How to do PORTFOLIO REBALANCING

Today I am going to talk about something which is one of the extremely important tool for risk management and also something which is encouraged if you want stable returns from your investments. We are going to talk about the investments in Equity and Debt.

How Re-balancing the portfolio will help in –

- Risk Management

- Stability

- Maximize returns

Understand the pros and cons of Equity and Debt

EQUITY

Pros : High returns, Low risk in Long term, High Liquidity

Cons : Risky, not suitable for short term investment

DEBT

Pros : Stable and assured returns, Good investment for short term goals

Cons : Low returns

Equity + Debt :

When we combine Equity and Debt, returns are better than Debt but less than Equity, but at the same time risk is also minimized compared to Equity and Debt, and when we apply technique of Portfolio Rebalancing, both risk and returns are well managed.

What is Portfolio Rebalancing?

The first step to understand is that each person must divide his investments into Equity and Debt in some ratio, it can be 40:60, 50:50, 60: 40, 75:25 or any ratio, The ratio depends on a persons risk taking capability and return expectation.

For an example let take the ratio to 60:40, portfolio rebalancing is nothing but rebalancing your portfolio in same ratio, in case they got changed after some months or years, as you wish. Preferably the good time is every 6 months or 1 yr, but not 15 days or 1 month.

Why Do we do it?

You have to understand that each person should concentrate on both returns and risk.

Case 1 : Equity:Debt goes up.

Action : Decrease the Equity part and shift it to Debt so that Equity:Debt is same as earlier.

Reason : As our Equity has gone up, we could loose a lot of it if some thing bad happens, we shift the excess part to Debt so that it is safe and grows at least.

Case 2: Equity:Debt Goes Down.

Action : Decrease the Debt part and shift it to Equity, so that Equity:Debt is same as earlier.

Reason : As out Equity part has decreased, we make sure that it is increased so that we don’t loose out on any opportunity.

Limitations Lets also talk about the limitations of this strategy, once your equity exposure has gone up, if you rebalance and bring down your Equity Exposure, you will loose out on the profits if Equity provides great returns after that, or if your Equity exposure as gone down and you bring up your exposure from Equity and if Equity does bad, then you will loose more.

Understanding the Game of Equity and Debt

But, we already said in the start that our primary concern is managing risk and profit is secondary. Let us understand that markets are unexpected and they can go in any direction, so better be safe than sorry. Many people are confused that if there equity has done very well then shall they book profits and get out with money and wait for markets to come down so that they can reinvest.

Portfolio rebalancing is the same thing but a little different name and methodology, so once you get good profit in something which was risky you transfer some part to non-risk Debt.

When we say Equity we mean shares or mutual funds which are related to Stock markets, which tend to go up and down, if it goes up, there are high chances that it will come down and when it comes down, its highly probable that it will move up again.

Lets us now see the most interesting part : Examples

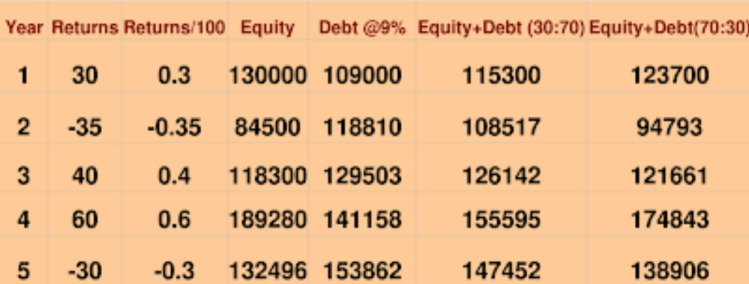

Ajay has Rs 1,00,000 to invest and he want to invest it for 5 yrs and the 5 yrs returns are 30%, -35%, 40%, 60% and -30% .

Lets look at his money and its growth in 3 different mode

– Only Equity

– Only Debt

– Equity + Debt in some ratio (without Portfolio Rebalancing)

(click on this image to see in large resolution)

We can see here that Debt performed better than Equity, because of the uncertain movement in returns, also the Equity+Debt performed better than Equity but not Debt.

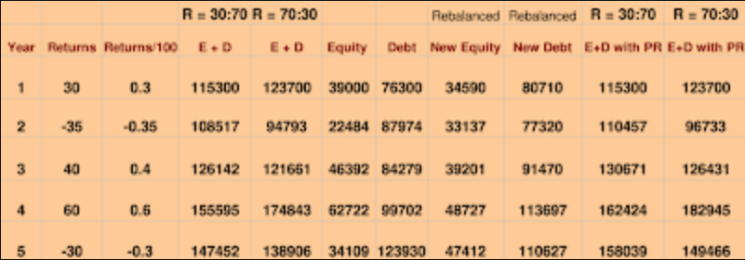

Let us now see the performance of Equity + Debt (with portfolio rebalance)

So now, every time our Equity and Debt ratio changes, we will rebalance it.

Ratio = 30:70

Investment = 1,00,000

Equity = 30,000

Debt = 70,000

At the end of 1st year (Equity return = 30% , and debt = 9%) :

Equity = 30,000 * (1.3) = 39,000

Debt = 70,000 * (1.09) = 76,300

Total Capital = 39,000 + 76,300 = 1,15,300

Now we will rebalance the portfolio

Equity = 30% of 115300 = 34590

Debt = 70% of 115300 = 80710

Now This is our new Equity and Debt investment

At the end of 2nd year (Equity return = -35% , and debt = 9%) :

Equity = 34590 * (1-.35) = 22484

Debt = 80710 * (1.09) = 87974

Total Capital = 22484 + 87974 = 110457

Now we will rebalance the portfolio

Equity = 30% of 110457 = 33137

Debt = 70% of 110457 = 77320

In this way we keep rebalancing the portfolio and lets see its performance for 5 yrs

(click on this image to see in large resolution)

Here, you can see that The column (E+D with PR) is the our main column which shows the performance with portfolio rebalancing. Here we have example for two ratio’s 30:70 and 70:30, we can clearly see that at the end of every year the final corpus for rebalanced portfolio was always greater than the non-balanced portfolio for both the ratio.

For ratio 30:70

Year 1 : 115300 vs 115300

Year 2 : 110457 vs 108517

Year 3 : 130671 vs 126142

Year 4 : 162424 vs 155595

Year 5 : 158039 vs 147452

For the 70:30 ratio also we can see that rebalanced portfolio outperformed the non-balanced portfolio.

Also you can see that for most of the years re-balanced portfolio outperformed “Only Equity” and “Only Debt” except 1st year and 4th year.

1st yr is very easy to understand why it happened and for 4th year, the returns were positive again after 3rd year and we made more profit in “Only Equity” portfolio because of high concentration on Equity side, but you can see that in 5th year, when there was a negative return of -35%, then the “Only Equity” fell heavily, but the rebalanced Portfolio fell very little because we have rebalanced it already and dropped our Equity Exposure to be safe.

Conclusion

So at last the question is what is the ultimate conclusion of all this talk.

Each person has his own Equity and Debt diversification, if the person is high risk taker his Equity component will be high else it will be less, every time your Equity and Debt component changes you have to see that it matches your risk profile, if it does not you bring it back to your level.

By bringing Equity exposure from high levels to your level, you are managing the risk you can take and by increasing the Equity exposure to your level back (in case it went down), you are making sure that you don’t miss out the chance.

Other reason is that Debt always increases, Every time your money goes up in Equity from your comfort level, you take that money which is earned by risk and shifting it to a safe place which will rise for sure though with less speed. Equity is linked with Stock Market and they tend to go up and down always and you don’t know when will it happen. So better manage that risk by Portfolio Rebalancing.

Please comment of this article to let me know how you feel about this article, Feel free to comment on anything which you feel is wrong .

Also, the example taken for this article was self made and does not represent any real life situation, but for sure its possible and similar scenarios have happened in our Stock Markets

July 24, 2008

July 24, 2008

Hi Manish,

Really appreciate your articles.

I want to invest in MFs from this month around 6k per month. This is my first MF investment.

Can you please suggest good MFs to start. I will invest for long term 5+ years.

Regards,

Mahesh

You can start with funds like HDFC Prudence !

Hello Sir,

i m new to the investment field. I want to know about “HDFC Life ProGrowth Plus – Balanced Fund” under ULIP is this product is good for investment or not please suggest me i am very much confused where to invest money for the short term.

No ULIP is suitable for investors

Hi Manish

i want your help i am perusing DFM i want to make portfolio of Rs. 25lacs, but i don’t have that much knowledge and this is my 1st ppt plz guide me how i make my ppt.

mohini

Mohini

Not sure what you need ?

Manish,

I am unable to understand one point. Suppose if I am investing thru SIP in 3-4 mutual funds and some money in debt part. According to u if equity goes up then I should stop 1-2 SIP in equity and move that amount to debt part. Is dat rite? But if I do like that then power of compounding won’t work for me. Can u plz tel us how to apply portfolio rebalancing for SIP?

Chetan

You dont have to do it every month .. Its something you need to do once in 1-2 years . and all you need to just check if your equity/debt ratio has moved a lot or not ?

Manish,

I am beginner in investment. However I have gained lot of knowledge from ur blog. Thanks a lot. Keepp blogging for many years to come.

My risk appetite is moderate. I want to invest in funds. I am 25 years now and I dont want to be late in investing. I am earrning from nearly 3 years but not saved much. As u say in ur book “5 years wasted in the start is worse than wasting 15-2- years towards the end of the you earning life”. Could you please help me which funds I can invest in the starting? Equity or Debt or Balanced funds? .. Later once I have gained enough knowlege i can go for Equity funds on my own. Also shed some light on which is best option for me. SIP or once time investment in funds?

waiting for ur reply..

Chetan

You can start with a RD first and then a balanced mutual fund .

Thanks a lot Manish.. I have already started RD for short term. I will go for Balanced Mutual Funds (either HDFC Balanced fund or SBI Magnum Balanced) for medium term (3-5 years). Also I will start slowly with Large, Mid or Small cap funds and Gold ETF.

Thanks,

Chetan

Yea , that would be great !

Hi Manish,

It was very good article.

I have invested in ULIP Kotak Second innings , Pension Floor II .

How it is and how to manage it.

Could you please explain in more details

Dheeraj

Pension plans are not that great in India http://jagoinvestor.dev.diginnovators.site/2011/10/pension-plans-drawbacks.html

Hiii friends ….

to understand diversification clearly or to understand balancing understand the principle “don’t put all your eggs into one bascket”

it would be clear…

and again good job manish thanks for making concepts more clear…

Arohi

Thanks 🙂

Manish

Ha manish, thanks for the prompt reply.

Hi Manish, I have read this article 3 times, but am unable to understand to understand these things. 1. Equity here means a ppf account or an debt oriented mutual fund. 2. how should i shift the profits from equities to debt. 3. will there be any charges when i shift profits from equity mutual fund, to balance the portfolio, and if so how much would it be for each transaction

1. Equity here means anythign which has equity component , it can be equity mutual funds , ETF , index funds or pure equity .

2. You can sell one thing and buy other . If you have ULIP , you can do a “switch”

3. There can be exit load , but more that you have to be looking at short term tax .

Manish

Hi Manish,

Some questions around implementation of rebalancing.

1) What debt instruments we should consider to rotate money between debt and equity. Some option come to my mind

– FD has a lock-in period with intereste rate you mentioned

– Savings a/c, but it wouldn’t attract the interest rate of a normal debt instrument

– STP with another debt mutual fund – but debt mutual fund doesn’t attract interest rate of 8% or so (BTW I might be wrong here)

2) How frequently we should do rebalancing? I know you said 6 months or 1 Year. Should it be done more frequently ….

Thanks for your great work in educating novice investors like me

Ashish

Ashish

You should not do rebalancing any early than 1 yrs, I would say do it in 2-2.5 yrs , as rebalancing means buy and sell and it might involve taxation issues from debt side atleast .

If you want to do it earliar than you should buy a ULIP .

Manish

Hi Manish,

I’m an avid reader of your posts and learned quite a lot from them. In fact I took up investments in mutual funds more seriously after going through your articles.

My age is 28 and have D:E of 29:71 and I invest regularly in 5/4 star rated (VRO) with medium aggression with equal proportions going to 2 diversified large cap, 1 asset allocation and 1 hybrid (equity tilted) fund.

I must say I’m quite confused when it comes to regular portfolio rebalancing. From most of the posts I understand that it’s due to time in the market that helps us earn more money but when we rebalance say we take out money from equity when we gain and shift it to debt, won’t it hurt the very purpose of long term investment in equities as we are taking out money (which would in other words mean lessening of units) and not allowing it to compound? Or I’m I missing the link somewhere? Please advice.

Regards,

Sumanth

Sumanth

Yes you are missing an important thing , and that cycles of investments . Markets go up and down , so portfolio rebalancing is taking that into account , read this article to clarify your doubt : http://jagoinvestor.dev.diginnovators.site/2009/07/power-of-asset-allocation-and-portfolio.html

Manish

Another good lesson for this beginner. Few questions:

1. In column-2 (either table), “returns”. Where will i find that yearwise return for a perticular plan? Is it some kind of fixed (or the trend) for a perticular product?

2. My allocation is 50:50. Whichever (E or D) gives me gain my balance (i.e. total after a term, say 1 yr) would increase or otherwise. The new total (aftr 1 yr) will also be distributed 50:50, automatically (am i right?). Then, why this balance need redistibution (unless i want to change the ratio), or who do i know it.

Mohan

1. the returns depends on what product it is and it would depend on how risky the product is , the article just gives example , Equity MF you can expect 12% , debt you can expect 7% and pure equity you can expect 20-25% or even more depending on how you invest/trade in it .

2. Rebalancing is something you do on your end, it does not happen automatically

Manish

Thanks. Crystal Clear. Now I understan the rebalancing things. But there is no general rule (is there?). Reading the market and trends seems purly chance (read Luck!).

Do you think it a good idea to consult a fund manager?

Mohan

You can learn the stuff , no need of fund manager, Or just invest in a balanced mutual funds and thats all

Manish

Hi Manish, do’t you think a balanced fund in equity and debt will do the job,rather than keep on rebalancing yourself.

Pankaj

It will be very similar , while rebalancing its your choice when you want to do it , you can decide to rebalance it depending on your gut feeling , where as in balanced funds its already in balanced state and growing .

Manish

HI MANISH,

I LIKE YOUR ARTICLES A LOT. I HAVE READ 90% OF THE MONEY YOU MAKE/LOSE IN INVESTMENTS IS DUE TO ASSET ALLOCATION AND PORTFOLIO REBALANCING/ LACK OF IT. YOUR ARTICLE IS A GOOD ONE. REALLY APPRECIATE YOUR WORK…

Adarsh

Keep coming 🙂

Manish

Hi Manish,

Thanks for a nice article. I would like to know more about the strategies for picking a good stock or a mutual fund. How to measure their performance? Can you explain for a beginner? If there are articles already in this topic,please provide the links.

I am a regular reader of your blog and benefitting quite a lot. Financial planning has begun to be my favorite.

Following articles would be of your help

http://jagoinvestor.dev.diginnovators.site/2009/05/video-post-explaining-how-to-choose.html

http://jagoinvestor.dev.diginnovators.site/2009/01/95-of-salaried-people-are-rushing-to.html

Manish

Hi Manish,

Great work.

Can you pls tell which debt instrument will give 9% return and is liquid also.

I don’t think we should use the savings bank a/c as debt option for asset allocation.

Amit

No pure debt options can give post tax 9% . 9% is expected from Debt oriented funds which have 15-20% equity component also .

Manish

[…] is better ? Equity or Equity + Debt . In this article i will show you how always maintaining your Asset Allocation with Discipline helps you in long term . We will See examples of Asset Allocation with Portfolio Rebalancing with […]

[…] list of different Asset classes one can consider for investing in Indian markets. For a building a successful balanced portfolio once has to understand different asset classes and as per their risk appetite , one has to build […]

What you must know about Diversifying your investments ?

To control over the ups and the downs of market and economic cycles, spread risk among different types of investments. In a word, diversify.

.-= Lalatendu Raju´s last blog ..Diversifying your investments =-.

Lalatendu Raju

Just diversifying is not the key . Diversification in non correlated products is important .

Manish

Long term regular investment in diversified products in a disciplined way may produce the desired results.

Hi,

As u said that take a policy in ulips of equity+debit both investment and as well as for

insurence,can u tell be that which is site to refer for to take step that when equity+debiti sup or down ,plz tellme site to refer for that so that i can make changes on that.

2) I have read article that , one person is say abt the ulips is not a best policy to take for the investors” he wrote that

:i)If you are looking into the coverage provided by the ULIPs, it is very low compare to the term insurance cover.”

ii)Insurance will protect your family by giving the lump sum amount which is sufficient for your entire family. In that case you must have the life cover of about Rs.50 lacs (it varies for each family). None of the ULIP policy will give you such a huge amount.”

iii)“I would suggest you to invest in the mutual funds, instead of ULIPs. If you are investing in the mutual funds, there is 1.25% charges deducted on each payment. Where as in the ULIP policies the deduction is nearly 25%.”

and also

iv)“Another drawback of the ULIP is charges on EACH INSTALLMENT of the premium. Almost 25% of your premium will be deducted as the charges.”

what will be ur suggestion by reading ?the article who written the above.

plz reply me

regarding

suri

Suri

You should avoid ULIP’s for the reasons you have mentiond above , read more articles on ULIP’s to understand why its not the best things for general investors .

Manish