paying premium. Stop paying premium of insurance is affect on credit score?

Yes Gaurav

You can surely do this . It has no effect on credit score !

The website or the article does not give any information regarding terminal illness. Can anyone explain?

What is terminal illness ?

Hi Manish,

Need your advise please.

I have got a new born. Am looking for a policy for him so that his school fees and other education expenses can be covered via this policy.

Me and my wife have sufficient polices which covers a good life coverage.

Can you please tell me if I should go with Policies or making FDs.

Thanks,

Vivek

Vivek,

Policy for a new born is really not a good idea.

What you can do is start an SIP and continue the contribution till his education and also increase the SIP amount each year.

The person who has dependents should take the policy. The child has no dependents and so it does not make sense to take a policy in his name. Moreover, the returns from the policy is poor.

There cant be any policies which cover it . I mean I have no idea what do you mean by “the policy should cover it” .

THe best option for those short term expenses is to make FD’s

Manish

Dear Vijay,

Can u pls advise how much is your SA and what premium u r paying.??

Understand HDFC click 2 protect is one of the cheaper online plans.

HI… friends

I have HDFC click-2-protect policy for myself and my wife paying high premiums every year. Is this policy trustable or should i add buy one more term policy from LIC ….

thanks!!

You can keep your HDFC click2protect. You can trust it ..

Is Online Term plan from LIC already out in market????..Cannot find any line as of now!!

No , its not yet launched !

Thank You Manish

19600 for 1 crore is still higher than other insurance providers. I think LIC should reduce it further.

Hi Manish,

I’m 32 and I took a LIC term insurance for SA 40 lakhs last year (2013) and paid the first premium (yearly premium of Rs. 14280).

Now after coming to know about this new term insurance with reduced premiums, I’m confused.

Since I’ve paid only one premium till date, does it make sense now for me to cancel the old policy and go for a new one? As I understand that, as per the new policy my premium would be reduced by almost 4000 – 5000 per year.

Regards,

Anand.

Given it has just been a year .. i would have gone for it !

If you are opting to cancel old one, make sure you get new one first and then cancel older to ensure continuos coverage.

Hi Manish ,

I am planning to buy LIC’s Amulya Jeevan – II, 35 year policy for 50 lac sum assured.

My age is 32 years( DOB 5th Feb 1982) .

Would you please calculate yearly premium for me ?

Hi Narasimha

You should get in touch with LIC agent for this.

This premium calculator may serve as a rough guideline…. actual premium may depend on health history and medical test results etc.

http://www.lic24.in/amulya-jeevan-2/

Thanks for sharing that !

hi Manish ,

LIC term insurence good to buy for thoes belive only on LIC. i will share my experience i took amulya jeevan term plan last year . it was just suggest by my friend i was paying premium of around 8000 Rs for 25 lac for 30 year & even i did n’t have any problems with that policy .

problem was started , when i forgot to pay next premium due to other priorites . after that my agent called me and asked for the reason for not paying the premium , i told him ok will pay right now . he told me sir your policy is stopped and if want to pay the premium you need to go throgh medical check -up with your own money and may be chances of getting rise in premium . it was just 2 day delay after the grace period . i ask him it is only 2 days delay , why should i go through medical check- up , ans came from him that medical test is must to check if you are not came across any illness . (how the people came in to in to serious illness within 2 days )

then que is that if people pay the premium on time are realy fit and don’t have any serious illness . suppose person has paid the premium almost 20 years and forgot for 21 premium so in that case as per this policy it like to purchase new policy with high premium ….. then what is the use or benifit of paying for 20 years.

i knew most of terms and conditons are same for all insurece company . but my mind was not accepting to go medical check -up just delay by 2 days & finally i took decision not to continue the policy and not to go for any new term plan by LIC .

Hi Prashant

Thanks for sharing that, but the rules are exactly like that for every company. If you feel stopping your policy is better for you, then its your decision

Hi Manish, this is Raghavan, I have taken LIC’s Jeevan Saathi policy in 2008, and am paying an annual premium of approx Rs 56000 for a SA of Rs 10 lacs for 20 yrs term. The policy covers both husband and wife, and pays both should it be warranted. However I have later taken term policies at far more easier terms and beleive it best to either surrender or leave it as paid up. Would like to know your views on what is the best course. I have paid 6 years premium so far

I would have made it PAID UP !

Hi Manish,

This is bhasker working in idbi federal life insurance (hyderabad)andhra pradesh

if any one interested with idbi federal life insurance pls suggest

Sure .. will let you know

Hi Manish,

I recently got a call from a guy from FundsIndia & told me a few things about term plan. He told me that its better to go for offline term plan rather than online term plan as in offline term plan there will be someone to help while claiming the term amount, if needed. And hence there will be more chance of getting the claim amount for the family.

Can you please tell whether its true or not?

It will be useful if someone is there at the time of claim. But there is no gaurantee that this gentleman will be there after 10-15 years.

Coming to the basics, online policy or off line policy is a policy first. So it is to be paid. True, the branch people may take the dependents for a ride, if they are not properly knowledgeable about the policy details.

In such case, it is better to educate family members on the procedure for claiming the amount. Off line policy or online policy, the dependents have to run around for some time time with documents to get the claim settled.

I personally do not support this view . Offline or Online – the claim procedure is totally same in both the cases. the argument “there will be someone to help while claiming the amount” is just an imaginary thing I guess .. Yes technically there is an agent who helped you to take the policy, but I dont see even a minute chance why he will still be motivated to help you with the claim procedure, unless its part of his offering and it surely depends on their business ethics !

Just make sure you know the premium difference between offline and online version and if you are fine taking the offline term plan

dear sir,

this is a good thought provocing question.

1. in my experience ( sales ) most of the nominees ( housewife ) really do not know the polices taken by his husband, from lic or others.

2. only few said some papers are in safe.

3. o k. next in case the policy holder has FORGOT to change nominee name ( mother to wife ).

4. in case of accidental death min 4 papers are required like fir in nearby police station,, doctors report, any eye witness like trafic police or the person called the ambulance or 101. etc

5. in some cases a good proffessional agent services are really required.

6. knowing what to do in such cases reduces mental pain. always tell your wife / dependents about your polices and claim process, there is no wrong in that.

you have taken for them only

and they may be excuted in your/ our ABSCENCE .

thanks to the forum !

Thanks for sharing your views !